We assemble a fixed asset from components in 1C accounting

It is impossible to give a resigning employee a copy of SZV-M. According to the law on personal accounting, when dismissing an employee, the employer is obliged to give him copies of personalized reports (in particular, SZV-M and SZV-STAZH).

However, these reporting forms are list-based, i.e. contain information about all employees. This means transferring a copy of such a report to one employee means disclosing the personal data of other employees. The basis for this is that, in accordance with the All-Russian Classifier of Fixed Assets OK 013-94 (OKOF), approved by Decree of the State Standard of the Russian Federation dated December 26, 1994 N 359, a computer and its components (system unit, monitor, printer) are classified as “Equipment” electronic computing" (OKOF code - 14 3020000) and on the basis of the Classification of fixed assets included in depreciation groups (hereinafter referred to as the Classification), approved by Decree of the Government of the Russian Federation dated January 1, 2002 N 1, are included in the second depreciation group with a useful life of over 2 and up to 3 years inclusive.

Accounting

A computer purchased for management or production needs (that is, not for sale) should be included as part of fixed assets (clause 4 of PBU 6/01). Write off the cost of such a computer through depreciation.

In the accounting policy for accounting purposes, the organization has the right to set a cost limit within which fixed assets are taken into account as part of materials. This limit should not exceed 40,000 rubles. (paragraph 4, clause 5 of PBU 6/01). In this case, a computer whose cost does not exceed the established limit can be taken into account as part of the materials.

Since the cost of a computer included in the materials is immediately transferred to costs, control over its safety should be organized (paragraph 4, clause 5 of PBU 6/01).

The initial cost of fixed assets acquired for a fee consists of the organization’s costs for their acquisition, construction and production, bringing them into a condition suitable for use. Expenses for the acquisition of computer programs, without which computer technology cannot perform its functions, should be considered as expenses for bringing an object of fixed assets into a state suitable for use. Therefore, include the programs necessary for the computer to operate in its initial cost.

This procedure follows from paragraph 8 of PBU 6/01.

Situation: how to reflect write-offs in accounting and monitor the safety of a computer put into operation. Is the cost of the computer completely written off as an expense?

Since the legislation does not regulate the procedure for accounting for a computer written off as expenses as part of materials, the organization must develop it independently. In practice, to control the safety of a computer for each department (materially responsible person), you can maintain:

- record sheet of computers in operation;

Reflect the selected option in the accounting policy for accounting purposes.

The chart of accounts does not provide for a separate off-balance sheet account for accounting for computers put into operation. Therefore, you need to open it yourself. For example, this could be account 013 “Inventory and household supplies”.

Debit 25 (26, 44…) Credit 10-9

– the computer was put into operation;

Debit 013 “Inventory and household supplies”

– the computer is accounted for in an off-balance sheet account.

Credit 013 “Inventory and household supplies”

– the computer is written off from an off-balance sheet account.

All operations must be documented (Part 1, Article 9 of the Law of December 6, 2011 No. 402-FZ). Therefore, when writing off a computer from an off-balance sheet account, you should draw up a report.

Situation: is it possible to reflect in accounting the components of a computer (system unit, monitor, etc.) as separate objects of fixed assets?

No you can not.

The components of a computer are a monitor, system unit, keyboard, mouse, etc. According to regulatory agencies, it is impossible to take into account a computer in parts. This is explained by the fact that the components of a computer cannot perform their functions separately. Therefore, these items must be taken into account as part of a single fixed asset item. This point of view is reflected in the letter of the Ministry of Finance of Russia dated September 4, 2007 No. 03-03-06/1/639.

Advice: there are arguments that allow you to take into account the computer in parts in accounting. They are as follows.

You can reflect the components of a computer in accounting as independent objects in two cases:

- The organization plans to operate the components as part of various sets of computer equipment. For example, the monitor is supposed to be connected to different computers. Or information from two or more computers will be printed via a printer. Do the same if the printer simultaneously performs the functions of a copier, fax, etc.;

- the useful life of the components of a fixed asset differs significantly (paragraph 2, paragraph 6 of PBU 6/01, letter of the Ministry of Finance of Russia dated February 20, 2008 No. 03-03-6/1/121).

In these two cases, depending on the useful life and cost, reflect the computer equipment as part of fixed assets or materials. At the same time, the cost of computer components taken into account as part of the materials should not be included in the tax base for property tax (clause 1 of Article 374 of the Tax Code of the Russian Federation).

The correctness of this point of view is confirmed by arbitration practice (see, for example, the rulings of the Supreme Arbitration Court of the Russian Federation dated June 28, 2010 No. VAS-7601/10, dated May 16, 2008 No. 6047/08, decisions of the Federal Arbitration Court of the Ural District dated February 17, 2010 No. Ф09-564/10-С3, dated December 3, 2007. No. Ф09-9180/07-С3, dated June 7, 2006. No. Ф09-4680/06-С7, dated April 19, 2006.

No. F09-2828/06-S7, Volga District dated January 26, 2010 No. A65-8600/2009, dated February 12, 2008 No. A12-8947/07-S42, dated January 30, 2007 No. A57-30171/ 2005, Moscow District dated April 13, 2010 No. KA-A41/3207-10, West Siberian District dated November 30, 2006 No. F04-2872/2006(28639-A27-40), Northwestern District dated March 20 2007 No. A21-2148/2006, dated February 22, 2007 No. A05-7835/2006-9).

How to capitalize a computer if purchased for spare parts

We believe that the system unit, monitor, keyboard, mouse, etc.

I.V. Artemova, chief accountant, consultant

Computer equipment is available in every institution. Spare parts, accessories, storage media, etc. are purchased for it. Accountants often have questions about how to account for individual parts - as part of one object or as independent units, as fixed assets or as inventories.

Computers belong to the fixed assets of an institution, since they are tangible objects of property with a useful life of more than 12 months, intended for repeated or permanent use with the right of operational management during the activities of the institution when performing work, providing services, for the exercise of government powers (functions). ) or for the management needs of the institution (clause

38 Instructions for the application of the Unified Chart of Accounts, approved by Order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n; hereinafter - Instruction No. 157n). A computer consists of a whole set of components - motherboard, processor, RAM, hard drive, monitor, keyboard, mouse and others. But, let us recall that the object of fixed assets is an object with all the fixtures and accessories, or a separate structurally isolated object intended to perform certain independent functions, or a separate complex of structurally articulated objects representing a single whole and intended to perform a specific job (p .

BTC specializes in membrane keyboards and produces the most complete range of them (due to this, their cost is low). Price from 15$ to 25$.

Mitsumi—keyboards from a Japanese company are distinguished by their quality and low price ($10 - $15).

Genius is a Taiwanese company that also produces inexpensive mass-produced keyboards. Price 7 - 20$.

And finally, keep in mind that cheap keyboards (up to $10) made in China can be no worse than their famous counterparts. n

Attention! After installing the keyboard, you can set the blinking frequency of the cursor and the speed at which characters appear, and through the BIOS setup - the Numlock state (automatically turning on the numeric keypad).

Discuss on the Dt-Kt forum “Automation of Accounting”

"Accounting", N 18, 2001

CAN A COMPUTER BE ACCOUNTED IN PARTS?

According to clause 6 of PBU 6/01, the unit of accounting for fixed assets is an inventory item. An inventory object of fixed assets is an object with all fixtures and accessories, or a separate structurally isolated object, designed to perform certain independent functions, or a separate complex of structurally articulated objects, representing a single whole, and intended to perform a specific job.

Find out what: How to obtain a certificate of registration of ownership of a house

A complex of structurally articulated objects is one or more objects of the same or different purposes, having common devices and accessories, common control, mounted on the same foundation, as a result of which each object included in the complex can perform its functions only as part of the complex, and not independently.

If one object has several parts that have different useful lives, each part is accounted for as an independent inventory item.

The components of a computer complex are a system unit, monitor, keyboard, mouse, printer, routers, racks and panels, communication equipment and other devices. Some peripheral devices can be located in the system unit (hard drive, network card, modem, etc.) or outside it.

Thus, a computer should be considered as a complex of structurally articulated objects, each of which cannot perform its functions independently.

According to PBU 6/01, it is possible to revise the useful life of reconstructed (modernized) fixed assets. However, this period can be revised only if, as a result of reconstruction (modernization), there has been an improvement (increase) in the initially adopted standard indicators of the functioning of the fixed asset object. The new Regulations do not provide for an increase in the organization’s additional capital by the amount of costs for the restoration of fixed assets.

Dt sch. 08 “Investments in non-current assets”,

K-t sch. 60 “Settlements with suppliers and contractors”

purchased scanner, speakers;

Dt sch. 19 “Value added tax on acquired assets”,

VAT included;

Dt sch. 60 “Settlements with suppliers and contractors”,

K-t sch. 51 “Current accounts”

payment has been made to the supplier;

Dt sch. 68 “Calculations for taxes and fees”,

K-t sch. 19 “Value added tax on acquired assets”

VAT on components is written off;

Dt sch. 01 “Fixed assets”,

K-t sch. 08 “Investments in non-current assets”

the initial cost of the computer was increased, an act was drawn up in form N OS-3.

In the same way, accounting should reflect the purchase of additional equipment and the installation of a local computer network based on computers already available at the enterprise.

In the case of retrofitting a computer that has already been put into operation in order to expand the functions it performs, cost accounting in 2001 is carried out in the manner established for accounting for capital investments, with VAT reimbursement from the budget at the time of registration. Until January 1, 2001, VAT was taken into account in the initial cost of the object.

Dt sch. 10 "Materials",

a monitor with characteristics similar to the one that failed was purchased;

VAT is reflected on the monitor;

VAT refunded from the budget;

Dt sch. 26 “General business expenses”,

K-t sch. 10 "Materials"

The costs of computer repairs have been written off.

If repairs are carried out by a specialized third-party organization, the cost of the work performed should be charged to current costs with reimbursement of VAT from the budget in the prescribed manner.

If there are parts in a computer complex (monitor, printer, scanner, etc.) that have different useful lives, each part can be accounted for as an independent inventory item.

— the expected life of the facility in accordance with the expected productivity and capacity;

— expected physical wear and tear, depending on the operating mode (number of shifts), natural conditions and the influence of an aggressive environment; repair systems;

— regulatory and other restrictions on the use of the object.

Most enterprises use the linear method of calculating depreciation using the specified norms, since the use of a different method of calculating depreciation leads to the need to maintain accounting records and tax calculations with adjustments to taxable profit on line 4.23 of the Certificate on the procedure for determining the data reflected on line 1 “Calculation of tax based on actual arrived".

In Classifier OK 013-94, independent codes have both devices of computer systems and electronic machines, and their individual parts (information input and output devices, computer devices and power supplies, computer service devices, peripheral devices, etc.).

The depreciation rate for personal computers is set at 10% per year (code 48008 of the Unified Standards), but under code 48003 “Peripheral devices for computing systems and machines” the rate is 11.1%. Since peripheral devices are parts of a personal computer, but have their own useful life, in our opinion, each device can be accounted for as an independent inventory item with a separate inventory number assigned.

purchased system unit;

VAT included;

Dt sch.

60 “Settlements with suppliers and contractors”,

VAT is reimbursed from the budget;

the system unit is included in the fixed assets with the assignment of a separate inventory number.

In the same way, accounting reflects the purchase of each new device (printer, scanner, speakers, etc.), regardless of the commissioning of the previous ones.

Clause 5 of PBU 6/01 determines that if one object has several parts that have different useful lives, the replacement of each such part during restoration is taken into account as a disposal and acquisition of an independent inventory object.

Thus, the replacement of a monitor that cannot be repaired with one with similar performance characteristics should be reflected not as a repair with the replacement of component parts, but as the write-off of a failed monitor and the purchase of a new one.

In accordance with clause 15 of PBU 6/01, the organization has the right, no more than once a year (at the beginning of the reporting year), to revaluate fixed assets at replacement cost by indexation or direct recalculation at documented market prices. The possibility of conducting an annual revaluation of computer equipment on the balance sheet of an enterprise must be enshrined in the order on accounting policies.

An organization that has decided to revaluate must take into account that subsequently revaluation will have to be carried out regularly. This is necessary to ensure that the cost of fixed assets at which they are reflected in accounting and reporting does not differ significantly from the current (replacement) cost.

The new Regulations do not provide for the revaluation of fixed assets as of the expired date (for example, during 2001 as of January 1, 2001). In the financial statements, the results of revaluation must be taken into account when compiling data at the beginning of the reporting year. This requirement is contained in paragraph.

Used equipment also has its advantages

They say that when buying a used car, a person buys another person’s problems along with it. Probably the same statement can be applied to computer technology. And yet this also has its undeniable advantages. Let's imagine a situation where a group of students who do not have much money as initial capital decided to open their own business. It is assumed that the staff of the future company will consist of five people. Of course, if they are going to be in an office, they will need computers. The question is, where can I get them? The answer is very simple - buy somewhere on Avito. By the way, we once talked about this site...

What will they get in return? That's right - inexpensive equipment that seems to work. As they say, it will work for the first time. And here the question arises: “How to reflect used computers in accounting”? This is actually very interesting. What is sold on similar sites is not subject to any documentation, because The sale of goods on them is primarily carried out by individuals. As if later there would be no problems with the inspection authorities, who would become very interested in where the computers came from, even if they were old... Young entrepreneurs should be prepared for this.

conclusions

Based on all of the above, we come to the following conclusions:

- The accounting rules for computer equipment are reflected in the PBU and depend on the configuration of the computer, as well as on how it was purchased;

- Computers costing up to 40 thousand rubles can be counted as material and technical expenses and not be perceived as fixed assets, which excludes depreciation;

- With used computer equipment, more problems will arise when the question arises of putting it on the balance sheet;

- When choosing between an old computer and a new one, it is better to opt for the new one. However, in any case, this will not affect the operation of the 1C online service;

- When taking computers into account, it is important to remember that if their total cost exceeds 100 minimum wages, they will automatically be classified as fixed assets.

Thank you for your attention and see you soon!

OSNO and UTII

The order of reflection when calculating computer income tax depends on its initial cost. When forming the initial cost, consider the following.

The initial cost of a computer includes pre-installed software, which is necessary for the full operation of this property (paragraph 2, paragraph 1, article 257 of the Tax Code of the Russian Federation). An organization should not list such software separately.

A computer purchased without the minimum software cannot be used. Therefore, include the costs of purchasing and installing such programs in the initial cost of the computer as expenses for bringing it to a state suitable for use (paragraph 2, paragraph 1, article 257 of the Tax Code of the Russian Federation).

Such clarifications are contained in letters of the Federal Tax Service of Russia dated May 13, 2011 No. KE-4-3/7756, dated November 29, 2010 No. ShS-17-3/1835.

A computer, the initial cost of which is more than 100,000 rubles, should be included in fixed assets (Clause 1, Article 257 of the Tax Code of the Russian Federation). When calculating income tax, write off its value through depreciation (Clause 1, Article 256 of the Tax Code of the Russian Federation).

According to the Classification approved by Decree of the Government of the Russian Federation of January 1, 2002 No. 1, computers belong to the second depreciation group. Therefore, for these fixed assets, the useful life can be set in the range from 25 to 36 months inclusive (paragraph 3, paragraph 3, article 258 of the Tax Code of the Russian Federation).

The organization determines the specific useful life of the computer independently. If an organization purchased a used computer, then the useful life when calculating depreciation using the straight-line method can be established taking into account the period of actual use of this object by the previous owners (clause 7 of Article 258 of the Tax Code of the Russian Federation).

Find out what: Buying an apartment on the secondary market: step-by-step instructions

A computer whose initial cost does not exceed 100,000 rubles should be included as part of material costs. With the accrual method, the organization has the right to independently determine the procedure for its write-off, taking into account the period of use of the computer and other economic indicators. For example, at a time or evenly over several reporting periods (subclause 3, clause 1, article 254 of the Tax Code of the Russian Federation).

Organizations that are engaged in activities in the field of information technology have the right to take into account the purchased computer as part of material costs, even if its initial cost exceeds 100,000 rubles. (clause 6 of article 259, subclause 3 of clause 1 of article 254 of the Tax Code of the Russian Federation). Such organizations do not have to write off the cost of a computer through depreciation.

To obtain this opportunity, the organization must simultaneously meet the following conditions:

- engage in the development and implementation of computer programs, databases or provide services (perform work) for the development, adaptation, modification, installation, testing and maintenance of computer programs and databases;

- have a document on state accreditation of an organization operating in the field of information technology;

- have an average number of employees for the reporting (tax) period of at least 50 people;

- receive income from activities in the field of information technology in the amount of at least 90 percent of all income of the organization based on the results of the reporting (tax) period, including from foreign entities - at least 70 percent.

In this case, foreign buyers are recognized as organizations that:

- place of state registration is the territory of a foreign state;

- in the absence of registration in the territory of a foreign state, the place indicated in the constituent documents, the place of management of the organization, the location of the permanent operating executive body or permanent representative office (if programs, works, services were purchased through it) are located outside of Russia.

In addition, foreign buyers are recognized as individuals whose place of residence is in a foreign country.

Documents confirming receipt of income from foreign buyers are:

- documents confirming the provision of services (performance of work), or a customs declaration with customs marks.

Such rules are provided for in paragraph 6 of Article 259 of the Tax Code of the Russian Federation.

Situation: is it possible to reflect the components of a computer (system unit, monitor, etc.) in tax accounting as separate objects of fixed assets?

No you can not.

The components of a computer are a monitor, system unit, keyboard, mouse, etc. According to regulatory agencies, it is impossible to account for a computer in parts. This is explained by the fact that the monitor, system unit, keyboard and printer cannot perform their functions separately. Therefore, these items must be taken into account as part of a single fixed asset item.

Advice: there are arguments that allow you to take into account the computer in parts in tax accounting. They are as follows.

When taxing, computer components can be taken into account as independent objects in two cases:

- if the organization plans to operate the components as part of various sets of computer equipment. For example, the monitor is supposed to be connected to different computers. Or information from two or more computers will be printed via a printer. Do the same if the printer simultaneously performs the functions of a copier, fax, etc.;

- if the useful life of the components of the fixed asset differs significantly (paragraph 2, paragraph 6 of PBU 6/01).

In these two cases, computer equipment, the useful life of which exceeds 12 months, and the cost of which is more than 100,000 rubles, is considered as a separate fixed asset item. Consider the rest of the computer equipment as part of the materials. This procedure follows from subparagraph 3 of paragraph 1 of Article 254 and paragraph 1 of Article 256 of the Tax Code of the Russian Federation.

The correctness of this point of view is confirmed by arbitration practice (see, for example, the rulings of the Supreme Arbitration Court of the Russian Federation dated June 28, 2010 No. VAS-7601/10, dated May 16, 2008 No. 6047/08, decisions of the Federal Arbitration Court of the Ural District dated February 17, 2010 No. Ф09-564/10-С3, dated June 18, 2009, No. Ф09-3963/09-С3, dated June 7, 2006, No. Ф09-4680/06-С7 and dated April 19, 2006.

No. Ф09-2828/06-С7, Volga District dated January 26, 2010 No. A65-8600/2009, dated April 15, 2009 No. A55-12150/2008, dated February 12, 2008 No. A12-8947/07- C42, dated January 30, 2007 No. A57-30171/2005, Moscow District dated December 8, 2008 No. KA-A40/10120-08, West Siberian District dated November 30, 2006

An example of reflection in accounting and taxation of a computer as a single object of fixed assets

In January, Alpha LLC purchased a personal computer with the following configuration:

- system unit – 94,400 rub. (including VAT – RUB 14,400);

- monitor – 31,860 rub. (including VAT – 4860 rub.);

- keyboard – 708 rub. (including VAT – 108 rubles);

- mouse – 295 rub. (including VAT - 45 rubles).

The cost of all computer parts is 127,263 rubles. (RUB 94,400, RUB 31,860, RUB 708, RUB 295), including VAT – RUB 19,413. (RUB 14,400, RUB 4,860, RUB 108, RUB 45).

The useful life of a computer is set by order of the head of the organization to be 3 years (36 months).

When registering the receipt of the computer, the acceptance committee filled out an act in form No. OS-1, after which it was approved by the head of the organization and handed over to the accountant. For accounting and tax accounting purposes, depreciation on office equipment is calculated using the straight-line method.

For accounting purposes, the annual depreciation rate for a computer is 33.3333 percent (1: 3 × 100%), the annual depreciation amount is 35,950 rubles. ((RUB 127,263 – RUB 19,413) × 33.3333%), monthly depreciation amount – RUB 2,996/month. (RUB 35,950: 12 months).

For tax accounting purposes, the monthly depreciation rate for a computer is 2.7778 percent (1: 36 months × 100%). The monthly amount of depreciation charges is 2996 rubles. ((RUB 127,263 – RUB 19,413) × 2.7778%).

Alpha uses the accrual method and pays income tax quarterly. The organization does not perform operations that are not subject to VAT.

Debit 08-4 Credit 60–107,850 rub. (RUB 127,263 – RUB 19,413) – the cost of the computer is taken into account;

Debit 19 Credit 60–19,413 rub. – VAT is taken into account on the cost of the computer;

Debit 01 Credit 08-4– 107,850 rub. – the computer is taken into account as part of fixed assets;

Debit 68 subaccount “Calculations for VAT” Credit 19–19,413 rub. – VAT is accepted for deduction;

Debit 60 Credit 51– 127,263 rub. – funds were transferred to the supplier to pay for the computer.

Debit 26 Credit 02– 2996 rub. – the monthly amount of depreciation charges on the computer is taken into account.

From the same month, Alpha’s accountant began to take into account the monthly amount of depreciation deductions when calculating income tax.

An example of reflection in accounting and taxation of a computer assembled from components on its own as a single object of fixed assets

Alpha LLC purchased computer components in January. Their cost was:

- motherboard, processor, RAM, video card, hard drive – RUB 94,400. (including VAT – RUB 14,400);

- monitor – 31,860 rub. (including VAT – 4860 rub.);

- keyboard – 708 rub. (including VAT – 108 rubles);

- mouse – 295 rub. (including VAT - 45 rubles).

In January, a computer was assembled from these components using our own resources.

The cost of the computer was 127,263 rubles. (RUB 94,400, RUB 31,860, RUB 708, RUB 295), including VAT – RUB 19,413. (RUB 14,400, RUB 4,860, RUB 108, RUB 45).

New or used equipment? What is more profitable to buy?

As part of our duties, we from time to time visit various organizations, communicate with people, and resolve some work issues with them. It’s clear that when communicating with a client, we cannot help but notice, excuse me, what chair he sits on, how high-quality and aesthetically pleasing the renovations are in his office, and, ultimately, what type of computer he has installed at his workplace. According to our modest observations, a considerable number of employers do not give much preference to the purchase of “powerful” equipment, opting for fairly “simple” technical solutions. Whether this is right or wrong is largely a subjective question, the answer to which everyone can give themselves.

But there is one problem here that concerns our long-suffering colleagues among accountants - they too often complain that their 1C is “buggy”, that the program “works very slowly” and that they constantly have to restart it. This is partly due to the fact that rather “heavy” software is installed on not very “strong” computers, in the form of “boxed” 1C.

Dear friends... Let's completely forget about this atavism in the form of installing Odeneski on the hard drive. Why is this necessary when many have been successfully using 1C 8.3 in the cloud for a long time - a fast, convenient and intuitive service that allows you to solve production problems without any problems. The most important thing is that it does not take up space on your hard drive and its speed does not depend on the newness or obsolescence of the computer. Take advantage of free access for 14 days and appreciate all its benefits! As they say, it is better to see once than to hear a hundred times!

At the same time, problems in solving production problems can arise much more often in the case of a used computer. We had a chance to talk with a client (by the way, he told us about how to account for a PC) whose computer had not been changed for more than 10 years. This is what he told us:

“You have no idea how annoying this is! Until it (the computer) starts, until it “boots up,” until it “comes to itself.” It only takes me 10-15 minutes in the morning! Fortunately, during this time I have time to go get coffee. What to do during the day? No matter how many times I approached the director, he kept sending me away “for later.”

- Indeed, an unpleasant situation. Have you really been suffering like this for the last 5-6 years?

“A little less, of course, but still. The fact is that sometimes I work from home - there I have a modern “gaming” laptop. The monitor is, of course, small, but everything works quickly. It’s good that I at least bought 1C from you - it doesn’t slow down, but everything else is a problem. I also need to create tables in Excel and respond to dozens of emails a day in Outlook. In general, I think it’s better to work from home.”

- Or maybe you should really approach the director and offer him this option?

“I offered! Only then he said that this would automatically reduce my salary by 10 thousand rubles. She asked why? He said that my salary, it turns out, includes travel expenses. Nonsense".

Of course, we could continue to continue the conversation in approximately the same spirit, but there was no point in it. When we were told about the rules for accounting for computers, the accountant spoke with such great enthusiasm, as if he really “dreams” about new technology and is waiting for the moment when he can apply his knowledge in practice. It's sad, though.

Buying a computer in parts

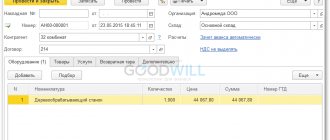

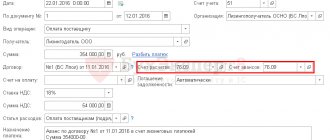

After a directory element has been selected in the tabular part of the document, the details “VAT Account” and “Account Account” will be filled in automatically according to the previously specified settings. Fig. 1 During the document processing, the following accounting entries were generated: Fig. 2 If mice, keyboards and system units were purchased from another supplier, this is reflected in the database with a similar document. Incoming documents for each individual counterparty, as well as a set of goods, are entered separately in this case.

How to install purchased equipment The assembly of fixed assets should also be displayed in the 1C Enterprise Accounting program 8.2. This must be done through a document entitled “Transfer of equipment for installation.”

4 Justify this accounting with the norm “Accounting for fixed assets”, it states that when parts of an object differ in terms of useful life, then each part can be accounted for as an independent inventory item. The level of such exploitation is determined by the organization itself.

For example, it can be set for a period of 12 months. For example, if the useful life of a PC and a printer differ by 12 months, capitalize them as different inventory items. 5 Keep track of the cost of components in case of replacing parts or repairing a computer as follows. The straight-line method involves calculating depreciation in equal monthly and annual amounts.

Find out what: How to draw up an application for the issuance of a court order to collect debt for housing and communal services using the sample?

Since the useful life of the purchased computer is set to three years, the annual depreciation rate is calculated as follows: 100% / ULI = 100% / 3 = 33.33%. The annual depreciation amount is calculated as the product of the original cost of the object and the annual depreciation rate, i.e.

in this case: 58150 rub. x 33.33% = 19381 rub. The monthly depreciation amount is calculated as the quotient of dividing the annual depreciation amount by the number of months in the year, i.e. 19381 / 12 = 1615 rubles. The following accounting entries were made in the accounting department of Vozrozhdenie LLC to reflect the receipt of the computer and depreciation charges (Table 2). Debit Credit Operation Amount, rub.

| 1. | Accounting for a computer as a single inventory object, including a system unit, monitor, keyboard, mouse, etc. |

| 2. | Accounting for the system unit and monitor as independent fixed assets. In this case, the keyboard, mouse and other parts are integral parts of the system unit. |

The chosen accounting method must be fixed in the accounting policy of the institution. It is necessary to take into account that the monitor and the system unit are easily separated, monitors can be rearranged between different computers, etc. If the computer is taken into account as a single fixed asset, then rearranging the monitors is already a disassembly of fixed asset objects.

Therefore, the second approach is more common - separate accounting of system units and monitors. However, questions remain about how to take into account other essential parts of the system unit (for example, motherboard, processor, RAM), as well as external devices and storage media (flash cards, USB -tokens, DVDs or CDs, etc.).

The Ministry of Finance explains

In a recent letter from the Ministry of Finance of Russia dated July 1, 2016 No. 02-07-10/38843, department specialists explained what criteria should be used when classifying individual material assets (DVDs, RAM, motherboards) as fixed assets or inventories.

VAT included;

VAT included;

Dt sch.

By Decree of the Government of the Russian Federation dated August 19, 1994 N 967 “On the use of the accelerated depreciation mechanism and revaluation of fixed assets,” the Russian Ministry of Economy was given the right to establish a list of high-tech industries and efficient types of machinery and equipment for which the accelerated depreciation mechanism is applied.

In Letter dated January 17, 2000 N MV-32/6-51, the Russian Ministry of Economy considers it possible to classify personal computers as the active part of fixed assets, which are subject to an accelerated depreciation mechanism using the uniform (linear) method of its calculation, at which the approved rate of annual depreciation charges increases by an acceleration factor of no more than 2.

With the introduction of PBU 6/01, accounting for computer equipment in parts or as a unit of accounting for fixed assets does not make any fundamental difference for tax purposes. The only differences will be in accounting. The choice of the method of accounting for computer equipment remains with the organization.

Signed for seal by E.A. Artemova

08/28/2001 T.S. Pavlenko

LLC "APN - Audit - Consulting"

Moscow

—————————————————————————————————————————————————————————————————— ———————————————————— ——

(C) Fin-Buh.ru. Some materials on this site may be intended for adults only.

In this case, the following entries will be made in accounting: Debit 60 Credit 51 - purchased assets have been paid for; Debit 08 Credit 60 - system unit, monitor, keyboard, mouse are capitalized; Debit 19Credit 60 - VAT on purchased assets is taken into account; Debit 01 Credit 08 - purchased devices are accounted for as a single inventory item of the fixed asset “Personal Computer”;

Debit 68Credit 19 - VAT on the purchased computer has been accepted; Debit 20(23, 26, 44) Credit 02 - depreciation accrued (monthly). If the cost of a personal computer turns out to be less than 40,000 rubles, then in this case the following must be taken into account. The fourth paragraph of clause 5PBU 6/01 stipulates that assets in respect of which the conditions provided for in clause

How is installed equipment accounted for?

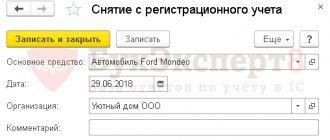

Since the debit of account 08.03 has collected all the costs for purchasing equipment and assembling it (installation), it is now necessary to put the personal computer into operation. Commissioning is carried out using the document “Acceptance for accounting of fixed assets”. If a fixed asset item requires assembly work carried out taking into account additional costs, then such an action should also be formalized using the document “Acceptance for accounting of fixed assets”. To do this, click the hyperlink “Acceptance for accounting of fixed assets,” which is located in the “Fixed assets and intangible assets” section below the link “Transfer of equipment for installation.” So, we create a new document. In the “Type of operation” cell, select “Construction objects”. To the right there is a cell with the table of contents “OS Event”, there we find “Acceptance for accounting with commissioning”. Fig.7 Since the “Construction Objects” operation was selected, the account in the “Fixed Assets” tab will be entered automatically on 03/08. Where you need to enter a construction project, select “Computer”, and to the right of it is the “Calculate amounts” button. After clicking on it, the program will automatically generate the initial cost of the fixed asset for tax and accounting purposes. This cost will be written off from the debit of account number 08.03, the object of analytical accounting is “Computer” (you can check the balance sheet for account 08.03). The next step is to create a new fixed asset in the “Fixed Assets” directory with the name “Computer”. For this purpose, you need to add a new row in the tabular part of the “Fixed Assets” directory, and in the form of a list that opens in the same directory, we add a new element interactively. In the process of entering a new element into the directory, it is not at all necessary to immediately enter all the necessary details, because the bulk of them are recorded using the “Acceptance for Accounting” document. At the initial stage, you can enter only the most necessary details, that is, those without which the entry of a directory element will not be carried out - the name of the fixed assets and their accounting group. Fig.8 In the “Name” field you should indicate “Computer”, and if you click on the button to select the line “OS Accounting Group”, then you need to look for the definition “Office Equipment” there. Thus, the “Fixed Assets” tab will only be partially filled. That is, fields such as “Group”, “Manufacturer”, “Date of issue (construction)” remain blank. Next, you need to go to the “Accounting” tab. In the “Accounting procedure” field, select “Depreciation calculation”, after which the details that must be filled out will become available on the tab in order for depreciation to be calculated adequately. These are “MOL”, and “Method of receipt”, and “Accounting account”, “Depreciation account”, “Method of calculating depreciation”, “Methods of reflecting depreciation expenses”, how long is the useful life of a fixed asset in months.

Fig.9 The “Tax Accounting” tab is filled in in a similar way so that tax depreciation can be entered for this fixed asset. Fig. 10 After all the details have been entered, we post the document. When conducting, the following transactions will be generated: Fig. 11 From this document, you can print the OS-1 form “Act of acceptance and transfer of fixed assets.” To do this, at the top right there is a button “Act of acceptance and transfer of OS (OS-1). Fig. 12 As you can see, the 1C Accounting program reflects the acquisition, installation, and acceptance for accounting of a fixed asset, which consists of several components. The considered case of purchasing a monitor, system unit, mouse, keyboard in different places, as well as taking into account the assembly and cost of the software, is just one of the possible options for purchasing a fixed asset by purchasing and assembling components. Often, in this way, an organization decides to purchase, for example, air conditioners or specialized equipment, because management is, first of all, interested in saving the budget. The responsibility of the accountant, in turn, includes the correct execution of all accounting transactions.

How to account for a computer?

In this case, there is no need to add it to the computer kit in order to register a peripheral device for the computer. The modem (printer) and computer were registered at different times, so there is no need to combine them.

PBU 6/01, and with a value within the limit established in the organization’s accounting policy, but not more than 40,000 rubles per unit, may be reflected in accounting and financial statements as part of inventories. Accounting for such “low-value” assets is carried out in accordance with PBU 5/01 “Accounting for inventories”.

Consequently, if the cost of a computer is less than 40,000 rubles, then the computer can be taken into account as part of the inventory. According to the Plan of Accounts for accounting the financial and economic activities of organizations (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n), account 10 “Materials” is used to summarize information on the availability and movement of inventories.

Such assets are subject to inclusion in the organization’s expenses upon commissioning (p. To register a fixed asset, which consists of components purchased from different sellers, as well as payment for services for setting up the necessary software, the following documents are used in accounting: • “Receipt goods and services”, with the type of operation “Equipment” (to capitalize the equipment that still needs to be installed);

• “Transfer of equipment for installation”; • “Receipt of goods and (to reflect services for installation and configuration of special licensed software); • “Acceptance of fixed assets for accounting”, operation “Construction objects”. Purchase of components that will make up the fixed asset. The preparatory work consists of creating an item group with account 07. Initially, the components for the computer are capitalized as equipment.

Acceptance of installed equipment for registration.

After all costs for the purchase and installation of equipment have been collected in the debit of account 03/08, we put it into operation.

This is done by the document “Acceptance for accounting of fixed assets”.

Let's create a new document. We select the type of operation “Construction objects”, the event “Acceptance for accounting with commissioning”.

The invoice is entered automatically: when selecting the “Construction Objects” operation, this is invoice 08.03.

We choose our computer as the construction object. When you click on the “Calculate amounts” button, the program automatically generates the initial cost of the new fixed asset for accounting and tax accounting, writing it off from the debit of account 08.03, the analytical accounting object “computer” (you can check the balance sheet for account 08.03).

The next stage is the creation of a new fixed asset “computer” in the “Fixed Assets” directory. To do this, add a new row in the “Fixed Assets” tabular section and interactively add a new directory element in the list form of the “Fixed Assets” directory.

At the stage of entering a new element into the directory, there is no need to immediately enter all the details - most of them are recorded in the “Acceptance for accounting” document. We will enter only the necessary ones, without which the directory element will not be recorded: the name and group of OS accounting.

Go to the “Accounting” tab. After selecting the accounting procedure “Depreciation calculation”, details become available on the tab, which must be filled in for the correct calculation of depreciation.

Similarly, we fill out the “Tax Accounting” tab to calculate tax depreciation for this fixed asset.

I will tell you in more detail about fixed asset accounting in a special course.

After entering all the details, we submit the document.

When conducting, the following transactions will be generated:

Form OS-1 “Act of Acceptance and Transfer of Assets” is printed from the document.

Thus, the acquisition, installation and acceptance for accounting of a fixed asset consisting of several components is reflected in the 1C Enterprise Accounting 8.2 program.

Did you like the article? Subscribe to updates on the site “1C Lessons for Beginners and Practicing Accountants”

Video tutorial:

simplified tax system

Organizations using the simplified procedure are required to maintain accounting, including fixed assets (Part 1, Article 6 of Law No. 402-FZ of December 6, 2011). Therefore, reflect the purchased computer in your accounting.

The tax base of simplified organizations that pay a single tax on income is not reduced by the cost of purchasing a computer (clause 1 of Article 346.14 of the Tax Code of the Russian Federation).

When an organization pays a single tax on the difference between income and expenses, the cost of purchasing a computer reduces the tax base in the following order.

A computer, the initial cost of which is more than 100,000 rubles, is classified as depreciable property (clause 4 of article 346.16, clause 1 of article 256 of the Tax Code of the Russian Federation). Therefore, when calculating the single tax under simplification, the cost of a computer can be taken into account as expenses for the acquisition of fixed assets (subclause 1, clause 1, article 346.16 of the Tax Code of the Russian Federation).

At the same time, in the initial cost of the computer, also include pre-installed software that is necessary for the full operation of this property (clause 4 of article 346.16, paragraph 2 of clause 1 of article 257 of the Tax Code of the Russian Federation). An organization should not list such software separately.

A computer purchased without the minimum software cannot be used. Therefore, include the costs of purchasing and installing such programs in the initial cost of the computer as expenses for bringing it to a state suitable for use (clause 4 of article 346.16, paragraph 2 of clause 1 of article 257 of the Tax Code of the Russian Federation).

If a computer is not recognized as depreciable property, the costs of its acquisition can be taken into account as part of material expenses (subclause 5, clause 1 and clause 2, article 346.16, subclause 3, clause 1, article 254 of the Tax Code of the Russian Federation). For more details on when these costs are written off, see How to write off material costs using the simplified tax system.

Input VAT presented by the supplier when purchasing a computer should also be included in expenses (subclause 8, clause 1 and clause 3, article 346.16 of the Tax Code of the Russian Federation).

How to reflect the purchase of computer equipment in accounting: is there really no way to take into account used ones?

Modern business cannot be imagined without modern equipment. Automation is not some kind of “kitsch”, but a truly urgent need. Thank God, there are practically no leaders left in our country who do not understand this. Actually, that’s why now at interviews you won’t hear such a once relevant question: “Do you own a computer, fax, or scanner?” Young people may think this is crazy, but it really happened.

Based on this, it turns out that the same computers need to be updated from time to time, replacing old ones with new ones. Of course, some money is spent on this, which means that these transactions are subject to tax accounting. Today we will talk to you about how to do this in practice, what the registration of equipment depends on, and we will also touch on an equally important question in this topic: “Is it possible not to keep records”? It turns out that it is possible. But first things first…

OSNO and UTII

The object of UTII taxation is imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). Therefore, computer expenses do not affect the calculation of the tax base.

If the computer is included in the materials, then you need to allocate the costs of its acquisition (clause 9 of Article 274 of the Tax Code of the Russian Federation). The costs of purchasing a computer used in one type of activity of the organization do not need to be distributed.

The VAT allocated in the invoice for the purchase of a computer also needs to be distributed (clause 4 of Article 170 of the Tax Code of the Russian Federation).