2. Calculation of tax deductions for VAT.

We assume that all payments related to production costs for the company were made in the 1st quarter. There are invoices for services received and goods received, which highlight VAT amounts. This entitles the company to tax deductions for VAT. All payments for goods and services include VAT at a rate of 18%.

Paid for raw materials and materials - 1800 thousand rubles. VAT = 1800*18/118 = 274.6 thousand rubles.

Paid for rent - 150 thousand rubles. VAT = 150*18/118 = 22.88 thousand rubles.

Paid for electricity - 100 thousand rubles. VAT = 100*18/118 = 15.25 thousand rubles.

Paid for other production expenses - 350 thousand rubles. VAT = 350*18/118 = 53.38 thousand rubles.

Paid for the car - 420 thousand rubles. VAT = 420*18/118 = 64.06 thousand rubles.

The total amount of VAT to be deducted is:

(274.6+22.88+15.25+53.38+64.06)=430.17 thousand rubles.

Practical assignment on the topic: “Accounting for the sales process in accounting”

Task 1. Svet LLC sold 320 c. buckwheat at a planned cost of 7,685 rubles. for 1c. Actual cost of 1 c. – 7,625 rub. for 1c. Sales expenses amounted to RUB 183,000. Average selling price per 1 c. 8,000 rub. VAT -10%. Determine the result from the sale of products, draw up correspondence accounts.

- D90/2 K43 - (320*7,685) = 2,459,200 rub.

- Adjustment by 1 c. 7,625-7,685 = 60 rub.

- D 90/2 K 20 (60*320) = 19,200 rub.

- D 90/2 K44 – 183,000 rub.

- D62 K90/1 – RUB 2,560,000.

- D90/3 K68 – 256,000 rub.

| Dt (Debit) | 90 “Sale of buckwheat” | Kt (Credit) | |

| Opening balance — rub. | |||

| 1) RUB 2,459,200 3) 19,200 rub. 4) 183,000 rub. 6) 256,000 rub. | 5) 2,560,000 rub. | ||

| Turnover 2,879,000 rub. | Turnover 2,560,000 rub. | ||

| RUB 319,000 | |||

| Total RUB 2,879,000. | Total RUB 2,879,000. | ||

- D 90/9 K 90/1 – RUB 319,000.

- D 99 K 90/9 — RUB 319,000.

Task 2. LLC “Rassvet” sold 280 c. wheat at a planned cost of 185 rubles. for 1c. Actual cost of 1 c. — 193 rub. Selling expenses RUB 10,485. Average selling price per 1 c. 240 rub. VAT -10%. Determine the result from the sale of products, draw up correspondence accounts.

- D90/2 K43 (280*185) = 51,800 rub.

- Adjustment by 1 c. 193 rub. — 185 rub. = 8 rub.

- D 90/2 K 20 (8*280) = 2,240 rub.

- D 90/2 K44 – 10,485 rub.

- D62 K90/1 – 67,200 rub.

- D90/3 K68 – 6,720 rub.

| Dt (Debit) | 90 "Sale of wheat" | Kt (Credit) | |

| Opening balance — rub. | |||

| 1) 51,800 rub. 3) 2,240 rub. 4) 10,485 rub. 6) 6,720 rub. | 5) 67200 rub. | ||

| Turnover 71,245 rub. | Turnover 67,200 rub. | ||

| RUB 4,045 | |||

| Total RUB 71,245. | Total RUB 71,245. | ||

- D 90/9 K 90/1 – 4,045 rub.

- D 99 K 90/9 – 4,045 rub.

Task 3. Luch LLC sold 780 units. parts at a planned cost of 380 rubles. for 1 piece Actual cost of 1 piece. — 400 rub. Selling expenses RUB 15,000. Sales price for 1 piece. 740 rub. VAT -18%. Determine the result from the sale of products, draw up correspondence accounts.

- D90/2 K43 (780*380) = 296,400 rub.

- Adjustment for 1 piece. 400-380 = 20 rub.

- D 90/2 K 20 (780*20) = 15,600 rub.

- D 90/2 K44 – 15,000 rub.

- D62 K90/1 –577,200 rub.

- D90/3 K68 – 103,896 rub.

| Dt (Debit) | 90 "Sale of parts" | Kt (Credit) | |

| Opening balance — rub. | |||

| 1) 296,400 rub. 3) 15,600 rub. 4) 15,000 rub. 6) 103,896 rub. | 5) 577,200 rub. | ||

| Turnover 430,896 rub. | Turnover 577,200 rub. | ||

| RUB 146,304 | |||

| Total RUB 577,200. | Total RUB 577,200. | ||

3.VAT for transfer to the budget

The amount of tax payable to the budget is calculated at the end of each tax period. Amount of tax payable = total amount of tax minus

the amount of tax deductions

plus

the amount of restored tax.

Amount to be paid = 549.15 – 430.17 = 118.98 thousand rubles.

According to Art. 163 of the Tax Code of the Russian Federation, the tax period is established as a quarter. In previous editions of the Tax Code of the Russian Federation it was stated that if revenue during a quarter does not exceed 2 million rubles, then the organization has the right to switch to paying tax once a quarter. This item is currently missing.

The tax period for VAT is a quarter. Taxpayers are required to submit a tax return to the tax authorities no later than the 20th day of the month following the expired quarter. VAT is paid entirely to the federal budget.

The salary accrued for the quarter is 800 thousand rubles. The rate of contributions to extra-budgetary funds is 34% (FSS - 2.9%, Pension Fund - 22%, FFOMS - 5.1%).

For persons who are disabled by Federal Law of July 24, 2009. 212-FZ “On Insurance Contributions” establishes reduced rates for disabled people (Article 58). Tariff rates for 2014: Pension Fund -21%; FFOMS - 3.7%, FSS - 2.4%, i.e. total 27.1%. Since in our case the percentage of disabled people is 62%, let us assume that the salary of disabled people is also 62%.

Insurance premiums = 800*38%*30% + 800*62%*27.1% = 91.2+134.41 = 225.61 thousand rubles.

The billing period is a calendar year. Reporting period - first quarter, half year, nine months of the calendar year, calendar year. During the billing period, the policyholder pays insurance premiums in the form of monthly mandatory payments by the 15th day of the calendar month following the month for which the payment is being made.

Payment of contributions is carried out in separate settlement documents sent to the Social Insurance Fund, Pension Fund, Federal Compulsory Medical Insurance Fund

To the Social Insurance Fund: 8.81+11.90 = 20.71 thousand rubles.

To the Pension Fund: 66.88+104.16 =171.04 thousand rubles.

To the Federal Compulsory Medical Insurance Fund: 15.50+18.35 = 33.85 thousand rubles.

In the main taxation system, organizations and individual entrepreneurs are required to pay VAT on sales amounts. Also, value added tax is imposed on construction and installation works for one’s own needs, import of imported goods, transfer of property rights, transfer of goods (as well as works or services) for one’s own use.

Calculations with the budget for income tax

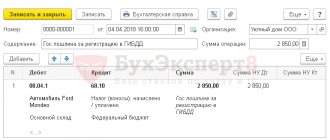

To summarize information about settlements with the budget for corporate income tax in “1C: Accounting 8”, account 68.04.1 “Settlements with the budget” is intended, subordinate to account 68.04 “Income Tax”.

The credit of account 68.04.1 reflects the accrual of income tax. The debit of account 68.04.1 reflects the amounts actually transferred to the budget (including advance tax payments).

Analytical accounting on account 68.04.1 is maintained:

- by types of payments (subconto Types of payments to the budget (funds)). To reflect transactions for the calculation and payment of tax (advance payments), the payment type Tax (contributions) is used: accrued / paid (we will consider other possible types of income tax payments below);

- by budgets to which tax is payable (subconto Budget Levels). For income tax, these are the Federal budget and the Regional budget.

Postings for calculating income tax in the program are generated automatically when performing the monthly routine operation Calculation of income tax, which is included in the Closing of the month processing.

The amounts of transactions for accrual of income tax are calculated as follows:

- According to tax accounting data, the taxable base is determined monthly on an accrual basis from the beginning of the year (regardless of the procedure for paying advance payments and the procedure for recognizing reporting periods in accordance with Articles 285 and 286 of the Tax Code of the Russian Federation).

- The income tax is calculated for each budget.

- The calculated amounts are compared with the tax amounts calculated in the last month of the current tax period (for each budget). If a positive difference is detected, then entries for “additional accrual” of tax are entered. If the difference turns out to be negative, then a decrease in previously accrued tax amounts is reflected.

Thus, the amount of calculated tax indicated in line 180 of sheet 02 of the income tax return (approved by order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3 / [email protected] ) for the reporting (tax) period must coincide with credit turnover of account 68.04.1 by type of payment Tax (contributions): accrued/paid for the corresponding period.

The procedure for reflecting transactions for calculating corporate income tax in 1C: Accounting 8 depends on whether the organization applies the Accounting Regulations “Accounting for calculations of corporate income tax” PBU 18/02 (approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n).

Note

The Ministry of Finance of Russia, by order No. 236n dated November 20, 2018, approved the new edition of PBU 18/02. The changes approved by Order No. 236n should be applied starting with reporting for 2020. Organizations can keep records under the new rules earlier, for example, from 2020 or from 2020. Read more about PBU 18/02 as amended. Order No. 236n and about support in “1C: Accounting 8” (rev. 3.0), see the article “Application of PBU 18/02 in “1C: Accounting 8”.

Tax base VAT

Calculated on the date of payment (advance payment) or on the date of shipment of goods (work, services). The earlier one is preferred. In case of receiving advances, the rates of 18/118 and 10/110 are applied to calculate VAT. Subsequently, during final settlements, the company deducts the amount of tax paid from the prepayment. When the buyer produces after receiving the products or services, the tax is charged once at the rates of 18% and 10%.

When the organization itself acts as a buyer, input VAT on the amounts of purchased goods or services can be used, thereby reducing the tax base. Or the tax can be reimbursed from the budget if the input VAT turns out to be more than the VAT payable.

Also, the VAT base can, on the contrary, be increased. We are talking about the restoration of value added tax, which falls under the requirements of Art. 170 Tax Code of the Russian Federation.

The final amount of VAT payable is obtained if deductions are subtracted from the tax base and added (if any) the amount of tax to be recovered.

Accounting entries for VAT: examples

VAT accounting covers a large layer of operations that reflect the interaction of business units with each other and the budget. Accounting records accompanying the company's activities streamline and structure all transactions performed with this tax. Let's talk about how the most common situations related to VAT are reflected in accounting - accrual, deduction, write-off, restoration, offset, etc.

Taking into account VAT, the accountant operates two accounts:

- Account 19, combining the amounts of “input” tax, i.e., accrued on acquired assets or services, but not yet reimbursed from the budget;

- Account 68 with the corresponding VAT sub-account, which reflects all tax transactions. On the credit side of the account, the accrual of tax is taken into account; on the debit side, the amount of VAT paid and reimbursed from the budget is taken into account. VAT reimbursement is reflected in the accounting entry D/t 68 K/t 19.

We invite you to familiarize yourself with the Deposited uncollected wages transaction

Postings

Alpha entered into a supply agreement with Omega. In February, Alpha purchased 150 units of goods for resale from Gamma in the amount of RUB 172,547. (VAT 18% - 321 rubles). In March, 138 units of goods were sold for the amount of RUB 287,598. (VAT 18% - 871 rub.) "Omege". Ownership of the goods passes at the time of payment. Calculate how much VAT should be transferred to the budget.

First, we need to find out the price of one unit of purchased goods: 172547/150 = 1150.31 (VAT 175 rubles). Then, we find out the cost of 138 units of goods sold: 138 x 1150.31 = 158,743.44 (VAT 24,215 rubles). Now let’s calculate the tax payable: 43871 – 24215 = 19656.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| . | Products have arrived for resale | 146 226 | Packing list | |

| 321 | Invoice | |||

| 68 VAT | VAT is accepted for deduction | 321 | Book of purchases | |

| Received funds from Omega | 287 598 | Bank statement |

Talking about what value added tax (VAT) is is not the most difficult task, unless you go into details. Basic knowledge on this issue will not be superfluous not only for future accountants and economists, but also for people far from such specific areas of activity.

VAT postings from A to Z for a teapot

Value added tax is an indirect tax. This concept means that it occurs at all stages of production, but is paid to the budget as it is sold. It is important to keep VAT records correctly and correctly generate VAT transactions.

VAT happens:

- Input - intended for deduction when purchasing goods, services, etc.;

- To be restored - the amount of tax that the seller must transfer to the budget.

Activities subject to VAT are any activities leading to an increase in the cost of a production product. In other words, when producing products, goods or any services, the seller sells them at a price higher than their cost.

VAT accrued arises upon sale and is taken into account in account 68 “Calculations for taxes and fees”, on the loan.

When selling products for the main activity of the enterprise, revenue is reflected in passive subaccount 90.1.1, and active subaccount 90 is used to reflect the amount of tax.

When selling in addition to the main activity (for example, when selling fixed assets), revenue is similarly reflected in account 91 “Other income and expenses”.

The trading company sells purchased goods in the amount of 236,000 rubles, as well as fixed assets, the sales amount is 178,000 rubles.

| Dt | CT | Operation description | Amount, rub. | Document |

| 62 | 90(revenue) | Revenue reflected | 236 000 | Invoice |

| 90(VAT) | 68(VAT) | VAT charged | 36 000 | Invoice issued |

| Dt | CT | Operation description | Amount, rub. | Document |

| 62 | 91(revenue) | Sales income reflected | 178 000 | Invoice |

| 91(VAT) | 68(VAT) | VAT charged | 27 153 | Invoice issued |

VAT recoverable

Input VAT or VAT for refund (deduction) is the amount paid to the supplier as part of the purchased goods. In delivery documents, the tax amount is shown separately, on a separate line.

The same company purchases its goods from the supplier Panda LLC at a wholesale price. Let's assume that a batch of goods purchased earlier for the amount of 156,000 rubles was sold, including VAT - 23,797 rubles.

| Dt | CT | Operation description | Amount, rub. | Document |

| 41 | 60 | The received goods have been capitalized | 132 203 | Invoice |

| 19 | 60 | VAT allocated for deduction | 23 797 | Invoice received |

| Dt | CT | Operation description | Amount, rub. | Document |

| 68(VAT) | 19 | Amount claimed for deduction | 23 797 | Book of purchases |

In this way, you can calculate the amount of tax that Orion must pay to the budget. This amount is calculated as “VAT accrued” minus “VAT deductible”. This difference is equal to 36,000 rubles. — 23,797 rub. = 12,203 rub.

Flamingo LLC received an advance payment from the buyer in the amount of 98,000 rubles against the upcoming delivery of goods. The amount of VAT intended for restoration to the budget: 98,000 * 18/118 = 14,949 rubles.

| Dt | CT | Operation description | Amount, rub. | Document |

| 51 | 62 | Receipt of advance payment | 98 000 | Payment order |

| 76(advances) | 68(VAT) | VAT charged on advance payment | 14 949 | SF issued |

After the sale has taken place, that is, the goods have been shipped to the buyer, or after canceling the transaction and returning the advance payment, this VAT can be deducted.

| Dt | CT | Operation description | Amount, rub. | Document |

| 68(VAT) | 76(advances) | VAT is presented for deduction to the budget | 14 949 | Book of purchases |

An organization has the right to receive a VAT deduction from advances transferred towards future deliveries if there is an SF and the contract specifies the condition for advance payment.

against the upcoming receipt of equipment, transfers an advance in the amount of 95,000 rubles.

| Dt | CT | Operation description | Amount, rub | Document |

| 60 | 51 | Advance transferred | 95 000 | Payment order ref. |

| 68 | 76(advances) | VAT is deductible | 14 492 | Book of purchases |

| 08 | 60 | Equipment accepted for registration | 77 900 | Invoice |

| 19 | 60 | VAT on delivery allocated | 17 100 | SF supplier |

| 68 | 19 | VAT is deductible | 17 100 | Book of purchases |

| 76(advances) | 68 | Recovered VAT from advance payment | 14 492 | Sales book |

VAT penalties

In case of late payment of tax, the organization is obliged to calculate and transfer penalties for the delay. Penalties are calculated at 1/300 of the Central Bank refinancing rate independently, or as a result of a tax audit.

| Dt | CT | Operation description | Document |

| 99 | 68 | The amount of the penalty is reflected | Accounting information |

| Dt | CT | Operation description |

| 26(20,44, etc.) | 60(76) | Reflection of services |

| 60(76) | 68 | Reflection of VAT for the agent |

| 19 | 60(76) | Input VAT |

| 68 | 51 | Reflection of tax remittance by agent |

| 68 | 19 | VAT refundable at the time of tax transfer |

Economic content of VAT

VAT is one of the taxes in Russia that has a significant impact on the formation of the state budget. The essence of the tax is fully reflected by its name. That is, it is from the added value by which the manufacturer increased the value of the original product (raw materials or semi-finished product) that it is accrued.

For “dummies”: VAT is a tax that is assessed and paid by manufacturing enterprises, wholesale and retail trade organizations, as well as individual entrepreneurs. In practice, its size is determined as the product of the rate by the difference between the revenue received from the sale of one’s own products (goods, services) and the amount of costs that were used for its production. Simply put, that part of the product that is added to the original product (in fact, this is the newly created value) is the taxable base. This type of tax is indirect, as it is included in the price of the product. Ultimately, it is paid by the buyer, and formally (and practically) its payment is made by the owners and producers of the goods.

Postings for the sale of goods without VAT

Sales of finished products with payment after shipment (transfer)

90.243 The posting reflects the shipment of finished products. The amount of the cost depends on the methodology for assessing the output of finished products. Cost of finished products. Consignment note (form No. TORG-12) 62.0190.1 The posting reflects the proceeds for the sale value of finished products with VAT. Sales value of finished products (amount including VAT) Consignment note (form No. TORG-12) Account invoice 90.368.2 The posting reflects the amount of VAT on products sold Amount of VAT Goods invoice (form No. TORG-12) Invoice Sales book 5162.01 The posting reflects the fact of repayment of debt for shipped products Sales value of finished products Bank statement Payment order 2. Sales of finished products on prepayment 5162.02 Reflects the buyer's prepayment for finished products Prepayment amount Bank statement Payment order 76.АВ68.2 VAT is charged on prepayment VAT amount Payment order Invoice Sales book 90.243 The posting reflects the shipment of finished products. The amount of cost depends on the methodology for estimating the output of finished products. Cost of products. Product invoice (form No. TORG-12) 62.0190.1 Revenue is reflected on the sale value of finished products with VAT. Sales value of finished products (amount with VAT) Invoice (form No. TORG-12) Invoice 90.368.2 The amount of VAT is calculated on the sold products. Amount of VAT. Invoice (form No. TORG-12) Invoice 62.0262.01. The previously received prepayment is credited to pay off the debt for the shipped products.Postings reflecting the disposal of finished products under commission agreements, barter, etc. similar to goods accounting

List of accounts involved in accounting entries:

|

|

Objects of taxation

Objects for calculating VAT are revenue from the sale of created products, works and services performed, as well as:

The cost of ownership of goods (work, services) when they are transferred free of charge;

The cost of construction and installation work carried out for one’s own needs;

The cost of imported goods, as well as goods (work, services), the transfer of which was carried out on the territory of the Russian Federation (it is not included in the taxable income tax base).

VAT calculation: posting

When selling goods (works, services) subject to VAT, the accrual of this tax must be reflected in the accounting records.

| Operation | Wiring |

| VAT is charged on the sale of goods (work, services) in the main type of activity | Debit account 90 “Sales” - Credit account 68-VAT |

| VAT is charged on the sale of goods (work, services) for additional types of activities. For example, if an organization is engaged in trade, but simultaneously rents out some premises | Debit account 91 “Other income and expenses” - Credit account 68-VAT |

VAT payers

Article 143 of the Tax Code of the Russian Federation establishes that VAT payers are legal entities (Russian and foreign), as well as individual entrepreneurs registered with the tax authorities. In addition, payers of this tax include persons moving goods and services across the borders of the Customs Union, but only if customs legislation establishes the obligation to pay it.

In Russia, VAT is provided in 3 options:

- 10 %.

- 18 %.

The amount of accrued tax is determined by the product of the interest rate divided by 100 by the taxable base.

Non-operating turnovers (deposit transactions for the formation of the authorized capital, transfer of fixed assets and property of the enterprise to the legal successor, and others), transactions for the sale of land plots and many others enshrined in law are not recognized as objects for the calculation of this tax.

Free sales: wiring

Sometimes sales also mean the gratuitous transfer of goods. Naturally, in this case, the “seller” does not reflect income from the disposal of goods. And expenses associated with the sale will not be taken into account in account 90. To account for the gratuitous transfer, account 91 “Other income and expenses” is used (Order of the Ministry of Finance dated October 31, 2000 No. 94n, clause 11 PBU 10/99).

Free sales of goods will be accounted for as follows:

| Operation | Account debit | Account credit |

| The cost of goods transferred free of charge has been written off | 91, subaccount “Other expenses” | 41 |

| VAT is charged at the time of shipment | 91, subaccount “VAT” | 68 |

| Expenses associated with gratuitous transfer have been written off | 91, subaccount “Other expenses” | 60 “Settlements with suppliers and contractors”, 71 “Settlements with accountable persons”, etc. |

18% VAT rate

Until 2009, the VAT rate of 20% was applied to the largest number of transactions. The current rate is 18%. To calculate VAT, you need to calculate the product of the tax base and the interest rate divided by 100. Even simpler: when determining (for dummies) VAT, the tax base is multiplied by the tax rate coefficient - 0.18 (18% / 100 = 0.18). Thus, the amount of VAT is included in the price of goods, works and services, falling on the shoulders of consumers.

For example, if the price of a product without VAT is 1000 rubles, the rate corresponding to this type of product is 18%, then the calculation is simple:

VAT = PRICE X 18/ 100 = PRICE X 0.18.

That is, VAT = 1000 X 0.18 = 180 (rubles).

As a result, the selling price of goods is the calculated cost of the product including VAT.

Sales of goods, works, services: how to reflect them in accounting

The amount of cost depends on the methodology for assessing the output of finished products

Cost of finished productsCommodity invoice (form No. TORG-12) 62.0190.1 The posting reflects the proceeds on the sale value of finished products with VAT Sales cost of finished products (amount including VAT) Consignment note (form No. TORG-12) Invoice 90.368.2 The posting reflects the amount of VAT for sold products Amount of VAT Goods invoice (form No. TORG-12) Invoice Sales book 5162.01 The posting reflects the fact of repayment of debt for shipped products Sales value of finished products Bank statement Payment order 2. Sales of finished products on prepayment 5162.02 Reflects the buyer's prepayment for finished products Prepayment amount Bank statement Payment order 76.АВ68.2 VAT is charged on prepayment VAT amount Payment order Invoice Sales book 90.243 The posting reflects the shipment of finished products. The amount of cost depends on the methodology for estimating the output of finished products. Cost of products. Product invoice (form No. TORG-12) 62.0190.1 Revenue is reflected on the sale value of finished products with VAT. Sales value of finished products (amount with VAT) Invoice (form No. TORG-12) Invoice 90.368.2 The amount of VAT is calculated on the sold products. Amount of VAT. Invoice (form No. TORG-12) Invoice 62.0262.01. The previously received prepayment is credited to pay off the debt for the shipped products.Postings reflecting the disposal of finished products under commission agreements, barter, etc. similar to goods accounting

List of accounts involved in accounting entries:

|

|

Zero VAT rate, features of its application

A rate of 0% applies to goods (work and services) related to space activities, sales, mining and production of precious metals. In addition, a significant volume of transactions consists of transactions for the movement of goods across the border, the registration of which must comply with the Zero VAT rate requires documentary evidence of export, which is provided to the tax authorities. The package of documents includes:

- An agreement (or contract) of a taxpayer for the sale of goods to a foreign person outside the Russian Federation or the Customs Union.

- for the export of products with a mandatory mark from Russian customs about the place and date of departure of the goods. You can submit documents on transportation and support, as well as other confirmation of the export of any products outside the borders of the Russian Federation.

If, within 180 days from the moment of movement of goods across the border, a complete package of necessary documents is not completed and submitted to the tax office, then the payer is obliged to accrue and pay VAT at an 18% (or 10%) rate. After the final collection of customs confirmation, it will be possible to refund or offset the tax paid.

Features of reflecting expenses

The main differences apply to three types of organizations: manufacturing and agricultural, trading enterprises (or acting as intermediaries), construction companies that directly procure technical materials or structures.

The main difference in recording expenses between the listed types of organizations is related to the nature of their activities. For example, sales organizations would not use account 44 for packaging or shipping costs. At the same time, the costs of storing goods at the points of sale themselves will relate specifically to this type of enterprise.

The debit of account 44 is also used to reflect the costs of an employee’s business trip if it is related to the sales of finished goods (manufacturing organization) or the main activity (trade organization). Correspondence is carried out by debit and credit of account 71 when accruing travel expenses. When paying for travel expenses, posting Dt 44 Kt 76 “Settlements with various debtors and creditors” is carried out.

Subaccounts 44 accounts

All costs associated with the sale of goods, performance of work and provision of services are reflected in accounting through “Sale expenses” - account 44 according to the accounting plan approved by Order of the Ministry of Finance No. 94n dated October 31, 2000.

Thus, accounting account 44 (for dummies) can be defined as a position in the plan, which is intended to record the enterprise’s operational data on costs arising in the process of selling goods, works, services (GWS).

In order to understand “Sales Expenses” which account is active or passive, you need to consider what is reflected in its debits and credits. Receipts of expenses are recorded as debit, and disposals are recorded as credit. This means that the count. 44 - active. It is also synthetic and analytical. Subaccounts to account 44 are opened depending on the specifics of the activity and industry of the organization, which must be fixed in the accounting policy. Analytics is carried out by types and cost items, which also depend on the type of activity of the enterprise.

What is taken into account in account 44 for institutions directly related to industry and the production process? For non-trading enterprises, the following types of costs are distinguished:

- packaging of manufactured products;

- loading, transportation and delivery costs;

- maintenance of premises intended for storing goods until sale;

- fees and commission payments;

- advertising and entertainment costs.

For organizations that engage in trade, such costs may include:

- employees' wages;

- rent;

- transportation of products;

- maintenance and storage of products;

- representation and advertising costs.

Filling out a VAT return and deadlines for submitting it

At the initial stage of preparation for filing tax reports, the accountant’s work is focused on determining the base on which the tax amount is subsequently calculated. Filling out a VAT return begins with the design of the title page. In this case, it is very important to carefully and carefully enter all the required details (names, codes, types, etc.). All pages contain the date and signature of the manager (or individual entrepreneur), which must be stamped on the title page. The declaration must be submitted to the tax office at the place of registration, but no later than the 20th day of the month following the reporting quarter. Its payment is also established within the same deadlines (if the deadline is quarterly). Thus, payment and accrual of tax for the 1st quarter of 2014 had to be made before April 20 of the current year.

Sales of goods posting

There are various accounting schemes for the sale of finished products. When selling, finished products are shipped to the buyer, and payment for the products is received from him.

Moreover, a situation is possible when payment is received first, and then the products are shipped. It also happens that the products are shipped first, and then payment is received from the buyer.

In addition to these simple cases in sales accounting (as, indeed, in other areas of accounting), more complex cases are possible.

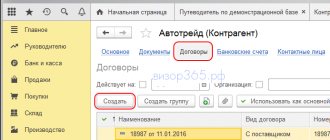

Various methods of selling products in 1C:Accounting fit into the following scheme:

1. An agreement is concluded with the buyer for the supply of products (type of agreement - With the buyer);

2. The buyer is issued an invoice (document Invoice for payment to the buyer);

3. When payment is received from the buyer based on the invoice (or by filling out the invoice without using the based entry mode), enter the incoming cash or bank document into the system. Moreover, payment is possible in installments, using various payment methods, etc.

4. The products are transferred to the buyer, the document Sales of goods and services is filled out, which reflects the sale of finished products in accounting.

5. Sales operations, like many other operations, require special actions regarding VAT accounting. In particular, when issuing an invoice to a buyer, you need to create an invoice (for example, using the appropriate link in the Sales of goods and services document), and at the end of the month you should create a Sales Book. We will talk more about VAT accounting in one of the following lectures.

Let's look at an example.

On 02/02/2009, Contract No. 1 was concluded with Buyer LLC for the supply of 320 shelves at a selling price of 300 rubles. for 1 shelf (VAT on top, 18%).

Tax deductions

Particular attention should be paid to deductions, that is, the amount of VAT that is presented by suppliers and also paid at customs when exporting goods. It is very important that the tax accepted for deduction is directly related to the accrued turnover. Simply put, if VAT is charged on turnover on the sale of product “A”, then all purchases related to this product are taken into account. Confirmation of the right to deduct is certified by invoices received from suppliers, as well as documents for payment of tax amounts when crossing the border. VAT is included in them as a separate line. Such invoices are filed in a separate folder, and turnover for each product is recorded in the purchase book according to the approved form.

During tax audits, questions often arise regarding the improper completion of required fields, the indication of incorrect details, and the absence of signatures of authorized persons. As a rule, in such a situation, employees of the Federal Tax Service cancel the corresponding amounts of deductions, which leads to additional VAT charges and penalties.

VAT accrued on products sold transaction

Tax authorities and investigators have agreed who can be considered “tax criminals”

The Investigative Committee and the Tax Service have developed methodological recommendations for establishing facts of deliberate non-payment of taxes and forming an evidence base.

Pension Fund branches do not have the right to demand zero SZV-M from companies

Recently, the Altai branch of the Pension Fund of the Russian Federation issued an ambiguous information message regarding the rules for submitting SZV-M. The information stated that “even if there are no employees, the employer still submits information, but only without indicating the list of insured persons.”

Changes have been made to PBU “Accounting Policies”

As of August 6, 2017, amendments to PBU 1/2008 “Accounting Policies of Organizations” come into force. Thus, in particular, it has been established that in cases where federal standards do not provide for a method of accounting for a specific issue, a company can develop its own method.

Unscrupulous taxpayers may be refused to accept reports

Khabarovsk tax officials reported that territorial inspectorates have the right not to accept declarations from organizations that have signs of unscrupulous payers.

How to provide explanations for the calculation of contributions

If the calculation of contributions reflects non-taxable amounts or reduced tariffs, then during a desk audit of the calculation, the Federal Tax Service will send you a request. In it, she will request documents confirming the validity of reflecting such amounts and tariffs. Your task is to correctly answer this requirement.

For income tax purposes, the date of presentation of the “primary report” is the date of its preparation

Expenses for the acquisition of work (services) performed (rendered) by third parties are recognized for “profitable” purposes in the period in which the fact of performing these works (rendering services) is documented. The Ministry of Finance reminded what to consider as the date of such documentary evidence.

The organization's expenses for purchasing drinking water for employees and installing coolers are included in the costs of ensuring normal working conditions, which, in turn, are taken into account as part of other expenses. This means that “water” amounts can be included in the “profitable” base without any problems.

Current as of: January 31, 2020

The sale of goods and services is the transfer of ownership of goods and the provision of services for a fee by one person to another person. We will tell you about standard accounting entries for the sale of goods and services in our consultation.

The main account for accounting for the sale of goods in accordance with the Chart of Accounts and the Instructions for its application (Order of the Ministry of Finance dated October 31, 2000 No. 94n) is account 90 “Sales”. This account reflects the proceeds from the sale of goods, as well as expenses associated with the sale and VAT accrued on sales.

Sales of goods are reflected in the Credit of account 90 “Sales” and in the Debit of account 41 “Goods”.

Expenses for the acquisition, storage and sale of goods are in account 44 “Sales expenses”.

D 90-2 “Cost of sales” K 42 “Trade margin” (reversal) – trade margin reversed

The organization (accrual method) shipped products to the buyer in January 2013 in the amount of 11,800 rubles. (including VAT RUB 1,800)

Under the contract, ownership of the products passes to the buyer on the day of shipment and transfer of payment documents to the buyer. Money from buyers arrived in April 2013.

The cost of production is 8,700 rubles.

Dt 62 Kt 90.1 (Revenue) – 11,800 rubles. – accrued revenue to be received from the buyer;

Dt 90.3 Kt 68 (VAT) – 1,800 rub. – VAT was charged on products sold for the 1st quarter;

Dt 90.2 (Cost of sales) Kt 43 – 8,700 rub. – the cost of shipped products is written off.

Receipt of goods from suppliers in retail and wholesale trade

Dt 60 – Kt 50; 51 – Paid to the supplier for the goods;

Dt 41.1; 41.2 – Kt 60 – Goods were capitalized at the purchase price;

Dt 41.3 – Kt 60 – Containers for goods received from the supplier are capitalized;

Dt 44 – Kt 60 – Transport costs from the supplier are reflected in the accounting;

Dt 19 – Kt 60 – Reflected in VAT accounting for the supplier’s transport services;

Dt 63 – Kt 60 – The shortage or damage to goods identified upon acceptance due to the fault of the supplier or transport company is reflected in the accounting;

Dt 84 – Kt 60 – The shortage or damage to goods identified upon acceptance is reflected in the accounting;

Dt 19 – Kt 60 – Reflected in the accounting of VAT on goods received in wholesale trade;

Dt 41.2 – Kt 60 – Reflected in accounting for VAT on goods received in retail trade.

Using count 45

Inventory items shipped to the buyer are recorded on account 45 “Goods shipped” before receiving money.

The basis for entries in the debit of this account are shipping documents.

Dt 45 – Kt 41.1 – Shipped goods are reflected in accounting;

Dt 62 – Kt 90.01.1 – Sales of goods are reflected;

Dt 90.03 – Kt 68.02 – VAT is reflected on the sale of goods;

Dt 91.02.1 – Kt 45 – Reflects the cost of goods shipped;

Dt 51(50) – Kt 62 – Money received from the buyer.

Sales of goods to the buyer

Dt 91.02.1 – Kt 41.1 – Reflects the cost of goods shipped;

Dt 51 (50) – Kt 62 – Money received from the buyer.

In retail trade.

Dt 62.R – Kt 90.01.1 Sales of goods are reflected;

Dt 50 – Kt 62 – Money received from the buyer at the cash desk;

Dt 57 – Kt 62 – Payment by bank card is displayed;

Dt 51 – Kt 57 – Receipt of payment by payment card;

Dt 57 – Kt 62 – Delivery of proceeds to bank collectors;

Dt 51 – Kt 57 – Crediting of collected proceeds.

Postings for Return of Goods

When returning a quality product by agreement of the parties, a reverse sale occurs in accordance with the new purchase and sale agreement. The seller becomes the buyer, and the buyer becomes the seller.

The accounting entries in the seller's and buyer's accounts are not reversed.

If the seller agreed with the claim presented to him for the return of low-quality goods and signed a certificate of return of the goods, then he should reverse all transactions that reflect the sale of the returned goods.

Dt 41 – Kt 60 – reflects the cost of the goods received;

We invite you to familiarize yourself with the Contract for the supply of building materials: sample filling

Dt 19 – Kt 60 – “input” VAT on the registered goods is taken into account;

Dt 68.2 – Kt 19 – the amount of “input” VAT is accepted for deduction;

Dt 41- Kt 60 – the cost of goods returned to the seller is reversed;

Dt 19 – Kt 60 – the amount of VAT presented by the supplier in relation to the cost of the returned goods is reversed;

Dt 68.2 – Kt 19 – the entry for the deduction of VAT relating to the cost of returned goods is reversed.

Markdown and Sale of Goods at Reduced Prices

Dt 41.1 – Kt 60 – purchased goods are capitalized;

Dt 19 – Kt 60 – reflects the amount of VAT on purchased goods;

Dt 68 – Kt 19 – accepted for deduction of VAT on purchased goods;

Dt 41.1 – Kt 42 – reflects the amount of the trade margin;

Dt 42 – Kt 41.1 – the markdown of goods is reflected in the amount of the trade margin on the purchased goods;

Dt 50 – Kt 90-1 – revenue from the sale of goods at a discounted value is recognized;

Dt 90-2 – Kt 41.1 – the sales value of the goods sold is written off;

Dt 90-3 – Kt 68.02 – VAT is charged on revenue payable;

Dt 99 – Kt 90-9 – financial result (loss) is reflected.

Conditions for VAT refund

Satisfaction of the rights of payers to reimbursement of the amount of tax paid is carried out on the basis of a desk audit carried out by the tax authorities. The declarative procedure for VAT refund occurs in relation to a few payers who meet the following conditions:

The total amount of taxes paid (VAT, excise taxes, income taxes and production taxes) must be at least 10 billion rubles. for the 3 calendar years preceding the year in which the application for compensation was submitted;

The payer received a bank guarantee.

The application of this procedure provides for one more condition: the payer must be registered with the tax authorities of the Russian Federation for at least 3 years before filing a tax return for

Accounting in trade

VAT on expenses for an advertising campaign; DEBIT 68 subaccount “Calculations for VAT” CREDIT 19-5400 rub. — VAT deduction has been made; DEBIT 60 CREDIT 51- 35,400 rub. — paid advertising costs; DEBIT 90-2 CREDIT 44- 226,500 rub. (150,000 + 1500 + 45,000 + 30,000) - business expenses written off. On line 2210 “Business expenses” of the profit and loss statement for the reporting year, the accountant must reflect the amount of 227 thousand rubles. (RUB 226,500). Write-off of expenses Business expenses are written off to cost in different ways.

The way they are written off depends on many factors. In particular, on the procedure for transferring ownership of shipped products. If this happens after the product has been shipped to the buyer, write off commercial expenses directly to the debit of account 90, subaccount 2 “Cost of sales”. PFR, FSS, FFOMS; DEBIT 44 CREDIT 60- 60,000 rub. (70,800 - 10,800) - reflects the costs of conducting an advertising campaign; DEBIT 19 CREDIT 60- 10,800 rub. — VAT on the advertising campaign is taken into account; DEBIT 68 subaccount “Calculations for VAT” CREDIT 19- 10,800 rub. — VAT deduction has been made; DEBIT 90-2 CREDIT 44- 450 600 rub. (300,000 + 600 + 90,000 + 60,000) - business expenses written off. On line 2210 “Business expenses” of the profit and loss statement for the reporting year, the accountant must reflect the amount of 451 thousand rubles. Write-off of expenses All business expenses of the company are written off monthly to account 90, subaccount 2 “Cost of sales”. An exception is provided for transportation costs associated with the purchase of goods.

Refund procedure

To receive a VAT refund, the taxpayer must submit a written application to the tax authority for the refund of tax amounts. These amounts can be returned to the current account indicated in the application or offset against other tax payments (if there are debts on them). The inspectorate will make a decision within 5 working days. VAT refunds are made within the same period in the amount specified in the decision. If funds are not received into the current account on time, the taxpayer has the right to receive interest for the use of this money from the tax authorities (from the budget).

Accounting for sales and settlements with customers

The purpose of reflecting business transactions for sales (sales) is to identify the financial result from the sale of products (goods, works, services).

In accordance with PBU No. 9 “Income of an organization,” an organization’s income is recognized as an increase in economic benefits as a result of the receipt of assets (cash, other property) and (or) repayment of obligations leading to an increase in the capital of this organization, with the exception of contributions from participants (owners of property) .

The income of the organization, depending on its nature, conditions for receipt and areas of activity, is divided into:

- income from ordinary activities;

- operating income;

- non-operating income.

Proceeds from the sale of products and goods, receipts associated with the performance of work and provision of services are income from ordinary activities.

PBU No. 9 defines the conditions under which revenue is recognized in accounting:

- The organization has the right to receive proceeds. This right must be supported by a specific contract or otherwise confirmed;

- The amount of revenue can be determined;

- There is confidence that a particular transaction will result in an increase in the economic benefits of the organization. Such confidence exists if the organization received an asset in payment, or there is no uncertainty in its receipt;

- The ownership (possession, use and disposal) of the product (goods) has passed from the organization to the buyer or the work has been accepted by the customer (service provided);

- The expenses that have been incurred or will be incurred in connection with this operation can be determined.

All five conditions must be met.

To account for sales, account 90 “Sales” is used. For information on using account 90 “Sales”, see the section “Sales, income and expenses, calculation of financial results.”

In financial accounting, products are considered sold from the moment of their shipment, unless the contract provides for another moment of transfer of ownership. The contract may provide for the moment of transfer of ownership of the shipped products after payment or not at the time of shipment, but at the time of receipt by the buyer.

Postings for product sales

Schematically, the correspondence of accounts for accounting for product sales can be presented as follows.

If ownership has passed to the buyer and the products are considered sold, then for the sale of products in this case the following is reflected:

(1) Revenue reflected:

Dt 62 “Settlements with buyers and customers” sales amount rub.

Kt 90.1 “Sales-Revenue” sales amount rub.

(2) Cost of products sold written off:

Dt 90.2 “Sales-Cost” cost RUB.

Kt 43 “Finished products” cost rub.

Selling expenses attributable to shipped products are reflected:

Dt 90.5 “Sales - Selling expenses” selling expenses rub.

Kt 44 “Sales expenses” sales expenses rub.

Expenses associated with the sale of products are called commercial (non-production) and are accounted for in account 44 “Sales expenses”. They include: costs for containers and packaging made in accordance with the terms of the contract; transportation costs for the sale of products made at the expense of the supplier, when wholesale prices are set taking into account loading, delivery, unloading, other sales costs (commission fees, product analysis costs, etc.).

Costs for containers are included in non-production expenses in cases where packaging of finished products is carried out after they are delivered to the warehouse. If packaging is carried out in workshops before the finished product is delivered to the warehouse, then the cost of packaging is included in the production cost of the product. Commercial expenses are recorded in active account 44 “Sales expenses”.

Desk inspection

To verify the validity of the returned amounts, the tax inspectorate conducts a desk audit within 3 months. If facts of violations are not established, then within 7 days after completion of the inspection, the person being inspected is informed in writing about the legality of the offset.

If violations of the current Russian legislation are detected, the inspectorate draws up an inspection report, based on the results of which a decision is made against the taxpayer (either to refuse to attract, or to hold accountable). In addition, the violator is required to return the excess amounts of VAT and interest for the use of these funds. If the specified amount is not returned, the obligation to return it to the budget of the Russian Federation rests with the bank that issued the guarantee. Otherwise, the tax authorities write off the necessary funds in an indisputable manner.

Some provisions relating to the calculation and payment of VAT are quite complex for immediate understanding, but thoughtful understanding gives results. Particular difficulty in understanding this tax is created by specific terms and regular changes in the legislation of the Russian Federation.

This article is devoted to perhaps one of the most confusing and difficult taxes to calculate - VAT.

. We will try to simply and clearly explain what VAT is, who pays it, how to correctly calculate VAT, at what rates, and some other nuances that will help you better understand this complex tax. And now, first things first.

What is VAT.

So, the very name “value added tax” means that the tax is charged on the cost of a product (work, service) added exclusively by your organization when selling this product (work, service).

For example:

We buy. We buy goods from the supplier

at cost No. 1 –

50,000 rubles. On top he added VAT No. 1 (18%) - 50,000 * 18% = 9,000 rubles. In total, we bought the goods at a cost including VAT No. 1 –

50,000+ 9,000 = 59,000 rubles. We sell.

We sell goods at cost No. 2 – 55,000 rubles. We add VAT No. 2 (18%) – 55,000*18% = 9,900 rubles. We sell goods at cost including VAT No. 2–

55,000+9,900=64,900 COST No. 2 – COST No. 1 = ADDED VALUE

That is, in essence, the difference between cost

No. 2

and cost

No. 1

is

added value.

And VAT is calculated arithmetically from this difference.

VAT=(55,000 – 50,000)*18%=900 rub.

Who pays?

As stated in Article 143 of the Tax Code of the Russian Federation, companies and individual entrepreneurs using the general taxation system must pay VAT. Conventionally, VAT payers are divided into 2 groups: - taxpayers of “internal” VAT, which is paid when selling goods, works or services in our country; — taxpayers of “import” VAT, paid at customs when importing goods into Russia.

The moment when the obligation to pay VAT arises.

The obligation to pay VAT arises at 2 points: 1. day of shipment 2. day of payment for goods (advance payment), depending on which of the events occurred earlier.

Example 1: Moment - shipment.

March 15 1. Dt 62.1 Kt 90.1

–

236,000 rub.

— goods shipped

2. Dt 90.3 Kt 68.02

–

236,000 rub.

It is on this day that we have an obligation to the budget to pay taxes.

April 18,

3. Dt 51 Kt 62.1

–

236,000 rub.

- the goods have been paid for.

Example 2: Moment – payment (advance).

March 15 Dt 51 Kt 62.2

–

236,000 rub.

— advance payment received from the buyer

Upon receipt of advance payment from the buyer, the seller has 5 days to issue an invoice for the advance payment; VAT is charged on the day the invoice is issued, i.e. our debt to the budget arises. Dt 76.AV Kt 68.02

–

36,000 rub.

— an invoice was issued for the advance payment, VAT was charged

on April 18 Dt 62.1 Kt 90.1

–

236,000 rub

. — goods shipped

Dt 90.3 Kt 68.02

–

36,000 rub.

— an invoice has been issued, VAT has been charged

Dt 68.02 Kt 76.AV

–

36,000 rub.

— VAT is credited from the advance received.

Tax rates.

Guided by Article 164 of the Tax Code of the Russian Federation, it is possible to determine the existing VAT tax rates. 18%.

The basic rate is 18% - it is applicable for most tax objects.

10%.

Some groups of food products, children's products, medicines, and books are subject to a VAT rate of 10%.

0%.

Exporters apply a 0% rate, provided that the fact of the export transaction is documented by the tax authority.

The Tax Code provides for another concept, such as the estimated rate. It should be used when receiving advances or prepayments for goods. It is calculated as follows: 18%: 118% or 10%: 110%, depending on the category of the above-mentioned goods.

For example:

An advance was received from the buyer for goods taxed at a rate of 18% in the amount of RUB 118,000. We calculate VAT at an estimated rate of 18%: 118%. 118,000*18:118=18,000 rub.

How to correctly calculate VAT.

In order to correctly calculate the VAT payable, you must first determine the tax base.

The tax base is the sum of all income received by the organization during the billing period. This amount is equal to: Calculation of the tax base is defined in Article 153 of the Tax Code of the Russian Federation. The next stage will be the direct calculation of VAT. The formula for calculating VAT on the amount looks like this:

VAT = Tax base x Tax rate (%)

It should be remembered

that if the company’s activities involve the sale of goods subject to different VAT rates, then the tax base is calculated for each category of goods separately.

Tax deductions.

At the beginning of the article, we examined the concept of “added value”. So, in order for the taxpayer to correctly calculate his “added value”, and accordingly the VAT payable to the budget, the concept of a tax deduction applies (Article 171 of the Tax Code of the Russian Federation).

A deduction is VAT that you paid either to the supplier of goods, services or work in the course of your business activity, or at customs when importing goods, as well as VAT on amounts for goods received or work performed.

So what tax should we pay to the budget?

Let's return to our example, discussed at the very beginning of the article.

VAT payable = VAT No. 2 – VAT No. 1

where

VAT No. 2

is the tax charged on the cost of goods upon sale.

VAT No. 1

– VAT that we paid to the supplier when purchasing goods, in other words,

a tax deduction.

How to confirm VAT accrual and deductions.

Invoice

According to the rules of Art. 168 and Art. 169 of the Tax Code of the Russian Federation, the main document for the purposes of correct calculation and payment of VAT is the invoice. It is in this document that the amount of tax is reflected. An invoice is issued within five days

from the date(s) on which we shipped the goods or provided any work or service, or within

five days

from the date on which we received payment for goods that have not yet been shipped, then have received an advance payment or advance payment. We recall the section of this article on the moments when VAT obligations arise.

Sales book

The seller must take into account the invoices that he himself issued to the buyer in the invoice journal. Although today this is a right, not an obligation. But still, I recommend adhering to the old rules so that it is convenient to keep records, especially since this form has been preserved in many accounting programs. Next, it must be registered in the sales book. Now this is an important tax document! Based on these documents, you will fill out a VAT return. It may also be required by tax authorities if necessary. Purchase book In turn, in order to be eligible for VAT deduction, you need an invoice received from the supplier. Payment of VAT upon import must be confirmed by a document that records the payment of tax at customs. “Incoming” invoices are recorded in the invoices received journal and in the purchase ledger. Subtracting the amount of “input” tax on purchases reflected in the purchase book from the amount of “output” tax recorded in the sales book is VAT, which must be paid to the budget on time.

The unique methodology used in this course allows you to complete training in the form of an internship in a real company. The course program is approved by the Moscow Department of Education and fully meets the standards in the field of additional professional education.

Matasova Tatyana Valerievna

Accounting entries when calculating income tax

If the organization applies PBU 18/02

The procedure for applying PBU 18/02 is configured in the Accounting Policy information register (Main section). If an organization applies the provisions of PBU 18/02, then the switch Accounting for deferred tax assets and liabilities (PBU 18 “Accounting for calculations of corporate income tax”) should be set to one of the positions:

- Maintained using the balance sheet method;

- It is carried out using the costly method (delay method). In the program, this method can be used after 2020, since PBU 18/02 does not contain restrictions on the use by an organization of any of these methods of its choice (Information message of the Ministry of Finance of Russia dated December 28, 2018 No. IS-accounting-13).

If the cost method is installed in the program, then the routine operation Calculation of income tax performs two functions at once: the calculation of tax for payment to the budget (according to tax accounting data), and calculations according to PBU 18/02 (according to accounting data).

If the organization uses the balance sheet method, then the Month Closing processing includes two separate routine operations:

- Calculation of income tax - only calculates tax according to tax accounting data for payment to the budget;

- Calculation of deferred tax according to PBU 18/02 - performs only calculations according to PBU 18/02 according to accounting data (according to the new algorithm, that is, the balance sheet method) for financial statements.

In any case, the calculated amounts of income tax are accrued by posting:

Debit 68.04.2 Credit 68.04.1.

At the same time, tax amounts are distributed among budgets of various levels.

A decrease in amounts due for payment to the budget is reflected by a reversal entry with simultaneous distribution among budgets:

REVERSE Debit 68.04.2 Credit 68.04.1.

Account 68.04.2 “Calculation of income tax” is specifically used in the program to summarize information on the procedure for calculating income tax for organizations in accordance with the provisions of PBU 18/02. Analytical accounting for account 68.04.2 is not provided.

Calculations according to PBU 18/02 include the following operations:

- recognition (settlement) of deferred tax assets (DTA) and deferred tax liabilities (DTL). Accounts 09 “Deferred Tax Assets” and 77 “Deferred Tax Liabilities” are intended to summarize information about the presence and movement of IT and IT. Analytical accounting of IT and IT is carried out by type of assets or liabilities in the assessment of which a temporary difference has arisen;

- determination of conditional income tax expense (income). Conditional income tax expense (income) is calculated as the product of accounting profit for the reporting period and the income tax rate. To summarize information about the amounts of conditional income tax expense (income) in the program, accounts 99.02.1 “Conditional income tax expense” and 99.02.2 “Conditional income tax income” are intended;

- recognition of a constant tax expense (income) for income tax. The permanent tax expense (income) for income tax is calculated as the product of the permanent difference that arose in the reporting period and the income tax rate. To summarize information about the amount of recognized permanent tax expense (income), the program uses account 99.02.3 “Permanent tax liability”.

Note

About the advantages of the balance sheet method and how in “1C: Accounting 8” edition 3.0 this method is used when determining temporary differences, see the articles “PBU 18/02: how the balance sheet method is used in “1C: Accounting 8” and “Application PBU 18/02 and the balance sheet method in “1C: Accounting 8”.

Postings related to calculations according to PBU 18/02 using the balance sheet method are presented in the table.

Table

Postings generated in the program when performing the routine operation “Calculation of deferred tax according to PBU 18/02”

Please note that income tax is calculated in whole rubles, and the amounts of conditional income tax expense (income), SHE and IT, constant tax expense (income) are in rubles and kopecks. As a result, a difference may arise on account 68.04.2 (even if permanent and temporary differences are reflected correctly in accounting). The resulting balance is automatically written off to account 99.09 “Other profits and losses” by posting:

Debit 99.09 Credit 68.04.2 or Debit 68.04.2 Credit 99.09.

Thus, after performing the regulatory operations Calculation of income tax and Calculation of deferred tax according to PBU 18/02, account 68.04.2 is always closed.

Let's look at a specific example of how income tax calculations are performed when applying PBU 18/02 in “1C: Accounting 8” edition 3.0 and what transactions are generated in this case.

Example 1

| LLC "Trading House "Complex"" applies OSNO and the provisions of PBU 18/02 in accordance with the new edition, approved. Order No. 236n. The income tax rate is 20% (including 3% to the Federal budget, 17% to the regional budget). In January 2020, the organization’s accounting records reflected the following financial indicators:

The tax accounting registers reflect the following indicators:

The deductible temporary difference for the type of asset “Deferred income” is:

The taxable temporary difference for the type of asset “Fixed assets” is:

|

Let's calculate income tax for January 2020 according to tax accounting data:

- 700,000 rub. — tax base (RUB 1,000,000 - (RUB 72,000 + RUB 228,000)).

- 140,000 rub. — income tax (RUB 700,000 x 20%), including RUB 21,000. — to the Federal Budget (RUB 700,000 x 3%); 119,000 rub. — to the regional budget (RUB 700,000 x 17%).

When performing the routine operation Calculation of income tax, postings will be automatically generated (see Fig. 1).

Rice. 1. Calculation of income tax in correspondence with account 68.04.2

Let's perform calculations according to PBU 18/02 for January 2020 according to accounting data:

- 1,600 rub. — repayment of ONA ((112,000 rub. - 104,000 rub.) x 20%).

- 400 rub. — repayment of IT ((118,000 rub. - 116,000 rub.) x 20%).

- 706,000 rub. - profit according to accounting data ((RUB 1,000,000 + RUB 8,000) - (RUB 230,000 + RUB 72,000)).

- RUB 141,200 — conditional income tax expense (706,000 x 20%).

When performing the routine operation Calculation of deferred tax according to PBU 18/02, the following transactions will be automatically generated (see Fig. 2).

Rice. 2. Calculations using PBU 18/02

Figures 3 and 4 show Analyzes of accounts 68.04.1 and 68.04.2.

Rice. 3. Analysis of account 68.04.1

Rice. 4. Analysis of account 68.04.2

The presented entries and standard reports on income tax settlement accounts demonstrate that account 68.04.2 in the program plays a purely technical (auxiliary) role. For example, in recommendation R-102/2019-KpR “Procedure for accounting for income tax”, adopted by the Committee on the recommendations of the NRBU “BMC” fund on April 26, 2019, account 68.04.2 is not used at all.

If the organization does not apply PBU 18/02

If the organization does not apply the provisions of PBU 18/02, then the switch Accounting for deferred tax assets and liabilities (PBU 18 “Accounting for calculations of corporate income tax”) should be set to the Not maintained position.

In this case, when performing the regulatory operation Calculation of income tax, account 68.04.1 corresponds with account 99.01.1 “Profits and losses on activities with the main tax system” (with the value of the subconto type Income tax and similar payments). The accrual of current income tax amounts payable is reflected by posting with simultaneous distribution among budgets:

Debit 99.01.1 Credit 68.04.1.

Accordingly, the decrease in amounts due for payment is reflected by an entry with distribution by budget:

REVERSE Debit 99.01.1 Credit 68.04.1.

Let’s change the conditions of Example 1 and consider how “1C: Accounting 8” edition 3.0 reflects income tax calculations if the provisions of PBU 18/02 are not applied.

Example 2

| LLC "Trading House "Complex"" applies OSNO, but does not apply the provisions of PBU 18/02. Numerical indicators correspond to the conditions of Example 1. |

In this situation, when performing the routine operation Calculation of income tax, postings will be automatically generated (see Fig. 5).

Rice. 5. Calculation of income tax in correspondence with account 99.01.1

Regardless of the procedure for applying the provisions of PBU 18/02, the credit turnover of account 68.04.1 by type of payment Tax (contributions): accrued / paid for the reporting (tax) period coincides with:

- with the amount of calculated income tax indicated in line 180 of sheet 02 of the income tax return;

- with the amount of current income tax indicated in the statement of financial results (form approved by order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

On the calculation of income tax in “1C: Accounting 8” (rev. 3.0), see also the answer from 1C experts (+ video).

If the organization acts as a tax agent

An organization that pays dividends to a company participant (shareholder) - a legal entity, must fulfill the duties of a tax agent and withhold income tax when paying dividends.

To summarize information on settlements with the budget for income tax when paying dividends, a separate account 68.34 “Income tax when performing the duties of a tax agent” is intended. Tax on dividends is always paid to the Federal Budget, therefore analytical accounting in account 68.34 is carried out only by type of payments to the budget.

For limited liability companies, the accrual of dividends and withholding tax on the payment of participation income can be registered in the program automatically using the Accrual of Dividends document (Operations section).

For joint stock companies, the accrual of dividends on shares and tax withholding should be reflected in the Transaction document (section Transactions - Transactions entered manually).

In any case, the withholding of income tax when performing the duties of a tax agent when paying dividends should be reflected by posting:

Debit 75.02 Credit 68.34.

Account 75.02 “Calculations for the payment of income” is intended to summarize information on the payment of income to the founders (participants) of the organization (shareholders of a joint-stock company, participants of a general partnership, members of a cooperative, etc.).

Thus, the “agency” tax is taken into account separately and does not affect the turnover of account 68.04.1.

| 1C:ITS For more information about the procedure for taxation and accounting of corporate income tax, see the practical manual “Practical Annual Report 2018” edited by D.E. Sc., prof. S.A. Kharitonov in the section “Instructions for accounting in 1C programs”. |