Home / Taxes / What is VAT and when does it increase to 20 percent? / Declaration

Back

Published: 08/01/2017

Reading time: 5 min

0

69

The tax period for value added tax is provided for in Art. 163 Tax Code of the Russian Federation. This is a period of time (calendar code or other period) after which it is possible to determine the tax base and calculate the tax. Each tax has its own tax period, and it can combine reporting periods.

One quarter is the time of one tax period. If the enterprise was registered after January 1, the first day of its VAT tax period will coincide with the day of registration. In the event of liquidation or reorganization of an enterprise, the last tax period will coincide with the day of its liquidation (reorganization), that is, the day on which the dacha event was registered with the corresponding entry in the unified state register of legal entities.

In 2020, the VAT tax period is quarterly. In 2015, changes were approved in the Tax Code that relate to the deadlines for paying taxes to the state budget - unlike the old rules, the new ones provide for payment of the tax not on the 20th, but on the 25th. Payment must be completed within 3 months after the tax period by paying in each month in equal shares of 1/3 of the amount.

- Reporting period

- Tax period codes

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

Taxable period

A tax period is understood as a certain time interval for which the tax base is determined. Moreover, for each type of tax, the legislation establishes its own time period, for example, a month, a quarter or a year. In addition, for certain taxes, tax periods are also divided into reporting periods, for each of which advance payments are calculated and paid. The reporting period for each tax is determined by the Tax Code of the Russian Federation and they are presented: quarter, half year and 9 months.

Important! In certain cases, a monthly form may also be used, for example, if a company is required to pay income tax on actual profits, then advances are calculated for a reporting period equal to a month.

https://youtu.be/W3gGLbMgxFQ

Links

- Tax Code of the Russian Federation (part one)

- Tax Code of the Russian Federation (part two)

- Ministry of Finance of the Russian Federation

- The Federal Tax Service

| This is a draft article on economics. You can help the project by adding to it. |

| This is a draft article about law and jurisprudence. You can help the project by adding to it. |

To improve this article it is desirable:

|

Tax period code in the organization’s property tax return

When calculating property tax, the previous year is taken into account for the tax period (379 Tax Code of the Russian Federation). Reporting periods may not be established, in which case the calculation and payment of advance payments will not be required. However, this type of tax has some nuances. Companies that have branches, divisions or real estate in other regions are required to submit their own declaration for each facility.

The property tax of companies is regional, which means that payments go to the budget of the region in which the payment is made, and not to the state budget. Separate divisions of the company must pay this tax independently. Situations are also possible in which the parent company does not pay advance payments, and its divisions or branches located in other regions are required to pay advance payments 2-4 times a year.

Important! If a company has real estate in another region that does not belong to a separate division, then the parent company must draw up a separate declaration for it and send it to the tax region at the location of the property.

The tax period codes included in the declaration will be identical to the income tax declaration codes. For example, when submitting an annual declaration, code “34” is entered. Submission of reports for each month for this type of tax is not provided (

Tax period for income tax

Tax-tax March 03, 2020 2859

The tax period for income tax is a time period at the end of which the company determines the results of its work, finally forms the tax base and calculates payments to the budget. In this material, we will consider the duration of the tax period, what time periods it consists of, and how this indicator is displayed in reporting documents.

The tax period for income tax is a calendar year.

Stages of the tax period

Tax period codes for income tax – 31, 34, etc.

Tax period code in the declaration according to the simplified tax system

Important! Under the simplified taxation system (simplified taxation system), the tax period is understood as a calendar year, and the reporting period is understood as a quarter, half a year and 9 months. Unlike income tax, calculations for advance payments are not submitted to the tax office.

As with the taxes discussed above, standard codes are used for the simplified tax system, that is, code “34” is entered in the declaration for the simplified tax system for the year. In addition, some special tax period codes are also used:

| Special tax period code | What does it mean |

| 50 | Indicated upon liquidation or reorganization of a company |

| 95 | Last tax period under the old tax system |

| 96 | Applicable in the last period of work of an individual entrepreneur using the simplified tax system |

If a taxpayer loses the right to work under the simplified tax system during the year, then the tax period will be the period of time while the right to the simplified tax system was still available. For example, the company lost the right to use the simplified tax system in October, so it will have to file a declaration after the expiration of this right, and indicate 9 months as the reporting period (code “33”).

How is the tax period determined in the Tax Code of the Russian Federation?

The definition of the tax period is contained in Article 55 of the Tax Code. It refers to a certain period of time for which firms or individual entrepreneurs calculate the amount of tax or contribution to be paid. It follows from this that the tax period in Russia is established for each tax separately. For income tax or the simplified tax system, the tax period is a year (Articles 285, 346.19 of the Tax Code of the Russian Federation), and for VAT it is considered a quarter (Article 163 of the Tax Code of the Russian Federation). Actually, for each payment, the tax period in the Tax Code of the Russian Federation is defined in the corresponding chapter, in a separate article, from the name of which it is quite obvious what exactly it says.

But the tax period is not always a whole year or a quarter, or another finite period of time determined by the usual calendar. For newly created organizations or registered individual entrepreneurs, the tax period is understood as the period of time from the date of their registration and, depending on the tax, until the end of the current calendar year or quarter. When liquidating a company or individual entrepreneur, the situation is exactly the opposite: in their case, the last tax period ends with the date of entry into the unified state register of deregistration.

Well, a somewhat unusual, but nevertheless possible situation: opening and closing a business within the same tax period. Most often this happens to individual entrepreneurs on the simplified tax system who have worked for part of the year. For them, the tax period will begin from the date of opening and end on the date of entry into the register of the deregistration mark.

Tax period code in the UTII declaration

When applying UTII (single tax on imputed income), the tax period is one quarter. In addition, in this case it will also be the reporting period. The deadline for submitting the UTII declaration to the tax office is until the 20th of the month following the reporting quarter, and payment is due until the 25th. The tax period codes in the UTII declaration are indicated as follows:

| Taxable period | Tax period code |

| 1st quarter | 21 |

| 2nd quarter | 22 |

| 3rd quarter | 23 |

| 4th quarter | 24 |

In addition, there are also special codes when filing a declaration in the event of liquidation or reorganization of a company: codes from 51 to 56 - for the first, second, third and fourth quarters, respectively. The number “5” in the code, which is in first place, indicates that this period is the last for the company’s activities. After this, the company is liquidated or reorganized into another company, which may apply a different taxation system.

Features of tax period approval

Tax periods are characterized by the use of the principle of one-time tax payment. This means that tax liabilities are paid only once during one period. For irregular taxes (one-time taxes), the concept of a tax period is not used. The procedure for adjusting the length of the tax period established in the Tax Code of the Russian Federation is not universal - it cannot be used when working under the UTII regime.

BY THE WAY , according to the standards of the Tax Code of the Russian Federation, reporting periods can be canceled for business entities in special cases; for tax periods this possibility is not provided. This right is reserved for government bodies, the norm is applicable to land tax (Article 393 of the Tax Code of the Russian Federation).

The concepts of tax period and tax payment period should not be confused. In the first case, we are talking about the time during which the results of commercial activities are summed up with the subsequent calculation of obligations to budgets of different levels. The second term is intended to indicate the range of dates on which the assessed tax must be paid. Both periods are strictly regulated by the Tax Code of the Russian Federation.

The main feature of tax periods is that they are a mandatory and integral element of the taxation system. Without them, it is impossible to establish a tax and introduce it into the current fiscal scheme. The norm is supported by clause 1 of Art. 17 of the Tax Code of the Russian Federation. The length of the tax period may vary. To do this, it is necessary to make adjustments to the Tax Code. This procedure is provided not only for national taxes, but also for regional varieties. Even if local authorities have the right to independently determine a wide list of mandatory tax elements, they cannot adjust the start and end dates of the tax period by their decisions and regulations.

Quarterly codes

For certain types of tax, reporting periods are coded quarterly. It allows you to facilitate the automatic processing of information provided in declarations. The following codes are distinguished:

- Standard quarterly codes for income tax.

- Quarterly codes for income tax for consolidated groups of taxpayers (CGT).

- Quarterly company property tax codes.

- Quarterly UTII codes.

When paying property tax, the following coding is used:

- 1st quarter – 21;

- 2nd quarter – 17;

- 3rd quarter – 18.

In case of reorganization or liquidation:

- 1st quarter – 51;

- 2nd quarter – 47;

- 3rd quarter – 48.

Reporting periods within the tax period

A tax period consists of one or more reporting periods. The most common reporting periods are quarter, half-year and nine months. But the specific distribution again depends primarily on the tax. Moreover, there are variations within the same budget payment. Thus, for income tax there are two options for reporting periods: the traditional quarter, six and nine months, and the “monthly” option, that is, the first month, two months, three months and so on until the end of the year. One or the other scheme is used depending on how the company calculates income tax.

Another interesting example is property tax. The reporting periods for it are also established by the Tax Code in two versions: by default it is a quarter, half a year and nine months, but for property taxed based on cadastral value, these are the first, second and third quarters. That is, in the first case, the tax base is calculated on an accrual basis throughout the year, and in the second, it is determined for each individual quarter. At the same time, reporting periods for this tax can be completely canceled if regional authorities provide for such a procedure for settlements at the local level (clause 3 of Article 379 of the Tax Code of the Russian Federation).

For some payments, such as VAT or UTII, the tax period for which lasts only one quarter, there are no reporting periods at all.

Tax return submission method code

Companies, in addition to the tax period code, also need to enter the code of the method and place of submission in the declaration. Based on the presentation methods, the following encodings are distinguished:

| Code | What does it mean |

| 01 | By registered mail |

| 02 | Personally to the tax office, on paper |

| 03 | On paper with a duplicate on electronic media |

| 04 | Via the Internet, certified by an electronic signature |

| 05 | Another method of submission |

| 08 | By mail with an electronic copy attached |

| 09 | In person on paper with a barcode |

| 10 | By mail on paper with a barcode |

Tax return submission place code

Some codes have also been approved at the place of submission of the income tax return, simplified tax system, UTII and property:

| Code | What does it mean |

| 120 | At the place of residence of the individual entrepreneur |

| 210 | By legal address of the organization |

| 215 | At the legal address of the successor company, which is not a major taxpayer. |

For the UTII declaration at the place of submission, the following codes are established:

- 214 – when submitting a declaration at the location of the Russian company (if the organization is not a major taxpayer);

- 245 – at the place of activity of a foreign company, which is carried out with the help of a representative office of the Russian Federation;

- 310/320 – at the place of business of the company/individual entrepreneur;

Tax period code when filling out a declaration

Each person receiving income in accordance with the legislation of the Russian Federation must be taxed and submit financial statements on a timely basis.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

What types are there?

For a number of fees, the tax period of 1 calendar year is relevant.

The rules define several options:

- provided that the organization is registered from January 1 to November 30, the period for it lasts from the moment of opening until December 31;

- if the company was registered from December 1 to December 31, then for it it lasts until December 31 of the next calendar year from the date of making an entry with the registration authority;

- if the structure has undergone a reorganization or liquidation procedure, then for it the period from January 1 of the year when it actually ceased its activities until the moment when the clarifying entry was made in the register is considered;

- provided that the company was registered and was liquidated within 1 calendar year, the tax period for it is considered to be the period from the moment of inclusion in the state register and until the recording of liquidation is made by the registering authority.

The following type is considered to be a quarter:

- if the registration of a person was carried out at least 10 days before its end, then for it there will be a period from the date of inclusion in the register until the end of the quarter in which it was carried out;

- if the enterprise was entered into the register less than 10 days before the end of the quarter, then the period from the moment of registration until the end of the next trimester is recognized.

In some cases, a tax period can be recognized as a time period of 1 month, 9 and the first half of the year.

How is the tax period determined in the Tax Code of the Russian Federation?

The definition of the tax period is contained in Article 55 of the Tax Code. It refers to a certain period of time for which firms or individual entrepreneurs calculate the amount of tax or contribution to be paid. It follows from this that the tax period in Russia is established for each tax separately. For income tax or the simplified tax system, the tax period is a year (Articles 285, 346.19 of the Tax Code of the Russian Federation), and for VAT it is considered a quarter (Article 163 of the Tax Code of the Russian Federation). Actually, for each payment, the tax period in the Tax Code of the Russian Federation is defined in the corresponding chapter, in a separate article, from the name of which it is quite obvious what exactly it says.

But the tax period is not always a whole year or a quarter, or another finite period of time determined by the usual calendar. For newly created organizations or registered individual entrepreneurs, the tax period is understood as the period of time from the date of their registration and, depending on the tax, until the end of the current calendar year or quarter. When liquidating a company or individual entrepreneur, the situation is exactly the opposite: in their case, the last tax period ends with the date of entry into the unified state register of deregistration.

Well, a somewhat unusual, but nevertheless possible situation: opening and closing a business within the same tax period. Most often this happens to individual entrepreneurs on the simplified tax system who have worked for part of the year. For them, the tax period will begin from the date of opening and end on the date of entry into the register of the deregistration mark.

Code in the declaration

When a taxpayer prepares reporting documents, he needs to indicate the tax period code. It is a combination of 2 numbers that is entered when filling out the title page. If there are doubts regarding the correctness of the entered codes, they can always be clarified in the orders of the FSIN.

According to VAT

The Tax Code of the Russian Federation establishes that in this case 1 quarter should be used. Accordingly, the period for which it is necessary to report will be the same.

The codes in the declaration will be the following digital values:

| I quart. | 21 |

| II | 22 |

| III | 23 |

| IV | 24 |

According to the simplified tax system

If an organization provides a report using a simplified system, then it must be submitted once a year. The calendar year is divided into reporting periods in the same way as when calculating income tax. In this case, there is no need to submit reports to the Federal Tax Service. The return must indicate standard code 34 for the tax period per year.

When closing an individual entrepreneur, 50 is used on the simplified tax system. It is also used during reorganization and liquidation.

Structures that work on imputation submit reports every quarter. In this case, use the following codes:

| For the first quarter | 21 |

| II | 22 |

| III | 23 |

| IV | 24 |

3-NDFL

When filling out the declaration, the following codes are used:

| When preparing a report for 1 calendar year | 34 |

| For 1, 2, 3, etc. months | 35, 36, etc. accordingly, up to 45 |

| Due to the liquidation of the organization | 50 |

For income tax

When filling out the declaration, you should use the following codes:

- for a voluntary association of legal entities when creating reports for the first quarter, half a year, 9 months and a year, 13, 14, 15, 16 are used, respectively;

- quarterly reporting periods - 21, 31, 33, 34 for the 1st, 2nd, 3rd and 4th quarters, respectively;

- when providing monthly reports - 35, 36, 37, etc. up to 45;

- when liquidating or reorganizing an enterprise, code 50 should be indicated;

- if taxpayers pay monthly advances based on actual profits, then the designations will be 57, 58, 59, etc. up to 68.

For property

Drawing up a declaration involves entering the following codes:

| When submitting reports for the 1st and 2nd half of the year | 17 and 18 respectively |

| When reorganizing the structure for half a year and 9 months | 47 and 48 |

| When preparing an advance report for the 1st quarter | 21 |

| If the company has undergone reorganization | 51 |

Tax period codes for income tax – 31, 34, etc.

When preparing a tax return, codes or digital designations are used, which can be used to judge which period (reporting or tax) is meant in this document (tax period 31, for example).

The code value allows you to find out the following parameters:

- frequency of reporting (every month, every 3 months or every year) by one legal entity (codes: 21, 31, 33, 34 - to indicate three-month reporting periods and years, codes 35 to 46 - to indicate monthly reporting periods and years inclusive);

- regularity of reporting (monthly, quarterly or annually) by a consolidated group of taxpayers (codes: 13, 14, 15, 16 - to indicate quarterly reporting time periods and the year, codes from 57 to 68 - to indicate monthly reporting periods and the year inclusive);

- the final tax period in circumstances where the company is being liquidated or reorganized (code 50).

The indicated values of the codes and the principles for their inclusion in the final reporting are stipulated by the order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3 / [email protected]

More details on how to correctly fill out a tax return can be found in the material “Tax return form for corporate income tax 2014-2015”.

Providing a declaration

The document must indicate the amount of income received for a certain period of time.

Filing deadlines may vary and depend primarily on the type of declaration itself.

In addition to their income, persons must enter a number of values into this document:

- all resources that, according to Russian legislation, are subject to taxation;

- the size of the tax base;

- a list of benefits provided by the state when paying fees;

- sources of profit.

Reporting periods within the tax period

A tax period consists of one or more reporting periods. The most common reporting periods are quarter, half-year and nine months. But the specific distribution again depends primarily on the tax. Moreover, there are variations within the same budget payment. Thus, for income tax there are two options for reporting periods: the traditional quarter, six and nine months, and the “monthly” option, that is, the first month, two months, three months and so on until the end of the year. One or the other scheme is used depending on how the company calculates income tax.

Another interesting example is property tax. The reporting periods for it are also established by the Tax Code in two versions: by default it is a quarter, half a year and nine months, but for property taxed based on cadastral value, these are the first, second and third quarters. That is, in the first case, the tax base is calculated on an accrual basis throughout the year, and in the second, it is determined for each individual quarter. At the same time, reporting periods for this tax can be completely canceled if regional authorities provide for such a procedure for settlements at the local level (clause 3 of Article 379 of the Tax Code of the Russian Federation).

For some payments, such as VAT or UTII, the tax period for which lasts only one quarter, there are no reporting periods at all.

Reporting period

It is considered the time period during which the business operations of a structural unit are carried out, reflected in accounting and reporting.

The following types exist:

| Quarterly | in this case, a report is provided for every 3 months |

| Annual | compiled once a calendar year |

The first reporting year for a company is the time period from the moment it was entered into the state register until December 31 (if the registration period fell on the day after September 30). Or from the moment of registration until December 31 of the following year (if it was added to the register after September 30).

When filing your tax returns, you need to keep an eye on changes in your financial statements. Codes are subject to change. Therefore, before submitting reports, you should clarify them with the Federal Tax Service.

Tax payment and reporting obligation

A tax period is understood as a period of time for which the amount of tax is determined. But this does not mean that it is necessary to pay off the budget only at the end of this period. And, conversely, the reporting period established within the tax period does not always mean that a company or individual entrepreneur is required to file returns at the end of each of them.

The same income tax requires filing reports, as well as paying the tax amount at the end of each quarter. On the simplified tax system, based on the results of the reporting quarter, half a year and nine months, the advance tax payment is calculated, but the declaration is submitted only at the end of the tax period, that is, for the year as a whole. In the context of fulfilling the duties of a VAT payer, the tax amount is calculated at the end of each quarter, and a declaration is submitted at the same time. But tax payment is made in three payments over the next three months, that is, it is quite formally tied to the calendar end of the tax period.

From all this it follows that one should focus on the established time frames of reporting or tax periods only in a clear connection with the procedure for paying a specific tax, as well as filing a declaration for it. All this is spelled out in detail in the Tax Code, as well as in regional laws, if they establish additional variables in the procedure for paying a particular tax.

Video on the topic:

https://youtu.be/q0fIWZbeXH4

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- Regions

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- Regions

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

List of VAT codes

According to Order of the Ministry of Finance No. 104 of 2009, not only quarters, but also months are encrypted with the tax period code in the VAT return. January – 01, … December – 12.

When liquidating an enterprise, the quarters are indicated as follows:

- I – 51.

- II – 54.

- III – 55.

- IV – 56.

Codes by month during liquidation:

- First quarter: 71, 72 and 73 respectively.

- Second: April - 74, May - 75, June - 76.

- Third: 77, 78 and 79.

- Latest: 80, 81, 82 for October, November and December.

Art. 55 clause 1 of the Tax Code of the Russian Federation implies several reporting periods in one tax segment. Regarding VAT, these indicators are the same - each reporting period is equal to one taxable period. The declaration is not filled out on an incremental basis - it reflects information only for a specific period of time.

Rules for filling out details

The details in question are filled out in coded form. The tax period code in the VAT return is indicated in accordance with the rules given in Appendix 3 to the Procedure for filling out this reporting form (Order of the Federal Tax Service MMV-7-3 / [email protected] ). The full list of codes specified in Appendix 3 to the Filling Out Procedure is quite large. Typically, the vast majority of organizations use the following ciphers:

| Code | Reporting quarter |

| 21 | First |

| 22 | Second |

| 23 | Third |

| 24 | Fourth |

The remaining ciphers are very specific and are used in rare cases: during the reorganization or liquidation of a company, or a production sharing agreement.

For example, when filling out the primary report for 9 months of 2020, you need to fill out information about the reporting quarter for which reporting is submitted as follows:

Application of codes in practice

VAT reports are submitted to the tax office on forms approved by the Ministry of Finance. The importance of correct completion is due to the fact that errors lead to resubmission of the report. Their untimely identification is fraught with the risk of violation of the Tax Code and corresponding administrative measures.

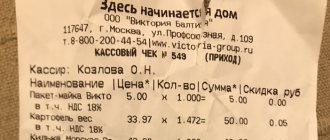

To fill out the declaration, information is taken from the following databases:

- List of invoices from counterparties;

- Database for control of invoice forms;

- Book of sales and purchases;

- Information from tax and accounting reports.

The form consists of 12 pages, including the front page. It contains the following information:

- TIN/KPP;

- Document version. If it is submitted for the first time during the reporting period, then 0 is entered; if this is a clarification, then 1, 2 or another corresponding figure;

- Tax period code according to the above rules;

- Information about the company.

Section 1 contains the following points:

- OKTMO/KBK codes;

- The final tax amount is reflected in clauses 030, 040 and 050;

If in the current reporting period there were transactions for which VAT must be charged, then you should fill out paragraph 3. The following should be indicated here:

- The amount of tax according to the established rates;

- Amount of restored VAT;

- Deductions.

The value of the 1st point is formed as the sum of lines 200 and 210.

Sections 8 and 9 are filled out in accordance with data from the book of sales, purchases and other accounting documents.

Sections 4 and 6 are intended for companies engaged in exporting. All documents confirming the right to export and types of exported goods are taken into account here.

The finished report is submitted in electronic format. The title page and the first section must be completed. The remaining blocks are filled in depending on the type of transactions performed in the reporting period.

If an error is found in a document, a correction on the same form is unacceptable. To correctly display the information, a new report is drawn up - a corrective declaration.

Tax payment and reporting obligation

A tax period is understood as a period of time for which the amount of tax is determined. But this does not mean that it is necessary to pay off the budget only at the end of this period. And, conversely, the reporting period established within the tax period does not always mean that a company or individual entrepreneur is required to file returns at the end of each of them.

The same income tax requires filing reports, as well as paying the tax amount at the end of each quarter. On the simplified tax system, based on the results of the reporting quarter, half a year and nine months, the advance tax payment is calculated, but the declaration is submitted only at the end of the tax period, that is, for the year as a whole. In the context of fulfilling the duties of a VAT payer, the tax amount is calculated at the end of each quarter, and a declaration is submitted at the same time. But tax payment is made in three payments over the next three months, that is, it is quite formally tied to the calendar end of the tax period.

From all this it follows that one should focus on the established time frames of reporting or tax periods only in a clear connection with the procedure for paying a specific tax, as well as filing a declaration for it. All this is spelled out in detail in the Tax Code, as well as in regional laws, if they establish additional variables in the procedure for paying a particular tax.

The calculation of any budget payment occurs according to the rules defined by the Tax Code or other federal laws. Most taxes and contributions require a specific payment procedure, as well as the preparation and submission of reports. The timing of this is determined based on the tax and reporting periods for each type of payment. We will talk about how to determine the tax period, as well as the reporting period, in this article.