Home / Labor Law / Payment and benefits / Wages

Back

Published: 05/09/2017

Reading time: 6 min

0

1024

A certificate in form 4n is a certificate of income.

It is issued to the employee on the day of dismissal along with the work book and other documents. It displays data on the employee’s income for 2 years and is needed to calculate benefits, which are calculated based on this period.

At the moment, form 4n is outdated; since 2013, a certificate in form 182n has been used. This replacement occurred due to changes in the calculation of average earnings. The new form of income certificate has made it possible to reduce the amount of paperwork when calculating benefits, as well as simplify the work of the accounting department .

- Help structure

- Who issues the certificate?

- Nuances of issuing a certificate

- What problems may arise when receiving a document?

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

Certificate of income for two years in form 4n: tips and recommendations for filling out

A separate line is allocated for each year. It is important that a certain salary limit is set for each year. This limit must not be exceeded.

Detailed information about excluded periods, that is, when contributions to the Social Insurance Fund were not made. The reason why the period is excluded from the calculation, the start and end date of this time period are indicated.

Who issues the certificate?

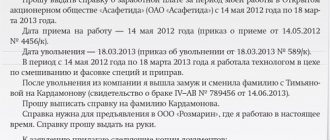

A certificate in form 4n is issued to the employee by the employer on the day of dismissal along with other documents. If for any reason the certificate was not issued, the former employee has the right to request it.

To do this, you need to write an application in which you indicate: Last name, initials of the manager to whom you are writing the application.

What does it look like?

A certificate in form 4n was first introduced in 2011. Previously, only 1 year of information was used to calculate the average daily earnings. Then all information was placed on 2 sheets.

However, in 2013, the certificate was changed and finalized, now it is called 182n (in accordance with the order of the Ministry of Labor dated March 30, 2013). Now it is 3 sheets. The form is strictly established, so certificates issued by different institutions must be similar. First, there must be information about the company that compiled the document. Secondly, the certificate contains information about the former employee, that is, the insured person. Next comes the direct amounts of income for which insurance payments were calculated. There is a separate line for each year. Finally, the last section contains information about periods when contributions to the Social Insurance Fund were not made. Their duration is indicated, as well as the start and end dates.

The certificate can be filled out either with a ballpoint pen with blue or black ink, or using technical means, including a typewriter. No corrections are allowed. Certificate 4n (182n) must be certified by the signatures of the chief accountant and the head of the organization, as well as a round seal.

New income certificate for calculating sick leave and maternity leave instead of 4n

N 182n.

Registered with the Russian Ministry of Justice on June 5, 2013.

N 28668. Officially published in Rossiyskaya Gazeta on June 21, 2013, comes into force on July 1, 2012. A new form of a certificate of the amount of wages, other payments and remunerations for the two calendar years preceding the year of termination of work (service, other activities) or the year of applying for a certificate of the amount of wages, other payments and remunerations, and the current calendar year for which insurance premiums were calculated, and the number of calendar days falling in the specified period for periods of temporary disability, maternity leave, parental leave, the period of release of the employee from work with full or partial retention of wages in accordance with the legislation of the Russian Federation , if insurance contributions to the Social Insurance Fund of the Russian Federation were not accrued for the retained wages for this period.

Certificate form 182Н form and sample filling

Document year: 2018

Document group: Help, Forms

Document type: Help, Form

Download formats: DOC, PDF

In order for the employee’s sick leave benefit to be calculated correctly, certificate 182n (2018 form) is used. You can download the document for free on the Internet, and we also have an official sample on our page.

Certificate 182n received this name from the order number of the Ministry of Labor and Social Protection, which certified the form of the paper, the procedure for filling out and the main points of providing information. Previously, functions 182n were performed by certificate 4n. This was before 2013.

Let's take a closer look: certificate 182 n - what it is, why employees need the document, when it can be requested, and how the information is filled out.

After reading the article to the end, you will learn:

- typical mistakes when filling out. What to pay attention to first;

- an example of specifying information in a document;

- download the form for free.

Get ready for thoughtful reading - the information will be useful.

Why do you need certificate 182 n

Using certificate 182n, the employee’s earnings, periods of temporary disability, and period of work with the employer are calculated.

The form is needed by resigned employees so that they can bring it to the accounting department at their new place of work. In fact, the accountant needs the paper to correctly calculate sick leave payments, but the employee must be interested in the correctness of the calculations. After all, the final amount of the benefit depends on them.

A form is drawn up for the last two years before the year of the employee’s dismissal. To make it clearer, let's look at a conditional example.

Agapov worked at AgroMash until October 28, 2020, which is the date of his dismissal from the company. Started working for the company back in 2012.

The following periods of work will be included in the calculation of the certificate:

- from January 1, 2020 to December 31, 2020;

- from January 1, 2020 to December 31, 2020;

- from January 1, 2020 to October 28, 2020

That is, the calculation periods included the work time for the last year of work before the date of dismissal, plus two years before the dismissal.

But the indication will be correct if Agapov was employed at AgroMash on the date January 1, 2020. If not, the start date of the period begins from the date of hiring. For example, Agapov did not join the company in 2012, but began working on January 29, 2020. The certificate will indicate:

- from January 29, 2020 to December 31, 2020;

- from January 1, 2020 to December 31, 2020;

- from January 1, 2020 to October 28, 2020

Based on the average earnings calculated in the certificate, benefits will be calculated for the employee in his new position:

- due to temporary disability due to illness;

- maternity benefits;

- state support for child care;

- payments for caring for sick close relatives.

In what cases is it issued?

The certificate is issued by the accounting department of the former employer and transferred to the accounting department at the new place of work.

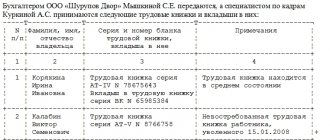

| An employee who has broken his employment relationship with his employer | The certificate is issued on the last day of work along with the required documents (work book, 2-personal income tax, etc.) |

| Dismissed employee | At any time after dismissal, if the accounting department did not issue such a certificate on the last day of work. Form 182n is prepared three days after receiving an application from a former employee. |

Regardless of the time of registration, the former employer does not have the right to refuse to issue a certificate. Even if you apply again.

The finished document is prepared in one copy, but can be made in several originals at the request of a citizen.

Gaidurov resigned from Faience LLC in May 2020. Among the documents that were given to him upon dismissal, there was no form 182n. At his new place of employment, he was asked for a certificate. Gaidurov turned to his previous employer with an application to provide him with 182n. The accounting department handed over the finished document three days later.

Regulatory regulation

| Order of the Ministry of Labor and Social Protection of the Russian Federation dated April 30, 2013 N 182n (as amended on January 9, 2020) The document determines the need for the developed form, the procedure and basic rules for filling it out. |

| Labor Code of the Russian Federation (Labor Code of the Russian Federation) – regulation of labor relations, definition of the concepts of average earnings, forms of remuneration, part-time employment and other things |

| Tax Code of the Russian Federation |

| Law “On Accounting” - regulation of the reflection of accounting transactions related to the payment and calculation of benefits and other things |

| Other regulations, local regulations of companies |

To begin with, we advise you to familiarize yourself with the Order of the Ministry of Labor - this is the primary source of form 182n. Study the correctness of filling out the document and the legal requirements.

Basic rules for filling out a document

A certificate is drawn up using the form from Order 182n of the Ministry of Labor and Social Protection. You can download the form for free on the Internet, the sample is valid for both 2020 and 2020.

Compiled in both written and electronic form.

If the certificate is in writing:

- print the template;

- fill out the information only with black or blue pens;

- Please provide information in legible handwriting.

Not allowed:

- two-side print;

- corrections, blots, use of proofreaders;

- strikethroughs, underlines;

- Forms with marks during printing (stripes, stains, ink stains) are not accepted.

When filling out a document electronically, double-sided printing, corrections on a ready-made document, and printing defects are also prohibited.

If you notice an error, inaccuracy or typo, fill out the document again (if you wrote it by hand) or correct it on the computer and print a new copy.

Important! The company seal is not required, but if there is one, it must be placed in a special place.

An example of filling out a certificate on form 182n

Let's take a closer look at how certificate 182nv is filled out in 2019, where you can do it for free. Below you can download a completed sample.

The certificate consists of four blocks of information, which is filled out by the executor. At the top of the certificate the date of issue is indicated and a number is assigned.

- A block of information about the policyholder – in fact, about the hiring company. Standard information is indicated here: company name or full name (for entrepreneurs), information about the insurer, and the legal address of the organization itself. The numerical value indicates the subordination code, taxpayer number and checkpoint.

- The second block is devoted to data about the insured person - in fact, about the employee. In this case, personal identification information is filled in. Information is taken from the passport (full name, number, series, full residential address). At the end of the block, the number of the insurance certificate and the periods of work of the dismissed person in the company are indicated.

- The third block contains an indication of the average salary for the last two years before dismissal. Amounts are entered in numbers and in words; the words “ruble” and “kopeck” are not abbreviated.

The third section on Averkov’s salary will look like this:

for 2020: 325,000.00 (three hundred twenty-five thousand) rubles;

for 2020: 425,022.50 (four hundred twenty-five thousand and twenty-two) rubles and fifty kopecks;

for 2020: 500,000.70 (five hundred thousand) rubles and seventy kopecks.

4. In the fourth block, periods of illness, maternity leave, releases with or without payment of salary, and terms of care for the sick are indicated.

The information is given as follows:

- year;

- how many calendar days this year fell during this period;

- name of the period (sick leave, maternity leave, etc.).

At the end, the form is certified by the chief accountant (if there is one on staff) and signed by the manager. To do this, put your full name, signatures, and affix a seal if the employer has one.

By the way! You can add additional lines as you fill out the paper.

Basic mistakes when filling out

In addition to errors associated with indicating general data for the organization and the employee, errors in calculations, indicating periods of work and amounts of earnings are common.

Accounting often makes mistakes:

- Does not take into account the earnings of an employee who also works part-time at the company while caring for a child. Also, such a period is often not indicated in section 4.

- The amount of earnings is calculated incorrectly. The certificate includes only the salary on which insurance premiums are calculated.

- The earnings limit for which insurance premiums are calculated is revised annually. Income above this limit should not be reflected in the certificate.

- Incorrect reflection of work periods.

- Errors associated with drawing up a certificate for an employee who was employed or transferred to part-time work. This earnings also count.

- There is a stamp on the paper, but it obscures the signature or information. Because of this, the information becomes unreadable.

After receiving certificate 182n, check the correctness of preparation and take into account the listed errors.

Where can

Certificate form 182n can be downloaded for free on the Internet. So that you do not waste time searching, we have added a sample to our website. This is an official form that you can download for free.

Note that the form of the certificate has been fixed by order of the Ministry of Labor and Social Protection since 2013. Since that time, changes have been introduced to the regulatory document only once - in January 2020.

The changes did not affect the structure of the form 182n. In general, the certificate distinguishes between the periods up to December 31, 2020 and from January 1, 2017. This is due to the fact that the insurance was transferred to the Federal Tax Service.

Some footnotes on the document itself have also been corrected.

182n as a certificate will be needed by any citizen who changes his place of work. In case of loss of ability to work (going on maternity leave, etc.), it is based on this certificate that the accounting department at the new place will make sick leave accruals.

The article is over – are there any questions left? Ask them to our lawyer in a free chat.

Download documents

If you have not found the answer to your question or there are still misunderstandings, contact a lawyer for a free consultation in the chat on our website

| Certificate form 182Н form |

| Sample of filling out certificate 182Н |

Source: https://Dogovory.com/formy/58-spravka-formy-182n-blank-i-obrazec-zapolneniya.html

Certificate for sick leave 182n: form

If the September salary was issued to employees on September 30, 2018, then in the calculation of 6-personal income tax for 9 months this operation will need to be reflected only in section 1. The payment for September and the corresponding personal income tax amount will only appear in section 2 when submitting the annual calculation.

Minimum wage and salary: when comparing, do not forget about allowances and regional coefficients. The salary of an employee who has worked his full working hours for the month cannot be less than the minimum wage. In this case, the salary is taken into account taking into account all allowances and increasing factors.

Fraudsters disguise malicious emails as PFR mailing lists If you receive a letter from an email address similar to the Pension Fund address (pfrf.ru), do not click on the link provided in such a letter.

Sample and form of certificate 4n

According to the regulatory legal acts of the Russian Federation, there is a package of documents that must be issued to a resigning employee. In addition to signing the relevant order by the head of the enterprise, making calculations and issuing a work book, until recently this list included a certificate in form 4n .

Help 4 - what is it?

benefits for temporary disability, pregnancy and childbirth, as well as monthly child care benefits, are calculated based on the average earnings of the insured person, calculated for the two calendar years preceding the year of occurrence: maternity leave, child care leave, including while working for another policyholder(s). In accordance with Article 1 of Law No. 21-FZ, Part 3.1, Clause 3, Article 14 “The procedure for calculating benefits for temporary disability, pregnancy and childbirth, monthly child care benefits” of Law No. 255-FZ is stated as follows: Average daily earnings for calculating: maternity benefits, monthly child care benefits are determined by dividing the amount of accrued earnings for a two-year period (specified in paragraph 1 of Article 14 of Law No. 255-FZ)

What it is

The document represents information about the employee’s salary and other amounts paid to him for the reporting period, from which deductions were made to the Social Insurance Fund.

The data specified in the certificate is necessary to calculate payments in the event of insured events such as loss of ability to work or, for example, going on maternity leave to care for a child.

The structure of the document in form 4n has the following features :

- Details of the policyholder . This paragraph indicates the name of the employing organization, its tax identification number, address and telephone number. In addition, the territorial body of the insurer is also indicated here.

- Details of the insured citizen . This section of the document contains information about the citizen: full name, passport data, SNILS, as well as the period of time during which contributions to Social Security were made for him.

- Amount of salary or other payments . This part of the certificate contains the amounts for which insurance premiums were calculated. The two years that preceded the issuance of the certificate are considered.

This is interesting: VAT Register Appendix 5

New form of certificate of earnings for calculating benefits

In the third section, several additional years can be added to the three existing years in order to use them for calculating benefits, if in the two calendar years preceding the onset of the insured event, the employee was on maternity or child care leave and wants to replace them with other years of the billing period.

The fourth section indicates the number of calendar days that are excluded from the billing period due to temporary disability. maternity leave. maternity leave, as well as average wages.

for which insurance premiums are not charged to the Federal Social Insurance Fund of the Russian Federation. The corresponding lines of the section indicate the start and end dates of the excluded period and its name.

Certificate form 4 about family composition

- indication of the name of the body that provided the document;

- complete information about the address of the place of residence (location of the premises): indication of the postcode, city name, street name, house number indicating the building or building (if any) and apartment;

- the name of the document, namely “Certificate of family composition”;

- the citizen’s personal data (full name) is recorded;

- information about family members, including all dates of birth, degree of relationship (or lack thereof), date of registration in this apartment, as well as information about passport data or data from the birth certificate (for children) for each member;

- number of rooms occupied by residents;

- the total area of the premises where the family lives;

- information about the personal data of the main owner of the premises - the owner or responsible tenant;

- name of the organization where the certificate is provided;

- date and time of preparation of the certificate;

- information about the official who issued the document, such as full name, signature and transcript of the employee’s signature;

- imprint of the official seal of the authority providing the certificate.

A very large number of citizens are faced with a situation where they are required to present a certificate of family composition. What does this certificate represent, who is included in the concepts of “family”, “family composition”? Why this document is needed, where to get it - this will be discussed in this article. First, you need to decide what a family is, the composition of the family from a legal point of view. There is no clear legal concept in the Family Code. There is no list of persons who are part of the family, which is universal for most cases. It is worth noting that the concept of family members, defined in the Civil, Housing Code, as well as in other legal and by-laws, are different from each other. In the theory of family law, the family and the composition of the family are distinguished from a sociological and legal point of view.

The procedure for obtaining a certificate of family composition

- the marriage between spouses must be officially registered, which is confirmed by an entry in the civil status act;

- all of the above relatives must have official registration in the owner’s home;

- Only that relative or stranger who has the absolute consent of the owner to live in his premises can be considered a family member.

Living together and registering does not mean that everyone automatically becomes family members. One of the important characteristics of the family structure is maintaining a common household, a certain level of responsibility to each other and a common financial budget!

Who issues a certificate of family composition in Russia in 2020

- the marriage of the spouses is officially registered;

- all residents have official registration;

- registration is completed with the consent of the owner;

- general farming is carried out;

- there is a certain responsibility to each other between family members;

- there is a certain general financial budget.

- citizens registered in the home where the family lives;

- owner of housing for himself or unregistered persons;

- legal guardians of minor children in the family;

- representatives of courts and law enforcement agencies, notaries and lawyers upon official request.

We recommend reading: The best banks for opening a sole proprietor account

Where can I get a certificate of family composition if the husband and wife are registered in different places?

If it happens that the spouses are registered at different addresses, then each of them will only be able to receive a separate certificate of family composition, in which form they cannot be indicated jointly. Those. Each address has its own house register, and, therefore, its own sample. The child will be indicated on the form that is linked to the address (i.e., he can be registered/registered with either parent).

The portal does not issue sample certificates through the corresponding MFC. Those. here you can only order a form for a certificate of family composition, and only then arrive at your destination and submit all the documents that are needed to receive it. In practice, issuance takes place within 1-3 days. But if you contact the passport office directly, you will be able to receive the form immediately - upon the current application, or the next day.

05 Aug 2020 toplawyer 1536

Share this post

- Related Posts

- Which countries in the Russian Federation allow dual citizenship?

- Traffic tickets are like a traffic police exam

- At what stage of pregnancy is maternity leave granted?

- You can build a house on agricultural land

Certificate of family composition

- application for a certificate;

- identification documents of citizens (passport or other documents replacing it);

- a power of attorney, which confirms the authority of a certain individual to act on his behalf to other (third) persons;

- an agreement or a technical passport indicating registration of property rights.

This document can be obtained from the housing office or the passport office upon submission by an individual of the appropriate application for drawing up this rate. A complete list of documents that must be submitted to the relevant authority to obtain a certificate:

Where to get a certificate of family composition - list of documents for registration

- they must be readable;

- documents should not contain corrections, additions, erasures, or have serious damage that makes it impossible to read and correctly interpret the text;

- documents must be submitted by the applicant personally for review and verification by a specialist, and then returned to the applicant.

- identification document (passport and others);

- application for the issuance of a certificate of family composition on a special form;

- power of attorney for the guarantor (if the certificate is issued by someone else);

- certificate of ownership of the apartment (or other registration documents) - usually required if the applicant is not registered, but is the owner.

Application form for issuing a certificate of family composition

- Name of the governing body indicating the full name of the official.

- Information about the applicant: last name, first name and – if present – patronymic, contact phone number and residential address.

- The essence of the request, which usually sounds like this: “I ask you to issue a certificate of family composition.”

- Personal signature of the citizen and date of drawing up the petition.

- If an authorized person acts on his behalf, then it is necessary to enter the details of the power of attorney.

A family composition certificate is a document confirming the number of its members living in the same territory. It may be required to apply for benefits and subsidies, provide tax deductions and collect alimony through the court, and in some other cases. Obtaining a document is possible after a written application to an official - who it will be in a particular locality is determined by its size and the administrative regulations in force in this territory. To apply, you need to fill out an application form for issuing a certificate of family composition.

Certificate of family composition form 4 for a notary

From April 2020, Ukrainians will no longer need certificates of family composition when registering a place of residence or to receive benefits. The president signed this law. It is expected that passport offices, administrative service centers, as well as notaries and state registrars will already have access to electronic registers and land registries. Therefore, they will be able to check information about the composition of your family and place of registration themselves. “If a person wants to deregister in one city and move to live in another, then he does not need to collect a lot of certificates. All information about him will be able to be checked using an electronic database,” says lawyer Rostislav Kravets.

In some cases, applicants may be denied a family composition certificate. For example, in the case of existing debts for utilities. But remember that refusal is not a legal action; the document must be issued to you regardless of your debts.

We recommend reading: Buy an apartment with a mortgage