Firing an employee is primarily an accounting transaction. Situations when the calculated amount is calculated with errors occur quite often. In such cases, a dissatisfied employee has the right to apply to the labor inspectorate or court to protect his interests. Next, we’ll talk about how to correctly make calculations upon dismissal, and also about what you need to pay attention to when carrying out such an operation.

Basic questions regarding dismissal

There are many reasons for dismissal: from the employee’s personal initiative to dismissal due to disciplinary punishment.

The provisions of the article of the Labor Code of the Russian Federation, according to which the calculation was made, cannot influence the amount of wages paid at the time of dismissal.

The calculation of the amounts is carried out by an accountant (in large enterprises, a large number of departments usually take part in this process). However, the employee can pre-calculate the correctness of the accrual on his own.

When dismissing, the following is taken into account:

- Salary for the last month of work.

- Average monthly bonus (if provided for in the employment contract).

- Overtime hours, night shifts, holidays (additional payment is made during this time).

- Compensation for unused vacation.

- Compensation payments to the employee upon dismissal (provided if the dismissal occurred at the initiative of the employer).

It should be noted that compensation payments are not provided at all enterprises.

Today you can pre-calculate the amount to be paid online. Many specialized sites offer the use of a calculator for calculating payments upon dismissal.

The general procedure for formalizing the termination of an employment contract is contained in Article 84 of the Labor Code of the Russian Federation. In accordance with this legislative norm, the employee’s calculation begins with the preparation and signing of an order, which is signed by the employer.

Clause 1 of the above article obliges the employer to familiarize the dismissed employee with the text of the order against signature. If necessary, a duplicate of the order to terminate the employment relationship can be handed over to the employee.

Important: if it is not possible to familiarize the former employee with the dismissal order or the employee deliberately ignores this requirement, an appropriate entry should be made in the text of the order.

The day of termination of employment is the employee’s last working day. An exception to this situation is the actual absence of the employee from the workplace while simultaneously retaining his place of work and position (for example, a woman wants to terminate her employment contract on the day she returns from maternity leave).

Payment terms

Upon dismissal, the employer is obliged to pay the employee wages for all days worked and financially compensate for unused vacation . At the same time, the Labor Code clearly establishes the payment terms. Article 140 of the Labor Code of the Russian Federation guarantees the employee payment of all amounts due on the day of dismissal. If in fact this cannot be accomplished, full financial settlement of the employee is allowed no later than the next day after the request for payment is submitted.

If an employee works on a shift schedule and the last shift before dismissal falls on an official day off of the enterprise (Saturday or Sunday), it is possible to organize the return to work of all employees responsible for accounting (for example, an accountant or a personnel department employee).

Paragraph 2 of the above article states that if there are controversial issues regarding the due material payments, the employer, within the prescribed period, pays the former employee an undisputed amount (the maximum amount that both parties to the conflict agree on).

Settlements with a dismissed employee can be made either through bank transactions or in cash.

If on the day of dismissal the employee cannot be present at the workplace (due to illness, time off or vacation), the calculation will be made on the last or next working day.

Along with the due payments, a work book is issued on the last working day.

It is impossible to violate the terms of payments upon dismissal. This requirement is enshrined in Article 236 of the Labor Code of the Russian Federation. For failure to comply with the norm, the employer is financially liable to the dismissed employee. Namely, the owner of the organization, in case of delay in payment, must pay the employee compensation for the delay in the amount of no less than 1/150 of the Central Bank key rate in effect during the period of delay.

In addition, the interests of working citizens are protected by the norms of the Administrative Code. Article 5.27 provides for administrative liability for violation of labor legislation. An employee who has not received a payment in a timely manner has the right to contact the labor inspectorate and hold the former employer accountable.

Request of a dismissed employee to pay him

In accordance with the provisions of Art.

140 of the Labor Code of the Russian Federation, the employer is obliged to make a full settlement with him on the last working day of the dismissed employee, paying all amounts due by law. Moreover, this condition must be implemented without any written reminders from the latter (except for the cases described below).

The main payments that an employee must receive upon dismissal include:

- salary for the last month;

- compensation for unused vacation (if any);

- severance pay (in case of staff reduction or liquidation of the organization), etc.

At the same time, in certain situations, in order to receive all amounts due, the dismissed person must prepare a corresponding request in writing and send it to the employer.

The need to write such a document may arise in the following cases:

- If on the day of dismissal the citizen was absent from the workplace (for example, was on sick leave, took a day off, etc.).

- If you disagree with the amount that was assigned by the employer as the final payment: in this case, the management of the organization will have to pay on the last working day the amount in respect of which there were no disputes. The issue of the remaining part of the payment can be resolved through the labor inspectorate or in court (find out where to go if you did not pay your salary upon dismissal, and how to file a lawsuit for its seizure).

- If the employer delays payments for some reason (what compensation is due for delayed payments upon dismissal?).

A request for payment upon dismissal is a written document in which the employee formally expresses a request to transfer in his favor the full amount of money assigned in connection with the dismissal.

Based on this paper, a former employee whose legal rights were violated will be able to defend his interests in the labor inspectorate or in court.

Some difficulties when terminating an employment contract may be caused by compensation for unused vacation. Find out how to calculate the amount if the employee worked for 11 months or less, and what to do if the employer refuses to provide payments.

How to calculate wages for laid-off workers in 2020

The salary upon dismissal takes into account:

- Accrued funds for days worked.

- Monthly bonus proportional to the number of working days.

- Overtime (night shifts, overtime, work on weekends or holidays).

- Payment for combination.

- Travel allowances.

When calculating the wages due to an employee upon dismissal, an accountant or personnel officer must adhere to a certain algorithm of actions:

The first thing you need to do is draw up an accounting sheet in form T-13. Many accountants recommend creating a separate time sheet for the dismissed employee (from the moment the resignation letter is written). This document records all working days, days of rest, business trips, vacations and sick leave. The signed time sheet is agreed upon with the employee’s supervisor and endorsed by an employee of the HR department.

The time sheet, drawn up in accordance with the requirements, is transferred to the accounting department of the enterprise.

The amount to be issued is calculated using the following formula:

Salary to be paid = "(salary + bonus, month + other payments) / number of workers. days. per month * no. of work days

This formula is used in standard calculations when the employee did not go on vacation or was on sick leave during the month of dismissal.

Important: voluntary dismissal entails two guaranteed payments: wages for the time actually worked and compensation for unused vacation. Termination of an employment contract by mutual consent of the employee and the employer also provides for the payment of severance pay (provided that this is specified in the text of the employment contract).

How to calculate an employee taking into account vacation compensation in 2020

In accordance with Art. 115 of the Labor Code of the Russian Federation, each employee is granted annual basic leave lasting 28 calendar days. In order to qualify for full leave, you must work at the company for 12 months. By simple calculations, you can understand that for each month worked, 2.33 vacation days are accrued.

In order to correctly calculate the amount of compensation, the accountant needs to multiply the number of vacation days that are accrued to the employee for the month worked by the number of months worked for a particular employer. Please note that this formula does not take into account previously used vacation.

Calculation of compensation upon dismissal for unused vacation is carried out using the following formula:

Compensation =» 28 days. / "12 months * number of complete work months – number of uses vacation days

The resulting number of days of production, which is subject to monetary compensation, is multiplied by the employee’s average salary for the last 6 months (average daily earnings). You can calculate preliminary compensation for unused vacation online using a special calculator.

Many categories of citizens are entitled to additional leave (provided only after the main one has been fully used). Therefore, the accountant must take this into account when preparing the calculation.

Not all categories of employees are granted leave based on calendar days. In accordance with Art. 295 of the Labor Code of the Russian Federation, employees who are employed in seasonal work are granted vacation at the rate of two vacation days for each month of work. For this category of employees, compensation for unused vacation is calculated according to the standard scheme. However, the number of unused days is calculated using the formula:

number of unused days \u003d" number of months worked. * 2 - number of vacation days used

Important: compensation for unused vacation days must be transferred (or handed over) to the employee on the last working day.

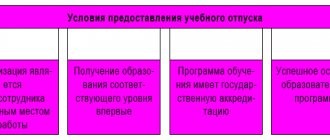

It should be noted that not all unused types of vacation are subject to financial compensation upon dismissal. Days of educational and sabbatical leave are not taken into account when calculating the amount of payments during termination of employment.

There are often cases when a dismissed employee takes vacation days in advance (in advance). That is, in essence, he did not work enough to rest. In this situation, the accountant will have to withhold part of the employee’s salary as compensation for early vacation use.

Payment amount

The size of payments, or rather the compensation included in them, mainly depends on several factors.

These can include:

- date of dismissal of the employee;

- salary amount;

- time elapsed since the last salary;

- time elapsed since last vacation.

All compensation is calculated using special formulas indicated below. In addition, severance pay is included in the amount of payments, if necessary.

How to calculate

If you can still sort out the calculation of wages, then compensation for unused vacation should be given more attention.

The basic formula for calculating compensation upon dismissal is the employee’s average daily salary multiplied by the number of vacation days.

To calculate, you first need to find the average daily salary (hereinafter M) and the number of days of unused vacation.

To calculate “M” you will need to find out the employee’s total income that he received during the calendar year before his dismissal. Once found, it must be divided by 12 (the number of months in a year) and 29.3 (the average number of days in a month). As a result, the average daily salary can be determined.

Now you need to calculate how many days the proposed vacation should last:

- To do this, it is worth calculating the number of months that have been worked since the end of the last vacation.

- The resulting number is multiplied by a factor of 2.33 and rounded to the nearest whole number.

It is worth clarifying that this formula is only effective for those organizations that provide employees with 28 days of vacation. The rest need to turn to the labor inspectorate for help.

To calculate it, you need to know the refinancing rate from the Central Bank (C), as well as the amount of debt (S) and the number of days that have passed since the end of the day of dismissal (D).

After all the circumstances have been clarified, it is enough to substitute the values into the formula: “C/100% × 1/300 × S × D.”

An example of calculating severance pay and compensation for unused vacation upon dismissal

Petrova resigned on July 20, 2014 due to changes in working conditions. Severance pay should be calculated in a single amount (05.2014 and 06.2014 are taken into account). Petrova received a salary of 10 thousand rubles. She also received about 4 thousand rubles in hospital benefits (not taken into account when assigning severance pay).

Petrova did not have time to rest during her 28-day vacation.

- Let's calculate the average daily income (for the above 2 months, 33 days were worked):

10,000: 33 = 303 rubles.

- Salary calculation based on average monthly number of days (20):

303 x 20 = 6060 rubles - this will be the amount of severance pay.

- Amount of compensation for unprovided leave:

303 rubles x 28 days = 8484 rubles.

Is it subject to personal income tax?

For working employees, income and compensation for unused vacations are taxed, as well as severance pay amounts, the amount of which exceeds the established ones several times. Those who quit are exempt from taxes.

Taxation does not provide for personal income tax deductions from income that relate to payments to employees in the event of their dismissal.

This is also important to know:

How does redundancy happen?

The same applies to payments for unused vacations, as well as severance pay. But if the latter was not transferred and was included in the company’s income, then the employer is obliged to pay NNP. Vacation compensation upon dismissal in 2021 is mandatory.

How to calculate average daily earnings in 2021

The calculation of payments due upon dismissal begins with determining the employee’s average daily earnings.

For this indicator, all payments made from the organization’s labor fund and wages are taken into account, with the exception of:

Financial assistance

Compensation for study leave

Compensation for study leave

Money allocated for employee health improvement

Average daily earnings upon dismissal are calculated using the formula:

Average salary = "income for working hours. days / quantity labor days

When calculating leave upon dismissal, days of absence of the employee from the workplace are not taken into account

The above formula is used to determine the average daily earnings of an employee who has worked the entire pay period. If the billing period has not been worked out in full, the average daily earnings are calculated differently:

Average daily earnings = "earnings for the billing period / (29.3 * number of fully worked months + number of calendar days in partially worked calendar months)

29.3 is the average number of calendar days in a year.

How to calculate severance pay upon dismissal in 2021

This cash payment is due to the employee in the following cases:

- The employment contract contains a corresponding clause that obliges the employer to pay severance pay.

- The organization in which the employee works was liquidated (or the individual entrepreneur ceased operations) - in accordance with clause 1 of Art. 81 Labor Code of the Russian Federation.

- A reduction in the number of employees was made - in accordance with clause 2 of Art. 81 Labor Code of the Russian Federation.

- When changing the owner of the organization's property - on the basis of clause 4 of Art. 81 Labor Code of the Russian Federation.

Important: severance pay should not be less than the average earnings of the dismissed employee for the last month.

The benefit is calculated using the formula:

Amount of benefit = "(amount of earnings in the calculation period / number of days worked) * number of days in the next months

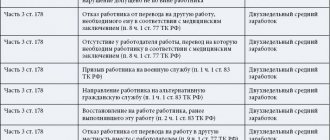

In some cases, a terminated employee may be subject to a reduced severance package. The grounds for its calculation are as follows:

- the employee is declared incapable of work;

- the employee quits due to joining the army;

- the employee does not agree to be transferred to another city;

- the employee who previously held this position has been reinstated and wishes to begin his work duties;

- deterioration of working conditions.

Severance pay is also provided to employees who work part-time (in accordance with Article 287 of the Labor Code of the Russian Federation).

The amount of the benefit depends on the reason for termination of the contract. If dismissal occurs due to the liquidation of an enterprise or in the event of a reduction in staff numbers, the employee is entitled to monetary compensation in the amount of average monthly earnings. In other situations, the dismissed employee will receive a cash payment equal to two weeks’ average earnings (based on Article 178 of the Labor Code of the Russian Federation).

Calculation of reduced severance pay is made on the last working day. There is no need to issue a separate order to issue this amount of money. Compensation payments are calculated based on the dismissal order. The exact amount of the benefit is indicated in the calculation note.

Calculation of personnel upon dismissal

HR department employees need to be careful when calculating compensation to dismissed individuals. In some cases, an amount is withheld from the employee, which goes to the company. Dismissed senior management employees are entitled to special compensation. In some cases, dismissed specialists receive not only severance pay, but they also retain their average earnings. It will be accrued to the employee until he is hired to a new place.

The calculation rules are specified in Art. 140 Labor Code of the Russian Federation. The person must receive payment on the same day the dismissal occurs. But the existing exception must also be taken into account. It is as follows. Situations often arise when a specialist is not at work. But it is necessary to understand that the law guarantees that he retains his position. If the employee was not at work on the last working day, then he receives payments no later than the next day.

In some cases, the specialist and the management of the enterprise cannot agree on the amount of compensation. In this case, the specialist leaving the company can file a lawsuit against the organization or a complaint to the labor inspectorate. Service employees will help calculate compensation and advise the person on all issues related to payments.

It is necessary to compensate the specialist leaving the organization for all vacations that he did not use. When calculating payments, it is worth paying attention to the number of days that the employee worked in a year. At some enterprises, a situation often arises in which employees do not go on vacation for 2 years in a row. If such an employee resigns, the company must pay compensation to the dismissed person for all this time.

Sometimes a completely different situation arises when a specialist has already used his vacation, and then wrote a letter of resignation from work. In this case, the organization has the right to withhold a certain amount from the resigning person’s payments. The HR department must analyze how many months and days the specialist has worked this year.

The HR department should consider the working year, not the calendar year. It is calculated not from January 1, but from the moment the employment contract was concluded with the specialist. There are a number of situations in which it is prohibited to withhold funds. These include the following situations:

- Specialist abbreviation.

- A person is unable to perform his duties due to poor health. However, he refused to take another position.

- An employee is called up for military service, a person is called up for alternative civilian service.

- The company has a new owner, and as a result the manager or accountant is fired.

- An individual entrepreneur decided to end his activities. The organization completely ceases its work.

- Death of an employee. The employee is declared missing.

- The labor inspectorate or judicial authorities reinstate the former specialist in his position. Dismissal of an employee who previously joined this position.

- The occurrence of force majeure circumstances that cause the dismissal of an employee.

- The organization moves to another location, and the specialist refuses to be transferred to a new place of work.

The general rule is that a dismissed specialist receives a salary for the days he worked in the current month. The company pays severance pay. In addition, compensation for vacation is accrued if the employee has not yet used it.