Many accountants have already heard that from October 1, 2020, a new report on employees who are not pensioners must be submitted to the employment service. Is it necessary to take it? If yes, then in what form? Where is the new report? Will the employment service accept a paper or electronic form? What is the deadline for submitting a new report? We will answer your questions and provide you with a sample of how to fill out the new report.

Where did the new report come from?

Starting with data for the third quarter of 2020, employers must submit a new employee report. This follows from the Letter of Rostrud of Russia dated July 25, 2020 No. 858-PR “On conducting quarterly monitoring of information about organizations (employers) and the number of employees of organizations that are not pensioners, as well as monthly monitoring of the implementation of measures to promote the employment of citizens of pre-retirement age.”

Thus, Rostrud begins to collect information about workers of pre-retirement age.

Also see “Responsibility is being introduced for refusal to hire people of pre-retirement age.”

https://youtu.be/HabiTkBsJe0

HR officer: employees of pre-retirement age

HR officer: employees of pre-retirement age

Workers of pre-retirement age - from 2020. these are persons who have no more than 5 years left before reaching the age that gives them the right to an old-age insurance pension.

The reform of the pension legislation of the Russian Federation provides for a gradual transition to increase the retirement age. Therefore, the pre-retirement period for different workers will be at different ages.

Since 2020, there is an obligation to provide a pre-retirement person with 2 working days a year to undergo a medical examination, while maintaining his place of work and average earnings. The head of an organization or an employee authorized to hire and fire employees may be held criminally liable for unreasonably refusing to hire or dismissing an employee of pre-retirement age.

Who are workers approaching retirement age?

From 2020, pre-retirement age is understood as the period of five years before the age entitling to an old-age insurance pension, including one assigned early (paragraph 6, paragraph 2, article 5 of the Employment Law).

From this year, women retire at 60 years of age, and men at 65 years of age. At the same time, a so-called transition period has been established - 2019 - 2027. (Part 1, Article 8, Appendix No. 6 to the Law on Insurance Pensions). During the first two years of this period, you can retire six months earlier. This right is available to employees who reach the retirement age provided for by the legislation of the Russian Federation, in force before January 1, 2019, or who have acquired length of service for the early assignment of a pension (Clause 3, Article 10 of the Federal Law of October 3, 2018 N 350-FZ).

During the transition period, you can determine whether a worker is considered pre-retirement based on their date of birth and gender. The specific start and end dates of pre-retirement age must be determined taking into account the employee’s date and month of birth. The mentioned laws do not contain provisions on how to determine the pre-retirement age during the transition period. There are two possible approaches.

First approach: pre-retirement age is defined for each employee as five years preceding the moment he receives the right to an old-age insurance pension. For example, if an employee was born on March 1, 1968, she will become eligible for a pension on March 1, 2028. Therefore, her pre-retirement period begins on March 1, 2023.

Second approach: pre-retirement age occurs five years before the new retirement age, taking into account the transition period. Thus, in 2019, the new generally established age at which the right to an insurance pension arises is 56 years for women and 61 years for men. Consequently, pre-retirees in 2020 are women born in 1964, 1965, 1966, 1967 and 1968, men - born in 1959, 1960, 1961, 1962 and 1963 (PFR Information “What you need to know about changes in the pension system”) . This means that if an employee was born on March 1, 1968, then the pre-retirement period for her began on March 1, 2020.

To avoid risks associated with uncertainty in legislation, we recommend that you check information about employees of pre-retirement age directly at the Pension Fund branch. To do this, the organization must enter into an agreement with the fund’s department (PFR Information Letter dated December 18, 2018 N AD-25-24/25310, FNPR dated December 17, 2018 N 101-114/231).

You can also confirm that an employee is classified as a pre-retirement pensioner with a certificate , which is provided through your personal account on the PFR website and in the territorial bodies of the PFR (PFR Information “What you need to know about changes in the pension system”, Letter of the Ministry of Labor of Russia dated December 24, 2018 N 16-1/10/ P-9611).

What guarantees are provided for pre-retirees when undergoing medical examination?

From 2020, workers of pre-retirement age, upon their request, must be released from work for two working days once a year to undergo a medical examination. For these days they need to be paid the average salary, as well as keep their job. Specific days of release from work are agreed upon with the employer. These guarantees are established by Part 2 of Art. 185.1 Labor Code of the Russian Federation.

What liability is provided for the dismissal of a pre-retirement employee?

If you violate the general procedure for dismissal, for example, do not pay or violate the deadline for paying the employee the amounts due upon dismissal, then you may be held administratively liable under Art. 5.27 of the Code of Administrative Offenses of the Russian Federation (if these actions do not contain a criminal offense in accordance with Article 145.1 of the Criminal Code of the Russian Federation).

For unjustified dismissal of employees in connection with reaching pre-retirement age, criminal liability is provided under Art. 144.1 of the Criminal Code of the Russian Federation . This liability also occurs if the employer forced the employee to submit a resignation letter of his own free will precisely in connection with pre-retirement age and fired him under clause 3 of part 1 of art. 77 of the Labor Code of the Russian Federation (clause 16 of the Resolution of the Plenum of the Supreme Court of the Russian Federation of December 25, 2018 N 46).

In the event of criminal liability under Art. 144.1 of the Criminal Code of the Russian Federation, the head of an organization or an employee authorized to hire and fire employees may be assigned one of the following types of punishment:

- a fine of up to 200,000 rubles. or in the amount of wages (other income) of the convicted person for a period of up to 18 months;

- compulsory work for up to 360 hours.

What liability is provided for an unreasonable refusal to hire a pre-retirement person?

For an unreasonable refusal to hire a pre-retirement worker, criminal liability is provided under Art. 144.1 of the Criminal Code of the Russian Federation . In this case, the refusal must be related specifically to the applicant reaching pre-retirement age (clause 16 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 25, 2018 N 46).

Let us note that the ban on unjustified refusal to hire, including due to the age of the applicant, has long been established by Art. 64 Labor Code of the Russian Federation.

The employer is obliged to provide the reason for the refusal in writing if the applicant so requests. The answer must be given within seven working days (Part 5 of Article 64 of the Labor Code of the Russian Federation).

Have you read “HR: workers of pre-retirement age” (source: K+)

HR manager: workers of pre-retirement age

3 (60%) 2 vote[s]

Is this a mandatory report or not?

There are no provisions in Russian legislation regarding such a report. Therefore, this report cannot be regarded as mandatory.

However, the Federal Service for Labor and Employment reports that it must be submitted on the basis of decisions of the Government of the Russian Federation (clause 3 of section III of the protocol of the meeting of the Government of the Russian Federation dated June 14, 2020 No. 16, as well as for the purpose of executing the protocol decisions of the meeting in the Federal Labor Service and employment with the heads of executive authorities of the constituent entities of the Russian Federation exercising powers in the field of employment (Minutes dated July 10, 2020 No. 1).

New report on employees from October 1, 2020

Most recently, media representatives became aware of the need to compile a new report on workers at nearby employment centers. According to the new regulatory act, starting from October 2020, employment centers will take on the functions of compiling a new quarterly report on workers who have reached the pre-retirement age limit. It is worth paying attention to the fact that this initiative came from the Federal Service for Labor and Employment.

According to official data, the new report was called Form No. 1. According to the rules for drawing up the new reports, the employer will be required to indicate the number of employees who have reached the pre-retirement age limit, namely, this report includes men who were born in 1959, as well as representatives of the fair sex who were born in 1964.

It is also worth paying attention to the fact that in this report it is necessary to indicate employees of the given birth years only if they are not currently active pensioners.

Specialists from employment centers say that the new type of reporting will be submitted by all kinds of organizations. Also, employment center specialists focused their attention on the fact that if the company does not have these employees, the need to submit reports does not disappear. The employer is required to submit this type of reporting, but in this case it will be submitted with zero indicators.

By checking the text of the official document, you can also find out that the process of submitting this type of reporting will begin in the third quarter of this year. Completion of reporting must be completed by October 1. It is worth remembering that the employer has the opportunity to submit reports electronically, or during a personal visit to the employment center.

Employers should pay attention to the fact that it is better to check the deadlines for submitting this type of report at local employment centers. Most regional employment centers provided information that the deadline for submitting this report is the third of October inclusive. These time frames are determined by the fact of submitting reports from employment centers to the Ministry of Social Protection and the Federal Service for Labor and Employment.

Mozilla/5.0 (Windows NT 6.3; Win64; x64) AppleWebKit/537.36 (KHTML, like Gecko) Chrome/81.0.4044.122 Safari/537.36 [2a01:4f8:162:224::2]

What are the deadlines?

A new report will need to be submitted quarterly, starting with data as of 10/01/2018, no later than the 15th day of the month following the reporting one. It turns out that the first report must be submitted before October 15 .

However, we note that some employment centers ask you to submit your report earlier. For example, the Zlatoust employment center asks for a report to be submitted quarterly by the 1st day of the month following the reporting month.

Submit a new report to Rostrud in October

Letter No. 858-PR states that information must be sent to a specific email address, but let us clarify that this address is indicated not for employers, but for employment services - CZN specialists will send systematized data on all reported employers to it.

Employers submit this form to their regional employment service structures. A new report to Rostrud from October 1 is submitted by sending it to the email addresses of service employment centers or in another way (it is possible to submit it to the Employment Center in the form of scanned copies, you can submit the report in person or in paper form by mail).

The general deadline for submitting information is as of October 1, 2018. is set until October 15, but some employment services are shortening the period for receiving reports so that they have time to summarize the data (for example, in Moscow the deadline is set until October 3).

In the future, a new report should be submitted to Rostrud at the end of each quarter, before the 15th day of the month following the reporting period, or within other deadlines established in the region.

Rostrud introduces a new report on employees in its letter; no other regulatory act provides for the introduction of an additional reporting form. On this basis, we can conclude that submitting the document is not mandatory, and there should not be a fine for late submission or failure to submit. At the same time, employment services insist on the obligation to submit a report, including a zero report, and the above letter from the Ministry of Labor directly refers to the government decision (clause 3 of section III of the minutes of the meeting of the Government of the Russian Federation dated June 14, 2018 No. 16) and to the protocol decision of the meeting in Rostrud (protocol dated July 10, 2018 No. 1). In addition, Art. 19.7 of the Code of Administrative Offenses of the Russian Federation provides for liability for failure to provide information, including employment service - fine up to 500 rubles. for officials and up to 5000 rubles. for organizations.

What to include in the report and how to fill it out: sample

The new report must indicate information about the number of employees:

- men born in 1959;

- women born in 1964.

Moreover, we note that the report will need to indicate both those working on the reporting date and those who ceased their working activities during the reporting period.

Also, in addition to the number of employees, the report must indicate the name of the company, its tax identification number and checkpoint.

The new report exclusively includes information on the number of employees. That is, you need to indicate the number of people. Personal data of employees (for example, full name and year of birth) does not need to be included in the report.

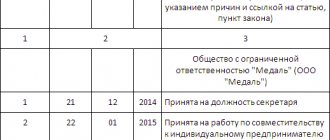

Let's assume that the company employs two men born in 1959 and one woman born in 1964. They operated during the 3rd quarter of 2018. Then a sample of filling out a new report will look like this:

Fines

For failure to provide information to the employment service, liability is provided for in Article 19.7 of the Code of Administrative Offenses of the Russian Federation:

- for citizens – a fine of 100 to 300 rubles. or warning;

- for officials - a fine in the amount of 300 to 500 rubles;

- for organizations - a fine in the amount of 3,000 to 5,000 rubles.

However, it is important to note that the law does not yet require employers to submit a new report. Consequently, in our opinion, there will be penalties for failure to submit it. shouldn't.

If you find an error, please select a piece of text and press Ctrl+Enter.