In the article you will read about what rights and obligations a co-borrower has under a mortgage, and what he will have to face if the main borrower violates the agreement. Read this information material and you will see answers to the questions that concern you. We will consider the requirements for the mortgage co-borrower and his obligations to the lending institution. You will learn how a co-borrower exits a mortgage and read about the important features of this process.

What does the term title co-borrower mean?

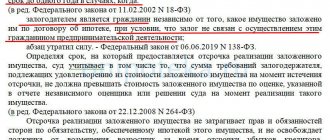

In legislation, the title co-borrower in a mortgage is the main borrower specified in the mortgage agreement (Federal Law of July 16, 1998 N 102-FZ On Mortgage (Pledge) of Real Estate). The title, that is, the main payer of the mortgage loan, acquires real estate on the same rights as other co-borrowers and is responsible with its property and all income received in case of violation of the conditions listed in the executed agreement.

Who can become a co-borrower on a mortgage? The official spouse is always taken into account as a mandatory co-borrower. If the relationship between a common-law husband and wife is not formalized legally (at the registry office), then they will not be able to take advantage of preferential programs or take out a housing loan at a reduced interest rate. The following may be involved as a co-borrower:

- A close or distant relative (sister, brother, father, mother or other person related to the main recipient of the loan).

- Third party - any citizen of the Russian Federation who has agreed with the terms of the transaction and voluntarily takes part in it.

If the title borrower and the co-borrower are related, then the chances of getting a long-term loan increase significantly. The approval rate in this case is high. Many banks allow the transaction to take place provided that the title co-borrower is in a common-law marriage. Transactions involving a third party or common-law spouse as a co-borrower have become widespread.

Life insurance with a mortgage: what cases

Life insurance is a significant expense that a co-borrower has to deal with when taking out a mortgage loan. The amount of payments during the year is 7-18 thousand rubles, and the higher the risk of illness or death of the borrower, respectively, the higher the tariff. In turn, life insurance provides the co-borrower with a number of advantages:

- there is a high probability of getting a mortgage loan;

- interest rates have been reduced (in the absence of personal insurance, Sberbank, Alfa Bank, VTB, etc. increase the interest on the loan);

- if the co-borrower turns out to be temporarily disabled, it will be easier to come to an agreement with the lender, for example, to refinance the loan or revise the repayment plan;

- if an insured event occurs, the debt is paid by the insurance company, and accordingly, the budget will not suffer;

- If a co-borrower is ill, the insurance company will pay for treatment and rehabilitation.

The lower the amount of mortgage debt, the lower the amount of insurance payments. If the co-borrower repays the loan early, the insurance company will return part of the payments made to him, provided that there are no restrictions in the contract. As a rule, it is in the interests of insurers to attract customers, which is why they often offer promotions that can actually reduce payments by a small percentage - 0.5-0.8%.

Insurance is issued to the mortgage recipient, co-borrower, guarantors, and other persons specified in the mortgage agreement. Each organization approves a list of citizens whose lives will not be insured:

- under 18 years of age;

- after 55-60 years;

- registered in drug treatment, anti-tuberculosis and other specialized medical institutions;

- persons who have had a heart attack or stroke;

- the presence of dangerous diseases (AIDS, HIV, oncology, diseases of the cardiovascular system, diabetes, cirrhosis of the liver, etc.).

Some insurers may not refuse to enter into an agreement with these persons, but the rate will be increased due to the riskiness of the insurance.

Each bank (Rosselkhozbank, Alfa-Bank, Sberbank, VTB, etc.) has its own list of insurance companies. When completing a mortgage transaction, large banks often offer co-borrowers the insurance services of their subsidiaries by default. And sometimes the client does not know that there is a legal right to choose the insurance company itself, which most likely can offer attractive conditions.

Features of the contract

Information regarding the amount, loan period, presence of diagnoses, doctor’s visits and hospitalization is usually asked to be included in the co-borrower’s application form. In the course of personal insurance, the insurance organization is interested in the profession and lifestyle of the citizen, in particular leisure activities associated with dangerous sports, etc. Such information may influence the assessment of the tariff and insurance risks.

The co-borrower must apply for insurance, provide a copy of his passport, mortgage agreement, SNILS.

If the questionnaire contains serious or chronic illnesses, the insurer may request a medical report regarding the citizen’s health status or a medical record. The entire list of life insurance conditions is specified in the contract. The latter should be carefully studied and focus on significant points.

Insured events: list

There are a number of insurance cases, more often than others specified in the contract, regarding the safety of health and life:

- 1st and 2nd disability groups. The amount of coverage (partial or all) is indicated in the contract.

- Demise. The insurance company pays off the debt in full. As soon as the encumbrance on the property is lifted, the relatives are the heirs of the deceased.

- Temporarily lost ability to work. The period should not exceed 30 days. Debt compensation is due in proportion to the period of sick leave.

You should carefully read the terms and conditions specified in the contract. Specific wording does not allow for discrepancies and disputes, which means that compensation payments are guaranteed.

Situations when compensation is not due

In some cases, insurance compensation will not be provided if the following is present:

- suicide;

- the co-borrower is registered at a specialized dispensary and has AIDS or HIV;

- death or injury occurred while under the influence of drugs or alcohol;

- the death of a person occurred in an accident while driving without a driver's license;

- committing a crime proven in court.

Note. If a person is assigned a disability, he received compensation, and then died, payments in such a situation are not due. If a citizen conceals a general or occupational disease while filling out the form, the insurance company will also refuse.

Conclusion

The client does not always have to save on his life insurance if it concerns his life and health. The desire to save more by insuring yourself with an organization with the lowest rates can result in losses in the future. Consequently, during the occurrence of an insured event, the co-borrower may lose payments. Not every insurance company pays for insurance.

It is necessary to insure yourself in a reliable organization, so that you do not receive a refusal later. By the way, if you want to save on insurance, it makes sense to insure your health and life in one place, where there are more guarantees, and your property - with an insurance company that has lower rates.

https://www.youtube.com/watch?v=8bzFe7L_hks

Requirements for a co-borrower: list of documents, ways to confirm income

The list of documents and requirements for this person will differ in different institutions. As an example, let’s look at the conditions that apply at Sberbank.

At the time of loan application, the age of the mortgage co-borrower is at least 21 years. At the date of final repayment of the debt, the age does not exceed 75 years. If a housing loan is issued without confirmation of official employment or income, then the maximum age of the co-borrower at the time of making the last payment will be 65 years.

The co-borrower must work at the current place of work for at least 6 months. Over the past 5 years, his total work experience is at least 1 year.

The borrower can attract no more than 5 individuals as co-borrowers. The size of the loan issued is determined by the total amount of confirmed income of the main payer and all co-borrowers. The spouse of the main borrower must become a co-borrower, regardless of her or his employment, creditworthiness and age at the time of receiving the loan.

The spouse of the main payer automatically becomes the second owner of the purchased apartment if two conditions are met:

- husband and wife run a joint household;

- a marriage contract has not been drawn up between the spouses, which spells out the property rights of each of them.

Document requirements

To become a co-borrower, you must have Russian citizenship, fill out and submit an application for a housing loan. This is a special form that must be filled out by all participants in the transaction - the main payer, each of the co-borrowers, the mortgagor and the guarantor (if any). The application contains the following information:

- the role of the citizen in the upcoming transaction;

- client’s personal data (full name, date of birth);

- information about monthly income and expenses;

- contact information for communicating with the applicant;

- information about the employer, position held, length of service;

- permanent registration address and place of actual residence;

- data on the number of family members and minor children who are dependent on the citizen;

- information about real estate and vehicles owned by the client.

The package of documents for a mortgage co-borrower must include a passport with a registration stamp. You must also provide a second document used to confirm your identity. The applicant independently decides which additional document to present to bank employees. You can bring a driver's license, foreign passport, military ID, pension insurance certificate or other document.

Who will be refused?

The bank will not approve a mortgage loan if at least one participant in the transaction, including the co-borrower, is:

- member of a farm;

- individual entrepreneur;

- manager or chief accountant of a small enterprise employing less than 30 people;

- the owner of the enterprise in the case when his share of ownership, as a participant, exceeds 5%.

It is important for the co-borrower to provide papers that confirm his stable financial situation and employment. Bank employees will verify the client’s official employment if he provides a certified copy of the work book or an extract from it indicating information about previous places of work. To ensure the client’s stable financial situation, specialists need to familiarize themselves with a certificate of the citizen’s income received over the past six months.

The more co-borrowers agree to participate in a housing transaction, the greater the amount the financial institution will approve for the main borrower. Each of the co-borrowers will provide financial insurance. All loan repayment obligations will be distributed evenly among all parties to the transaction. There is a limit on the maximum number of co-borrowers. Typically, a financial institution allows you to connect no more than 5 participants with this status.

Important! Unlike mortgage guarantors, co-borrowers may have property rights to the property being purchased, that is, receive a certain benefit from the transaction.

If an object is acquired in common ownership with the title borrower, then the co-borrowers, along with the main borrower, are endowed with the same property rights. Being a guarantor is unprofitable and risky; this decision is not always justified . He bears financial responsibility for failure to comply with the conditions in the contract and cannot claim the apartment.

Recommended article: Changes in military mortgages in 2020

FAQ

Our legal agency often receives requests from readers who want advice on mortgages. Now we will answer 2 popular questions:

First question. Can a pensioner be a co-borrower on a mortgage?

Answer: Yes, some banks allow this option. But solvent pensioners who are officially employed and not just receiving pension payments from the state can play this role. There is also an age limit - it should not exceed 65 years for most banks. Sberbank allows a pensioner under 75 years of age to be a co-borrower, subject to confirmation of official employment and salary.

Second question. If the co-borrowers on the mortgage are parents who are not the owners of the property purchased on credit, can the bank require them to repay the housing loan?

Answer: Yes, the financial institution imposes equal obligations to repay the home loan on each participant. Representatives of the institution will definitely require parents to make monthly payments if the title payer does not fulfill loan obligations.

Important! If financial problems arise with the main borrower, not only the parents, but also the other co-borrowers listed in the bank agreement will be forced to pay the mortgage.

Requirements for co-borrowers on a mortgage

The degree of responsibility of the co-borrower under the agreement is no less than that of the main borrower, therefore banks check his solvency, quality of servicing the previous debt, level of income, integrity, etc.

The specific requirements depend on the lender's mortgage program. The general requirements are similar to those for the main borrower:

- Availability of Russian citizenship, permanent or temporary registration;

- Age from 20–21 to 55–60 years;

- Good level of solvency, there may be no requirement to provide certificates, but if possible, it is always better to provide them;

- Minimum experience of 3–6 months;

- Presence of positive CI.

Some credit institutions have restrictions on co-borrowers: they can only be employees, but not individual entrepreneurs, business owners with a share of more than 5%, managers, etc.

For example, the following conditions are stated in the Sberbank mortgage program:

Legal rights and obligations of a co-borrower

A co-borrower on a mortgage has the right to an apartment, provided that after taking out a housing loan, he becomes the owner of a share of the purchased property. His data is included in the purchase and sale agreement. Along with the main borrower, he is the buyer of the property. If the co-borrower has property rights, this will be stated in the mortgage agreement.

Let's consider what rights to an apartment a co-borrower under a mortgage will have after receiving a loan. The legal rights of a co-borrower under a mortgage for an apartment will appear if agreements are reached between the main borrower and this citizen regarding ownership of the apartment. They will need to enter into an agreement, the provisions of which will provide for the transfer of ownership of a part of the purchased housing to the co-borrower.

The obligations of the co-borrower are specified in the mortgage agreement. Before agreeing to participate in a transaction, this citizen needs to find out from a reliable information source what responsibility the co-borrower bears under the mortgage and what the consequences of violating obligations are. If he firmly knows his rights and obligations, this will protect him from inevitable financial expenses, loss of personal time and property.

Here are the basic rules:

- The co-borrower needs to pay off the mortgage loan debt if the financial situation of the title borrower has deteriorated and he is having problems servicing the mortgage.

- If the payment terms under the mortgage agreement are systematically violated, or the period of delay exceeds 3 months, then the bank can take away the apartment for debts.

- The collateral agreement may include a clause that the main payer, together with the co-borrower, must repay the mortgage every month, in equal shares.

The area of responsibility of the co-borrower for the mortgage is established by the financial institution in accordance with all regulations and rules established by the bank. There are three options for registering ownership of an apartment:

- The classic option is that the main borrower and his family become the owners of the home. This is the spouse and children born in an official marriage.

- To third parties - co-borrowers who are not related to each other.

- For co-borrowers who are each other's spouses, and their family members - children.

Housing purchased with a mortgage will be pledged to the lender until the borrowers repay the mortgage loan in full. Some home loan programs allow you to pledge either the property you are purchasing or real estate that is already owned by any of the parties to the transaction.

Who is a mortgage co-borrower?

A co-borrower under a mortgage agreement is a person who is jointly and severally liable, together with the main borrower, to the lender for repaying the debt. The bank has the right to make a demand for debt repayment against all borrowers under the agreement.

A co-borrower may or may not be the owner of a share of the purchased property, this does not reduce his responsibility to the lender. If the main borrower stops making payments on the loan, the co-borrower must do this under the agreement, and the bank does not need to find out the reasons for the non-payment of the debt by the first debtor.

The number of additional borrowers under a mortgage agreement can be up to 4 people, but more often banks accept 2-3 co-borrowers.

The need for additional borrowers arises in the following situations:

- If the mortgage is issued to a citizen who is officially married

. The second half necessarily becomes a co-borrower under the agreement. This is a legal requirement. Even if the apartment is registered as the property of one of the spouses, the share of the second spouse will be present, so he must bear joint responsibility for repaying the debt. The exception is the existence of a prenuptial agreement, which establishes a regime for separate ownership of real estate. - When the income of the spouses is not enough to obtain the loan amount necessary

to purchase a particular property, additional co-borrowers will be required. When calculating the maximum possible amount for a transaction, banks take into account the solvency of all its participants. Usually, relatives of borrowers who have sufficient income come to help.

There are situations when the purchased housing is registered in the name of a minor citizen. In this case, the co-borrowers under the agreement are solvent relatives (or other persons) who are able to pay the debt.

Is it possible for a co-borrower to repay the mortgage early?

The answer to the question of whether a co-borrower can repay the mortgage ahead of schedule must be sought in the property pledge agreement. When this condition is stated in plain text, there will be no problems with early repayment. Typically, only the main payer has the right to repay the mortgage early. He must personally visit the branch of the financial institution that issued the mortgage and make early repayment.

A co-borrower can repay a housing loan before the due date, subject to one condition: the main borrower has issued a general power of attorney for this participant with a notary. The organization does not have the right to refuse early repayment to a co-borrower who has presented this document. Paying off your mortgage early has its positive consequences:

- after taking into account the deposited amount, the monthly payment schedule will be revised by the credit institution, taking into account the deposited amount;

- the amount of principal owed on the mortgage loan being repaid will decrease.

Some banks will require the primary borrower to notify the lender of his intention to prepay a certain amount into the mortgage account. This must be done 30 days before the upcoming date. But the number of days may be different, it all depends on the conditions specified in the contract.

Early repayment is also possible without prior notice to the lender. Moreover, the borrower is allowed to deposit the required amount both at a bank branch and in a mobile application or using a remote service system. The following banks are among the organizations that provide this opportunity:

- PJSC VTB Bank;

- JSC Raiffeisenbank;

- PJSC Sberbank of Russia.

There are 2 options for early debt repayment: payment of part of the mortgage loan and full repayment of the debt. Even a person who has nothing to do with the housing loan will be able to transfer the amount of the current monthly loan payment to the account. To complete this task, he needs to know the details of the current account where the money will go, the number of the mortgage agreement, the last name, first name and patronymic of the main borrower.

Step-by-step guide on how to change mortgage co-borrower

We are often contacted by people who want to find out whether it is possible to change a co-borrower on a mortgage and how this procedure is performed. Yes, it is possible to replace one individual with another, but with the permission of the creditor. If the corresponding clause is included in the real estate pledge agreement, then there will be no problems.

To change the initial composition, the initial number of co-borrowers, or transfer the mortgage debt to another private person, you need to follow these steps:

Recommended article: List of mortgage insurance companies accredited by Sberbank

- Complete and prepare a package of documents and provide it to the lending manager. You need to contact the branch where the mortgage was issued.

- Write an application form and present it to credit managers.

- Document the employment of the parties to the transaction. You can provide a certificate in form 2-NDFL, a copy of a document confirming the employee’s length of service and employment. Salary clients will need to indicate in the application form the number of their card to which the salary is transferred.

- Provide title documents for the apartment purchased with a mortgage and the original loan agreement.

- Also present other documents that are related to the subject of the transaction. This is a purchase and sale agreement, a marriage contract, court orders or other papers.

The financial institution that issued the home loan acts as the collateral holder and has the right to approve or deny a change in the existing co-borrower. Not all financial institutions are ready to release the previous co-borrower from obligations and redirect his functions to another citizen.

It is permitted to remove the legal husband or wife of the title borrower from the list of debtors in two cases. The first situation is that the marriage between the spouses was dissolved in the registry office. The second case is when a husband and wife entered into a marriage contract, the terms of which determine the boundaries of their property rights.

In what cases can a mortgage borrower refuse insurance?

The issuance of a mortgage loan is accompanied by the offer of a whole set of policies to protect against a variety of risks: from loss or damage to the collateral (apartment, house) and termination or restriction of ownership of the collateral (title insurance) to loss of work, disability or death of the borrower. Of this entire list, only insurance of collateral property is required by law. It is impossible to refuse it. The purchase of other policies is a personal matter for the borrower. But there are nuances.

If you refuse insurance, the bank (if it is specified in the contract) has the right to revise the interest rate on the loan. The absence of a title insurance policy can cost the borrower 1-1.5 percentage points on the interest rate. If you cancel two types of insurance at once - life and title - the rate may increase by 8-10 percentage points.

What to do? On the one hand, in the case of a mortgage (the agreement, as a rule, is concluded for an average of 15-20 years), the borrower needs insurance. During this time, anything can happen, including health. Insurance is a guarantee that the loan will not have to be repaid to the borrower’s relatives: the balance of the debt and interest will be paid off by the insurance company.

In a situation with the purchase of housing on the secondary market, it makes sense to insure ownership of square meters. The policy will be useful if, for example, it turns out that during the sale of real estate the rights of the minor heirs of the former owner were violated, or if fraud is discovered and the purchase and sale agreement is terminated. The borrower will be left without housing, but with the need to repay the loan.

In the case of a mortgage, only insurance of the collateral property is required

On the other hand, mortgages are still expensive. Few people want to pay for insurance as well.

To save money, experts advise purchasing policies directly from insurance companies, rather than from banks (they sell products from several accredited insurers). Even if you have already entered into an insurance contract when applying for a loan, it can be canceled within 14 days (the so-called cooling-off period). After this, it is worth studying the offers available on the market and concluding an agreement with the insurance company that offers the most optimal option in terms of price and set of risks. A policy purchased in this way can cost 1.5-2 times cheaper than the one the bank sold you. Do not forget to take the insurance contract to your credit institution. There should be a mark indicating that you have insurance.

In September 2021, a rule will come into force that will allow borrowers to return part of the insurance if they repay the loan early. It will be possible to demand back the “unused” portion of the insurance within 14 days from the date of early repayment.

Withdrawal of the co-borrower from the mortgage agreement. Procedure

To stop being a co-borrower on a mortgage, you must obtain the consent of the lender. And this is not easy to do. Financial institutions are very reluctant to agree to the withdrawal of any of the parties to the transaction from the mortgage. The reasons are the need to perform a number of tasks at once:

- review the entire package of mortgage lending documents and make changes to this documentation;

- consider an appeal regarding the withdrawal of a transaction participant in a credit committee consisting of several bank employees, make an informed decision on this application;

- make current changes to the real estate pledge agreement in connection with new circumstances of the transaction;

- if necessary, draw up an addition to the mortgage agreement and register it in the manner established by law.

Instructions on how to get rid of co-borrowers on a mortgage cover several aspects at once. Each participant will need to draw up and submit to their creditor an appeal written according to a given sample. Applications may be submitted in free form.

In your application you need:

- indicate the number and date of execution of the current loan agreement;

- write the reason for the application - exit, change of party to the transaction or re-issuance of a certificate of ownership;

- report the circumstances that led to the need to contact a financial institution and change the terms of the current agreement.

In addition to a correctly completed application, the banking institution must provide a passport from each applicant, including the co-borrower withdrawn from the transaction. It is important to provide copies of passport pages and show documents to confirm the marital status of each participant. Specialists will not consider an application for the withdrawal of the debtor if each participant does not provide copies of his work record book, previously certified by the employer.

You can read more about the requirements for documents in the article: Requirements for documents for an online mortgage

To successfully exit your mortgage, you will need a certificate of income received over the past six months. It must be provided by all individuals named in the collateral agreement. If the financial institution agrees to consider the possibility of the debtor exiting the mortgage, a decision on the application will be made within 10 days.

Procedure after divorce

The procedure for the withdrawal of a co-borrower depends on the reason that prompted this decision. If the main payer has dissolved the marital relationship with his wife and wishes to remove his ex-wife from the loan agreement, then the following actions are necessary:

1. It is necessary to determine the regime of ownership and use of the collateral real estate in a documented manner. Can provide:

- decision of a judicial authority on the division of jointly acquired property;

- a marriage contract concluded by agreement of both parties;

- agreement on the division of property, drawn up by a notary.

2. It is required to calculate the total income of the remaining participants. It is important to make sure that its size will be sufficient so that the obligations under the mortgage agreement are fulfilled on time. If the total income of the borrowers is not enough to make the monthly scheduled payments, then the financial institution will require the introduction of a new solvent co-borrower who meets the requirements.

We also recommend that you read: How a mortgage is divided during a divorce - important points

How not to lose your home with a mortgage in a civil marriage

Nuances of obtaining a mortgage before marriage: division, maternal capital, judicial practice

Let's say the bank made a positive decision on the received request for the co-borrower to withdraw from the mortgage agreement. Then the change in the composition of participants will take place in several stages. First, the lender's representatives will draw up an additional agreement to the current agreement. In this document they will include information about the exclusion or replacement of the participant.

All parties will sign an additional agreement, a new mortgage on the apartment. At the next stage, you need to contact Rosreestr to register the changes made to the agreement. After the co-borrower exits or is replaced, mortgage participants will only have to reissue their mortgage insurance policies.

Rights and obligations

Before taking such a step, a person, be it a stranger or a close relative, should understand the full extent of responsibility that he assumes from the moment his signature appears on the mortgage agreement. Before confirming your agreement with the document, the agreement must be carefully studied, since it is the normative act that regulates the rights and obligations of the borrower for the entire duration of the transaction. Let's consider a standard package of contractual obligations:

- strictly fulfill all the clauses, requirements and conditions of this agreement, including the right of priority in making payments if there are several performers;

- timely make current payments to the bank account of a banking organization if the main debtor or persons in first place, for a number of reasons, are unable to make payments within the current schedule;

- sign an additional agreement between the debtor and the co-borrower - this is done only in situations where they are not close relatives.

Reference! Young families, who are often the main mortgage clients, should formally legalize their status before applying for a loan.

Along with the obligations, the mortgage co-borrower has the right:

- on the share of the real estate purchased in this way;

- formalize a voluntary renunciation of joint ownership of housing (while maintaining the full extent of your contractual obligations to repay the debt);

- upon divorce, insist on dividing the remaining amount of money between the two spouses;

- in the event that the debtor is unable to pay the loan, insist on a fair distribution of debt priority between all parties to the agreement on a monthly basis;

- receive a tax deduction in cash equivalent in a situation where all participants in the process are equal share owners of the apartment;

- refuse this status if he can find a full-fledged alternative.

Is it possible to transfer a mortgage to a co-borrower?

It is not uncommon for the title borrower to have serious problems servicing the mortgage. Making monthly payments becomes an unbearable burden on the budget. Then the optimal solution is to reissue the loan to another individual.

Is it possible to re-issue a mortgage to a co-borrower or is another borrower not specified in the agreement required? You can make either a co-borrower or another solvent citizen a new payer. A prerequisite is the consent of the creditor. If one of the co-borrowers becomes the main debtor, then a new participant must be attracted to fill the vacated place, who will fulfill his previous obligations.

What to do if a co-borrower fails to fulfill loan servicing obligations

Life circumstances can develop differently, so a situation often occurs when a co-borrower refuses to pay a mortgage, motivating his decision with arguments that seem reasonable to him. Problems arise if the main payer has problems servicing the loan, and the co-borrower also does not pay the mortgage due to various reasons, but he is an equal participant in the transaction.

Readers of our site are interested in whether a co-borrower can refuse a mortgage, what to do in this case. If a participant categorically refuses his obligations, then there are two options:

- Re-register ownership of the property, excluding from the ownership of the co-borrower who does not make payments. This must be done with the consent of the creditor. You will need to draw up an additional agreement to the mortgage agreement.

- Put the mortgaged apartment up for sale in order to fully repay the loan with the proceeds. To implement this plan, it is important to obtain the bank’s consent by contacting it in a timely manner.

Attention! When the main payer does not have the financial ability to service the loan, and the co-borrower refused to pay the mortgage, then these participants will be jointly and severally liable for failure to fulfill the requirements specified in the agreement.

The presence of overdue payments will be the factor that determines the bank's further actions. For a financial institution, it is not decisive whether the co-borrower pays for the mortgage or whether it is done by the main borrower appearing in the agreement. If obligations on the part of payers are not fulfilled, then the consequences are negative:

- fines and penalties are charged on the balance of the overdue debt;

- if calls from credit managers are ignored, the bank may contact a collection agency;

- the creditor will sue and take the apartment even if it is the only home, despite the presence of children registered in it.

When problem debt arises, the bank often makes demands for full early repayment of the loan to all its participants - the main payer, each of the co-borrowers. According to the bank, all parties become debtors.

In a situation where both the main borrower and the co-borrowers do not make payments, after 2-3 months the creditor will turn to the judicial authorities to restore their violated rights. He will take the mortgaged apartment and use the proceeds from the sale of the collateral property to pay off the debt.

Recommended article: What to do if you don’t have money to pay your mortgage

Real Estate Blog

Useful publications and instructions for using a competent shareholder

How to choose the right apartment in a new building?

Finishing from the developer: how to evaluate quality

What is included in the total area of the apartment

How to remake the layout to suit yourself if all the walls are load-bearing. Three examples

How to sell a mortgaged apartment: 3 popular schemes

What buyers of new buildings want

All developers All new buildings

Will the bank oblige the co-borrower to repay the loan if the title borrower dies?

A mortgage is a long-term loan that is issued for a term of up to 30 years. During the payment of the mortgage, various force majeure circumstances may occur to the parties to the transaction. The primary payer may lose his job, become seriously ill, or die. Let's consider whether the co-borrower pays the mortgage upon the death of the borrower and what obligations pass to the heirs of the deceased payer.

We recommend reading: Who pays the mortgage after the death of the borrower

Of course, after the death of the title borrower, mortgage debts are not written off; they will have to be repaid. Other people will have to repay the loan. There are three possible scenarios:

- The relatives of the deceased payer entered into an inheritance, then the obligation to pay the mortgage passes to them.

- If the deceased does not have heirs, or they did not declare their rights in due time, then the co-borrowers and guarantors who took part in the housing loan will have to pay the mortgage.

- The insurance company will pay part of the mortgage debt if the deceased borrower insured his life when taking out the mortgage, and the insured event meets the conditions.

If close relatives of the deceased borrower accepted the inheritance, then, due to the death of the main payer, the bank may meet halfway and offer them to restructure the mortgage. It is possible that the lender will provide a deferment in debt repayment, but banks rarely agree to such concessions. If the heirs do not make payments on time, the financial institution will go to court to collect the remaining amount of the debt.

Each of the co-borrowers will definitely have to pay the mortgage if the heirs of the real estate do not show up. In a situation where the borrower took out the mortgage alone, without involving co-borrowers and guarantors, and no one accepted the inheritance, the mortgaged apartment will become the property of the financial institution. The bank will sell the property at auction, and the debt will be repaid.

If the deceased borrower was legally married, then the obligations associated with repaying the remaining debt will pass to his wife. When several co-borrowers appear in an agreement, their rights are listed in such a document. Suppose the main borrower took out an insurance policy, and his sudden death was covered by the insured event. Then the co-borrowers will pay off their part of the debt. The remainder of the debt for the deceased borrower will be paid by the insurance company with which the agreement was concluded.

Rate the author

(

1 ratings, average: 5.00 out of 5)

Share on social networks

Author:

Mortgage specialist Maria Yurievna Sokhan

Date of publication August 17, 2019 August 17, 2019