The company has the right to increase the amount of its capital if necessary.

To do this, you need to organize a meeting, make a decision, prepare documents and report the increase to the state body - the Federal Tax Service. At the same time, there are several ways to increase the value of the LLC’s capital. One of them is an increase due to a contribution made by one of the founders of the company - money or property.

Below is a step-by-step sequence of actions that the founders of an LLC need to perform to change the size of the charter capital due to making an additional contribution.

Is it possible to increase the capital of an LLC with the help of an additional contribution?

Yes, the size of the authorized capital can be increased due to the additional contribution of the participant. Moreover, it can be contributed in any form - in the form of property (goods, materials, fixed assets), in monetary form - cash, non-cash.

This need arises when a new participant is introduced into the founders of the company. Also, the founders can make additional contributions when the size of their shares increases.

It is not enough to simply contribute money or property to the authorized capital. This procedure must be properly completed, changes must be made to the charter, and the tax authority that deals with state registration of legal entities must be notified of the adjustments.

The capital can also be increased at the expense of the company's property - at the expense of profit at the end of the year.

How is a sole member of an LLC accepted?

It is necessary to increase the capital of an organization when attracting a new participant or making changes to the charter by observing the following algorithm of actions:

- preparation of a new Charter or a set of documents reflecting the new amount of capital;

- payment of state duty (when increasing the authorized capital of a limited liability company, it is equal to 800 rubles);

- preparation of papers confirming the fact of an increase in capital.

A change in the amount of the authorized capital is proven by a payment receipt, cash order, or payment order.

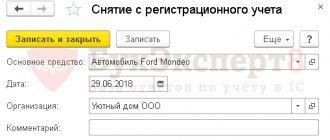

If the volume of assets increases due to the organization’s property, then the real estate is assessed and an acceptance certificate is drawn up for the LLC’s balance sheet.

Within 30 days after the decision is made, the sole founder sends an application to the tax office in the prescribed form (P13001), which indicates a request to register an increase in the authorized capital.

In addition to the application, a notarized decision, an amended charter or a separate paper with adjustments to the amount of capital and a receipt with paid state duty are also attached.

An extract from the Unified State Register of Legal Entities and the new Charter of the LLC will be prepared with the changed information within 5 days (the days of filing and application and receipt of documents are not taken into account).

If there are several founders of the LLC, then instead of a decision, a protocol on increasing the authorized capital is adopted.

How to make a decision to reduce the capital.

How to compose?

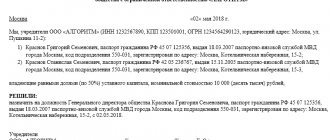

The document is drawn up in any form, indicating the place of its execution and date, and is divided into an introductory and main part.

The introductory block contains information:

- LLC name;

- Full name of the sole founder, his passport details and registration address;

- on the basis of which the organization carries out its activities.

This is followed by the word “Decided”, and a list of instructions from the LLC participant is listed:

- increasing the authorized capital at the expense of funds (property);

- designation of the amount of change in assets;

- fixing the term and method of depositing funds (to the company’s current account) and the share of the sole participant (participants);

- an indication of the approval of the results of changes in the authorized capital by this decision no more than 30 days from the date of expiration of the deadline for depositing funds.

The decision is signed by the sole founder indicating the position and full name.

The procedure for acceptance by the founder

Depending on the method of increasing the company's assets, there are several points for making decisions in a given situation.

If the owner decides to include an additional participant in the LLC, then first it is necessary to study the Charter of the company for the possibility of carrying out such actions (raising funds from 3 parties).

If the Charter provides for these manipulations, then an application is drawn up in the name of the director from the future participant with a request for his entry into the company and becoming one of the members of the LLC. After receiving it, the manager unilaterally makes a decision indicating all the personal data of the applicant and the size of his share in the authorized capital of the enterprise.

The first priority of the new participant is to timely deposit funds in accordance with the period indicated in the application. The maximum period for transferring a share to the company from the date of the decision is established by law - six months. The period should be counted from the date of filing the application addressed to the manager.

If the founder decided to contribute his own funds to increase the assets of the enterprise, then the nominal price of the share changes, but the size remains unchanged (100%).

The option of increasing capital when attracting additional property (real estate, land) has limitations. After all necessary procedures have been completed, assets cannot change by an amount greater than the initial value of the company's property (reserve fund and net assets).

A very important point when making a decision is the use of real financial information (accounting statements for the previous year).

How it is certified - notarized certificate

Part 3 Art. 17 of the Federal Law “On Limited Liability Companies” states that a decision made at a general meeting to increase the authorized capital requires mandatory notarization.

If the decision is made by a single participant, then only the authenticity of his signature is verified.

decision of the sole founder to increase the authorized capital of the LLC - sample.

Step-by-step instructions for increasing the company's capital with the property of the founder

The procedure for increasing the size of the authorized capital at the expense of the property of LLC participants is regulated by Article 19 of Law No. 14-FZ as amended. dated 04/23/2018.

This article states that the amount of the capital can be increased through additional contributions from the founders of the company and an increase in the size of their shares. In this case, the value of the share may increase by an amount equal to or less than the additional contribution.

Any existing founder can make an additional contribution. At the same time, its size is limited - it should not exceed part of the total cost of additional deposits, proportional to the size of the share of this founder in the company's capital.

A contribution can also be made by a new person who is added to the LLC.

Additional contributions can be made either by decision of the general meeting or on the basis of an application from a participant or a third new person.

Step-by-step instructions for carrying out the procedure for increasing through additional contributions:

Step 1. A statement from the current participant is written about the desire to make an additional contribution to the existing capital. When introducing a new founder (third party), the application is drawn up by this person. This step is optional. You can increase your capital through additional contributions without an application.

Step 2. A general meeting of LLC participants is convened. If there is only one founder, then he alone makes the decision.

Step 3. At the meeting, the issue of introducing a new participant into the company is discussed, the size of his share and the amount of contribution are established. If a new participant is not introduced, and the authorized capital is increased due to additional contributions from the existing founders, then the amount of contributions and the amount of increase in their share in connection with this are determined.

Step 4. A decision is made to introduce a new participant, the size of his share and contribution - unanimously (in this case, the share cannot be greater than the contribution). If contributions are made by the existing founders, then a decision is made to increase the capital with 2/3 votes (unless otherwise established in the company itself). If a contribution is made on the basis of an application, the decision must be made unanimously.

Step 5. Contributions must be made to the authorized capital within two months from the date of the decision - in any form (property, non-cash transfer, cash, foreign currency). If the contribution is made based on the application of a new participant or an existing one, then 6 months are allotted for making the contribution.

Step 6. Within a month after the entry, a decision is made on the results of the procedure, as well as on making the necessary changes to the Statutory Documents in connection with the increase in the value of the Criminal Capital.

Step 7. Within a month after the decision on the results from step 5 is approved, a package of documents must be sent to the tax authority for state registration of changes.

Step 8. If the LLC has a standard Charter, then within a month from the date of the decision on the results, you need to inform the Federal Tax Service about the increase in the capital.

If the specified deadlines are not met or the necessary documents are not provided, then the change in the authorized capital will not be considered completed, and the founders may demand their contributions back.

What documents are needed?

During the procedure for increasing the authorized capital through the contribution of a new or existing founder, a number of documents must be completed. Their list is given in Article 17 of Law No. 129-FZ.

Scroll:

- An application from a participant or a third party, if the increase is carried out on the basis of the personal desire of these persons (the size of the share, the composition of the contribution, the deadline for making the contribution, the size of the share, and other conditions are indicated).

- Application for state registration of changes to the charter P13001 - sample.

- Decision to amend the statutory documents.

- New constituent documents (new edition of the Charter).

- A document confirming payment of the state fee.

- Decision to increase the authorized capital.

Minutes of the general meeting of the LLC on increasing the capital capital - link.

Decisions of the sole founder to increase the capital capital - link.

Accounting entries

The authorized capital is accounted for on the credit of account 80. This is a passive account, the credit of which reflects the total amount of capital formed at the stage of registration of the LLC.

The balance of account 80 does not change until the company decides to increase the capital through additional contributions or the introduction of a new founder.

An increase in the authorized capital must be reflected in the credit of account 80 - the amount must increase. In this case, the wiring looks like this: Dt 75 Kt 80.

Next, entries are made to reflect deposits depending on their composition - property, money.

The table below shows the transactions that accompany the procedure for increasing the size of the capital account at the expense of additional funds and property:

| Operation | Debit | Credit |

| The increase in the company's capital is reflected (debt of the founders on deposits) | 75 | 80 |

| The founder makes a contribution in the form of property - materials | 10 | 75 |

| Contribution made in the form of property - fixed assets | 08 | 75 |

| Additional contribution in the form of goods is reflected | 41 | 75 |

| Cash contribution (cash, non-cash, foreign currency) | 50,51,52 | 75 |

Increasing the authorized capital at the expense of LLC property

The company has the right to increase the authorized capital by a total amount not exceeding the actual value of the company's assets. In this case, the contribution to the capital of the company is made only and exclusively with property, but not with cash.

IMPORTANT: The percentage of shares of co-founders is not subject to redistribution and retains their “percentage” values. For example, the capital of an LLC was 10,000 rubles, two founders owned shares of 40% and 60%, respectively - that is, 4,000 rubles each. and 6000 rubles. Due to the company's assets, the management capital was increased to 50 thousand, thereby the founders maintained the ratio of 40% and 60%, but the value of their shares changed, amounting to 20 thousand and 30 thousand rubles, respectively.

Restrictions:

- To make a decision to increase the capital of an LLC at the expense of the company’s assets, 2/3 of the votes of the founders is sufficient;

- The charter may prescribe a different procedure for making a decision on this issue (for example, 100% number of votes);

- The decision is made taking into account the final accounting reports for the past year.

The capital increases due to the contribution of one participant

The following situation is when one of the owners wants to increase their share in the company. This is permissible with the consent of the others and is achieved by increasing the authorized capital through the contribution of only this participant.

For example, a company with a capital of 50 thousand rubles was created by two founders who have equal shares of 50% with a par value of 25 thousand rubles. One of them wants to increase his share to 75%, and the second does not object. To do this, the first founder must contribute an additional 50 thousand rubles to the management company. Then the capital will be equal to 100 thousand rubles, and the shares will be distributed as follows:

- the participant who made an additional contribution will own 75% of the LLC, the nominal value of his share will be 75 thousand rubles;

- the second participant will retain 25%, and the nominal value of his share will not change and will still be equal to 25 thousand rubles.

The founder who increases the capital capital must submit an application to the director of the LLC. In it, he prescribes the size and composition of the additional contribution, the term and form of payment (money or property), as well as the share that he expects to ultimately receive.

At the general meeting, participants must make a unanimous decision on:

- increasing the share of this owner in the management company and its nominal value;

- changes in the shares of the remaining owners of the Company;

- making related changes to the charter.

Next, the owner must deposit money or property into the management company, but no later than six months from the date of the general meeting.

For an LLC with one founder, everything is somewhat simpler - he makes the decision to increase the authorized capital himself. As a result of the changes, the nominal value of his share becomes equal to the new value of the authorized capital.

How to increase the authorized capital of an LLC - step-by-step instructions

The authorized capital is called the company's assets, both in property and in monetary terms. The founders make these contributions after registering the LLC. Based on the legislation, the current minimum amount is equal to 10 thousand rubles.

At the time of creating a company, the founders are often limited to a similar amount (read the article on how to leave the founders of an LLC:). However, in the future there is a need to increase.

If it needs to be changed for the subsequent development of the business, you do not have to make adjustments to the Unified State Register of Legal Entities.

Increasing the authorized capital of an LLC - step-by-step instructions

There are various situations in which it is necessary to increase the authorized capital:

- A new person appears in the company with his own property;

- The company is radically changing its business direction;

- One of the participants wants to increase the current share size;

- It can be increased according to the interests of investors;

- It may be increased due to existing assets or additional investments from members of the Society.

Sample decision to increase the authorized capital 2018

First, you will need to fill out an application in form P13001 according to an increase in the size of the authorized capital, taking into account the current contributions of other persons. To fill out the provided application, certain data is required, which you can find in the following documents:

- TIN and OGRN of the Company;

- A document containing data, as well as confirming the amount of the current contribution and the final decision;

- Amounts of contributions of members of the Society;

- Passport information of the general director of the LLC;

- Own TIN of the general director;

- Identification of participants who intend to be part of the participants.

Sample solution

Entry of a new participant into the LLC with an increase in the authorized capital 2018 - documents

In order to increase the contribution along with the arrival of a new participant, the documents provided below will be required:

- Application according to form P13001. It is registered or certified by a notary;

- Updated version of the charter and provision of two originals;

- OSU Protocol;

- Balance sheet for the last year - a copy, certified and stamped, as well as signed directly by the director;

- Certificate of payment of the state registration fee.

Sample protocol on increasing the authorized capital of an LLC

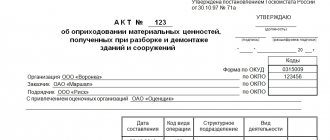

The protocol, as a rule, must contain the following information in accordance with Article 19, paragraph 1 of the Federal Law on LLC:

- The final price of all investments;

- The same ratio for all members of the Company regarding the additional cost and the amount by which, as a rule, the nominal price of the share increases;

- Deciding what is planned to be increased;

- Information on the decision to approve the new authorized capital and its subsequent registration.

Sample protocol

The procedure for increasing the authorized capital of an LLC at the expense of contributions from participants

After determining for what reasons the contribution may be increased, we can talk about how the registration takes place and what both the participants and the head of the Limited Liability Company are required to provide:

- First you need to decide that it should really be increased. If it is carried out through the investment of amounts and existing equipment of registered participants, an additional solution must be provided. This concerns the approval of the final results of changes.

- Agree on a new version of the charter or change it. The new size according to the authorized capital will now be reflected there.

- Pay the state fee for the fact that adjustments have been made to the charter. Cost - 800 rubles.

- Provide documents on the basis of which the fact of making an optional contribution or contribution of a member of the company is confirmed: Receipt;

- Cash order;

- Payment order.

- An application that was notarized - form P13001;

Statement

Increasing the authorized capital by increasing the par value of shares

Typically, the issue of increasing the authorized capital in accordance with the increase in the price of shares is included in the agenda for a further meeting, in which this matter will be discussed by the board of directors. Therefore, the decision of the board of directors to hold an AGM is extremely important.

The second stage is the conduct of the OCA. To decide that it needs to be increased, it is enough to collect a certain amount. In the document please indicate:

- Magnification method;

- Method of placing shares for sale;

- What type of shares are their par value, which subsequently increases;

- Date of change and method of determination;

- An asset that causes the par value of shares to increase dramatically.

If it increases due to the organization’s profits, shareholders must comply with a number of conditions that are established in Federal Law No. 2008 On Joint Stock Companies .

If you have questions, consult a lawyer. You can ask your question in the form below, in the online consultant window at the bottom right of the screen, or call the numbers (24 hours a day, 7 days a week): ( 4 4.00 out of 5) Loading…

Source: https://classomsk.com/predprinimatelskoe-pravo/kak-uvelichit-ustavnoj-kapital-ooo-poshagovaya-instrukciya.html