Cases of exclusion from the founders

Also, the founder of an organization can be excluded from its founders in the following situations:

• If the co-founder voted against concluding a transaction of particularly large significance and after that the remaining participants of the company demanded his exit.

• If the decision to exclude the founder was made at the general meeting of the founders of the organization.

• If the founder has died. In this case, payment of the share due to him may be demanded by his heirs.

There are also other reasons that are provided for by law. In this case, the organization is obliged to pay the due share, regardless of the reasons for which the founder left the organization’s founders. The organization is charged with a similar obligation from the moment the share of the withdrawing participant is transferred to it. The consent of the LLC participants to sell shares is also required.

It is worth noting that the company does not have the legal right to pay the share due to the withdrawing participant if, at the time of withdrawal, the company is undergoing a process to declare it bankrupt. That is, if it shows signs of insolvency.

How is the share of an LLC participant assessed? Let's figure it out.

Calculation of unequal shares in an apartment online calculator

- Dissolution of an officially registered marriage with division of jointly acquired property, which occurs at the initiative of the spouses;

- Entry into inheritance after the death of the testator;

- Joint privatization;

- Other individual situations.

The judicial authorities decide to allocate part of the object in kind or, if this is not possible, to pay one of the parties an amount equivalent to it. Division of living space is usually impossible if it could cause damage to property.

https://youtu.be/KyPJ9CJDBLY

Methods of leaving the company and the process of distribution of shares

How does the process of state registration of changes take place?

In the event that one of its founders leaves the company, the information about the organization that is subject to registration changes. The responsibility for submitting changes to the relevant authorities lies directly with the company itself, and not with the participant who left the LLC. More specifically, the company must transmit to the registration authorities information that the share of the LLC participant has been sold and his withdrawal from the company has occurred. This information must be submitted in the form of an application on form P14001. This obligation of the company is fixed in law and is regulated by Federal Law No. 14, its Article No. 31.1.

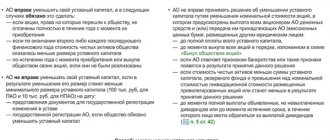

There are various ways for the founder to exit the company and subsequently distribute his share. However, the organization is obliged to make a decision on how to dispose of the share within only one year from the date of withdrawal of the participant. If this does not happen, then the authorized capital of the organization must be reduced in proportion to this share. The share of LLC participants must be calculated.

Lawyer Anisimov Representation and defense in court

A common fraction is written as two numbers, usually separated by a horizontal line indicating the division sign. The number above the line is called the numerator. The number below the line is called the denominator. The denominator of a fraction shows the number of equal parts into which the whole is divided, and the numerator of the fraction shows the number of these parts of the whole taken. Fractions can be regular or improper. A fraction whose numerator is less than its denominator is called a proper fraction. If a fraction has a numerator greater than its denominator, then it is called an improper fraction. A mixed fraction is a fraction written as an integer and a proper fraction, and is understood as the sum of this number and the fractional part. Accordingly, a fraction that does not have an integer part is called a simple fraction. Any mixed fraction can be converted to an improper fraction (see example below). The presence of shared ownership allows you to distribute existing shares or allocate new ones. The issue of establishing shares by law can be resolved in two ways - by drawing up a peace agreement or through court proceedings. When the participants can independently adopt a single resolution, then all they have to do is properly fix certain shares.

How to calculate a share in an apartment How to calculate a new share in an apartment if there is a redistribution of existing shares? In this case, the rights of one or more shareholders are subject to change, due to which a new accounting unit appears.

How can I dispose of my share?

The company can dispose of the share of a participant who has left the LLC in several ways, for example:

- Distribute it among the remaining participants, and in an amount proportional to their own shares.

- Carry out the sale of a share in the LLC to a participant (any) of the company.

- If the organization’s charter allows, then it is possible to sell the share of the withdrawn participant to a third party who is not part of the LLC.

- Donation of a share to an LLC participant.

Mechanism for calculating the actual value of a share

DSD, which belongs to the founder of the LLC, is that part of the assets that is proportional to the share itself. This definition of DSD is recorded in Article No. 23 of Law No. 14. In accordance with this definition, we can say that the formula for calculation is as follows:

DSD=NA/100*RDU;

that is, in order to calculate the DDI, it is necessary to divide the amount of net assets by one hundred and multiply by the size of the share owned by the founder.

Such a concept as the net assets of an enterprise is a very important indicator that characterizes the financial and economic stability of an organization in the market. The procedure for determining the NA is provided for by law and is recorded in the relevant regulations. In accordance with this procedure, the NAV represents a delta that arises between the assets of an enterprise and its liabilities. This is part of the procedure for assessing the share of an LLC participant.

CA cost calculation

The mechanism by which the cost of private equity is calculated is provided by the Ministry of Finance, but only in relation to joint-stock companies. But taking into account the fact that the formation of LLC financial statements follows similar principles, the established procedure also applies to LLCs. The Ministry of Finance does not object to this practice, as stated in its official letter.

In accordance with the established procedure, the formula for calculating the NA is as follows:

NA = (total amount of the third section of the balance sheet) + (estimated future income) - (debt that the founders must pay in the form of contributions to the authorized capital).

It should be noted that the organization does not have the obligation to pay the cost of the share when a participant leaves the LLC if the organization’s NAV is at a negative level.

In fact, the only document on the basis of which the ADI is calculated is the organization’s financial statements. The cost indicators that are taken as the basis for calculating DCI must be taken from the balance sheet, or more precisely, from its corresponding lines.

If there is a complete ban on inheritance

In this case, the heir has every right to demand payment of the actual value from the LLC. After this payment is made, the share is divided among all members of the LLC, since from that moment it is his direct property. Sometimes the share can be sold.

The procedure for evaluating a share in the authorized capital is necessary in order to calculate its market value, which you must know in order to prepare for a special report. It is submitted to the notary within a clearly defined period, which is established by law.

When calculating, the liabilities and assets of the organization are analyzed, and their value is determined. In addition, absolutely all debts (including credit) and investments are taken into account. Patented products are also subject to mandatory evaluation. We can say that within the process of assessing the share for inheritance, there is also an assessment of the business itself, the business project as a whole.

To evaluate the authorized share, it is necessary to collect all the necessary papers, and it is important to entrust the procedure itself exclusively to a professional appraiser. If you are interested in getting a positive result, you should take into account the information we provide.

Property rights are part of the total inheritance that remains after a deceased person. In the process of preparing documents for a certain share, which is included in the fixed capital of the LLC, it is necessary to obtain data on its value. Actions to inherit any part of an enterprise are carried out on a general basis. The deed of the value of the property is provided to the person receiving the inheritance, and then it is given to the notary who handles the paperwork. Using this document you can calculate the amount of state duty. This type of payment is mandatory to be paid into the state budget when registering the right of inheritance.

The valuation of a share in an LLC is carried out on the date of death of its owner. In this case, the financial condition of the company over the next 6 months is not taken into account. This is the period given to close relatives of the testator to complete the documents. The charter of the enterprise may stipulate a ban on receiving a share as an inheritance. In this case, monetary compensation is paid, which is based on the amount determined by an independent expert. Property valuation is carried out at market prices. This ensures that the value of the company's share is up to date. The determination of the amount is established based on the study of accounting documents. For a specialized company, the valuation of a share in an LLC is often considered its main specialization. The documents drawn up by specialists have legal force, since the company performs its duties on the basis of the received state license. Interested parties draw up an agreement with the contractor company. It must reflect the following points:

- purpose of property valuation;

- a detailed inventory of the inherited object;

- cost of work;

- information about the person conducting the assessment.

For an objective assessment of the value of the property, the applicant must provide some documentation: an accounting report in Form 1, information about the profits and expenses of the company at the time of the death of its founder, information about the availability of fixed assets and the level of their depreciation, an extract from the Unified Legal Entity to confirm information about the company. For enterprises operating under a simplified taxation system, it is sufficient to provide a completed declaration with current information at the time of death of the owner of the LLC. The compiled independent appraisal report contains information about the inherited property and key financial indicators. An analysis of the profitability and profitability of the enterprise is carried out, as well as a description of it. An important section of the document is information about the methods that were used as a result of property valuation.

Currently, the service of independent expert assessment has achieved particular popularity. It is in demand in many areas of activity, including real estate and entrepreneurship. The assessment of the share in the authorized capital requires special attention. This is a very important and necessary task for all entrepreneurs.

In what cases is it necessary to evaluate the share in the authorized capital? In the event of the withdrawal of one of the participants, before carrying out purchase and sale transactions, before registering a pledge, during legal proceedings and other circumstances. The assessment for a notary is no exception.

In order to begin the process of assessing a share in the authorized capital, you must first collect the necessary documents. Among them:

- passport of the person who orders the assessment or details of the enterprise;

- an accounting report for two years on all monetary transactions and results of the enterprise;

- list of fixed assets of the enterprise;

- information about additional divisions of the enterprise, if any;

- information about the company's real and movable property.

Additional information about the package of documents can be obtained exclusively from the expert bureau.

You can also make a valuation of the LLC interest at the date of death to inherit a portion of the business. For this purpose, you need to collect a separate package of documentation. Among the necessary papers, it is important to note a document that confirms the death of a person, a passport of the heir (customer), an accounting report on the financial transactions of the enterprise for the period when the death occurred, as well as a tax declaration for the same period. The valuation of the share in a limited liability company is made on the date of death of the testator. The protocol of the expert company provides a complete and objective assessment of the activities of this enterprise. This type of independent assessment is carried out exclusively on the company’s documents, so there is often no need to go to the site in order to write down all the details in the protocol. The procedure for assessing a share in an LLC is carried out in a short time and can take two days.

It is worth noting that this procedure is very important and must be ordered only from trusted independent expert bureaus. Only in this way will a specialist who has completed special courses and certification be able to evaluate the share in the LLC as much as possible and issue a special document that is endowed with strong legal force.

The need to evaluate a share in the authorized capital of an organization arises at the time of sale of this part of the authorized capital or its transfer by inheritance to one of the relatives of the person who took part in the creation of the company and allocated funds or equipment subsequently included in the authorized capital. The inheritance of a share of capital under a will or the transfer of ownership rights on the basis of a gift agreement are also considered as the reason for the assessment.

Most often, an equity interest is valued after its original owner dies.

Valuation of shares to determine market value

It is worth separately considering a different procedure for calculating ADI when a founder leaves the organization, which is based on taking into account the market value of the enterprise’s assets. This approach is reflected in existing judicial practice, and this is confirmed by relevant regulations. The Government believes that this market value approach is fully consistent with the principles of fairness.

In other words, the value of the share of an LLC participant is a nomenclature value, which is reflected in the balance sheet of the enterprise. But when taking into account market value, the organization’s assets are calculated based on their valuation in the corresponding market segment.

It is natural that the value of an enterprise's assets, for example its real estate, transport or land, may change over time. However, most enterprises, wanting to save money when paying property taxes, try not to display the real value of the assets they own, for example, the value of real estate listed on the company's balance sheet. In the event that the balance sheet distortedly reflects the real value of fixed assets, then this will undoubtedly negatively affect the founders who leave the LLC and their interests.

Legislative provisions on accounting require that the financial statements of the organization's business activities reflect reliable data on the financial position. If this requirement is met, then the value of assets on the balance sheet will fully correspond to their value on the market.