Where can I get advice and services for collecting accounts receivable? What does a sample collection letter look like? When does foreclosure on receivables not occur?

Welcome to the popular online magazine “HeaterBeaver”! Expert in touch - Denis Kuderin.

The topic of the new publication is “Collection of accounts receivable.” The material will be useful to both beginners and experienced entrepreneurs, as well as anyone interested in the financial security of a business.

Read carefully: at the end of the article, an overview of the most competent companies in the Russian Federation involved in the collection of receivables will be given, and situations where it is impossible to repay such debts will be considered.

What is accounts receivable collection?

Before studying the process of collecting receivables, you should first understand the terminology.

Almost every business enterprise has accounts receivable. A debtor is a debtor who has not paid for supplies and services within the time limits specified in contracts and agreements.

Accounts receivable is the amount of debts not paid to the company for goods supplied or services provided.

The term “accounts receivable” itself refers to the accounting field, not the legal field. However, the collection of such debts is carried out by arbitration courts on the basis of the Civil and Arbitration Codes of the Russian Federation, as well as the Law on Enforcement Proceedings.

Debts arise for various reasons - the debtor’s reluctance to pay the amount established by the contract, the financial insolvency of the debtor, disputes between companies regarding mutual obligations.

Conditionally receivables are divided into several types:

- normal accounts receivable - a debt for which the payment period has not yet come;

- overdue - a debt for which the payment period has already passed;

- doubtful debt – a debt that is not paid on time and is not secured by a bank guarantee or collateral;

- bad debt, payment of which is impossible due to objective reasons.

If a company has significant receivables, this reduces asset turnover, negatively affects solvency indicators, which ultimately reduces its commercial efficiency and value.

For this reason, accounts receivable management issues are always relevant for businesses interested in commercial success.

Each enterprise has a Regulation on the collection of receivables. This document describes in detail the algorithm of actions of the legal department in the event of receivables, the procedure for writing off such debts from the balance sheet and other important points regarding working with counterparties.

The success of any operating business - be it a private bakery or a major factory producing household appliances - is associated with the prompt and timely liquidation of accounts receivable. Managing such debts is an important part of every company's financial management.

Fact

Every year, the total amount of receivables in the country is about 20% of all assets of medium and large businesses. Translated into money, this amounts to a colossal amount - more than 25 trillion rubles. Moreover, this figure is increasing every year.

Additional details can be found in the article “Collection of debts from legal entities.”

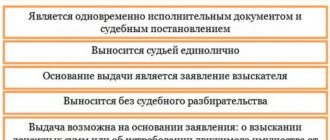

Collection of receivables from a legal entity within the framework of writ proceedings

Writ proceedings are the procedure for considering an application regarding the issuance of a court order, which is a judicial act issued by a single judge, acting as an executive document. In writ proceedings, only the documentation submitted by the claimant is examined. After studying these documents, a decision is made regarding the issuance of a court order, which can be applied for in the following cases:

- The basis for demands for collection of receivables from a legal entity is non-fulfillment or improper fulfillment of the terms of the contract. These requirements must be supported by documentation that establishes the monetary obligations recognized by the debtor. The size of these obligations should not exceed 400 thousand.

- The requirements are based on the notary’s undating of acceptance, non-acceptance and protest of the bill of exchange for payment. In this case, their size cannot be more than 400 thousand.

- Requirements have been made regarding the collection of sanctions and mandatory payments. Their size cannot be more than 100 thousand.

The documents provided must clearly demonstrate that the defendant undertakes to satisfy the demands placed on him. At the same time, there should be no legal dispute between the collector and the debtor regarding the collection of receivables.

What methods exist for collecting receivables - 4 main methods

Accounts receivable are collected both voluntarily and forcibly. In the first case, the parties independently, without involving third parties, agree to repay the debt and pay fines for late payments. Sometimes the affected company, in order to reward the debtor, writes off part of the sanctions.

Forced recovery is carried out through an arbitration court. In order for the judicial authorities to make a positive decision on the claim, the company must provide indisputable evidence of the debt.

To delve deeper into the topic, read the review article on our website “Debt Recovery”.

And now about each collection method in detail.

Method 1. Contract method

It is possible to agree on the repayment of overdue receivables only with a responsible and loyal counterparty. Statistics show that it is possible to repay debts without involving the court in only 60% of cases.

It happens that a counterparty simply forgets to pay debts or does not have time due to workload or inexperience of the company’s accounting department. In such situations, it is enough to present a written claim to the defaulter to initiate the payment procedure.

Sometimes even written reminders are not required - employees of the financial department simply call the debtor and remind them of the overdue payment.

Read an article on a related topic - “Pre-trial debt collection.”

Method 2. Debt recovery through court

Attempts to resolve a financial dispute without involving third parties do not always end in success. Sometimes the debtor refuses to repay the debt or does not have the available funds to do so.

In such cases, going to court is inevitable. If the debtor acknowledges the debt, a simplified procedure for legal proceedings is possible. The decision is made unilaterally, and the presence of the parties at the meetings is not necessary.

The workload on Russian arbitration courts is very high. In one day of work, a judge has to consider on average 3-5 cases related to non-fulfillment of debt obligations. It is easier and more profitable for judicial authorities to carry out simplified collection procedures than to conduct lengthy proceedings, but not everything depends on their preferences.

To quickly and correctly complete the case, the plaintiff needs to prepare for the trial in advance:

- collect evidence (work completion certificates, contracts, correspondence with the debtor, accounting documents, copies of claims against the debtor);

- prepare a claim;

- pay the state fee.

The result of a successful lawsuit is a writ of execution or an order for forced collection of debt. These documents are transferred either to the plaintiff or to the bailiff service.

Repayment through the court is a fairly effective way to collect debt. If you act wisely, you can recover not only debts and late fees, but also legal costs.

However, there are also negative aspects - the process takes a lot of time, and the enforcement stage of collection will take even more time. Even the most experienced bailiffs cannot guarantee an immediate return of funds after the court decision enters into force.

If you are in Moscow, lawyer Igor Yuryevich Noskov will ensure proper collection of receivables and protect the interests of entrepreneurs and companies that find themselves in a controversial or difficult situation.

If your problem is related to contracting, real estate, services, trade, financial obligations or bankruptcy , you have come to the right place.

“If you litigate, then win” is the principle that Igor Yuryevich follows in his work, and dozens of won cases speak for themselves.

Method 3. Attracting collectors

Collectors are more willing to work with overdue bank loans, but can also deal with receivables. Professionals have their own secrets for successful recovery of funds, but the downside is that agencies charge from 30 to 50% of the debt amount for their services.

For comparison: law firms prefer a fixed rate, which is several times less than the remuneration of collectors. In addition, recent changes in legislation have significantly limited the rights of professional collectors.

Their functions are limited in their legal essence to informing debtors and motivating them to fulfill their financial obligations. Psychological methods are still working with individuals, but they have almost no effect on legal entities.

Method 4. Contacting law enforcement agencies

This method involves the debtor committing some illegal actions - basically fraud of one kind or another.

Example

The organization enters into a contract for the supply of goods. The products are successfully shipped to the buyer, and a formal contract is drawn up.

After receiving the goods, the company disappears from the radar, and no payment is received from it to the accounts. Upon inspection, it turns out that the company’s management includes a dummy or fictitious person.

To avoid such situations, legal and financial departments of companies need to carefully study counterparties at the negotiation stage. It’s better to do business with proven and reliable partners with whom we have already established long-term and successful cooperation.

The table clearly shows the advantages of each method of collecting receivables:

| № | Debt collection method | Advantages |

| 1 | Contract method | Avoids legal costs |

| 2 | Arbitration court | High probability of refund |

| 3 | Collectors | Professionals take charge of debt recovery |

| 4 | Law enforcement | Will help return money to victims of scams and fraud |

A useful link on debt topics is “Debt Collection”.

How to collect a debt with the help of bailiffs

To collect a debt, one of the measures taken by the bailiff may be to suspend transactions on the debtor’s accounts. This paralyzes any operating company, and, as a rule, leads to 100% debt collection in a matter of days. Debtors are willing to pay to be allowed to continue working.

In addition, the bailiff can seize the debtor’s property, forcibly collect money from his debtors, seize cash from the cash register, etc. It’s worse if the debtor company (entrepreneur) does not work, there is no money in the accounts, there is no liquid property that can be seized and sell.

Photo from wordpress.com

Unfortunately, in such a situation, in the vast majority of cases, you can forget about returning the money. The only consolation is the opportunity to “put towards expenses” the amount of the unrepaid debt. This way you can reduce your income tax.

In practice, the percentage of actual execution of court decisions that have reached the stage of forced execution is quite high - on average 60-70%. Things are worse in Minsk and the Minsk region. These are the business centers of the country where, in principle, more companies are created and closed. This is also where most of the fly-by-night companies, as well as other owners, are concentrated. In Minsk, the percentage of actual execution of court decisions is much lower - 40%.

How receivables are collected - 7 main stages

On the one hand, returning receivables is a simpler procedure than collecting debt from individuals. Accounts receivable are usually documented and are relatively easy to prove.

However, in the case of mutual settlements between legal entities, we are usually talking about larger amounts than household debts. At the same time, debtor enterprises do not always have the “physical” opportunity to pay the plaintiff within the time frame established by the court decision.

Sometimes companies adhere to the policy of “not paying until the last minute” until the bailiff appears with a writ of execution in hand. Others are more accommodating, but they will also spoil your nerves before they settle the deal.

In order for the collection process to proceed with minimal losses, adhere to a well-functioning scheme of actions.

Stage 1. Monitoring of accounts receivable

First, you should conduct a preliminary analysis of the situation. Professional lawyers and financiers are always aware - at least in general terms - of why the counterparty develops debts. Having found out the reason for the delay, it is easier to choose the right course of action.

It is necessary to decide what tactics to choose - peaceful “friendly” negotiations, a dry official tone, pressure. If you already know that this company does not like to repay debts on time, you need to remind its representatives in advance about the receivables that have arisen in order to properly “prepare the client.”

Stage 2. Notification of the debtor

The creditor's side calls the debtor, writes letters, sends messages by pigeon mail and by any other means notifies the counterparty of the fact of the debt. The purpose of such reminders is to motivate the debtor and not allow him to calm down.

If a defaulter comes up with excuses, this is a sure sign that you should not expect an easy life. Prepare yourself psychologically for litigation and discard false hopes for a successful outcome.

Example

You politely notify the counterparty of the existence of a debt. For the first time, the defaulter makes the excuse that his accountant is ill. Then he says that he himself was let down by suppliers (buyers, transport companies, warehouse workers).

Then his computer breaks down or the bank closes for the holidays. All this indicates that you will have to take more drastic measures.

Stage 3. Preparing and sending an official letter to the debtor

We are writing an official complaint. This is an important document, so it must be drawn up strictly according to the rules. The claim is written not just “for show”; this paper gives the defaulter the last chance to “come to his senses” and pay off his debts peacefully.

If a claim is made by a lawyer experienced in debt matters, he must describe in detail what awaits the debtor in the event of failure to fulfill obligations. In addition, this document will be needed at the next stage of collection - when filing a claim.

The content must include the following information:

- amount of debt, interest and late fees;

- specific date for repayment of the debt;

- details of your company, which can be used to make payments;

- consequences of non-payment of debt.

The letter is drawn up in 2 copies, one of which is sent to the counterparty.

Stage 4. Drawing up a statement of claim for debt collection

If, 30 days after sending the claim, the receivables remain outstanding, we proceed to the next stage - we draw up a statement of claim for debt collection to go to court. It is advisable to entrust the preparation of this document to a professional lawyer.

The claim specifies the plaintiff’s demands, supported by a legal basis. It is imperative that the document reflects that all reasonable attempts have been made to resolve the financial dispute before trial. The claim is accompanied by: a copy of the claim, invoices for goods, documentary evidence of work and services performed.

See what a claim for collection of accounts receivable looks like.

Stage 5. Sending a notice of transfer of the case to court

The counterparty must be given a notice of transfer of the case to the court along with an offer to nevertheless pay off the debt and resolve the issue “amicably”. Perhaps the “last Chinese warning” will help resolve the issue out of court.

Stage 6. Transfer of documents to the bank’s legal department

Next, the documents are sent to the legal department. In addition to the statement of claim, confirmation of the plaintiff’s claims is needed - invoices, acts, invoices, payment documents, correspondence with the counterparty. You will also need a copy of the plaintiff’s registration as a legal entity and a payment order for payment of the state duty.

Stage 7. Conducting a court hearing

And the final stage is the trial. If an experienced lawyer representing the interests of the plaintiff takes on the case, the likelihood of a positive decision is quite high. Even the defendant’s failure to appear at the court hearing will not interfere if all evidence of the debt is presented to the court and the claim is filed in accordance with all the rules.

How to correctly file a claim for collection of accounts receivable for an arbitration court

It is very important to correctly draw up a statement of claim so that the court does not return it or leave it without moving to eliminate the shortcomings. To do this, it is necessary to comply with the requirements of Art. 125 of the APC on the form and content of the claim and indicate in it the following information:

- Name and address of the arbitration court to which the claim is filed.

- Names of organizations (plaintiff and defendant), information about individual entrepreneurs, registration or location address, telephone and fax numbers, email of the plaintiff. Write down the data according to the extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs by downloading it from the Federal Tax Service website.

- Requirements to the defendant on the merits of the dispute. Pay special attention to the correct wording of the requirements, since the court does not have the right to change them on its own, and incorrect requirements will become an obstacle to satisfying the claim in court. It is also necessary to provide a reference to the provisions of law that are to be applied to resolve the dispute.

- Factual circumstances that served as the basis for filing a claim in court. It is necessary to describe the essence of the dispute, indicating, for example, information about the conclusion of the contract, its performance by the plaintiff and failure to fulfill obligations to pay for services by the defendant. These circumstances are confirmed by specific evidence - documents attached to the claim.

- The cost of the claim, which consists of the amount of the principal debt, penalties, fines or penalties.

- Calculations of debt, penalties (interest and penalties).

- Information about the plaintiff’s compliance with the pre-trial procedure for resolving the dispute (about sending the claim to the counterparty, receiving the defendant and the response to it).

- Information about the measures that were previously taken by the arbitration court to secure the claim (for example, seizure of the debtor’s property, bank account, etc.). If they were not previously accepted, but you doubt that you will be able to collect the debt even after the demands are satisfied, then present such a demand simultaneously with the main one in the claim.

- List of attached documents.

- Signature and date. As a general rule, the plaintiff independently signs the claim. If the plaintiff is a legal entity, then the signature is affixed by the sole executive body (director, general director) or the person who has been granted such powers by proxy.

On a note. There is no need to file a large claim. The maximum is 7-9 pages, but 2-3 is recommended, since it is easier for the court to understand a more concise presentation of the case.

How to draw up a claim for a court of general jurisdiction, a magistrate judge

In form and content, the claim for collection of receivables must comply with the requirements of Art. 131 Code of Civil Procedure. It states:

- The name of the court in which the claim is filed.

- Information about the plaintiff: his full name or name, registration address or location (for legal entities), as well as information about the representative if he files a claim in court.

- Name of the defendant, his place of residence or location (for legal entities).

- The plaintiff’s demand, in which he explains what the violation of his rights, freedoms and legitimate interests is.

- The circumstances that justify these requirements, as well as the evidence supporting them.

- The price of the claim, as well as the calculation of the amounts to be collected from the debtor (calculation of receivables, interest for the use of other people's funds, penalties: penalties or fines provided for in the agreement).

- Evidence of compliance with the pre-trial procedure for resolving disputes in cases provided for by law. For example, the mandatory submission of a claim under a contract of carriage is provided for in Art. 797 Civil Code.

- List of documents attached to the claim.

On a note. Indicate in the claim the telephone, fax, and e-mail numbers of all persons involved in the case, and also state requests, for example, to call witnesses and apply interim measures.