To avoid claims from tax inspectors, an accountant needs to know how to correctly arrange business trips and how to take into account business travel expenses for tax purposes. In this article we talk about the taxation of travel expenses - how certain expenses incurred by the company when sending a subordinate on a business trip will affect the calculation of income tax, personal income tax, insurance contributions to extra-budgetary funds, payments in case of occupational diseases and accidents on production and VAT.

Taxation of travel expenses: value added tax (VAT)

An accountant has the opportunity to apply for a deduction for value added tax only if the goods (work, services) that were purchased by a seconded employee on a trip were purchased on the territory of one of the constituent entities of Russia.

In the event that the route begins or ends abroad of the Russian Federation, services for the transportation of baggage or the transportation of passengers, which were issued under uniform international transportation documents, will be subject to VAT at a zero rate. Accordingly, there is no requirement to include VAT in the cost of a travel ticket (train or plane) to the destination of the posted employee located abroad and back to the place of permanent work.

Important!

If the VAT amount in travel documents purchased in one of the CIS countries is written on a separate line, a tax deduction cannot be issued.

The inability to claim for tax deduction the amount of VAT indicated on the travel document as a separate line is explained by the fact that:

- The place of sale of services, as a general rule, is the place where the company operates or services are provided to an individual entrepreneur.

- An exception to this rule are the situations referred to in paragraphs. 1-4 p. 1 tbsp. 148 of the Tax Code (that is, in each of these cases, the service is still considered to be sold on the territory of the Russian Federation).

- Railroad transportation is not included in the list of exceptions to the general rule, since nothing is said about them in the mentioned article of the Tax Code of the Russian Federation (which means that transportation services will be provided in the country in which the carrier company operates).

In connection with all of the above, a ticket purchased at the ticket office of an airline or railway station in another country makes it clear that the services of the carrier company are provided not on the territory of Russia, but abroad. That is why the “input” VAT, written as a separate line in the travel document, is not claimed by the company’s accountant for tax deduction.

How are payments made when traveling abroad taxed?

If an employee is sent abroad, the employer, in addition to normal expenses (travel compensation, accommodation), compensates for a number of additional costs (clause 23 of the Regulations on Business Travel):

- for obtaining a visa, passport and other travel documents;

- mandatory consular and airport fees;

- fees for the right of entry or transit of motor vehicles;

- registration of compulsory medical insurance;

- other mandatory payments and fees.

Compensation for these expenses is not subject to personal income tax , provided that they are actually incurred and documented (clause 3 of Article 217 of the Tax Code of the Russian Federation). Otherwise, personal income tax must be charged on the amount of travel expenses.

If documents are drawn up in a foreign language, their line-by-line translation into Russian may be required (clause 9 of the Regulations on Accounting and Financial Reporting).

This is important to know: How to use open data from the Federal Tax Service

It is important to consider the following points:

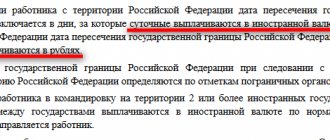

- Conversion into rubles of compensation for expenses paid to an employee in foreign currency (including daily allowances) is made at the Bank of Russia exchange rate on the last day of the month in which the advance report for the business trip was approved (clause 5 of article 210, clause 6 of clause 1 of article 223 Tax Code of the Russian Federation).

In this case, personal income tax must be withheld and transferred to the budget in the same way as when traveling around Russia: the tax must be withheld upon the next payment of cash income to the employee, and transferred to the budget no later than the working day following the date of such payment. This conclusion follows from clause 6 of Art. 6.1, paragraphs. 6 clause 1 art. 223, paragraph 4, 6 art. 226 Tax Code of the Russian Federation.

An example of personal income tax calculation for payments in connection with a business trip abroad

Deputy Director Sidorenko spent four days on a business trip outside of Russia in January.

According to the collective agreement, the daily allowance for business trips abroad is 50 euros. The daily allowance was issued to Sidorenko on the eve of departure on a business trip in the amount of 200 euros (50 euros x 4 days).

Upon returning from a business trip, Sidorenko drew up an advance report, which was approved by the head of the organization also in January.

Let's assume that the Bank of Russia exchange rate on January 31 was 60 rubles/euro.

The accountant will withhold personal income tax from this amount and transfer it to the budget no later than the working day following the day of payment of salaries for January. The tax amount will be 260 rubles. (RUB 2,000 x 13%).

Taxation of travel expenses: insurance contributions to extra-budgetary funds

According to the text of Federal Law No. 212-FZ of July 24, 2009, from January 1, 2010, enterprises must make deductions of insurance payments to extra-budgetary funds instead of paying the unified social tax (UST). Insurance premiums are levied on employee payments specified in employment agreements. The list of payments for which insurance premiums are not charged is listed in the text of Article 9 of the mentioned legislative act. For example, insurance premiums should not be charged for compensation paid to subordinates for expenses incurred in the performance of their official functions. As for business trips, if the posted employee has documents proving the fact of incurring expenses, the compensation payments issued to him will not be subject to contributions.

Important!

If an employee returning from a business trip does not have documentary evidence of the expenses he incurred on a business trip, only amounts within the limits approved by current legislation will not be subject to insurance premiums.

The following payments to seconded employees returning from a trip are not subject to insurance payments:

- daily allowance (the rate of payment must be specified in the collective agreement or other internal act of the company);

- costs of purchasing a travel ticket to the destination and back to the employer’s enterprise;

- costs of exchanging cash at a currency exchange office (or checks at a banking institution) for foreign currency;

- consular fee for visa application;

- costs of paying for telephone operator services and other communication services;

- costs of rented living quarters;

- costs for transporting personal belongings (luggage);

- costs of purchasing tickets in public transport (sometimes paying for taxi services) to travel to the place of train departure or plane departure, to the destination or to the place of transfer;

- various commission fees;

- airport fees.

Contributions from industrial accidents and occupational diseases

Contributions for accidents at work and occupational diseases are calculated on the income of employees. An exception is the payments listed in the List of payments for which insurance contributions to the Social Insurance Fund of the Russian Federation are not calculated, approved by Decree of the Government of the Russian Federation of July 7, 1999 N 765 (hereinafter referred to as the List of Payments).

According to clause 10 of the List of Payments, contributions are not accrued on amounts paid in the form of reimbursement and compensation within the limits established by the legislation of the Russian Federation:

— daily allowances within the limits established by law;

- payment of housing rental costs;

— compensation for the cost of tickets;

— reimbursement of other expenses related to the employee’s performance of work duties.

As is known, from January 1, 2009, the daily allowance norm established by law is 100 rubles. (Resolution of the Government of the Russian Federation dated 02/08/2002 N 93), canceled on the basis of Decree of the Government of the Russian Federation dated 29/12/2008 N 1043.

Therefore, insurance premiums for insurance against industrial accidents and occupational diseases should only be calculated for daily allowance amounts that exceed the daily allowance established by a collective agreement or local regulations. This is stated in the Letter of the FSS of the Russian Federation dated March 18, 2009 N 02-18/07-2165.

If an organization pays daily allowances to posted employees in the amount established by a collective agreement or local regulations, insurance premiums for insurance against industrial accidents and occupational diseases should not be charged.

Taxation of travel expenses: personal income tax

Costs incurred by a posted employee while on a business trip are not subject to personal income tax, since the company only compensates the employee for expenses (that is, the amount of compensation does not bring commercial benefits to the subordinate).

Important!

If the amount of daily payments exceeds the norm (when traveling within Russia - 700 rubles per day, when traveling abroad - 2,500 rubles per day), the excess amount is included in the tax base for calculating personal income tax. If the daily allowance was paid in foreign currency for a trip abroad, it is necessary to calculate the amount in rubles at the Central Bank exchange rate on the date of payment.

The accountant must also remember that if an employee incurred expenses to pay for rented housing (hotel room or apartment) and received compensation in an amount exceeding the amount of 2.5 thousand rubles per day of stay (without confirming the expenses with payment documents residential premises), personal income tax must be withheld from the compensation amount.

Important!

Compensation payments for VIP lounges (at airports open for international traffic, Russian border checkpoints at railway stations, sea and river ports) are not subject to personal income tax - this decision was made by the Arbitration Judges and the Federal Antimonopoly Service of the Moscow Region (the Ministry of Finance has a different opinion) .

If an accountant doubts whether personal income tax should be withheld from compensation for the use of taxi services while an employee is on a business trip, when there is documentary evidence of payment for travel, the following rules should be followed:

- If the employee traveled by taxi to the destination, place of departure or transfer point, the compensation payment does not need to be subject to personal income tax.

- If the employee used the services of a taxi to travel to the destination and back to the employer, personal income tax is also not required to be withheld from compensation.

- If public transport was not available at the time required by the subordinate, and he had to use a taxi to get from the hotel to work, the amount of compensation is not subject to income tax, but provided that there are documents confirming the fact of the trip, the call of a taxi is due to production needs, and the possibility of using taxi service is specified in the collective agreement of the enterprise.

- If a posted employee took a taxi around the city during a business trip, the compensation amount is subject to personal income tax.

The following are cases when it is necessary to charge personal income tax on compensation for payment of rented housing by a posted employee, and when tax withholding is not required:

- In any case, if the employer paid the employee compensation for travel and/or accommodation costs, while the employee did not provide documents confirming the expenses, personal income tax is charged on the entire amount of compensation.

- If the employer agrees to compensate for accommodation costs, including breakfast at the hotel, personal income tax will have to be withheld from the cost of food (insurance contributions must also be calculated).

Daily allowance for a business trip 2020: norms, amount in Russia and abroad

For days on a business trip, the employee is entitled to average earnings and daily allowance for each calendar day of the trip. Let's figure out how to properly pay for business trips in Russia and abroad

Per diem is an employee’s additional expenses related to his residence outside his place of residence.

The employer is obliged to reimburse employees for daily allowances (paragraph 3, part 1, article 168 of the Labor Code of the Russian Federation):

- for each day while he is on a business trip;

- for weekends and non-working holidays, as well as days on the road, including during forced stops along the way (clause 11 of the Business Travel Regulations). For example, an employee went on a business trip on Sunday and returned the following week on Saturday. Daily allowances for Saturday and Sunday are paid.

Daily allowances for one-day business trips within Russia are not paid, but the employer has the right to provide for compensation in the local regulations of the organization in exchange for daily allowances for such trips. Read more about daily allowances for one-day business trips later in this article.

Example of calculating daily allowance for an employee

Condition . The employee was on a business trip for 10 days: from June 1 to June 10. Daily allowance:

- for 9 days - 40 euros per day;

- for 1 day of return to Russia - 700 rubles.

On May 30, an advance in the amount of 360 euros and 700 rubles was issued against the report.

Exchange rate (conditionally) euro:

- on the date of advance payment (May 30) – 70 rubles. for 1 euro;

- on the date of approval of the advance report (June 14) - 68 rubles. for 1 euro.

Solution . The daily allowance will be included in income tax expenses in the amount of:

- 40 euro x 70 rub. x 9 days = 25,200 rub.

- Daily allowance in Russia = 700 rubles.

- Total : 25,200 rub. + 700 rub. = 25,900 rub.

Amount of daily allowance for business trips in Russia and abroad

The company has the right to decide for itself how much to pay employees per business trip day (Article 168 of the Labor Code of the Russian Federation).

The amount of daily allowance for business trips must be fixed in the internal documents of the organization, for example in the regulations on business trips.

Accountants know about 700 and 2,500 rubles. — if the daily allowance does not exceed these amounts, then you will not have to pay personal income tax on these amounts. Therefore, some companies introduce these daily allowance amounts for convenience. But this does not mean at all that the organization can set the daily allowance for employees at 700 and 2,500 rubles. and not a ruble more or less.

You can, for example, fix the daily allowance to 4,000 rubles. for each day of a business trip in Russia, but then from 3,300 rubles. you will have to withhold personal income tax (4,000 rubles – 700 rubles = 3,300 rubles).

As a general rule, daily allowances paid to an employee are not subject to personal income tax if their amount does not exceed:

- 700 rub. — for each day of a business trip in Russia;

- 2,500 rub. - for each day when traveling abroad.

Conclusion : as such, there is no daily allowance limit for commercial organizations. There are only amounts that are not subject to personal income tax (700 and 2,500 rubles). So how much per diem should you pay? Decide for yourself (fix the decision in the internal documents of the organization).

How to calculate business trip days for which you need to pay daily allowance

If an employee goes on a business trip in a personal and company car, then you can count the days using a memo.

The employee must provide it upon returning from a business trip along with documents confirming the use of transport to travel to the place of business trip and back (waybill, for example, in form No. 3), invoices, receipts, cash receipts, other documents confirming the route).

In other cases, the number of days for which daily allowance must be paid is determined by travel documents.

Daily allowance in foreign currency

For business trips outside the Russian Federation, you pay daily allowance in the amount established in the company’s internal documents.

Daily allowance for a one-day business trip

By law, there is no minimum travel period established. A trip on behalf of the employer can be a one-day trip. We arrange such a trip as a multi-day business trip (we issue an order and put the appropriate mark on the time sheet: “K” or “06”).

Afterwards the employee reports for the trip. The employer reimburses him for expenses, such as travel, as well as other agreed amounts. Is there a daily allowance? By law, daily allowances are not paid for “mini-trips” around Russia. Leaving an employee completely without money, even on a one-day business trip, is not the best idea, even if it is legal. How can you get out of the situation?

Payments for one-day business trips instead of daily allowances

The employer, at its own decision, can pay the employee a certain amount instead of daily allowance.

Daily allowance for one-day business trips:

- abroad - in the amount of 50% of the daily allowance for business trips abroad, established in the company’s local documents;

- in Russia - in general, they are not paid, but you can set the payment to the employee yourself.

Personal income tax on daily allowances for one-day business trips

Previously, the situation with the taxation of daily allowances and reimbursement of other expenses for one-day business trips was controversial. The situation has stabilized and the general trend is as follows: payments for one-day business trips are not subject to personal income tax. However, the positions of different departments differ:

- Opinion of the Ministry of Finance of the Russian Federation : documented expenses associated with a one-day business trip (for example, food expenses) may not be subject to personal income tax in full. If there is nothing to support such expenses, then they are exempt from tax up to 700 rubles. for domestic Russian business trips and 2,500 rubles. during a one-day business trip abroad (Letter of the Ministry of Finance of Russia dated March 1, 2013 No. 03-04-07/6189).

- Opinion of the Supreme Arbitration Court of the Russian Federation : funds paid to an employee (called daily allowances) are not such due to the definition contained in labor legislation, however, based on their focus and economic content, they can be recognized as reimbursement for other expenses associated with a business trip, made with the permission or knowledge of the employer , and therefore are not income (economic benefit) of an employee subject to personal income tax (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated September 11, 2012 No. 4357/12).

Daily allowance for business trips to CIS countries

Business trips to CIS countries (for example, Kazakhstan, Belarus, etc.) are a special case. During such business trips, they do not put marks in the passport about crossing the border. Daily allowances for such trips are calculated in a special manner: the date of crossing the border is determined by travel documents (clause 19 of Regulation No. 749 “On the specifics of sending workers on business trips”).

For more information on how to pay daily allowances for business trips to the CIS countries, read the article by Kontur.Schools “Two difficult questions when applying for a business trip: calculating average earnings, daily allowances for business trips to the CIS countries”

Report on daily allowance for a business trip

Training

BASIC. USN. Personnel. Salary. Training at Kontur.School

Online courses

Upon returning from a business trip, the employee is obliged to provide the employer within three working days:

- an advance report on the amounts spent in connection with the business trip;

- final payment for the cash advance issued to him before leaving for a business trip for travel expenses (clause 26 of the Business Travel Regulations No. 749).

As part of the advance document, the employee is not required to report either daily allowances for business trips within Russia, or daily allowances for business trips outside the Russian Federation, or for one-day or any other business trips. There are no supporting documents for daily allowance. The employer pays a daily allowance of x rubles, the employee spends it at his own discretion.

Taxation of travel expenses: income tax

The procedure for accounting for expenses incurred by the company for an employee’s business trip is presented in the table below:

| Type of expenses | Possibility of taking into account costs when calculating income tax |

| Daily allowance | The full amount of daily allowance can be taken into account when calculating income tax. In this case, no documents confirming expenses are required - an accounting certificate with calculations, an order for sending on a business trip, tickets indicating the point of departure and arrival are sufficient. |

| Compensation for travel to the destination and back to the employer’s enterprise | Can be fully taken into account when reducing the tax base for income tax. When purchasing luxury train tickets (or business class air tickets), their cost can also be taken into account in full. If there is documentary evidence and justification for the need to pay for a luxury lounge or the cost of chartering an aircraft for travel to the place of performance of an official assignment and back to the place of work, these costs can also be taken into account when calculating income tax. |

| Travel compensation in case of loss of travel documents confirming the fact of the trip | If it was not possible to obtain a duplicate ticket, copy of a travel document or a certificate from the transport company, it is prohibited to take into account travel expenses when calculating income tax. |

| Compensation for the purchase of an electronic ticket | If there is documentary evidence of the purchase of an electronic ticket (printout, boarding pass, cash register receipt, slip, electronic terminal receipt), you can take into account the cost of the electronic document when calculating income tax. |

| Taxi fare compensation | Taxi fares can be taken into account if:

|

| Compensation for living expenses | If there is documentary evidence of payment for housing, the company's expenses can be taken into account in full. If there are no documents, costs cannot be taken into account. |

| Visa costs | If the trip took place, you can take the expenses into account when calculating your income tax. If the employee has not traveled abroad, costs cannot be taken into account. |

| Losses associated with payment of a fine for returning a ticket in case of interruption of an international business trip | You can include it in expenses and reduce the tax base for income tax. |

| Expenses for the services of intermediary companies (travel agencies, etc.) | They can be taken into account if there is a certificate of work performed with a breakdown of the cost of each service provided. |

The concept of "per diem"

In situations where a company employee goes on a business trip in Russia or abroad, the employer undertakes to pay him a certain monetary remuneration, which is calculated per day - these are the so-called daily allowances. At the same time, there are only 3 main situations in which the employer is obliged to pay per diem.

To study the issue more accurately, let’s look at how the law interprets business trips. A business trip is a business trip, the terms and conditions of which are determined by the employer. In this case, the place where the work will be carried out must be remote from the established one.

Per diems are not part of the housing payment when working remotely and are taken into account as additional expenses for the employee’s daily needs. As a rule, the further away the remote work location is, the greater the amount the employer pays.

Legislative regulation

| Decree of the Government of the Russian Federation dated December 29, 2008 No. 1043 | On the abolition of the daily allowance rate of 100 rubles |

| clause 3 art. 217 Tax Code of the Russian Federation | The fact that travel expenses, confirmed by documents, are not included in the tax base for personal income tax |

| Art. 210 Tax Code of the Russian Federation | On the withholding of personal income tax from compensation for payment of accommodation and travel on a business trip, if the amounts of expenses were not documented |

| Letter of the Ministry of Finance of the Russian Federation dated October 14, 2009 No. 03-04-06-01/263 | On the withholding of personal income tax from the cost of breakfasts included in the invoice for hotel accommodation |

| Letter of the Ministry of Finance No. 03-03-06/1/30978 | On the possibility of taking into account, when calculating income tax, a company’s expenses for a remote employee’s business trip |

What expenses are reimbursed to a posted worker?

There are often cases when employers are forced to send their employees outside the location of the organization to resolve official issues. Trips for a certain period of time, on a specific official assignment from a manager, to another locality or abroad are called business trips.

While an employee is on a business trip, he is paid the average salary (Article 167 of the Labor Code of the Russian Federation). The calculation of average earnings is regulated by the Regulations on the specifics of the procedure for calculating the average salary, approved by Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 (Part 7 of Article 139 of the Labor Code of the Russian Federation) and Art. 139 Labor Code of the Russian Federation.

Before the start of a business trip, the employer must:

- establish the amount and procedure for paying travel expenses to an employee;

- prepare the documents necessary to send an employee on a business trip.

These aspects are regulated by the Regulations on the specifics of sending employees on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749.

In accordance with the Labor Code of the Russian Federation, the employee is reimbursed for the following business trip expenses:

- for travel;

- rental of residential premises;

- additional living expenses (per diem);

- other expenses for the performance of official tasks (with the permission of the manager).

As a rule, an organization develops internal documents or a collective agreement that defines the procedure and amount of reimbursement for these expenses.

The procedure for reimbursement of business trip expenses to employees of various federal government bodies, institutions and funds, as well as municipal institutions is determined by regulatory legal acts of the Government of the Russian Federation, local governments, state authorities of the constituent entities of the Russian Federation (Parts 2, 3 of Article 168 of the Labor Code of the Russian Federation, paragraph 15 of Art. 2 of the Law “On Amendments to Article 10 of the Law of the Russian Federation “On State Guarantees and Compensations for Persons Working and Living in the Far North and Equivalent Areas” dated April 2, 2014 No. 55-FZ).

During a business trip, hospitality expenses may also apply. For information on what documents to support them, read the article “Drafting a regulation on entertainment expenses - a sample.”

Answers to common questions about taxation of travel expenses

Question #1:

How can an accountant reflect in an employee’s income certificate in Form 2-NDFL the amount of daily allowance by which the payment established by the collective agreement was exceeded and from which personal income tax was withheld?

Answer:

You need to enter data in Section 3 according to income code 4800 “Other income” (instructions are contained in the Appendix to the Order of the Federal Tax Service of Russia dated October 13, 2006 No. SAE-3-04 / [email protected] - in the “Income Codes” directory).

Question #2:

How will the costs incurred by a company to obtain a visa for an employee affect the payment of personal income tax and income tax if the business trip ultimately does not take place?

Answer:

Such costs should not be taken into account when calculating income tax. Also, such expenses will not be included in the employee’s personal income tax tax base.

Is personal income tax withheld from travel salaries and when to pay the tax?

While the employee is on a business trip, the employer continues to pay him a salary based on his average earnings.

You can learn more about the procedure for calculating average earnings in the article “How is the average monthly salary calculated?”

Is travel salary subject to personal income tax? Of course, since it is a special case of remuneration (clause 9 of the Regulations approved by Decree of the Government of Russia dated October 13, 2008 No. 749). Payment of travel wages is carried out within the same terms as payment of regular wages.

If the traveler and the employer have an agreement to pay wages on a card and the former has difficulties with cashing it out or even spending it - for example, due to the fact that there are no ATMs of his credit institution in the area (or the Internet in general), then the employer can send the money by postal order (Clause 11 of the Regulations).

Read us on Yandex.Zen Yandex.Zen

But when do you pay personal income tax on business trips? Since, from the point of view of tax accounting, a travel salary is a complete analogue of a regular salary, personal income tax on it is paid within the same time frame - the next day after deduction. And the deduction occurs from the next first payment after the day on which income is recognized as received, that is, the last day of the month of accrual of income.

Example

Ivanov I.I. went on a business trip in June 2020 for 10 days. He received his salary for June (which included the travel portion) on July 1. Taxable income is recognized as at 30 June. Personal income tax on all parts of the salary is subject to withholding on July 1 and payment on July 2.

Determining limits

So, the current legislation does not establish a maximum size of SR. However, officials have determined a certain limit, above which daily allowances in excess of the norm are subject to insurance premiums (2018).

Article 217 of the Tax Code establishes that excess daily allowances are subject to insurance contributions (2018). Also, personal income tax will have to be withheld from amounts exceeding the limit. The limits are set as follows:

- for trips within Russia - 700 rubles per day;

- for foreign business trips - 2500 rubles per day.

In other words, if an institution has established large values for this type of expense, then the amount exceeding the limit is subject to taxation (personal income tax and personal income tax). Please note that this limit only applies to taxation. The company has the right to establish a CP greater than specified in Art. 217 Tax Code of the Russian Federation.

Using a specific example, we will determine whether daily allowances are subject to personal income tax and insurance premiums.

Primerov Ivan Andreevich was sent to Moscow for 10 calendar days. 43,000 rubles were allocated for travel expenses, including:

- 5000 rub. - to pay for travel;

- 18,000 rub. — for rental housing (payment for a hotel room);

- 20,000 rub. - SR (2000 rubles per day, therefore, daily allowances over 700 rubles, insurance premiums will have to be charged).

Amounts allocated for travel and accommodation are not subject to taxes. But above-limit daily allowances are subject to insurance premiums. Let's do the calculation:

- We determine the amount of excess (2000 rubles – 700 rubles) × 10 days. = 13,000 rub.

- We calculate personal income tax: 13,000 × 13% = 1,690 rubles.

- We determine the amount of SV: 13,000 × 30.2% (OPS - 22%, compulsory medical insurance - 5.1%, VNIM - 2.9%, NS and PZ - 0.2%) = 3926 rubles.

Consequently, Examples will receive 41,310 (5000 + 18,000 + (20,000 – 1690)) rubles. And the company’s expenses will amount to 46,926 (43,000 + 3926) rubles.

Please note that one-day business trips and daily allowances (insurance contributions) are no exception. You will still have to withhold personal income tax on the excess and pay the contribution tax to the budget.

How are payments made when traveling for a remote worker taxed?

Even if an employee works remotely, the employer must compensate him for business trip expenses in the general manner - the same as for an ordinary employee (Article 168, Part 3 of Article 312.1 of the Labor Code of the Russian Federation). Read above about the procedure for withholding personal income tax from various types of payments during business trips.

We recommend that you read:

Didn't find the answer to your question?

Find out how to solve

exactly your problem - contact the online consultant form. Or call us at: