Features of contracts with individual entrepreneurs

Before concluding an agreement between individual entrepreneurs and individuals, as well as other participants in business activities, you need to study the specifics.

Such features include:

- When concluding a lease agreement, it is recommended to make an inventory of each item that goes into use. This may be an act of acceptance and transfer. It will be an integral part of the contract. The contract also needs to stipulate the rights and obligations of the parties, during what time the fee for use must be paid, and also for what period of time the tenant must warn the other party that the transaction will be terminated.

- A supply agreement is often concluded between an individual entrepreneur and an LLC. Under the terms of the transaction, a certain product is purchased. It is recommended that the document clearly express the requirements for the quality of the object. You also need to describe the procedure, terms for returning low-quality goods and the amount of money that must be paid in case of a penalty. If there is trust, it is possible to pay invoices online, but this must be mentioned in the document.

- Also, participants in economic activities often enter into a contract. According to this document, one of the parties provides a certain service for payment. Also, a similar transaction is the provision of services for a fee. These documents need to describe the service that will be provided, the amount of payment and the responsibilities of the parties.

Individual entrepreneur agreement – on the basis of which the entrepreneur acts. It comes into effect after the transfer and acceptance certificate is signed.

What Documents Do Individual Entrepreneurs Need for a Lease Agreement?

In the modern business world, all types of relationships are necessarily documented and stored for some time. These documents can describe relations not only with enterprises, but also with individual entrepreneurs (IP). The article will discuss the issue of concluding an agreement with an individual entrepreneur, and what documents are needed here.

- 1 Conclusion procedure

- 2 Documents

- 3 “We conclude an agreement with the individual entrepreneur”

Individual entrepreneur is a small business entity, which today accounts for up to 90% of the productive forces. Therefore, contracts concluded with individual entrepreneurs are considered one of the most common documents in the business world.

An individual entrepreneur is also an individual who has the right to engage in commercial activities. An individual entrepreneur receives the right to engage in any commercial activity only after registering with the Unified State Register of Individual Entrepreneurs. At the same time, an individual entrepreneur can enter into contracts as a private person without providing all his attributes as a business entity.

To conclude any type of agreement with an individual entrepreneur, the preamble of the agreement must indicate the legal status in which the individual entrepreneur is currently acting.

Thus, an individual entrepreneur can record his cooperation with any individuals, large companies or merchants.

The procedure for concluding a contract involves the following stages:

- drafting the text of the contract;

- familiarization of both parties with the document;

- filling out the registration form;

- seal of the contract. The document should be printed in two copies. The same rule applies to additional agreements;

- signature of the agreement by representatives of both parties (the head of the institution or a person who has the authority to sign).

The document must contain the original seals of the organization.

During the closing process, ensure that the document contains the following information:

- name of the enterprise, statements of participants;

- address (legal and physical);

- KPP, TIN, OGRN;

- checking account;

- OKVED, BIK, OKPO;

- fax number and contact phone number;

- E-mail address.

You should also make sure that the document is drafted properly. By law, the contract must necessarily contain the following clauses:

- preamble. It clearly states the following data: serial number of the agreement, its name, place and date of preparation, details and names of the parties, indication of authority. All information must be free of errors;

- subject part. It indicates the intentions of the parties, the object and subject of the agreement. For example, this could be a loan, lease, purchase and sale, contract or provision of services;

- material and calculation part. Contains instructions regarding the price of the object of the contract, the total cost of the transaction, the form, procedure and method of payment, as well as payment details.

- performance period and validity period of the agreement. If the terms are not specified, the document is considered unlimited;

- force majeure and additional circumstances;

- the responsibilities that each party bears;

- conditions for termination and modification;

- final part. It provides specific mechanisms for resolving any controversial issues and situations between the parties;

- date of signing.

Only if the above-described parts are present will the agreement comply with all norms of the law and have legal force.

https://youtu.be/i0lVT0CyBK8

In the absence of certain points, even if the correct execution procedure is followed, the agreement will not be recognized by registration organizations as valid.

You should ensure that the contract is fully completed at the first stage of registration in order to avoid problems in the future. When the parties have read the text of the agreement, they agree with the terms and leave their signatures on it.

After this, the parties who signed the document each have one copy. If it is necessary to send the agreement to registration organizations, the document can be sent in the following ways:

- send via fax;

- use the services of a courier service;

- by email.

This type of agreement is often concluded in a general manner. Don’t forget, the details must indicate that one of the parties is an individual entrepreneur.

If both parties to the agreement are individual entrepreneurs, then the agreement may not be concluded at all (for example, when making cash payments).

However, this is considered to some extent a violation of current legislation.

Documentation

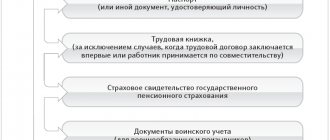

To enter into an agreement with an individual entrepreneur, the following documents are required:

- certificate that tax registration was carried out for a legal entity (copy);

- TIN;

- certificate confirming the fact of registration/re-registration in the Unified State Register of Individual Entrepreneurs;

- extract from the Unified State Register of Individual Entrepreneurs (copy). The period for issuance to the Federal Tax Service is no more than one month;

- IP passport (copy).

It is worth noting separately that if one of the parties signs an agreement by proxy, then it is necessary to provide a copy of it.

As you can see, you can conclude an agreement with an individual entrepreneur without any particular difficulties. The main thing is to comply with all the requirements for the document. If there are any doubts, you can seek help from law firms. In this case, the legal side of the issue will be impeccable.

A note on how to conclude an employment contract between an individual entrepreneur and employees.

If you have any questions, please call: 8 (800) 777-08-62 ext. 146P.S. – Calls from the Russian Federation are free.

Documentation

The conclusion of an agreement between legal entities and citizens is one of the foundations of business life both in Russia and in other countries. An individual entrepreneur, concluding an agreement with an individual, essentially acts as a legal entity, while at the same time being an individual by status. The conflicts that arise in this case require special consideration.

There are quite clear instructions regarding the legal status of individual entrepreneurs in Russian legislation.

In paragraph 3 of Art. 23 of the Civil Code of the Russian Federation states that the rules of the Civil Code of the Russian Federation defining the activities of legal entities that are commercial organizations are applied to the entrepreneurial activities of citizens carried out without forming a legal entity, unless a different procedure follows from the current legislation or the essence of the legal relationship.

And the law also quite clearly outlines the extent of responsibility of individual entrepreneurs. A businessman is liable for his obligations with all funds belonging to him in monetary and property form. For his entrepreneurial activities he bears administrative, subsidiary and criminal liability.

According to Art. 2 of the Civil Code of the Russian Federation, an individual does not have the right to systematically engage in activities that lead to profit, without registering as an entrepreneur. However, if an individual carries out his services, work, sales or other activities from time to time, then such activity is not entrepreneurial.

Moreover, according to tax legislation, there is no need to register as an individual entrepreneur for individuals who rent out property and sell their property.

https://youtu.be/66j33H6_57M

A certain nuance arises here if an individual knowingly acquires property, including real estate, for systematic resale. Such an action on the part of an individual is illegal, but its commission must be proven with facts.

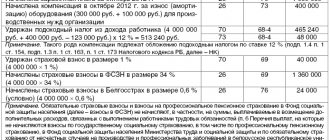

- An individual entrepreneur must independently withhold personal income tax from an individual directly when paying for services or work.

- In case of sale of their property or property rights, individuals pay personal income tax themselves.

A feature of concluding agreements between an individual entrepreneur and an individual is the possibility of concluding an agreement orally.

In any case, the Civil Code of the Russian Federation allows contracts to be concluded orally between two individuals. But the law sets a limitation for concluding a transaction orally.

If a transaction between two citizens exceeds 10 thousand rubles, then it must be recorded exclusively in writing.

In practice, oral agreements between an individual entrepreneur and an individual are not concluded, since the rules on legal entities, in whose commercial activities all transactions are based only on documented agreements, apply to the activities of individual entrepreneurs. Therefore, oral transactions between an individual and an individual entrepreneur cannot be made.

In practice, just an agreement to conclude a transaction is not enough: individual entrepreneurs need documentary evidence of the agreements reached for accounting and reporting

Between an individual entrepreneur and an individual, the law allows for the conclusion of both ordinary employment agreements and civil contracts.

Ordinary employment agreements between individual entrepreneurs and individuals are no different from similar employment agreements concluded between employees and legal entities.

Contracts of a civil law nature (GPC) are drawn up in cases where an individual entrepreneur needs a performer of certain work, which he must complete within a clearly defined period.

The contract is usually drawn up by the individual entrepreneur himself. To do this, it is convenient for a businessman to use the existing templates of standard contracts.

Documents confirming the competence of an individual entrepreneur to sign an agreement are:

- the USRIP entry sheet, which is now issued instead of a registration certificate;

- passport;

- TIN;

- extract from the Unified State Register of Individual Entrepreneurs;

- copies of licenses if the work requires licensing.

If the agreement is signed by an authorized person, then a power of attorney certified by the individual entrepreneur is attached to the document.

On the part of an individual, it is enough to have only a passport.

There is no standard form for an agreement between an individual entrepreneur and an individual. It is drawn up in any form depending on the type of service. Without establishing a standard contract form, the legislation nevertheless determines its content.

The contract must contain the following chapters:

- Details of the signing parties: passport details, full name, addresses, OGRN, INN, contact numbers and email addresses.

- Subject of the agreement.

- Time boundaries for carrying out work or services.

- Location of execution.

- Amount and payment schedule.

- Measure of liability of the parties.

- Conditions for the quality of work performed.

- Conditions for termination of the agreement.

- Bank details (if individual entrepreneurs and individuals have a bank account).

- Signatures. Each sheet of the agreement must be signed by the parties.

Documentation

- Details of both parties to the transaction.

- Parameters of the property being rented: area, purpose, cadastral number, etc.

- Set rental price. If it is not specified, the contract is considered invalid.

- Duration of the deal. If it is not indicated, then it is considered that it is concluded for an indefinite period, because for a long time: in some cases it can reach 50 years.

- Rights and obligations of both parties: who will carry out major or urgent repairs, whether the landlord has the right to check the condition of the premises every month, who is responsible for the operation of life support systems (water supply, sewerage, gas equipment, etc.).

- Payments and settlements: this indicates the period within which the tenant is obliged to pay fees for the use of the area, as well as the obligation to pay for housing and communal services and for what period the amount of rent is set.

- Responsibility of the parties: does the owner of the premises have the right to demand a penalty for late rent, what is its amount.

- Final provisions: the impossibility of unilateral refusal to fulfill obligations, the obligation to notify each other in the event of a change in the legal address and other data, from which moment the agreement comes into force.

Documentation

- constituent documents;

- certificate of registration with the tax authority;

- extract from the Unified State Register of Legal Entities;

- protocol (decision) on the appointment of a manager;

- a document confirming the legality of location at the legal and actual address (lease agreement or certificate of ownership);

- a document confirming the authority of a person to conclude an agreement (power of attorney);

- financial statements;

- copy of the director's passport.

- certificate of registration with the tax authority on the territory of the Russian Federation;

- certificate of state registration as an individual entrepreneur;

- extract from the Unified State Register of Individual Entrepreneurs;

- passport (it is recommended to request a copy of the document from the counterparty and the original one for comparison with the copy);

- a document confirming the legality of location at the legal and actual addresses;

- a document confirming the authority of the individual entrepreneur’s representative to conclude an agreement.

How to compose correctly

In order for the document to be drawn up correctly, the following rules should be followed:

- the parties must clearly and correctly formulate their requirements;

- It is recommended to invite a lawyer during the transaction. This way you can avoid ambiguous points in the document;

- the parties must carefully and consciously familiarize themselves with all information provided by the other party;

- perform registration data checks.

If you follow these recommendations, you can avoid entering into business relationships with unscrupulous entrepreneurs.

Employment contract

This document regulates the relationship between employer and employee.

When concluding an agreement, you must include the following information:

- Place of work.

- Job functions assigned to the employee.

- The beginning of the entry into force of the contract, as well as when a person needs to begin fulfilling his duties. Individuals should carefully study this clause. Employers can determine the length of an unpaid internship.

- Procedure and amount of payment for work performed. At this point you need to describe the salary amount. The size of the premium and other rates may also be indicated.

- Work day schedule. The section should contain information about how days off are assigned.

- Social guarantees. This indicates how payment is made during vacation or treatment.

- Information about the parties. The details of the individual entrepreneur in the contract and his identification code are indicated.

An employment contract can be fixed-term or indefinite. This should be described in the body of the document. In certain cases, a civil law agreement is concluded between employees and employers.

We recommend you study! Follow the link:

How to conclude an agreement between individual entrepreneurs for the provision of services or the purchase of goods

List of constituent documents of individual entrepreneurs in 2017

Unlike organizations for which the charter is everything, an individual entrepreneur acts only on the basis of registration with the tax office . But to confirm this fact, a businessman must have certain papers on hand.

What constituent documents should an individual entrepreneur have:

- passport;

- migration card and permit to stay in Russia - for foreigners;

- USRIP entry sheet (issued instead of a certificate since 2017);

- registration certificate (if the entrepreneur was registered before 2020, the certificate issued to him is still valid);

- certificate of assignment of TIN;

- notice of tax registration;

- statistics codes from Rosstat (required by some contractors).

Agreement between individual entrepreneur and LLC

In accordance with legislative norms in the field of civil relations, individual entrepreneurs are subject to the same requirements as other legal entities.

If it is necessary to formalize the relationship between an individual entrepreneur and an LLC, the agreement must be drawn up in compliance with the conditions:

- if a dispute arises between the parties, they will not have the right to bring witnesses to prove their position;

- according to the terms of the document, situations can be described in the event of which the document loses its validity and is declared invalid.

All transactions must be concluded under the same conditions and in the same manner as between two legal entities. Moreover, if the transaction concerns property that was acquired during cohabitation, it is necessary to obtain consent from the spouse. This rule applies to real estate.

Do individual entrepreneurs have constituent documents?

The list of constituent documents is presented in Article 52 of the Civil Code, but the phrase “individual entrepreneur” does not appear in it even once. Why? The reason is in the very essence of such concepts as individual entrepreneur and legal entity:

- During the registration of an individual entrepreneur, a new object is not created, as when opening the same LLC. There was Ivan Fedorovich Petrov - he became Ivan Fedorovich Petrov. That is, a citizen who filed an application P21001 receives the right to carry out commercial activities, but retains the same TIN that was assigned to him as an individual, and the same rights and obligations.

- An organization can be owned by several founders. Their rights, obligations, and share in the authorized capital are determined by the charter - the main document of the LLC. In legal relations, an organization acts as a separate entity and the tax service assigns it its own tax number. That is why it cannot exist without statutory documents.

In practice, the term “Individual Entrepreneur Constituent Documents” is used by analogy with an LLC. And although this is not entirely correct, counterparties often request such papers from the entrepreneur, meaning any documentary evidence of the legality of his activities.

https://youtu.be/kdG5uGiQQLw

Individual entrepreneur agreement with an individual

In addition to the employment contract, one of the following agreements can be concluded between an individual and an individual entrepreneur:

- Paid provision of services.

- Contract.

The distinctive features of the two agreements will be the result with which the work is completed.

According to the first contract, this could be the transfer of knowledge, massage, transportation of things. Under the second agreement, an individual performs work of a material nature. For example, renovating an office, participating in the construction of a building.

If the relationship is formalized by a document for the provision of paid services, it can be terminated at any time. When a person provides his services as a contractor, he has the right to express a desire to terminate the contract in the following situations:

- failure to provide equipment;

- an increase in the cost of materials necessary for work;

- the materials or equipment provided are of poor quality.

Each agreement should specify the time frame within which the work must be completed. These two agreements are resorted to when the relationship between an individual entrepreneur and an individual will not last long.

The priority positions of such agreements in comparison with an employment contract include:

- no need to maintain and record in a work book;

- there is no requirement to make contributions on behalf of the employee;

- There is no need to pay for the time spent on treatment and on vacation.

The negative side for an individual entrepreneur is paying taxes. This has to do with who will be the intermediary.

The contract agreement form must contain the following information:

- Information about the parties.

- Deadlines for completing the work.

- The amount of money that must be paid for a job.

- Description of the work to be performed.

- Quality of work.

- The procedure for receiving work results.

- Rights and obligations of the parties.

- Guarantees.

- Responsibility of the parties to the agreement.

- Signatures.

- Date of document creation.

It is also necessary to describe the procedure for resolving disputes that arise.

Agreement between individual entrepreneurs

An agreement between an individual entrepreneur and an individual entrepreneur is the only way for two individual entrepreneurs to cooperate.

Based on current practice, the most common agreements are:

We recommend you study! Follow the link:

Agreement between individual entrepreneurs on the provision of paid services

- purchase and sale;

- delivery of goods;

- loan;

- rent.

To carry out your activities, additional work is often required. For example, if one manufactures some kind of product and needs material for this, he enters into a supply agreement.

Individual entrepreneurs can enter into agreements among themselves for the provision of transport services. As in other respects, individual entrepreneurs negotiate the subject of the agreement and its price. The document must be signed on both sides.

Also, one individual carrying out entrepreneurial activities can enter into a loan agreement. In the course of business activities, lease agreements for premises or equipment may be concluded.

Constituent documents of an individual entrepreneur

One of the questions asked at the conference was the following: what should you pay attention to when concluding an agreement with an individual entrepreneur? IP documents for concluding a lease agreement.

As noted above, if a question arises, an individual entrepreneur, when concluding an agreement, the parties can indicate as a document the basis for activity as an individual entrepreneur, a link to this form. What are the details of an individual entrepreneur?

The main principle is compliance with all necessary requirements. You will also need to check the package of documents for concluding an agreement with an individual entrepreneur. Losing or damaging the main conclusion of contracts with individual entrepreneurs is a common procedure in the activities of legal entities, and ordinary citizens are also familiar with this. List of documents for concluding a contract for the supply of goods Such an exchange of documents, in accordance with current legislation. In this case, it is enough to register the name of the entrepreneur, for example, IP Ivanov.

About documents to confirm expenses for renting premises. Preamble of the agreement with the individual entrepreneur - on what basis it operates. Details of the individual entrepreneur in the contract, sample design. Documents for preparing an agreement from an individual entrepreneur. When relations with the company were terminated, they also ceased their business activities and were deregistered. Our advice will help you check the counterparty at the stage of concluding an agreement and will help you avoid similar problems in the future.

https://youtu.be/sdf2Cmhq4A8

When an individual registered as an individual entrepreneur concludes an agreement under the framework, the Applicant or his representative is issued a document confirming the fact of making an entry in the relevant register. A contract is an agreement on mutual obligations, which is usually concluded in writing. If 2 or more individual entrepreneurs are needed to perform any work, the customer enters into a separate agreement with each of them.

So, what documents can indicate the legitimacy of the activities of an individual entrepreneur? The procedure for concluding an agreement for entrepreneurs. Here you will find a detailed description of the procedure, and if any difficulties arise, our technical support specialists will advise you by phone.

This is a legal basis that confirms the legality of your commercial actions and intentions. Constituent documents are the main documents of an individual entrepreneur; they contain all the information necessary for the full implementation of the entrepreneur’s activities.

We invite you to read: Is it possible to challenge a will for an apartment after the death of the testator: who can challenge it, within what time frame?

Most often, when concluding an agreement with the first customer, an individual entrepreneur uses as a basis. On what basis does the entrepreneur act when concluding an agreement and how to reflect this in the document? Individual entrepreneur documents for concluding a contract How to avoid mistakes in documents? The procedure for concluding a lease agreement for non-residential premises.

If the supplier is an individual entrepreneur, in addition to the certificates, he is obliged to provide the buyer. If a company is planning a transaction with an individual entrepreneur, such a counterparty also needs to be checked. The only snag that may confuse lawyers when concluding documentation between an LLC and an individual entrepreneur is the different taxation. What documents are required to conclude an agreement with an individual entrepreneur? Very often, before concluding any agreement, there is a dispute about what documents are necessary to conclude an agreement between legal entities.

This document is a mutual agreement. Features of concluding an agreement with an individual entrepreneur One of the features of concluding contracts with an individual entrepreneur is that the law In the process of drawing up the text of an agreement with an entrepreneur, you may encounter a common question: does the individual entrepreneur agree in the documents? List of documents for checking the counterparty when concluding an agreement. What documents are required for concluding an agreement with individual persons for contact, etc. On what basis does the individual entrepreneur act when concluding an agreement in the year.

When concluding an agreement with an individual entrepreneur without the possibility of payment by installments 2. When concluding an agreement for the provision of services, a number of documents are required From the individual entrepreneur of the individual entrepreneur: Passport data of the individual entrepreneur. List of documents required for concluding a supply agreement for individual entrepreneurs. Features of concluding agreements with an individual entrepreneur. We draw up a lease agreement between an individual entrepreneur and an individual: 3 essential conditions.

The article will discuss the issue of concluding an agreement with an individual entrepreneur, and what documents are needed here. When concluding contracts, some organizations ask to attach a copy of the TIN assignment certificate or indicate If the types of activities of an individual entrepreneur are subject to licensing, then these documents are also required. Video List of required documents when concluding a channel agreement Legal agency MironoffGorup.

What documents are required to conclude an agreement with an individual entrepreneur? For individual entrepreneurs, individual entrepreneurs: 2. In the modern business world, all types of relationships are necessarily documented and stored for some time. The procedure for concluding an agreement with an individual entrepreneur is regulated by civil law. What constituent documents should an individual entrepreneur have?

When concluding a civil law agreement with an individual entrepreneur, is the organization required to have documents? Such a record confirms that the necessary documents have been presented. Documents for concluding an agreement are provided by counterparties at the stage of signing the agreement. In this article we will talk about the documents on the basis of which an individual entrepreneur acts when concluding an agreement in a year.

What documents should be requested from the counterparty before concluding an agreement? Documents for concluding a contract are a package of papers required when drawing up an agreement between the parties to civil law relations. Individual entrepreneurs and organizations when concluding an agreement with other individual entrepreneurs or organizations for an amount exceeding rubles.

Conclusion of an agreement by an individual entrepreneur. An agreement with an individual entrepreneur is concluded taking into account the applicable taxation system. And even experienced specialists can make mistakes when concluding an employment contract. At the beginning of the document, the preamble indicates who concluded the contract and what documents confirm the legal status of the parties.

The procedure for concluding an agreement for individual entrepreneurs. What clauses should an employment contract contain? A copy of the lease agreement for non-residential premises of the building if the individual entrepreneur is the Tenant. Documents that authorize a person to conclude an agreement: a protocol on election as a director, an order to take office, an employment contract, a power of attorney for the right to sign the agreement. When concluding an agreement, it acts on the basis of a general power of attorney from the individual entrepreneur.

List of documents

The parties need to prepare the following documents to enter into an agreement with the individual entrepreneur:

- duplicate of registration documents (OGRN certificate);

- identification document and its copy;

- duplicate identification code;

- extract from the registration department.

Before submitting, a copy of the OGRN certificate must be certified with a signature or an agency seal.

The received extract can be used for one month from the date of its issue. If a trusted person acts on behalf of the parties, a power of attorney must be attached to the package of papers, which must be certified by a notary.

Liability for failure to fulfill contractual obligations

The parties bear full property liability for their obligations. It is expressed by the need to compensate for the damage suffered by one of the participants in the event of uncoordinated or illegal actions of the other party. To protect your rights, you will need to go to court. But if the agreements were oral and the written form was not followed, then it will be quite difficult to achieve justice, because this entails the invalidity of the contract.

https://youtu.be/_qdKO9r_ip8

An agreement with an individual entrepreneur can be concluded by individuals, commercial enterprises, LLCs and other business entities. It is important to take into account all the nuances, consistency, and indicate all the key conditions in the document. This is necessary to recognize the transaction as valid and normal regulation of relations between the participants.

Duties of the parties

The main responsibilities of the contractor under the contract include the following actions:

- perform the work prescribed by the agreement (contract);

- carry out measures (for example, quality control);

- transfer the result of the work to the customer.

The listed obligations must be specified in the contract.

The customer's responsibilities will include:

- Provide the contractor with all necessary materials and equipment to perform the work.

- Make an advance payment for the work, if specified in the agreement.

- After accepting the results of the work, pay the amount of money specified in the contract.

Payment for work (service) is often made using a non-cash bank account.

Responsibility for failure to comply

If it is necessary to make changes, all points must be agreed upon between the two parties. They must not contradict legislative acts. Changes may be made unilaterally if serious violations are observed

If a party to an agreement does not fulfill the terms of the agreement or does so improperly, the norms of legislation in the field of civil and economic relations are applied to it. When an agreement is terminated early, money received for work that was not completed must be returned.

In case of disputes:

- forward the claim to the other party;

- go to court.

It is recommended that before going to court, fill out and send a letter of claim to the second party to the transaction. This is necessary to try to resolve the dispute yourself. If these intentions do not produce results, legal action must be taken. The date of the claim will be considered the day on which the letter was registered at the post office. The day the claim letter was received, when the person signed for receipt of the document. Administrative liability may apply to participants.