Are they real?

As you know, a work book is the main document about the work activity and length of service of an employee who receives it from the employer (Article 66 of the Labor Code of the Russian Federation).

In other words, this document is issued once at the first place of work, after which, when applying for employment at the next place of work, the individual presents this document to the new employer. The reasons for the appearance of several work books are different for everyone: this is the loss of the first book and its subsequent discovery after the issuance of a duplicate, and the desire to hide unpleasant facts reflected in this document, etc.

As a result of solving any of the problems outlined above, the employee ends up with several work books. And the thought immediately arises: are such documents considered real or is the employee using a fake document?

In our opinion, it is perhaps impossible to call such books counterfeit: they are drawn up in strict accordance with the law - entries were made by the personnel department, there are all the necessary signatures and seals. There is no deliberately fictitious information there, no one forged the autographs of the personnel officer or superiors and no one affixed fake stamps. Therefore, the book itself, of course, is not fictitious.

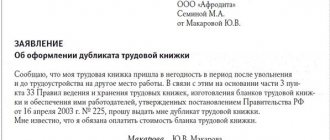

The only question is how the new employee justified the reason why he was issued another work book (duplicate). For example, he could claim that he lost her and write a corresponding statement. If at the same time the old work document is lying at his home or is really lost, then most likely there will be no problems. Difficulties may arise if it turns out (it doesn’t matter how) that the first book did not disappear anywhere, the person knew this very well, and, nevertheless, gave the new employer deliberately false information when applying for a job. In this case, the cunning citizen may face termination of the employment contract on the basis of paragraph 11 of Article 81 of the Labor Code of the Russian Federation - “for the employee to submit false documents or knowingly false information when concluding an employment agreement.”

Take care of yourself

Before you embark on this difficult path of a permanent worker, it is worth remembering the main rule: replenishing your own strength is one of your most important priorities. If you forget to have lunch (or sleep), then soon the productive worker you were just beginning your heroic journey will be nothing but a shadow. What will happen in this case? Right. There will be no one to work. And at the next turn of fate, one may well expect long trips to the doctors in attempts to cure diseases that have worsened and re-emerged due to the hellish schedule. Therefore, timely fulfillment of your own physiological needs should be no less important for you than getting from the office to the client’s apartment at eight in the evening in metropolitan traffic jams. Even if such a need is jogging, you should not regard it as a whim. The stronger you are physiologically, the more successfully you will cope with the tasks.

Health status: Russians explained why salaries decrease after 40 years

Capital exceeds the GDP of Luxembourg, Estonia and Bolivia: how rich is Bill Gates

VkusVill and Svetofor became the fastest growing food retailers

Tax deduction: not divisible by two

Next, you should understand the tax deductions that employees usually receive at their main place of work. Let us note right away that nowhere is it stated that deductions are provided specifically at the main place of work. Thus, the deduction can be made by any tax agent of the employee’s choice (Article 218 of the Tax Code of the Russian Federation). To do this, you just need to write the appropriate application and attach to it documents confirming the right to the deduction - the child’s birth certificate, a certificate of his residence with his parents, and if they are divorced, then an agreement on the payment of alimony or a writ of execution on the transfer of child support. .

You should not claim tax deductions for two jobs at the same time. The second employer, if information about him comes to light, will be able to recover the amount of the deduction and accuse the employee of abuse of rights.

By the way, the issue of providing deductions is important not only for owners of several jobs, but also for the enterprises where they were employed. After all, the employer, being sure that the employee is registered with him as his main place of work, will, after the taxpayer submits an application, in good faith provide deductions, thereby reducing the amount of tax to be collected.

That is why owners of several work books, in order to avoid additional complications, should not claim tax deductions in two places of work at the same time. Otherwise, the second employer (if information about another employer comes to light) will be able to recover the deduction amount from you and accuse you of abuse of right. He most likely will not go to court, but the situation as a whole will be extremely unpleasant.

The situation is the same with the use of other guarantees provided exclusively at the main place of work. For example, if you are already taking study leave, let it be paid for only from one employer, and take the leave “at your own expense” from the second.

Positive programming

It is impossible to expose yourself to excessive loads without proper motivation. If the mind is not concentrated on the purpose for which all this is being done, the strength will be exhausted very quickly. Especially if the work being performed is of little interest. Sooner or later, attention will get tired of focusing on the goal. Doubts will arise about the appropriateness of these efforts: “Why should I work two jobs if I can’t even just take time for a short walk?”

That is why the most important component of achieving success for those who still decide to fill all their waking hours with work is proper motivation. Everyone has their own, and the methods of reminding them of their goals may also be different. For example, if you are working hard to save enough money for a new home, you can hang a picture of a new, spacious apartment on your refrigerator. Or vice versa - try to experience the power of motivation from the opposite, its negative side. In our case, such a reminiscent image will be a photograph of a person without a specific place of residence. It will have to instill fear, remind you that if you give up everything now, then you will have to pay for today’s lack of desire to do anything.

Stay or quit your job: problems that need to be solved using logic

How many schoolchildren want to become farmers: the advantages of the profession and salary

Ethereum rate exceeded $3500: analysts predict an increase to 5200

We have given only an example. Everyone has their own reasons that force them to work multiple jobs. But it is worth remembering that without proper motivation it will be extremely difficult to achieve your goals. Therefore, finding ways to add enthusiasm to you is the first method of self-help that will allow you not to go crazy and correctly distribute your strength.

What will the Pension Fund say?

Now let’s consider the issue of presenting work records for calculating pensions. With the introduction of personalized accounting in the state pension insurance system, the work book, in fact, loses its function of recording work experience. The personal record contains much more complete information about the work activity of the future pensioner than is reflected in the work book. In addition, as a result of the pension reform, the size of the labor pension of citizens of the Russian Federation is calculated on the basis of income to their individual personal account in the Pension Fund, and not only on the basis of work experience.

“I have an employee who received two work books at different times,” says Anastasia Starostina

. “And when calculating her length of service, in order to count the period of work from the second work book, they were ordered to take a certificate from the place of work that was entered in the second book.”

All this is true, but, nevertheless, it is almost impossible to apply for a pension without presenting a work book; it still needs to be presented “live”. Currently, the work book (copy and original), as a document confirming the insurance period, is included in the mandatory list of documents that must be attached to the application for a pension.

And anyone who has acquired several work books should remember that in the legislation there is no such thing as “parallel work experience”. Therefore, he will not be able to present both books - they simply will not be accepted. Only one, more “profitable” one, will have to be attached to the pension application.

Experience and benefits: combination possible

An employee who has several work records should remember that in the legislation there is no such thing as parallel work experience. Therefore, he will not be able to present both books to the Pension Fund - they simply will not be accepted.

Calculating the length of insurance and calculating benefits is no less important an issue for holders of several years of employment than the problem of registering a pension. As a general rule, the insurance period for determining the amount of benefits for temporary disability, pregnancy and childbirth includes periods of work of the insured person under an employment contract, work in the state, civil or municipal service, as well as periods of other activities during which the citizen was subject to compulsory social insurance. insurance in case of temporary disability and in connection with maternity (Part 1 of Article 16 of the Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”). And the required periods of work are confirmed by the work book (clause 8 of Order of the Ministry of Health and Social Development dated February 6, 2007 No. 91 “On approval of the Rules for calculating and confirming insurance experience to determine the amount of benefits for temporary disability, pregnancy and childbirth”, hereinafter referred to as Order No. 91) .

However, holders of several such documents may well take advantage of the rules set out in paragraph 2 of Article 16 of the Law “On compulsory social insurance in case of temporary disability and in connection with maternity” (Law No. 225-FZ of December 29, 2006). It states that if several periods coincide in time, counted in the insurance period, one of them is taken into account at the choice of the insured person. That is, payments for sick leave, as well as for pregnancy and childbirth (including a lump sum benefit), as well as parental leave, can be safely received only at one job. Otherwise, your actions will strongly resemble intent aimed at illegally obtaining money or an attempt at illegal enrichment...

“I warn all “two-book” workers who expect to receive a one-time allowance, as well as “children’s” money for both places of work: this is impossible,” confirms graduate student Galina Ivanova

(last name changed at the request of the latter. – Editor’s note). – After all, these benefits are accrued on sick leave, which is issued to a woman at a medical center or antenatal clinic. In turn, the sick leave note indicates which place of work it is for – the main or “additional” one. I was convinced from my own experience that in these institutions it is impossible to explain that you have two main places of work. In my case, the manager, whom I had to contact to resolve a situation that was so unusual in the opinion of the staff of the medical institution, immediately called Social Security, where they confirmed to her that two sick leaves addressed to different (and main) places of work could not be issued.”

However, there is another option for receiving an “increased” benefit - a kind of combination of data from both work books. To do this, you need to bring documents to the company that can confirm the fact of your work during certain periods (order No. 91). Confirmation of your words can be copies of orders on the basis of which a person worked in another company (or extracts from them), certificates from other employers, documents on the deduction of money for social insurance, etc.

Hone your professional skills

Even those who devote themselves to only one type of employment know: what is important in work is not so much the amount of time spent performing duties, but its quality. You can spend half a day trying to write a report and still not really get around to it; But you can do both what you planned and a few more things in the same period of time. The whole difficulty lies in concentrating on the task as much as possible and using your skills to the fullest. And if you lack any professional qualities, now is the time to hone them.

For example, this could be mastering hot keys on a computer; studying programs that can help speed up the process of completing work; or training in special psychological training, if we are talking about improving skills in interacting with people. All this will allow you to do your work better and faster - and therefore with a minimum of energy costs.

Russians will work no more than 4 hours a day: financier’s forecast

The mortgage market was predicted to slow down and increase rates

Every fourth owner of personal transport (27%) bought a car on credit

There is no formal ban

Let’s say right away that the legislation does not provide for any sanctions for an employee having two work books. Rather, this can be regarded as an abuse of right rather than a violation of the law.

The rather ancient, but still valid Resolution of the Council of Ministers of the USSR and the All-Union Central Council of Trade Unions of September 6, 1973 No. 656 “On work books of workers and employees” does not pose any particular danger. In accordance with paragraph 17 of this document, those responsible for falsifying or using a knowingly false work book will be held accountable in the manner prescribed by law. And, as we have already found out, a second work record, correctly completed and containing reliable information, can hardly be considered fraudulent (the resolution itself does not say whether the second work record will be considered a fake).

Well, upon retirement, everyone will be able to independently decide which work record book to present to confirm their work experience. After all, if several periods of work coincide in time, only one of such periods is taken into account for calculating a pension at the choice of the citizen (Clause 1, Article 12 of the Law of December 17, 2001 No. 173-FZ “On Labor Pensions in the Russian Federation”).

So, if we follow the law, we were not able to find any violations that would entail liability for having two work books. It’s a completely different matter when internal local acts of an enterprise (collective agreement, regulations, etc.) may provide for a preferential position for main employees over part-time workers, which an employee with two employees can take advantage of. But then liability for deceivers should be provided for in these same local documents.

Anna Mishina