- May 22, 2020

- Legislation

- Elena Spi

The calculation of vacation days is based on several factors, and only they can affect the duration of the vacation. It also depends on the position, for example, teaching staff can have vacation for several months, and medical laboratory workers can have up to 90 days. The vacation schedule must be drawn up at the beginning of the next reporting period or year, after the staffing table has been approved.

Beginning of the reporting period

Let us immediately give an example of how vacation days are calculated. Let’s assume that a person got a job in March 2017, and took the first part of his vacation in August 2020. The reporting period for calculating vacation pay begins from the moment the employee is hired, and for 2020 he will be accrued days of rest, which are added to 2020. Vacation pay is calculated based on the days that a person worked without taking time off and periods at his own expense. The accountant calculates the average profit. It does not include:

- Time off is unpaid and not included in the rest period.

- Periods of absence of a person due to illness.

- Days when payment was not made according to regulatory and legislative frameworks.

These days are subtracted from the workers' paid days, and on their basis the amount of vacation pay is calculated, as is the amount of the vacation itself. It is worth noting that a highly paid job does not provide the opportunity to get longer rest due to the legal framework of the labor code. If part of the vacation is taken, as in the example above, then the second period of time off, although it relates to the current period, cannot be calculated based on income in the current year.

https://youtu.be/CGZY3fykYww

Transferring unpaid days off

Holidays are transferred to the next year; accordingly, next year it will be necessary to re-calculate vacation days for each employee.

Important! If, due to holidays, a person works a working calendar day on a day off by providing official time off on a weekday, the accountant is obliged to count it not only as regular work, but also include the added value, despite the fact that formally the people’s days of work were simply swapped.

According to the Labor Code of the Russian Federation, any overtime on holidays, weekends and overtime must be paid at a double rate, based on the number of allotted hours per month or week. Annual leave will also be affected by the increase in salary, regardless of when it was accrued - at the end of the year, in the middle or at the beginning.

Main mistakes when calculating payments

Below we will look at the main mistakes that accountants make when calculating average earnings for vacation pay.

Mistake #1. The procedure for applying the conversion factor.

Employee of Asia LLC Filippenko K.V. took leave from 11/05/16 to 11/18/16. The billing period for Filippenko is 01.10.15 – 31.10.16. From 07/01/16, Filippenko’s salary was increased individually, the salary of other employees of Asia LLC remained the same. The accountant of Asia LLC calculated the increasing coefficient of salary changes and indexed Filippenko’s average earnings.

Asia's accountant calculated Filippenko's average earnings incorrectly. The increasing coefficient is applied only when the salary of all employees of the organization was increased, so there was no need to index the average earnings in this case.

Mistake #2. Accounting for monthly bonuses.

To the senior adjuster of workshop No. 5 of GlavStroy JSC Stepanov V.T. During the billing period, monthly bonuses were awarded for fulfilling the production plan (12 bonuses in total), as well as a 13th bonus for fulfilling the same indicator. When calculating the average earnings for vacation pay, Stepanov’s accountant at GlavStroy takes into account all 13 bonuses.

The GlavStroy accountant calculated Stepanov’s average earnings incorrectly. Since all bonuses are paid for the same indicator, no more than one per month can be taken into account, that is, no more than 12 during the billing period.

Mistake #3. Calculation of earnings for a period consisting of excluded days

Employee of Baza LLC Fedortsov K.T. hired on August 1, 2017 with a salary of 31,720 rubles. On the same day, Fedortsov was sent on a business trip, where he remained until September 30, 2017. In October 2017, Fedortsov applied for leave, but he was not paid vacation pay - the Baza accountant referred to the fact that it was impossible to calculate average earnings, since the billing period consists only of excluded days.

The Baza accountant had to calculate the average earnings based on the salary:

RUR 31,720 / 29.3 = 1.082 rub.

| ★ Best-selling book “How to calculate vacation pay” (120 pages, practical examples, formulas and complex cases) > 3000 books purchased |

How many vacation days will there be next year?

After all the days have been counted, the accountant will calculate the remaining days included in the paid leave. If a person takes more time off than necessary, next year he will not be given a full vacation or will not be paid for the entire duration. Of course, if there was unpaid overtime, then days off are added to the vacation to equalize the rest balance, but this rarely happens in practice. Management issues days off to avoid paying extra vacation days. After all, you will have to transfer twice as many deductions than just giving a day off at the tariff rate.

- When an employee does not take the required rest for more than 2 years, this is a violation, even if this is the employee’s desire.

- The management must force everyone on paid leave, and also give all payments due in full.

- If a person is called back from a legal vacation that has already been paid, the money for the work performed is still transferred to the employee’s account, since he, while on “vacation,” works during the wrong period.

Legally, each person is entitled to 14 days of vacation if he takes them according to the schedule established by the plan and does not violate labor standards. Teachers, for example, are entitled to 56 days of vacation, since the period of study for schoolchildren reaches 9-10 months a year, taking into account the period of admission in August and June. The maximum length can reach 60 days if management allows vacation to be rounded off for actual time worked or early overtime.

Calculation of vacation pay for an unworked pay period

There are cases when employees do not use their legal calendar days off 100%, as they should. This is not a legal violation, but a completely standard situation. It’s completely possible not to take days off, not to go to the seaside, but simply work according to the plan with days off every week. But it happens that the company employs students, temporarily employed citizens, pensioners and mothers and fathers of many children. How are vacation days calculated in the following cases:

- A student goes to study in another city for a session.

- Pensioners receive invitations from relatives to visit sanatoriums.

- Parents are forced to go to the sea to improve their child’s health.

All this should be taken into account before counting officially used or unused vacation.

Example of calculating vacation pay

For example, a person joined the company in August 2020 and did not take a vacation until March 2018, the duration of which is 14 days. But in August 2020 he went on vacation for 10 days at sea. The days were included “in the vacation account”, which is not reflected in the weekend balance as a full vacation used. How to calculate the number of vacation days in such a situation? You need to use a formula to calculate days off and average salary.

It follows from this that the person worked for 19 months and 14 days. According to the formula, you need to remove from these days 10 days that he has already taken off. It turns out:

- 19 months 14 days – 10 days = 19 months and 4 days.

- The length of service is 19 months, rounded up to an even number.

- For each year, 14 days of vacation pay are issued, which must be divided into 12 months a year.

- This number is multiplied by the period worked, which is the length of service - 19 months.

- It turns out that in less than two years a person is entitled to 22.16 days.

Using the same principle, you need to calculate the working period for each staff unit. If the time off falls on a non-working day, it cannot be counted, since it cannot be worked off. It should be paid according to the number of days of total staff employment. Also, the accountant is supposed to calculate the number of hours worked in advance in order to later draw up an estimate. This will make the job much easier when deducting the main days.

Per month

It is important to understand how many vacation days accrue per month. For a whole calendar year of work equal to twelve months - 28 days. The estimated figure is obtained by dividing the rest period by the number of months in a year. The number of vacation days per month worked is 2.33.

Articles on the topic (click to view)

- Fine for late payment of vacation pay

- What to do with unused vacation

- What to do if your employer does not pay vacation pay

- How long after employment is vacation allowed?

- Is maternity leave taken into account when calculating pensions?

- Accounting for compensation for unused vacation

- Dismissal while on maternity leave

A citizen cannot go on vacation every month, the days accumulate, and in the future they are provided upon written request when drawing up the appropriate administrative order. Main regulatory documents:

- Labor Code with comments and explanations.

- Approved vacation schedule. When the head of the organization and the newly hired employee have agreed on the latter’s work and rest time, the table should be supplemented with new data. A person who gets a job after drawing up a vacation schedule for company employees will have to take into account the wishes of other colleagues, except in legal situations where he has a priority right to grant annual or additional leave.

- Labor contract. If the document is concluded for a period of up to two months, then the vacation is calculated based on two days for each month of activity.

- Collective agreement.

Are non-standard work schedules taken into account?

Certain categories of companies use this formula when there is a need to equalize time off according to a complex shift schedule, for example, a rotational work schedule. How is annual leave calculated, which is due annually in case of shift and non-permanent employment?

In the north, many enterprises initially provide the opportunity to split their vacation into parts, since a shift involves workers staying at work for up to several months in a row, however, this cannot be considered a business trip.

Vacation and business trip: what is considered a paid period?

If the office and main place of work is permanent, then a business trip means traveling and a forced change of workspace.

In this case, the rate when calculating vacation days is set for the entire period of concluding the contract. For example, an employee works on shift for 2 months and is at home for 1 month. In both cases, he is listed as an employee. He will still receive the due salary rate for the entire quarter, and the money will also go to his account if the vacation was unused for 1 year.

Unused or incompletely used vacation

Partial holidays are calculated in the same way as in the previous example. Don't forget about maternity benefits:

- Men also have the right to take out maternity leave and, accordingly, payments.

- The duration of vacation is included in the length of service, as is going on maternity leave.

- The maternity period is taken into account when determining the total number of days off.

When calculating vacation days and compensation from the state and company, the accounting department uses a calculator to index transfers. Since pregnancy from the 30th week can become the basis for going on maternity leave, a person is obliged to take out additional leave to care for a child, that is, up to 3 years. If this is not done, then 36 months will be counted from the 30th week of pregnancy, and the employee may be called to work until the child is 1.5 years old.

How to apply

To go on temporary vacation, first of all, you need to determine specific dates. In most cases, they must be agreed upon with management in advance. You must write an application 14 days in advance and submit it to the HR department. Here, authorized employees must write an order addressed to the employee.

Since many people prefer to relax in the summer, companies usually create a vacation schedule, and each employee plans their free time based on it. Having a schedule has its benefits not only for company management, but also for employees. After all, in this case the likelihood of labor disputes is reduced. There is no need to discuss dates with management, there is no need to seek a compromise. In this case, the employee is confident that it is during this period of time that he will definitely be able to go on temporary leave. If there is a schedule, the manager is obliged to inform each employee about the approaching vacation date two weeks before it. The notification must be in writing. If the employer has not done this, the employee has every right to reschedule the date to any time convenient for him.

Labor Code of the Russian Federation - vacation after six months of work

This is an employee's right, but it should always be discussed with the employer. It should be noted that the application is written in free form and in handwritten form.

Although many employers allow the text of the application to be typed on a computer and signed.

The submitted sample is correctly formatted and complies with the regulations on office work.

This is important to know: Can they be denied leave followed by dismissal: copy of the order

Vacation after leaving maternity leave

Here's how vacation is calculated after leaving maternity leave:

Maternity leave to care for a child up to 3 years old for employee Ivanova L.D. began after the sick leave issued to her for pregnancy. It ended on 02/02/2018. The sick leave has been open since November 21, 2014. After returning from maternity leave, Ivanova turned to management with a request to grant her leave (annual, paid). By law, in accordance with local regulations of the enterprise where Ivanova works, she is entitled to a vacation of 28 days. The calculation period takes the time interval from November 21, 2014 to February 2, 2018.

The first thing you need to do in order to correctly calculate her vacation pay is to determine the amount of income received for 12 months. The following formula is used for this:

Average earnings = income / number of full days X 29.3 + number of days in partial months

Presumably, in this example, the amount of total income for the specified period of time was 50,000 rubles. After this, the average earnings (daily) are determined. It should also be calculated using the formula: SDZ is equal to 50,000 / 12 months / 29.3. The result is 1,422 rubles. After this, the final action in this calculation is drawn up, namely determining the amount of vacation money. For this, vacation pay = 1,422 X 28 = 39,816 rubles. From this amount it is necessary to withhold 13%, personal income tax. Give the difference to employee Ivanova.

The formula applies to insured persons who are officially employed by the company.

How much?

The Labor Code establishes a minimum duration of 28 calendar days.

Important! 28 days of vacation time are due for each year worked at work.

Moreover, the working year is taken minus the following periods:

- absenteeism;

- inadmissibility to work due to the fault of the employee;

- child care time up to 3 years;

- leave without pay in excess of two weeks.

To calculate how many vacation days are due for each month worked, you need to use a simple formula.

Vacation for 1 month = Total duration for the year / 12 months.

That is, the annual duration is divided by the number of months in the year.

In most cases, for employees who do not belong to special categories with an increased length of vacation time, they have the right to count on 2.33 days of rest per month (28/12).

It is this rounded number that is used by the personnel specialist when calculating the required number of vacation days at a specific point in time.

An employee does not always request leave clearly after the end of the working year. He may ask for rest time earlier or later. In this case, you must first find out how many days he is entitled to for the time worked, and for this the number of vacation time per month will be useful.

This indicator is also useful when calculating compensation upon dismissal, when the vacation period in months is determined, which is then multiplied by the required number of vacation days per month. As a result, the total duration of vacation time for the entire period is determined.

Then it is enough to subtract the number of days already used, and the result is the duration for which you need to pay monetary compensation.

An example of using the indicator 2.33

The employee was hired on January 10, 2020, and will go on annual leave from September 1, 2019. How many days of vacation should he be provided and paid for?

- The total length of service giving the right to paid rest is established: 7 months. and 23 d. 23 are rounded up to a full month, for a total of 8 months of experience.

- The number of allotted rest days is calculated = 8 * 2.33 = 18.64.

- Vacation pay is calculated: earnings for the period worked are divided by the amount of time worked and multiplied by the required vacation duration.

For an incomplete monthly period

With an annual duration of 28 days, for an incomplete monthly period of work, either 2.33 vacation days are due, or no vacation is provided at all. There can be no other cases.

This is important to know: What to do if the employer does not pay vacation pay

If an employee worked less than 15 days in a month, then this period is not the basis for assigning vacation time.

If 15 or more hours are worked, then it is recognized as a full month and is compensated by 2.33 days of rest.

This point is usually interesting when an employee is dismissed, when it is necessary to calculate compensation for unused time, as well as when vacation is taken for an incompletely worked year.

The employee is leaving on February 7, 2020. Vacation experience is 2 years, 4 months and 16 days. During work, 42 days of rest were used. It is necessary to establish for what period compensation must be paid upon dismissal.

- Vacation experience is calculated in full months (16 days are taken as a month, since more than half of it has been worked), the total length of service is 29 m.

- The allotted vacation time for this period is calculated: 29 * 2.33 = 67.57.

- The number of unused days is determined: 67.57 - 42 = 25.57 - it is during this time that monetary compensation must be calculated.

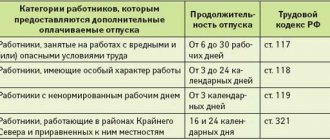

Who is entitled to a longer rest?

Those categories of persons who are entitled to receive additional paid leave under the Labor Code of the Russian Federation and other legislative acts can calculate the monthly parameter by dividing the annual duration, taking into account the main and additional components, by 12.

The following persons may be included in this category:

- minors;

- disabled people;

- doctors;

- teachers;

- police officers;

- judges;

- working in dangerous and harmful conditions;

- civil servants;

- workers with irregular work schedules, as well as a number of others.

Formulas for calculating vacation pay and days off

The number of vacation days for each type of schedule is calculated using the same formula. To begin with, a period of days is established that the employee is entitled to, taking into account study leave, holiday weekends and other time off. The entire period by day must be multiplied by the amount of payments due, which will allow the employee’s daily income to be determined. SDZ = Salary/Drab. The last indicator is the days worked for the period for which money is accrued.

Important! It is necessary to take into account not only the actual cost of a working day, but also payments for lunches, travel passes, payment for food stamps, travel expenses and more. Social benefits that are accrued to the employee as an insurance premium are not subject to accounting.

- The reporting period is the time that the employee worked, even if it was several weeks.

- Next, Drab is installed. According to the formula, it turns out: 12 months multiplied by the average length of the calendar period, which turns out, for example, 12 * 28.9 days per month.

- Since people don't always work seven days a week, you need to find out how many breaks he might have had. Drab. = Dp. + Days, where Days means days from the used period, Days means days from unused rest.

Having found out the average amount of vacation, you can set O - vacation pay. You need to multiply SDZ by vacation days. If the vacation falls on an increased number of calendar days, all payments must be taken into account. In the case of maternity leave, a separate limit for the days used is also established, but they have a separate rate, since a separate planned calendar budget is calculated for this period. It may not exist if a woman or man receives benefits from the state.

How to calculate average daily income - step by step procedure

The rules for calculating average earnings for various purposes are set out in Resolution No. 922 of December 24, 2007.

The algorithm specified here is also used when calculating the average daily earnings for paying annual leave.

In general, we can highlight the following algorithm for an accountant’s actions when calculating average earnings for vacation pay:

- Stage 1. Determine which period of time to take as the calculated one.

- Stage 2. Determine how many full and incomplete months there were.

- Stage 3. Calculate the number of calendar days worked in this period.

- Stage 4. Sum up payments to the employee for the estimated time.

- Step 5. Calculate daily earnings by dividing total earnings by hours worked.

When calculating, it is important to exclude unaccounted time and income paid for this time.

Below are the necessary explanations and formulas, as well as an example for better understanding.

We recommend: Calculate vacation pay using an online calculator for free.

Billing period

According to clause 4 of Regulation No. 922, a time period of 12 months is taken as the estimated time period.

Calendar months are taken from the first to the last day, which precede the month in which vacation pay is calculated.

For example, when vacation starts on June 23, 2020, the period from 06/01/2018 to 05/31/2019 is considered as the calculated period.

If an employee has worked for a shorter period of time in a given organization, then the period actually worked in this organization must be taken.

Earnings from previous employers are not taken into account when calculating vacation pay.

What doesn't turn on?

There are periods of work that should be excluded from the 12 months; they are listed in paragraph 5 of Resolution No. 922:

- sick time on sick leave;

- maternity leave;

- downtime due to the fault of the employer or due to circumstances beyond the control of the parties;

- the employee did not work, but he retained his average earnings during his absence (annual, educational, maternity leave, business trip, paid time off);

- failure to fulfill duties in connection with a strike, provided that the employee did not participate in it;

- periods of additional time off to care for children with disabilities;

- absenteeism.

The presence of at least one of the listed events in the billing month makes it not fully worked out.

If there were no specified periods in a month, then it is considered that the employee worked 29.3 days in that month.

If there were, then the calculation of the time worked is also considered = Cal. days worked * 29.3 / Total number of cal. days of the month.

What payments are included?

The list of payments taken into account in average earnings is given in paragraph 2 of Regulation No. 922.

According to this clause, it is necessary to include all those incomes that are provided for by the employee’s remuneration system, that is, specified in his employment contract, local regulations, Regulations on remuneration, and the Collective Agreement.

Such payments include:

- salary in cash (based on salary, tariff rates, piece rates);

- salary in kind;

- monetary support for municipal and civil servants;

- bonuses, allowances, additional payments, if provided for in wages and are of an incentive nature.

Articles to help:

- how to account for one-time bonuses;

- annual bonuses;

- financial assistance;

- sick leave;

- vacation pay;

- travel allowances

Which ones are not taken into account?

Types of payments that are of a social nature are not included, as well as all those incomes that the employee received during periods excluded from the calculation time.

Therefore, the following amounts are not taken into account:

- material aid;

- compensation for food, travel, accommodation, communications, recreation, training, treatment;

- vacation pay;

- business trips;

- maternity leave;

- sick leave;

- other social benefits.

How does gender affect the amount of vacation pay?

Gender is also taken into account - a man can continue to work at the enterprise, but a woman is still entitled to additional paid time - to care for a child up to 3 years old.

According to the calculation of the number of vacation days, it can be extended or shortened. Part-time work can affect the amount of vacation pay and days off if the mother decides to go to a part-time 0.75 rate in order to remain employed, but not lose 100% of her benefit payments. An accountant must know how to count vacation days, since in addition to the basic entitlements, a woman is paid benefits for unused vacation at the time of leaving and leaving maternity leave. According to the formula, all the amounts received for deductions are added up and the arithmetic average is obtained, which makes it possible to establish the standard of wages and vacation pay, as well as planned leave in addition to maternity leave.

How are employee holiday payments calculated?

The total amount to be issued is calculated based on three figures:

- duration of vacation in days;

- the average value of an employee’s wages per day - calculation of the average earnings for vacation pay is made for the billing period;

- billing period – the time period from the first working day to the end of the calendar year.

The formula for calculating payments looks like this: average daily earnings * number of days of rest = amount to be paid to the employee