Examination

The procedure for processing primary accounting documents is a formal check, consisting of several stages.

Correspondence

According to established standards and norms, the form of the document is verified and the details are correctly written. The timely completion of all papers and their submission to the accounting department must be checked.

Content Accuracy

The accuracy of reflected business transactions is taken into account, in accordance with legal standards and the requirements of the enterprise.

Arithmetic calculation

Filling out columns indicating tariffs and prices, as well as reconciling the total amounts for accuracy, are subject to mandatory control.

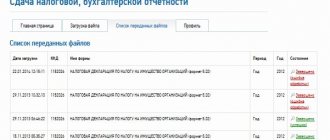

Recognition of graphic and PDF files on the server

To set up recognition of graphic and PDF files on the server, you need to install several specialized utilities:

- Install CuneiForm, ImageMagic and Ghostscript programs;

- Set recognition parameters in the program settings and specify the path to the ImageMagic program.

The CuneiForm program is needed to recognize graphic files. It is important to install the CuneiForm program for the file version of the 1C: Document Management system on the user’s computer under the user who will subsequently work with it, and in the client-server version on the 1C: Enterprise server - under the user under whom the 1C: Enterprise service runs.

The ImageMagic program is needed to convert graphic files to pdf format and vice versa. Ghostscript is needed by ImageMagic to convert files. We install both programs on the user’s computer.

Errors and their correction

The human factor, as well as technical faults, can become an investigative reason for the incorrect execution of primary documents.

Errors are classified as:

- local – when incorrect information goes through only one accounting list, for example, the date of the transaction is entered incorrectly.

- transit – in this case, distorted information is displayed in several accounting lists at once. This happens automatically - the same, incorrectly displayed date of the transaction, entered in the registration journal, in transit ends up in the balance sheet, accounts and other balance sheets.

Corrections in documentation related to cash and banking transactions, as well as corrections on securities, are prohibited.

Forwarding document processing

The term “forwarding document processing” is derived from the word “expedition” in the meaning of “a division of the office management service that processes documents.” The creation of a special unit - an expedition - is typical for large organizations with a large volume of document flow. In medium and small organizations, forwarding processing of documents is carried out by one of the employees of the office work service (office) or by the employee responsible for organizing work with documents, if the institution does not have an office work service at all.

Let's consider the main stages of forwarding processing of incoming and outgoing correspondence.

Stages of processing incoming correspondence

Processing of incoming correspondence includes:

- checking the correct delivery of documents, integrity of packaging and attachments, completeness of documents (presence of all attachments);

- recording the fact of receipt of documents;

- sorting of documents for subsequent transfer to their destination.

Checking the correct delivery of correspondence

is carried out before opening envelopes or other packaging - you must first make sure that all correspondence is delivered to the correct address. If correspondence is identified that was intended for another addressee, it is returned to the post office.

If the envelope is damaged (

and possibly documents) an act is drawn up, which records the fact of receipt of damaged correspondence. The act is drawn up in two copies, one of which is sent to the sender, and the other remains in the organization’s records management service.

After checking the correctness of delivery, envelopes with correspondence are opened, with the exception of envelopes with an access restriction stamp (“Confidential”, “For official use”, “Trade secret” or others) or o. Envelopes are opened using scissors or, if there is a large volume of correspondence, using a special device - an envelope opener. As a rule, envelopes are destroyed, but there are exceptions. Envelopes are not destroyed in the following cases:

- upon receipt of citizens' appeals;

- if there are no o or marks on the envelope indicating restriction of access to information), or if upon opening the envelope it is discovered that the documents have a special status;

- when only the postmark on the envelope can be used to determine the date of sending and receiving the document;

- when only the envelope can be used to determine the sender's address if the envelope is significantly damaged;

- if the envelope contains only attachments without a covering letter.

In the above cases, the envelopes are fastened together with the documents and then handed over to the authorities together, as a set.

The next step is to check the completeness of the documents

. When checking the contents of the envelope you may find:

- lack of separate attachments to the document or, conversely, a cover letter for attachments,

- the presence of documents intended for another addressee.

In the absence of attachments, a corresponding entry is made on the covering letter; in the absence of the covering letter itself in the envelope, a mark is made on the envelope (in this case the envelope is not destroyed). In both cases, the sender of the documents must be informed (orally or in the form of a letter) about the incompleteness of the documents sent by him. If documents intended for another addressee are discovered, these documents are sent in accordance with the address indicated in them or returned to the sender with a notification that the documents were sent to the wrong address.

Telegrams and telephone messages received for processing simultaneously with letters are processed first.

All received documents are marked with receipt

using the so-called incoming stamp, in which the date of receipt of documents is indicated by hand. In accordance with GOST R 6.30-2003, the admission mark is placed on the cover letter or the first sheet of the document in the lower right field.

If envelopes were not opened during initial processing, a receipt mark is placed on the envelope itself. In addition to the date of receipt, the mark may indicate the time of receipt in hours and minutes if the document requires urgent consideration.

The initial processing of documents ends with their sorting

. Documents are distributed into two arrays: registered and unregistered. Non-registered documents include documents that do not require execution or use for reference purposes - as a rule, these are advertising materials, letters of invitation, congratulations, thanks, documents on logistics, statistical and accounting documentation and reporting, etc., planned, financial documents, information materials sent for information, curricula, programs, etc. The list of non-registered documents, as a rule, is included as an appendix to the organization’s office management instructions.

Unregistered documents are laid out in cells of a sorting cabinet, in which each division of the organization has its own cell. In the absence of such a cabinet, folders with the names of departments can be used.

Further work is carried out with an array of documents subject to registration. If the organization has adopted a centralized form of office work, in which all documents are registered in the office work service, then forwarding processing of this array of documents ends with their transfer for preliminary review and registration. If the organization has a mixed form of organization of office work, in which documents are registered in the office work service and in departments, then forwarding processing is completed by sorting documents into two groups:

- documents submitted for review by management (they are submitted for preliminary review and registration to the records management service),

- documents sent directly to structural units for registration and consideration.

Documents intended for transfer to departments are laid out in the cells of the sorting cabinet, just like non-registered documents.

Stages of processing sent documents

Processing of sent documents includes:

- checking the completeness of documents;

- sorting;

- putting the address on the envelope;

- folding (folding a paper sheet into one, two or more folds) and document packaging;

- sending a document (delivery to a post office or courier).

The preparation of documents for sending by mail is carried out in accordance with the Rules for the provision of postal services (approved by Decree of the Government of the Russian Federation of April 14, 2005 No. 221).

Documents must be sent for shipment registered, correctly executed, with all attachments and accompanying documents

. When sending documents, the correctness of the correspondent's address is checked, and the documents to be returned are stamped “Returnable”. Documents must be sent on the day of their registration or, in extreme cases, on the next business day. Urgent documents and telegrams are sent immediately.

If a letter is sent to several addresses (up to four), then the expedition worker, placing the document in the envelope, underlines the name of the addressee to whom this copy of the letter is sent. If there are more than four addressees, documents are sent according to a list that is prepared by the contractor and sent to the expedition along with copies of the letter.

At the stage of sending documents, they are sorted by addressee

. Documents prepared by different departments on different issues, but sent to the same address, are placed in one envelope.

Addresses on envelopes

in letters sent within the territory of the Russian Federation, are drawn up in Russian. Addresses on postal items sent within the territory of a republic within the Russian Federation may be issued in the state language of the corresponding republic, provided that the addresses are repeated in Russian. For international mail, the address is written in Latin letters and Arabic numerals. It is allowed to write the address in the language of the destination country, provided that the name of the destination country is repeated in Russian.

In accordance with the Rules for the provision of postal services, the address is written in the following order:

- for a legal entity - full or short name, for a citizen - last name, first name, patronymic;

- street name, house number, apartment number;

- name of the locality (city, town, etc.);

- name of the area;

- name of the republic, territory, region, autonomous okrug (region);

- country name (for international postal items);

- postal code (conventional digital designation of a postal address assigned to a postal service facility).

The recipient's address is written in the lower right part of the mailing envelope, and the sender's address is written in the upper left corner.

After applying the address to the envelope (by hand or using a PC), the documents are inserted into the envelope and sealed

. When sending documents to regular correspondents on expeditions, it is advisable to have envelopes with already printed addresses or addresses printed on labels - strips of paper that are glued to the envelope when sending documents.

Envelopes with windows can be used on expeditions. Window is a rectangular cutout on the front side of the envelope. The window is covered with a protective film, through which the recipient's address should be easy to read. When using windowed envelopes, the document is folded so that the address printed on the document can be read through it. In this case, there is no need to indicate the address on the envelope.

Postal items can be:

- simple (accepted from the sender without issuing a receipt to him and delivered (handed over) to the addressee (his legal representative) without his receipt);

- registered: registered, with declared value, ordinary (accepted from the sender with the issuance of a receipt and handed over to the addressee (his legal representative) with his receipt of receipt).

Registered mail items can be sent with a description of the attachment, with a notification of delivery and with cash on delivery.

Organizations are advised to send correspondence by registered mail (including with notification) only in cases where this is required by law or in cases of extreme necessity.

Postal services are paid. To confirm payment for postal services for sending simple and registered written correspondence provided by federal postal organizations, state postal payment marks are used. The following are used as state postal payment marks:

- postage stamps affixed to written correspondence or printed on postal envelopes and postcards;

- imprints of state postal payment marks applied by franking machines;

- other signs established by the Federal Communications Agency and applied in printing.

In accordance with the Rules for the provision of postal services, affixing postage stamps to written correspondence in the amount of the cost of the postal service is the responsibility of the sender. It is prohibited to stick one postage stamp on another. Government postage marks are placed in the upper right corner of written correspondence.

Simple written correspondence, payment for postage services for which is confirmed by postage stamps, can be placed in mailboxes. Written correspondence with imprints of franking machine clichés and other signs confirming payment for postal services is accepted at postal facilities determined by the postal operator.

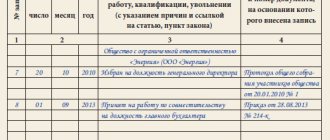

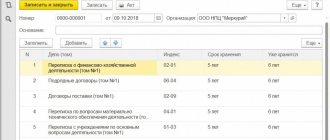

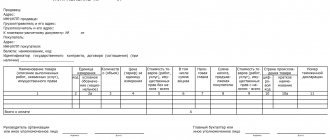

Registration of primary documents

“Manual” processing of primary materials is a painstaking and tedious task that consumes the lion’s share of working time. We have to check in each document whether all details and signatures are included and whether it meets the requirements of the law. And this still does not exclude errors. To minimize routine work, you need to automate these processes as much as possible, reserving only control and solving more complex problems.

Thus, the integration of an accounting program with a bank allows you to automate the posting of bank statements, quickly generate payments and send them to the Internet bank, where the client will only have to sign them. Instead of diligently transferring data, the accountant only needs to monitor the correctness of filling out the lines and make entries.

Explain to your colleagues the importance of timely receipt of the primary report for record keeping and reporting. Write down sanctions for managers who submit the initial report late. Agree on a single channel for transmitting scans to quickly record documents.

To quickly create documents, you can also use the invoice scan recognition system in accounting programs. She herself determines the nomenclature, quantity, price of goods, and if you doubt the correctness of recognition, she will draw your attention to this.

To save time spent on data entry or eliminating scan recognition errors, switch to electronic legally significant documents. They are entered into accounting in a few clicks. Errors that arise during “manual” processing of the primary document, as well as discrepancies during tax reconciliation with the counterparty when working with EDI, are excluded. After all, everyone works with the same document, the signed copy of which cannot be changed.

Maintain accounting, pay salaries and submit reports in one service

What is taxation?

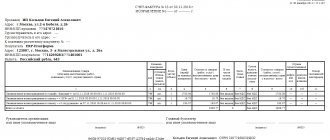

Taxation means determining the cost of transactions performed if documents (for example, acts, invoices) indicate only the quantity of goods or services. It assumes the following algorithm of actions:

- natural values are entered into an accounting program (for example, 1C);

- it automatically finds their value;

- the program performs simple calculations: it multiplies the quantity by the price and shows the accountant the result.

Taxation is used for documents where only natural indicators are indicated. For example, these are waybills, which indicate the time of departure and return, a list of objects where the car visited. Based on the specified data, the accountant determines gasoline consumption and calculates the driver’s wages.

Another example of documents subject to taxation are acts for the liquidation of an organization’s equipment, acts on the receipt of products from its own production. They contain only natural values; the accountant’s task is to enter the value based on the prices indicated in the accounting program.

Acceptance, verification and accounting processing of documents is an important stage in the work of an enterprise, saving it from errors and problems with regulatory authorities. This function can be entrusted to existing specialists or to a new staff member hired specifically to control the “primary” - an accountant or operator.