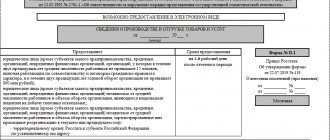

In accordance with Instruction 33n, state (municipal) budgetary and autonomous institutions must submit a Report on the implementation of the FCD plan. The report is generated quarterly as of the 1st day of the new quarter on a cumulative basis from the beginning of the year.

Attention! An important feature of completing Form 737 is that it does not have to include any closing transactions entered into on December 31 of the fiscal year.

According to Instruction 33n, a budget organization must submit f. 0503737 in the context of all CFOs applied in the organization during the reporting period:

- income of the institution (KFO 2);

- subsidies for the implementation of state tasks (KFO 4);

- subsidies for other purposes (KFO 5);

- funds for compulsory health insurance (KFO 7).

Form 737. Filling out.

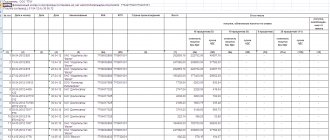

To fill out the form, you must use the menu item Accounting - Regulated reports - Accounting statements:

In the right part of the window that appears, select the desired report and click the Create new report button:

Before clicking the fill () button, you need to fill in 3 details by clicking on the Options button:

On the Basic , enter the details Institution and Period.

On the Details tab, fill in the Type of financial security field:

Now you can fill out the report!

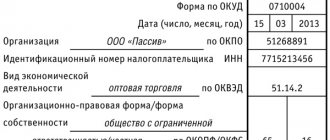

Form form 0503737

On June 24, 2019, Order No. 73n of the Ministry of Finance dated May 16, 2019, with amendments to Instruction 33n, came into force. This legal document changes the report form 0503737 and makes adjustments to the instructions for filling it out. The adopted amendments should be applied when preparing reports for 2020. Letters from the Ministry of Finance No. 02-06-07/43076 and the Federal Treasury No. 07-04-05/02-12069 dated June 11, 2019 clarify that quarterly and monthly reports in 2019 are formed on the basis of the new edition of 33n. This means that you need to submit a new form 0503737 6 months in advance.

The name of column 10 was changed: it was “Planned assignments not fulfilled”, it became “Amount of deviation”. Column 10 is now filled in under any conditions.

Submit the report (f. 0503737) as part of the quarterly and annual financial statements. Submit it on April 1, July 1, October 1 and January 1 of the year following the reporting year.

Reporting Guide: 33 samples and 37 recommendations for completion

Changes in legislation. Rule 737 (2015).

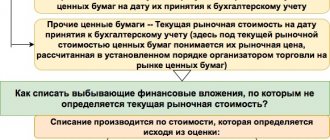

Based on Letter of the Ministry of Finance of Russia dated June 26, 2012 N 02-06-07/2335, clauses 4 and 5 of the Appendix, starting with the release 1.0.32 of the 1C: Public Institution Accounting 8 program, a new option has appeared for generating a report using records from off-balance sheet accounts 17 and 18 when cash flows between personal (settlement) accounts, accounts and cash:

Attention! To bring accounting records generated by documents from January 1, 2015 until the installation of release 1.0.32 to the new rules for using off-balance sheet accounts 17 and 18, external processing “ Updating payment documents 2015 ” (PDActual_21003 file) is used. The PDActual_21003 file is contained in the configuration update templates directory.

For all KFOs, except KFO 1:

- account 18 applies only to disposal or return of expenses;

- account 17 is used when receiving and returning income, as well as when moving between accounts 201 XX, accounts 201 XX and 210.03. In the latter case, KEC 510 for debit and 610 for credit of account 17 are applied. For example, D 210.03.560 K 201.11.610 and K 17.01.610 - departure from the bank upon application for cash, and then D 210.34.510, K 210.03.660 and D17.01.510 - receipt at the cash desk under PKO.

The structure of the report still consists of 3 sections : 1. Budget revenues; 2. Budget expenses; 3. Sources of financing for the institution's funds.

Invoice M-15 for outsourcing of materials: fill out the form (Excel)

Saving on purchases? Don't forget to reflect this in your accounting, reporting and plans! Read more in the article in the magazine State Institutions.

The reporting year for public sector employees is the calendar year: from January 1 to December 31. Annual reporting is prepared as of January 1 of the year following the reporting year.

Fill out Table 4 based on analytical accounting data for account 0 502 07 000 “Accepted obligations” in terms of competitive procurement methods (see sample 4). It should not contain negative values. This account is used only for competitive procurement. Therefore, if you place a notice for purchase from a single supplier, do not take into account the obligations assumed in this account.

The main document containing the requirements for filling out financial reporting forms and submitting them to regulatory authorities by budgetary and autonomous institutions is the corresponding instruction approved by Order of the Ministry of Finance dated March 25, 2011 No. 33n.

Fill out Table 4 based on analytical accounting data for account 0 502 07 000 “Accepted obligations” in terms of competitive procurement methods (see sample 4). It should not contain negative values. This account is used only for competitive procurement. Therefore, if you place a notice for purchase from a single supplier, do not take into account the obligations assumed in this account.

The list of additional analytical indicators along the lines “including:” is established by the institution as part of the formation of its accounting policy, taking into account the founder’s requirements for analytics.

In budget accounting, transactions for accepting budget obligations are reflected in the accounts given in Section. 5 “Authorization of budget expenditures” of the Chart of Accounts for budget accounting, approved by Order of the Ministry of Finance of Russia dated December 30.

It is not possible to make changes to the statistical form submitted and registered with the customs authority. In case of detection of incorrect information provided, the applicant is obliged to write an application addressed to the head (or person replacing him) of the customs authority to which the statistical form was submitted, about its cancellation, and attach a copy of the statistical form that needs to be cancelled.

In accordance with the procedure for drawing up and submitting annual, quarterly and monthly reports on the execution of budgets of the budget system of the Russian Federation, approved.

In the “Report Form” field, select the form of the report to be added. In the “Report Date” field, specify the date of the report to be added.

After adding the necessary subreports, you can begin filling out (editing) them. To do this, select the line with the desired subreport from the list and double-click on it with the left mouse button, or select “Correct values” in the context menu.

Unified document forms (UFD) are developed using the names of details and their corresponding codes in accordance with all-Russian classifiers (classifications) of technical and economic information for automated processing and exchange of information.

Often there is a need to transfer one or another value or return unused material to another department. To have a clear idea of where certain material assets are located, any movement of inventory items should be documented.

It can also be used to process the return to the warehouse of materials that were put into operation, but were not completely consumed.

Budget revenues.

This section reflects the funds coming into the budget.

Column 4 of the report reflects the planned amounts of income for the year, which may change during the year and are taken into account in account 504.11 Estimated (planned, forecast) assignments for income (receipts). Here you can read about how to use the Planned Assignments to reflect the necessary correspondence to fill out the column.

The off-balance sheet account 17.01 Receipts of funds to the institution’s accounts, opened to accounts 201.11 Institution’s funds on personal accounts with the treasury authority and 201.13 Institution’s funds with the treasury authority on the way, is responsible for the indicators in column 5. This is income received to the organization’s personal account, with the exception of cash from the cash register. The main document in 1C is Cash Receipt.

Column 6 is income reflected in off-balance sheet accounts 17.01 Receipts of funds to the institution's accounts and 17.07 Receipt of funds to the institution's accounts in foreign currency opened for accounts 201.21 Institution's funds in accounts with a credit institution and 201.27 Institution's funds in foreign currency on accounts with a credit institution. The main document in 1C is Cash Receipt.

Attention! Autonomous organizations do not include crediting cash from the cash register (if it is income) in column 6.

Column 7 indicates income received by the organization's cash desk and reflected in account 201.34 Cash, as well as returns of excess income received by the institution, reflected in correspondence with the debit of account 304.06 Settlements with other creditors. The main document in 1C is PKO.

Column 8 reflects non-cash income transactions provided for by planned assignments for the current (reporting) financial year, that is, executed without taking into account the movement of funds . For example, mutual repayment of receivables and payables of the counterparty under different agreements.

Attention! The Income section does not reflect data on the execution of returns of excessively received income reflected in the debit of account 304.06 Settlements with other creditors.

What are non-cash transactions?

Non-cash transactions (NO) are transactions in which there is no movement of money. This may be mutual coverage of receivables and payables. For example, a government agency has a debt of 50,000 rubles to another municipal entity. This municipality, in turn, has a debt to a government agency in the same amount (50,000 rubles). In this case, mutual offset of claims occurs. In this case, the debt is repaid. However, the procedure is not accompanied by the movement of money. This is a non-cash transaction.

FOR YOUR INFORMATION! BUT ensure a reduction in settlement times between institutions and partners. They are relevant when the subject has little free money in his accounts.

Budget expenses.

Column 4 of the report reflects the planned amounts of expenses for the current year, which may change during the year and are taken into account in account 504.10 Estimated (planned) assignments for expenses (payments). Here you can read about how to use the Planned Assignments to reflect the necessary correspondence to fill out the column.

The indicators in column 5 are accounted for by the off-balance sheet account 18.01 Removal of funds from the institution's accounts, opened to accounts 201.11 Institution's funds on personal accounts with the treasury authority and 201.13 Institution's funds with the treasury authority in transit. These are funds that have left the institution’s personal account, except for cash that has gone into the cash register. For example, transfers to suppliers. The main document in 1C is Cash disposal or Application for cash expense.

Column 6 is based on expenses reflected in off-balance sheet accounts 18.01 Receipts of funds into the institution’s accounts and 18.07 Outflows of funds from the institution’s accounts in foreign currency opened to accounts 201.21 Institution’s funds in accounts with a credit institution and 201.27 Institution’s funds in foreign currency on accounts with a credit institution. The main document in 1C is Cash disposal or Application for cash expense.

Column 7 indicates expenses incurred from the cash register and reflected in account 201.34 Cash. The main document in 1C is RKO.

Column 8 - reflects non-cash transactions for expenses provided for by planned assignments for the current (reporting) financial year, as in the case of income, performed without taking into account the movement of funds .

Information on accepted and unfulfilled obligations (f. 0503775) (Silvestrova T.)

In the article, the author considers the procedure for filling out section. 4 tables “Information on accepted and unfulfilled obligations” f. 0503775 (hereinafter referred to as information (f. 0503775)), using indicators generated under an agreement concluded by the institution in 2020, the deadline for which is 2020. The agreement was concluded based on the results of an auction. When concluding a contract, savings occurred (the cost of the subject of the contract is lower than the initial (maximum) price of the contract).

By virtue of the norms of paragraph 308 of Instruction N 157n <1>, the obligations assumed are the obligations of the government body (state bodies), local governments, state (municipal) institutions to provide, using competitive methods of identifying suppliers ( contractors, performers) (tenders, auctions, request for quotations, request for proposals), in the corresponding financial year, funds from the corresponding budget. The amounts of obligations assumed are determined on the basis of notices of procurement using competitive methods for identifying suppliers (contractors, performers) (competitions, auctions, request for quotations, request for proposals), posted in a unified information system, in the amount of the initial (maximum) contract price.

<1> Instructions for the application of the Unified Chart of Accounts for public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions, approved. By Order of the Ministry of Finance of Russia dated December 1, 2010 N 157n.

According to the norms of clause 309 of Instruction No. 157n, accounting objects section. “Authorization of expenses of an economic entity” are taken into account according to the analytical groups of the synthetic account of accounting objects formed by financial periods:

— 10 “Sanction for the current financial year”;

— 20 “Sanction for the first year following the current (next financial year).”

Since the period for placing the contract is 2020, and the year of execution is 2020, that is, the first year following the current (next) financial year, the obligations assumed under the notice of the auction posted on the official website are taken into account on account 0 502 27 226.

At the end of 2020 (December 31, after the completion of final transactions), the indicator on the account 0 502 27 xxx is subject to transfer, as required by the provisions of paragraph 312 of Instruction No. 157n, and in accounting from January 1, 2020 will be reflected on the account 0 502 17 xxx as acceptance of current year obligations. If, as a result of concluding a contract through an open auction, savings have arisen, the amount of accepted obligations reflected in account 0 502 27 xxx is adjusted according to the rules established in clause 167 of Instruction N 174n <2> as amended by Order of the Ministry of Finance of Russia dated December 31, 2015 N 227n <3>.

<2> Instructions for the use of the Chart of Accounts for accounting of budgetary institutions, approved. By Order of the Ministry of Finance of Russia dated December 16, 2010 N 174n.

<3> Order of the Ministry of Finance of Russia dated December 31, 2015 N 227n “On introducing amendments to the Order of the Ministry of Finance of the Russian Federation dated December 16, 2010 N 174n “On approval of the Chart of Accounts of accounting of budgetary institutions and Instructions for its application” is being registered with the Ministry of Justice of Russia ( at the time of preparation of the journal for publication, it is registered with the Ministry of Justice of Russia).

Let us consider, using an example, the correspondence of accounts to reflect the amounts of accepted obligations in accounting.

Example. In 2020, the institution held an auction for the provision of services in 2020 (subarticle 226 “Other work, services” of KOSGU). Based on the results of the auction on December 29, 2015, a contract worth 520,000 rubles was concluded. During the auction, the initial (maximum) price indicated in the notice (RUB 670,000) was reduced, resulting in savings of RUB 150,000. (670,000 - 520,000). Transactions are carried out as part of income-generating activities.

The correspondence of accounts for recording the amounts of accepted obligations in accordance with the provisions of paragraphs 164 - 167 of Instruction No. 174n as amended by Order of the Ministry of Finance of Russia dated December 31, 2015 No. 227n will be as follows:

| Debit | Credit | Amount, rub. | |

| Obligations have been accepted based on the notice posted on the official website | 2 506 20 226 | 2 502 27 226 | 670 000 |

| Liabilities were adjusted to the amount of savings resulting from the auction | 2 502 27 226 | 2 506 20 226 | 150 000 |

At the end of the year (December 31, after the completion of final transactions), the indicator on the account 2,502 27,226 is transferred to the account 2,502 17,226.

Here I would like to note that in accounting it is not enough to reflect only the amount of accepted liabilities of the year following the reporting year (account debit 0 506 20 xxx account credit 0 507 20 xxx, 0 502 20 xxx). It is also necessary to reflect planned assignments on the relevant accounting accounts (debit of account 0 504 20 xxx in correspondence with credit of account 0 506 20 xxx). Therefore, if obligations are accepted for the next year, the correspondence scheme of accounts should be as follows:

| Debit | Credit | |

| Reflection of the rights to assume obligations in the amount of approved planned assignments for the institution’s expenses for the next financial year | 0 504 20 xxx | 0 506 20 xxx |

| Reflection of the amounts of accepted obligations | 0 506 20 xxx | 0 502 21 xxx |

| Reflection of the amounts of obligations assumed during competitive procedures | 0 506 20 xxx | 0 502 27 xxx |

| Adjustment of accepted obligations | 0 506 27 xxx | 0 506 20 xxx |

At the same time, the question arises about the possibility of applying such a scheme of accounts in relation to activities financed by activity code 4 “subsidies for the implementation of state (municipal) tasks” in the case of:

— one-year planning;

— the absence of a founder’s prohibition on spending current year funds and concluding contracts in the current reporting period for the next financial year.

Since the state (municipal) task is drawn up for the current year and periods <4> (for 2020 and for the planning period 2016 and 2020; for 2020 and for the planning period 2020 and 2020), and the amounts of subsidies are allocated for fulfillment of the state (municipal) task of the founder in accordance with the subsidy transfer schedule for the corresponding year (as a rule, the current period is indicated) <5>, application in the accounting of accounts of authorization of expenses with analytical group 20 “Authorization for the first year following the current (next financial year) “, in our opinion, it is possible. As part of transactions for income-generating activities, the above account correspondence scheme can also be used.

<4> To confirm the validity of this statement, we cite as an example Resolution of the Government of the Russian Federation dated June 26, 2015 N 640 “On the procedure for forming a state task for the provision of public services (performance of work) in relation to federal government institutions and financial support for the implementation of the state task.”

<5> To confirm the validity of this statement, we cite as an example Order of the Moscow Department of Finance dated December 10, 2012 N 219 “On approval of sample forms of Agreements on the procedure and conditions for providing subsidies from the budget of the city of Moscow for financial support for the implementation of state assignments.”

Now let's talk about filling out section. 4 tables of information (f. 0503775). According to the provisions of clause 72.1 of Instruction No. 33n, the information (form 0503775) reflects information on unfulfilled expenditure obligations, unfulfilled monetary obligations, expenditure obligations accepted in excess of the approved plan of economic (financial) activities, as well as on the amounts of savings achieved as a result of the use of competitive ways to identify suppliers.

From the provisions of clause 72.1 of Instruction No. 33n it follows that in section. Tables 1 and 2 reflect analytical information based on data on accepted and unfulfilled expenditure and monetary obligations on the corresponding accounts of analytical accounting of accounts 0 502 11 000 “Accepted obligations for the current financial year”, 0 502 12 000 “Accepted monetary obligations for the current financial year” .

In Sect. Table 3 reflects analytical information based on data on expenditure obligations accepted in excess of the approved plan for the economic (financial) activities of the institution, in particular, in column 1 of the form the numbers of the corresponding analytical accounts of account 0 502 11 000 “Accepted obligations for the current financial year” are indicated, for which as of the reporting date in the report (f. 0503738), the indicator reflected in column 7 “Monetary obligations accepted, total” exceeds the indicator of the approved data reflected in columns 5 or 4.

In Sect. 4 forms of the table indicate analytical information based on data on savings when concluding contracts using competitive methods, while:

— column 1 indicates the numbers of the corresponding analytical accounts of account 0 502 07 000 “Accepted obligations”;

— column 2 reflects the amount of obligations accepted using competitive methods based on data from the corresponding analytical accounts of account 0 502 07 000 “Accepted obligations” in the amount of credit turnover on the account for the reporting period;

— column 3 is formed on the basis of data from the corresponding analytical accounts of account 0 502 07 000 “Accepted obligations”, reflected in correspondence with the credit of account 0 502 11 000 “Accepted obligations for the current financial year”;

— column 4 is formed on the basis of data from the corresponding analytical accounts of account 0 502 07 000 “Accepted obligations”, reflected in correspondence with the credit of account 0 506 00 000 “Right to assume obligations”.

Thus, from the provisions of clause 72.1 of Instruction No. 33n it follows that the table (form 0503775) is filled out on the basis of accounts reflecting the authorization of expenses of the current financial year. Amounts of accepted liabilities of the first year following the current (next financial year) (account indicator 0 502 27 xxx), in section. 4 tables (f. 0503775) are not reflected.

On the website https://www.roskazna.ru/, in the “Accounting and Reporting” section, control ratios are presented that must be observed in the table (f. 0503775). We present them below.

Sources of financing the institution's funds deficit.

Sources of deficit financing are funds raised to pay off the budget deficit. These include:

- non-produced assets (land, subsoil resources);

- precious metals and jewelry;

- securities, shares and other forms of participation in capital;

- cash (account balances, loans, credits, etc.).

If a budget organization carries out operations with such objects, then data on receipts and disposals should be reflected in section 3 of the Report on the implementation of the financial management plan.

The chapters of this section are filled in similarly to the previous ones, but not by income or expenses, but by sources of financing the institution’s deficit. However, there are a number of differences.

An example of filling out the 700th lines of section 3 of the Report on the Execution of the FCD Plan:

Lines 731 and 732 reflect the turnover of funds between various accounts and (or) cash desk.

Features of filling out section 3 of the Report on the implementation of the FCD plan.

One important feature of completing this section of the report is that

The amount in line 500 in the corresponding columns must be equal to the amount from the 2nd section in line 450 with the opposite sign.

Violation of this rule may result in an Intraform Control :

Typically the reason is as follows:

On line 700, column 4, on the basis of Order of the Ministry of Finance of the Russian Federation dated March 25, 2011 N 33n, the balance of funds of the institution planned by the FCD Plan at the beginning of the year should be indicated. It is entered using the Planned Assignments document.

Step-by-step instructions for filling out

We will show you a sample of filling out a new report if an employee quit in January 2020.

Step 1

We enter the basic details:

- general registration data;

- name of the insured.

Step 2

Fill in the employee information:

- First and last name must be written down;

- if a person does not have a middle name according to his documents, it is permissible to put a dash in the line;

- Date of birth and SNILS are required fields.

Step 3

We enter information about whether the employee agrees to switch to maintaining an electronic work record book or decides to keep a paper one. Additionally, we indicate the period for which we submit the report. In our example, there are still empty lines.

Step 4

Let's move on to the tabular part and fill in each column in order:

- numbers in order from 1 to the required number according to the number of personnel changes;

- the next column is the date when the changes occurred;

- column 3 - type of change; officials allow the use of either a numerical value (from the table) or a specific word;

- Column 4 is called “Labor function (position, profession, specialty, qualification, specific type of work assigned), structural unit”, and all information is not always entered into it;

IMPORTANT!

Officials clarify that the code for the type of work assigned and other information should be taken from the employer’s staffing table. Sometimes benefits are provided for the performance of certain work or restrictions are introduced for them, and the Pension Fund of the Russian Federation should be made aware of these nuances. In this case, the list of documents where to obtain the type of assigned work in SZV-TD is limited to qualification reference books and professional standards for the relevant positions, specialties or professions. For state and municipal employees, indicate the position code according to the corresponding register of positions.

- Column 5 is filled in only if there is a code;

- columns 6–9 relate to information about dismissal, in other cases they are filled with dashes;

- the last column (10) is filled in if the policyholder needs to cancel a previously made entry; To do this, fill out the form with the initial data, put the “X” sign in column 10, and indicate the correct information in the next line (clauses 2.6 and 2.7 of the filling procedure).

Step 5

All that remains is to sign and date it.

The procedure for filling out the section on transactions with financial assets and liabilities

The procedure for filling out this section is as follows:

| Line | Index |

| Difference between lines 390 and 510 | |

| Line sum 410, 420, 440, 460, 470, 480 | |

| Difference between lines 411 and 412 | |

| Amount according to debit turnover on the account 0 201 00 000 | |

| Amount according to credit turnover on the account 0 201 00 000 | |

| Difference between lines 421 and 422 | |

| 421* | Amount according to debit turnover on accounts 0 204 21 000, 0 204 22 000, 0 204 23 000, 0 215 21 000, 0 215 22 000, 0 215 23 000 |

| 422* | Amount according to credit turnover on accounts 0 204 21 000, 0 204 22 000, 0 204 23 000, 0 215 21 000, 0 215 22 000, 0 215 23 000 |

| Difference between lines 441 and 442 | |

| 441* | Amount according to debit turnover on accounts 0 204 31 000, 0 204 34 000, 0 215 31 000, 0 215 34 000 |

| 442* | Amount according to credit turnover on accounts 0 204 31 000, 0 204 34 000, 0 215 31 000, 0 215 34 000 |

| Difference between lines 461 and 462 | |

| Amount according to account debit turnover data 0 207 00 000 | |

| Amount according to account credit turnover data 0 207 00 000 | |

| Difference between lines 471 and 472 | |

| 471* | Amount according to debit turnover on accounts 0 204 51 000, 0 204 52 000, 0 204 53 000, 0 215 51 000, 0 215 52 000, 0 215 53 000 |

| 472* | Amount according to credit turnover data on accounts 0 204 51 000, 0 204 52 000, 0 204 53 000, 0 215 51 000, 0 215 52 000, 0 215 53 000 |

| Difference between lines 481 and 482 | |

| Amount according to debit turnover on accounts 0 205 00 000, 0 206 00 000, 0 208 00 000, 0 209 00 000, 0 210 10 000, 0 210 03 000, 0 210 05 000, 0 210 06 000 | |

| Amount according to credit turnover data on accounts 0 205 00 000, 0 206 00 000, 0 208 00 000, 0 209 00 000, 0 210 10 000, 0 210 03 000, 0 210 05 000, 0 210 06 000 | |

| Line sum 520, 530, 540 | |

| Difference between lines 521 and 522 | |

| Amount according to credit turnover on accounts 2,301 12,000, 2,301 14,000 | |

| Amount according to debit turnover on accounts 2,301 12,000, 2,301 14,000 | |

| Difference between lines 531 and 532 | |

| Amount according to credit turnover on accounts 2,301 24,000, 2,301 44,000 | |

| Amount according to debit turnover on accounts 2,301 24,000, 2,301 44,000 | |

| Difference between lines 541 and 542 | |

| 541** | Amount according to credit turnover on accounts 0 302 00 000, 0 303 00 000, 0 304 00 000 |

| 542** | Amount according to debit turnover on accounts 0 302 00 000, 0 303 00 000, 0 304 00 000 |

* These lines do not indicate internal movements (acceptance of objects for accounting at the cost of investments).

** Data on credit (debit) turnover on accounts 0 304 04 000, 0 304 06 000 are reflected until the final turnover on accounts at the end of the reporting financial year.

How to fill out the form in the first half of the year

Therefore, according to column 9 “Unfulfilled assignments” in these sections is also not filled out. In section 1 and section 3 (in terms of receipts from sources of financing the budget deficit), column 5 is filled in based on data from the corresponding accounts of account 121002000

“Settlements with the financial authority for budget revenues”

(without reflecting funds credited on the last working day of the reporting period to accounts opened by the departments of the Federal Treasury for the constituent entities of the Russian Federation on balance sheet account 40101, and subject to transfer to budget accounts on the first working day of the month following the reporting month). The data must correspond to the indicators of the Certificate of transfer of revenues to budgets (f.

0531468). Column 6 is filled out based on the data reflected in off-balance sheet accounts 17 “Receipts

Commitment report

This is explained by the norms of budget legislation (budget laws) at the level of the Russian Federation, constituent entities of the Russian Federation and municipalities, according to which limits on budget obligations are not approved for expenditures on the fulfillment of public regulatory obligations. We believe that filling out columns 4 and 5 of the report (f. 0503128) should be carried out taking into account the requirements of the joint letter.

0

“Public regulatory social payments to citizens”

(311, 312, 313), 330 “Public regulatory payments to citizens of a non-social nature.”

Let's summarize the requirements of instructions No. 191n and 33n for filling out a report on obligations into a table. Report column (form 0503128) Report column (form 0503738) Column name Features of filling out 6 5 Obligations assumed Indicators are reflected

Review of changes in budget reporting for government agencies

Added paragraph to paragraph.

7 of Instruction No. 157n, according to which reporting is prepared on the basis of planned (forecast) and (or) analytical (managerial) data generated during the implementation of its activities by the subject of accounting (clause.

1.2 Amendments No. 176n). An inventory of assets and liabilities is carried out for the purpose of drawing up annual budget statements in the manner established by the economic entity within the framework of its accounting policies.

3. Features of the formation and reflection of indicators in reporting forms are given in paragraph.

8 Instructions No. 191n. When generating and (or) presenting budget reporting using automation software systems, budget reporting documents that do not have numerical values of indicators and do not contain explanations are generated and presented with an indication of (clause.

Filling out form 0503169 in 2020 with an example

In columns 5–8 “Change in debt”, indicate the decrease and increase in the total amount of debt. In columns 6 and 8, highlight non-cash settlements for accounts 206 00 and 302 00. Non-cash transactions include settlements that were carried out without cash expenses (non-cash transactions), without accounts:

- 304 05 “Settlements for payments from the budget with the financial authority.”

- 210 02 “Settlements with the financial authority for budget revenues”;

- 202 00 “Funds in budget accounts”;

- 201 00 “Institutional funds”;

- 210 03 “Settlements with the financial authority for cash”;

We recommend reading: Forest egais website

An example of non-cash transactions (non-monetary settlements) in form 0503169: deduction from wages of arrears on accountable amounts or deduction from contract security of a penalty (advance not returned by the counterparty).

6-NDFL for the first half of 2020: example of filling out

If a “segregation” is reported, then the checkpoint is given for the region where it is registered. If an individual reports, there will be no checkpoint.

Correction number. If the payer himself or the inspectors find errors in the submitted report, then a corrected version must be sent. This field is used to distinguish between the original version and subsequent revisions. For the primary version, we put “000” in it, then, if there are clarifications, “001”, “002”, etc.

Budget reporting 2019

annual – as of January 1 of the year following the reporting year.

The institution submits additional accounting reports to the federal government body that exercises the functions and powers of the founder in relation to the institution (hereinafter referred to as the founder), or by decision of the financial authority to the financial authority within the time limits established by the founder. In your

Budget (accounting) reporting for the 1st half of 2020: recommendations from the Ministry of Finance of Russia and the Federal Treasury for preparation

; Information about the institution’s cash balances (f.

0503779); Information on the execution of court decisions on the institution’s monetary obligations (f. 0503295). Please note that these lists were additionally outlined in the presentation on current issues of reporting in 2020, published on.

This presentation from a video conference held on June 29, 2019, was also published on.

The first and most important thing that is required from institutions is the submission of additional information to the main set of reports for the first half of the year.

Namely: 1. Formation of Reports (f.f. 0503128, 0503738) and Information (f.f. 0503169, 0503769) taking into account the provisions of the GHS.

That is, assumed obligations in these reports are reflected in the amount of lease payments according to the agreements.

New deadlines for salary reporting for the first half of 2019

All companies that provide payroll reports should be aware that reporting deadlines have changed significantly. In order not to be mistaken with the dates, it is necessary to familiarize yourself with information about all current changes.

On July 2, the necessary document, issued under number 1-PR, must be provided by large and medium-sized companies whose work was stopped due to various protests. Also on July 2, those companies that have not fully resolved collective disputes related to labor activities that arise in June can issue a form under number 1-CTS.

This document is urgent. On July 16, 2020, policyholders must provide documentation, which is drawn up in the SZV-M form.

All information contained in it must correspond to June.

On the same day, employers with 16 employees (there may be more) provide documentation drawn up in Form P-4. On July 20, 2020, those employers with 25 or fewer employees provide a paper document filled out in accordance with Form 4-FSS.

On June 25, for the first half of the year, those insurers with 25 or more people on staff provide the necessary documentation.

In this case, documentation is drawn up in Form 4-FSS, the condition being that it is submitted electronically. The last documents to be prepared for the first half of the year are personal income tax agents.

In order to meet deadlines and send all the necessary documentation in accordance with current legislation, these persons draw up a special document that must comply with Form 6-NDFL.

It must correspond to all data collected for the first half of 2020.

Report of budgetary institutions 0503723: form, filling, instructions in 2020

“Analytical information on disposals”: for current operations. For line 900, the indicator is equal to the sum of lines 220 and 310, column 4 of section.

2 of the Report, as well as the sum of column 7 detailing lines to line 900.

For example conditions, see .

Form 0503723 in 2020 is compared with the Report on the institution’s implementation of its financial and economic activity plan f. 0503737, which is compiled quarterly on an accrual basis from the beginning of the year.

Source: https://disk-shetka.ru/kak-zapolnjaetsja—forma-v-pervom-polugodie—goda-80666/