Do I need to change the date on the sick leave certificate?

If an employee brings a bulletin where the onset of illness occurs on the day worked, the accountant will have to clarify a number of issues for himself.

The first of them sounds like this: is it possible to accept this sick leave? Or should it be returned to the employee so that with the help of doctors he can correct the date of onset of incapacity for work? In search of an answer, let us turn to the procedure for issuing certificates of incapacity for work (approved by order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n). Paragraph 15 of this document states the following: “For citizens who seek medical help after the end of working hours (shift), at their request, the date of release from work on the certificate of incapacity for work may be indicated from the next calendar day.” Thus, postponing the date of onset of illness to the next date is not an obligation, but a right of the employee. He can refuse the transfer and receive a bulletin where the release from work begins from the date on which the employee was present at the workplace. Such sick leave does not contain any errors, and the accountant must accept it.

Work with electronic sick leave and submit reports through “Kontur.Extern”

External alignment

Please note: all this time we were talking about full-time employees working only in one organization. A part-time worker can create even bigger problems. Here, for example, is the following situation: an employee worked in one organization and part-time in another company. He took sick leave and did not go to work at the main organization during the period indicated on it, but he worked for another employer (part-time) as usual. But no notes on violation of the regime were made on the certificate of incapacity for work.

This fact was revealed during an inspection by the Federal Social Insurance Fund of the Russian Federation - after the sick leave was presented and paid for by the “main” employer. The fund qualified such actions of the employee as a violation of the regime and, despite the absence of a corresponding note from the attending physician on the sick leave, it considered that the amount of benefits at the main place of work should have been reduced (and, as a result, did not accept part of the benefits paid).

But the main employer believed that since at the time of payment he did not know and could not know about the violation of the regime, he legally paid sick leave on the basis of the documents presented by the employee and the entire amount should be offset.

The court concluded that the Federal Social Insurance Fund of the Russian Federation quite rightly did not take into account the costs of paying part of the benefit (i.e., the difference between the accrued amount and the amount that was due to the employee taking into account the reduction in the amount of the benefit in accordance with Article 8 of Law No. 255-FZ).

Facts of abuse of his rights by the insured person were established (he actually worked for another employer during the period of sick leave and, therefore, violated the regime). This means that the costs of paying sick leave in such a situation were incurred by the insurer in violation of the norms of the current legislation (Resolution of the Federal Antimonopoly Service of the Ural District dated April 20, 2011 No. F09-1302/11-C2.

Based on the foregoing and in view of the lack of adequate explanations on this issue, it is worth advising accountants to rely on common sense, arbitration practice, intuition and the instinct of self-preservation.

And as a bonus, let us recall the general rules for calculating sick leave. Yes, just in case.

What to put on your time sheet

Another difficulty that an accountant faces is the discrepancy between the certificate of incapacity for work and the time sheet. If you believe the bulletin, then the employee was on sick leave, and if you believe the report card, then at the same time he was fulfilling his job duties. In this regard, the question arises: is it not necessary to adjust the working time sheet and put in it the designation of temporary disability (“B” or “25”)? It is not necessary, because according to an article of the Labor Code of the Russian Federation, the employer is obliged to keep records of the time actually worked by each employee. This means that the report card must contain a designation that corresponds to reality. And if a worked day is designated as unworked, then labor legislation and the employee’s rights will be violated.

Who does the Decree concern?

Sick leave from April 6 to April 19 can be issued to insured working citizens 65 years of age and older, provided that they:

- not transferred to remote work (“remote workers” will receive salaries);

- are not on annual paid leave (those on leave will receive vacation pay);

- are not on leave without pay;

- are not released from work due to downtime;

- comply with the self-isolation regime.

You can self-isolate at home or in your garden (clause 2 of Government Decree No. 402 dated April 1, 2020, hereinafter referred to as Decree No. 402). If a citizen violates the self-isolation regime, he will have to compensate the FSS for the damage caused (clause 11), that is, in all likelihood, return the amount of paid sick leave.

Perhaps the exception will also be employees of companies that are not subject to the Presidential Decree on quarantine. These are continuously operating enterprises, medical and pharmacy organizations, etc. (clause 4 of the Decree). If your company is on this list, contact your territorial FSS office for clarification.

But part-time and part-time work are no exception. If an employee 65 years of age or older works part-time for your company and only 4 hours a day, he is also entitled to sick leave from April 6 to April 19.

Is it possible to calculate both wages and temporary disability benefits?

At first glance, it may seem that the employee has the right to claim two payments at once: wages and sick leave benefits. In fact, double accrual cannot be done, because each payment has its own basis.

The basis for payment of benefits is temporary incapacity for work. This follows from Part 1 of Article 1.3 of the Federal Law of December 29, 2006 No. 255-FZ. It says that the insurance risk for compulsory social insurance is temporary loss of earnings. The basis for payment of wages is the actual time worked or the amount of work completed. This directly follows from the provisions of the Labor Code. And since the two grounds are mutually exclusive, it is impossible to apply them simultaneously.

Calculate your salary and benefits for free in the web service

Basic rules

The regulations do not specify the procedure for taking sick leave after a working day. Therefore, the employer will have to make independent decisions. The main requirement for decisions made is that they should not violate workers’ rights. It is advisable to support your decision with documents. This could be, for example, a statement from an employee with a request to make this or that payment.

Read more: Job Description for a Developer Programmer

The legislation does not contain a clear answer to this question. If a sick employee works a day, he receives wages for it and this day is not paid on the certificate of incapacity for work. For citizens who seek medical care after the end of working hours (shift), at their request, the date of release from work on the sick leave may be indicated from the day following the day of application to a medical institution. However, this is not a mandatory requirement. Thus, if the certificate of incapacity for work in the situation under consideration was opened on the day of the employee’s illness (fully worked by him), this is not a violation.

The basis for calculating temporary disability benefits is sick leave (Part 5, Article 13 of Federal Law No. 255-FZ of December 29, 2006). However, the organization does not have the right not to pay an employee a salary for the time actually worked (Article 22 of the Labor Code of the Russian Federation). At the same time, the simultaneous accrual of wages and sick leave benefits is also not allowed, since these payments are calculated on different bases: benefits - for the time an employee is absent from the workplace due to incapacity (based on sick leave), and wages - for time actually worked (based on time sheet).

In their explanations, representatives of the Social Insurance Fund of the Russian Federation indicate that the organization is obliged to accrue wages for a fully worked day by an employee. Temporary disability benefits are not accrued for this day. But from the next day, accrue sick leave benefits.

Phone: (495) 587-43-84

Fax: (495) 647-25-28

Contact numbers of RO branches in the Branches section

Monday, Tuesday, Wednesday, Thursday: 9:00 – 18:00

Many accountants are faced with a situation where an employee, after working a whole day or shift, went to the doctor in the evening and from the same date opened a sick leave. In this situation, the accountant has many questions. Is it possible to accept such sick leave? How should I pay for this day? What documents need to be completed? We analyzed this situation and drew conclusions that can be applied in practice.

Which payout to choose

Unfortunately, the laws do not establish what kind of payment to accrue to an employee who receives a bulletin after a working day or shift. Each employer must make its own decision.

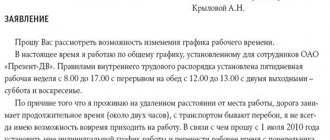

There is an opinion that the right to choose between salary and benefits according to the ballot should be given to the employee himself. The main argument is the fact that this approach is not prohibited by anyone. Employers who have chosen this option ask the employee to write a statement indicating the payment he has chosen. The text of the statement may be something like this: “Since the first day of incapacity for work, falling on March 1, 2020, was worked by me in full, I ask you to consider it a working day and calculate wages for it.”

But we take a different point of view and believe that the employee in any case needs to receive a salary. This indirectly follows from the article of the Labor Code. It lists the employer's responsibilities, and one of them is to pay the full amount of wages due to the employee. In this case, the person fulfilled his official duties, and he is due remuneration for his work. Denial of remuneration would mean non-compliance with labor laws. Consequently, despite the open sick leave, the first day of illness must be paid based on the salary or tariff rate.

Various situations and procedures in them

Regulatory acts do not approve a clear sequence of actions when receiving sick leave after a working day. Therefore, the course of action depends on the specific situation.

A certificate of incapacity for work was issued at the end of the work shift

To prevent problems, the employer is recommended to have a conversation with employees regarding the procedure for obtaining a certificate of incapacity for work after a work shift. In particular, workers should be advised to ask the doctor to issue a certificate the next day. Employees have every right to do this.

What should I do if the sheet is issued on a date that is a working day? It makes sense to pay the employee not a benefit, but a salary. There is no direct indication of this in the laws, but there are indirect indications. Supporters of salary payments put forward this argument:

- Article 22 of the Labor Code of the Russian Federation states that the employer is obliged to pay wages for the time worked.

- The salary amount is usually greater than the benefit amount. It makes sense to choose a larger payment, since this cannot be interpreted as a violation of worker rights.

In this situation, the salary will be accrued from the next day of sick leave.

A certificate of incapacity for work was issued after a shift that was not fully worked

Let's look at an example. The employee felt unwell and took time off from work in the middle of the day. He went to the clinic and received a sheet for the same day. What to do in this case?

An employee can send an application to the employer requesting payment of salary for the day of sick leave. In this case, you need to accrue salary only for hours worked or work performed. Disability benefits are accrued from the following date.

An employee may submit an application to the employer requesting payment of benefits. In this case, the employer must provide the benefit. The legality of such a decision is confirmed by the worker’s statement. In this case, the salary does not need to be paid in order to avoid double accrual.

Certificate of incapacity for work issued upon completion of shift

Shift work is an additional factor that needs to be taken into account. Let's look at an example. The employee completed his shift. After her, he went to the clinic and received a certificate of incapacity for work. In this case, the employer must pay the salary for the shift worked. After this, benefits are calculated.

The sheet is issued upon completion of the night shift

Let's look at an example. The employee worked the night shift and then went on sick leave. Another shift falls on the sick leave date. That is, one day includes:

- worked night shift;

- sick leave;

- unworked day shift.

In this case, you need to pay in full for the night shift and record it on your time sheet. The benefit is paid for the day following the night. This means that the employee receives both salary and benefits for one day.

How to calculate sick leave benefits

Accruals on the ballot should begin on the second day. To ensure that inspectors from the Social Insurance Fund and the tax inspectorate do not have questions, it is better for the accountant to prepare the relevant documents in advance. This could be, for example, a directive or order from a manager. The text must describe in detail the essence of the matter and make a conclusion about how to make the payment. In addition, it is a good idea to ask the employee to write a statement that he does not object to the accrual of wages for the first day of illness.

In practice, software-related difficulties often arise. The fact is that the program does not allow you to calculate wages for a day that is included in the period of temporary disability. To get around this obstacle, you need to enter data about the ballot as if it were open from the next day. Then all calculations will be done correctly.

Contacting the FSS

A certificate of incapacity for work that is not submitted within the required period can only be submitted to the Social Insurance Fund. All cases are individual. Therefore, decisions are made depending on specific circumstances. Thus, you cannot be 100% sure that the payment will be approved. The FSS may refuse.

To submit an application to the FSS you should:

- Contact the employees with an application, which is filled out on a special form.

- To determine whether the reason will be classified as valid, you can first read the Order of the Ministry of Health and Social Development No. 74 of 2007.

- Confirm the stated reason with relevant documents.

Overlapping sick leave

If an employee brings two sick days for different diseases and the last day of sickness on the first sick leave is the first day of sickness on the second sick leave, then this day must be paid for on the first sick leave. After all, benefits cannot be paid twice for the same period.