What are accounts receivable?

Accounts receivable are the financial and commodity assets of a company working for the counterparty as a result of a transaction, agreement, etc.

The role of the counterparty can be buyers, contractors and other accountable persons. Accounts receivable relate to the company's property (its assets) and are subject to inventory, regardless of the maturity date. In simple words, the concept of a company's receivables is the amount of debt that has not yet been returned to the borrower for certain services or goods.

Here is an example of accounts receivable:

The MAX company specializes in the production of building mixtures. He has several debtors (debtors), these are companies that do not have the financial ability to pay for the goods immediately. The two parties enter into an agreement indicating the repayment period of the debt and all the nuances in case of non-fulfillment. Thus, without refusing a loan, he will receive economic profit in the future.

Back to contents

What is Accounts Receivable?

There are several objects that make up the usual structure of an organization's receivables:

- debts for goods supplied, work performed and services rendered;

- overpayment to the budget and extra-budgetary funds for taxes, duties, fees;

- debts on bills;

- debt of subsidiaries, branches, dependent companies;

- advance payments for future supplies or performance of services;

- other debts, for example, the debt of the founder, who contributed a share to the authorized capital not in full.

In general, in economic activity about 90% of debt is of the first type.

What is the difference between accounts receivable and accounts payable?

With accounts receivable, your company has debtors, and with accounts payable, you are the debtor. On the one hand, the absence of receivables indicates the company’s caution, since not all debtors ultimately have the opportunity to repay the debt. But even in this case, the company deprives itself of potential income from bona fide counterparties.

Regarding accounts payable, the same story, its high level indicates the company’s problems, and its absence demonstrates the success and payback of the business on its own. But since KZ is third-party capital, it would be foolish not to take advantage of the opportunity to develop at the expense of other people’s investments. It follows from this that it is not the presence itself that matters, but the volume and ratio of receivables and payables.

Back to contents

Rules and procedure for compilation

The rules and content of the application in connection with the dismissal of an employee or due to full repayment of the debt were set out in paragraph one of this article. If the circumstances of the return are different, provided for in Art. 46 Federal Law No. 229, then the reasoning part of the application indicates the paragraph of the article that served as the basis for the return.

Related article: Restoring the deadline for presenting a writ of execution for execution

Sample letter

As stated above, there are no special requirements and no statutory application form. Documents posted on the FSSP website are used as a sample for preparation, for example:

General Director _______________ /full name/

Chief accountant _______________ /full name/

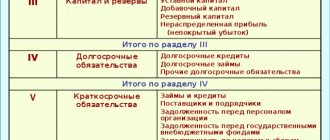

Types of accounts receivable

There are many criteria by which types of receivables can be classified, but we will turn to the main ones.

Depending on the repayment period:

Depending on receipt of payment:

To avoid serious consequences of non-payment of debt, firms create reserves for doubtful debts. The volume of reserves is approved individually, it all depends on the financial situation of the debtor and the likelihood of repayment of obligations. A provision for doubtful debts is established after an inventory has been taken.

Back to contents

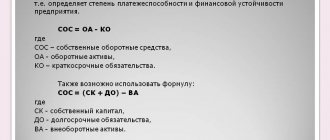

Accounts receivable calculation

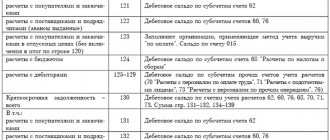

Accounts receivable are calculated not only when it is necessary to organize the process of managing it, but also when drawing up a balance sheet. There is no universal formula for calculating accounts receivable; each company does it differently, since the structure of accounts receivable may differ. To calculate debt, you need to collect information on all accounting accounts where it is listed, analyze the amount of debt, the number of debtors, and repayment periods. After this, the accounting department reconciles the amounts with counterparties and also identifies doubtful debts.

Enterprise accounts receivable management

There are often situations when an enterprise, in an effort to increase profits, begins to overload itself with debtors, which can ultimately lead to a large amount of unpaid debt and even bankruptcy of the enterprise. Smart managers pay great attention to the volume of debts and maintain strict accounts receivable records using various tools, such as Excel.

Accounts receivable management methods:

- Strengthening work with accounts receivable - collecting debts without resorting to the help of judicial authorities.

- Balance control and analysis of accounts payable and receivable.

- Motivation of sales department employees (regarding taking measures to ensure the fastest possible return of funds from debtors).

- Calculation of the real value of the property, taking into account the possibility of its sale.

- Creation of a sales system in which payments will be made regularly and guaranteed, for example, a system of discounts for punctual customers.

- Calculation of the maximum level of accounts receivable.

- Audit of losses from remote work (what profit the company could have received in case of instant payment and use of this money).

With proper control and management of receivables, an enterprise can protect itself as much as possible from the risks associated with non-payment of debts, decreased solvency and lack of working capital.

Back to contents

Accounts receivable forms

In addition to dividing by maturity, the debt of counterparties is classified according to the type of the latter.

Thus, debts can arise from the following counterparties:

- customers and buyers;

- budget and extra-budgetary funds;

- persons to whom finances are issued for reporting;

- employees who received loans from the company;

- employees who have outstanding debts for material damage caused;

- banks and other financial institutions that are in arrears in paying interest on deposit accounts.

Depending on the type of counterparties, receivables are also divided into the following forms:

- a commercial;

- administrative and economic.

A complete diagram of the types of receivables depending on counterparties can be seen in the figure below.

Commercial debt is directly related to the main activity of the lender. Its components:

- prepayments and advances to suppliers;

- deferment of payment for shipped products;

- overpayments for commercial purchases.

Non-commercial (or administrative-economic) receivables are understood as debt that is directly related to the financial costs of ensuring the operation of the company.

The above forms of receivables, in turn, are divided into two types, depending on the reasons for their occurrence:

- documentary;

- monetary

The first type is characterized by the fact that expenses are not covered by primary accounting documentation. The consequence is distortion of reporting - both accounting and tax, as well as excessive payment of taxes to the budget.

Cash receivable appears as a result of non-receipt of funds from counterparties and is a form of temporary diversion of working capital. The consequences are lost profits, illiquidity of an asset subsequently received from the counterparty.

The purchase of receivables is discussed in the article: purchase of receivables. Find out the cost of accounts receivable inventory services in this article.

Accounts receivable inventory

An inventory of accounts receivable is a reconciliation of documents with counterparties, confirmation of the existence of debt and its size. They carry out an inventory before an annual report, a change of chief accountant, during the liquidation or reorganization of an enterprise and in case of emergency situations, such as a fire.

The inventory is carried out on a certain date, the company sends data on the debt to its borrowers, and they must confirm or deny in writing the existence and amount of the debt. This is ideal, but in reality not everything is so smooth, firstly, inventory can take a lot of time, in some companies the indicators reach up to a month. Secondly, not all debtors respond to requests, especially those whose debt has been waiting for a long time to be repaid.

The next problem is resolving data inconsistencies; in this case, you have to reconcile all transactions performed with a given enterprise; this creates particular difficulty if the enterprise is located in another city or, even better, in another country. When sending a certificate of receivables, you need to take into account the fact that an enterprise can be both a debtor and a creditor at the same time. Even if, according to calculations, you turn out to be a debtor, you need to send a statement, indicating the amount of both receivables and payables.

After reconciliations, the company must draw up an inventory report; some set their own form template, or use a standard one, for example: .

Back to contents

The procedure for analyzing bank receivables

A bank's receivables are an integral part of its assets, which are determined by the specifics of its activities. At the same time, it is important for a banking institution that the size of accounts receivable corresponds to the volume of the bank’s current assets, as well as the volume of generated accounts payable.

Figure 1. Types of accounts receivable. Author24 - online exchange of student work

Finished works on a similar topic

- Coursework Bank debtors 460 rub.

- Abstract Bank debtors 270 rub.

- Test work Bank debtors 240 rub.

Receive completed work or advice from a specialist on your educational project Find out the cost

Definition 1

It follows from this that the analysis of a bank’s receivables is an integral part of a comprehensive analysis system that operates in a given banking institution, along with other areas of analysis.

Note 1

The purpose of analyzing the debt of bank debtors is to assess the quality of the generated debt and identify its effect on the general condition of the bank’s assets.

At the same time, during the analysis of accounts receivable, the following key tasks are solved:

- determination of the main and secondary composition of the bank’s debtors;

- assessment of the amount of debt of debtors in the total volume of banking assets;

- identifying the ratio of bank income to its receivables;

- division of receivables into classes (according to years of education) and long-term assessment from these positions;

- implementation of measures for settlements with bank debtors (mostly for items of overdue receivables);

- identifying the impact of accounts receivable on the liquidity of a banking institution and its financial condition as a whole;

- assessing the quality of receivables' debt by determining doubtful receivables in the total volume of debts, as well as by receivables turnover.

Need advice from a teacher in this subject area? Ask a question to the teacher and get an answer in 15 minutes! Ask a Question

Sources of information for conducting bank accounts receivables may be:

- turnover sheet for the accounting accounts of a banking organization;

- data on the balance sheet accounts of the bank’s assets “Settlements with debtors and creditors” and “Funds and property”;

- management and analytical accounting data for those types of debt of debtors that are presented in the context (main debtors, debt repayment terms and quality of debt of bank debtors).

Note 2

It should be noted that today there is no single method for analyzing bank receivables, so the options for conducting the analysis may be different.

Accounts receivable turnover

Accounts receivable turnover shows how quickly a company receives payment for goods and services sold.

The accounts receivable turnover ratio shows how effective measures the organization is taking to minimize debt. This metric quantifies how many times a firm has received payment during a period equal to the average outstanding balance from its customers.

*The average balance of accounts receivable is calculated as the amount of accounts receivable from customers according to the balance sheet at the beginning and end of the analyzed period, divided by 2.

Receivables turnover formula

Accounts receivable turnover period in days formula:

* DZ in days shows the number of days during which the debt remains unpaid.

As such, there is no norm for the turnover ratio; it will be different for each industry. But in any case, the higher the OPL, the better for the organization, this means that buyers quickly repay the debt.

Back to contents

The concept of accounts receivable

Accounts receivable is the economic profit of an organization for services provided, work performed, or goods shipped, which it will receive in the future under transactions or non-contractual obligations.

A debtor (debtor) is recognized as both an individual and a legal entity that has a debt to external counterparties (commercial organizations).

Thus, accounts receivable are a component of working capital, which increases as a result of economic relationships with both individuals and legal entities. This process may be legal in nature - it is a debt within a temporary period according to the terms of the contract.

Collection of accounts receivable

Any enterprise faces the problem of non-payment of accounts receivable. Of course, the buyer may have various valid reasons, but who cares? The company wants to recover its money for the goods provided.

Repayment of receivables can be carried out using different methods, for example, hiring the mafia, but if it is legal, then it is better to file a claim or contact the judicial authorities. If you decide to resolve the conflict amicably, you should send a complaint to the debtor to clearly explain your position and find out whether he has any reasonable objections.

When applying for collection of receivables, you must indicate the following points:

- Call

- Detailed calculation of the amount of debt incurred

- Interest calculation

- Debt repayment deadline

- Warning about going to court

In addition, the claim must be signed by an authorized person, and copies of all documents related to the debt must be attached. If the debtor received your letter (there must be evidence) and did not respond within the established time frame, then with a clear conscience you can go to court demanding the return of receivables.

Back to contents

How to write a letter to a bailiff?

If you submit an application to the bailiff for the calculation of alimony debt, which will indicate the details of the person who applied and nothing else, you will receive a formal response. Bailiffs are busy with current work; they will not look for V.V. Ivanov, on whom a court decision was made 2 years ago.

The response will require additional information, which is recommended to be provided immediately.

Before writing a letter, the applicant will need to find the number of the enforcement proceeding (IP) and the court decision . The first makes it easier to search for a case, the second is necessary to indicate in the application information about the writ of execution itself: on the basis of what court decision it was issued, what was indicated in it, the amount and procedure for payments.

Related article: Power of attorney to obtain a writ of execution: sample 2021

You can find out the number from any bailiff's order. This document states:

- IP number and date.

- FSSP officer involved in the case.

- Name and other details of the writ of execution.

Any of the parties to the proceedings or their representatives can submit an application to the bailiff for the calculation of alimony debt. The latter must have a notarized power of attorney.

Sample document

The submitted application conditionally consists of the following parts:

- Hats.

- Introductory.

- Basic.

- Motivational.

- Resolute.

This is the typical structure of a procedural document-appeal, be it a claim or a written complaint. There is no strict form provided, but the more the document resembles a well-drafted claim, the better the effect.

The bailiff immediately pays attention to the applicant’s approach and understands that the letter received can easily be transformed into a complaint to higher authorities or a lawsuit. This does not guarantee that the requirement or request will be fulfilled exactly or on time, but it increases the chances of success.

The header indicates the name of the territorial body of the FSSP, the address of its location, the surname, first name and patronymic of the applicant, place of registration and contact information. Each of the following parts takes 1-3 sentences. The introductory description describes the fact that the court made a decision and carried out enforcement proceedings.

Write-off of accounts receivable

By law, a debt is considered overdue if the statute of limitations on the debt has expired (3 years) and bad debt if the company is unable to pay the debt. On these grounds, the company has the right to write off the debt. The write-off of hopeless overdue receivables is permitted on the final day of the period in which the statute of limitations has passed.

There are two methods for writing off expired accounts receivable. The first is to use the reserve for doubtful debts for this purpose; if a reserve was not provided for this debt, then write it off as financial results. Postings for writing off accounts receivable must be carried out exclusively for each obligation separately. The reason for this may be the results of the inventory, written confirmation or an order from the head of the enterprise.

Sample order to write off accounts receivable: .

Writing off a bad debt is not an actual cancellation of the debt, therefore, for five years after the write-off, receivables are reflected in the balance sheet. And throughout the entire period, you need to monitor the financial condition of the debtor to see if he has the opportunity to repay the debt.

Back to contents

Accounts receivable accounting

The legislation of the Russian Federation does not provide for a separate legal act regulating the issues of accounting for receivables. It is conducted in accordance with existing accounting regulations, the accounting policies of the enterprise and established accounting practices.

According to IFRS, accounts receivable are accounted for in accordance with IFRS 9 “Financial Instruments”. Accounts receivable in the balance sheet are displayed as an asset and characterize the receipt of money into the organization's account in future periods. The difference in accounting between RAS and IFRS is presented in the table.

| Index | IFRS | RAS |

| Asset recognition criteria | Receipts are recognized if revenue can be measured reliably and there is a high probability of economic benefits being realized. | None |

| Recognition procedure | On the date of conclusion of the contract or settlement | On the date of product shipment |

| Assessment methods | Initially, the asset is measured at fair value, taking into account direct costs. Subsequently – at fair value | The assessment is determined by the terms of the contract |

| Reflection of accounts receivable on the balance sheet | In the current assets column | |

| Less bad debts | Less provision for doubtful debts | |

| Formation of a reserve for doubtful debts (RDD) | Determined by the management of the organization. The reserve is necessary to bring the asset to fair value | Calculated based on inventory results, formed only in relation to a specific debt |

| Purpose of inventory | Identification of overdue debts, carrying out measures on doubtful debts, confirmation of balance sheet data | Documentary evidence of the company's existing obligations to confirm the accuracy of the report |

Read about the company's current assets here. Due to the difference in the principles of recognition and reporting of receivables, the IFRS report and the RAS report will reflect different amounts of the debtor's debt. Plus, sometimes part of the receivables can be duplicated in non-current assets, further indicating its long-term nature. Below are the reports of PJSC LSR as of June 30, 2021 (millions and thousand rubles, respectively).

In the explanations to the statements you can find a more detailed breakdown of accounts receivable, which mainly falls on the company’s five largest debtors located in the Russian Federation:

At the reporting date, trade receivables were distributed by limitation period as follows:

Foreign companies do not have reporting under RAS. They report only according to IFRS, and the word “net” is used in the balance sheet when reflecting debtors’ debt, i.e. cleared of bad debts. For example, you can look at Apple's balance sheet from investing.com (millions of dollars)

In order to minimize the risk of non-repayment of debts from debtors and, as a consequence, the risk of loss, enterprises must create a financial reserve. According to tax accounting, it cannot be more than 10% of the revenue received for the reporting period.

The formation of the reserve is also influenced by the period of delay. It is not created if the period of delay in repaying the receivable is less than 45 days. If the delay is 45-90 days, then a reserve can be formed in the amount of 50% of the amount due. If over 90 days – 100% of the debt.

Sale and purchase of receivables

If you do not have the slightest desire to deal with debtors, but want to return the funds, you can sell the receivables, if there are persons who would be interested in this. Often these are people who themselves have a debt to the debtor. The company has the opportunity to buy receivables at a lower price, at a discount, so to speak, and then present documents to the debtor and demand repayment of the debt at full cost. To sell a debt, the debtor’s consent is not required; it will be enough to notify him of the sale of the debt.

Optimization of the enterprise sales system and minimizing risks in working with receivables and payables

How do accounts receivable appear?

When considering the reasons for the occurrence of receivables, it is necessary to clarify that there are debt obligations that are not realized quickly. For example, if an error occurred and excessive payments were made to government agencies (tax, pension fund, etc.), then it will not be possible to quickly return them; moreover, they will be credited to subsequent mandatory payments.

Often, the reasons for the occurrence of accounts receivable in enterprises with more than 100 employees are associated with debt payments to the enterprise’s employees. These calculations are made in parts, by deduction from wages. Thus, a full settlement with the employer may take several years.

The main reasons for the formation of receivables can include unfulfilled debt obligations of employees who left the enterprise, which will be considered irrecoverable (doubtful) amounts of money. Such debts also include payments on claims if the debt collection process has stopped at the stage of pre-trial dispute resolution, and the debtor is not going to pay the required amount.

In the last two cases, accounts receivable may be subject to write-off only after the expiration of the statute of limitations, on the days of the end of the next tax period. Now let's move on to the possibility of collecting the debt in question.

Debt payment letter templates

Claim for payment of debt under a supply agreement

Where: _______________________ __________________________________ __________________________________

"___" ___________ 202_g. Moscow

Seeing you as a valuable and promising partner, we are also pleased to express our satisfaction that our company’s products are represented in the trade assortment of your enterprise / in the wine list of your restaurant / …………./. We hope that you share our plans for long-term cooperation and, for our part, we will make every effort to create a stable and streamlined scheme of joint work. In order to avoid possible delays in deliveries due to your violation of the payment terms established in the contract, we ask you to make payment for the delivered goods on time. As of the date of the letter, the amount of the principal debt of your company to __________________ for the goods transferred to your disposal under invoice No. ______ dated “__”__________202__. is (_________________________________) rub.

____ kopecks, the payment deadline for which, taking into account a deferment of ___ calendar days, came on “__”__________202__.

We ask you to liquidate the resulting debt within days from the date of receipt of this letter.

Claim for debt under a service agreement

Seeing you as a valuable and promising partner, we are pleased to express our satisfaction with our cooperation. We hope that you share our long-term plans and, for our part, will make every effort to create a stable and streamlined scheme of joint work. To avoid possible delays in the provision of services by us due to your violation of the payment deadlines specified in the invoice, we ask you to make payments on time.

As of 03/21/2020, the amount of the principal debt of Industry LLC to Land LLC is 2,643.55 US dollars and 1,083.05 euros, the payment period of which, taking into account the indication in the invoices:

No. 219 of January 17, 2019 on the need to pay them within 2 banking days from the date of receipt, which was February 16, 2021. No. 220 of January 13, 2019 on the need to pay them within 2 banking days from the date of receipt, which was February 16, 2021. No. 416 dated February 28, 2019 on the need to pay them within 2 banking days from the date of receipt, which was February 16, 2021. No. 459 of 03/04/2019 on the need to pay them within 2 banking days from the date of receipt, which was February 16, 2021. No. 465 of 03/04/2019 on the need to pay them within 2 banking days from the date of receipt, which was February 16, 2021.

We ask you to eliminate the resulting debt.

Deputy General Director

Debt claim letter

Company Attention: (Director, Financial Director) Tel: Fax: Date

Re: unpaid bills

Dear Mr... Despite our numerous reminders, the bills listed below remain unpaid:

According to the decision made by the company's management, our company is suspending work with you, since the debt on these accounts has exceeded 45 days.

We remind you that the deadline for payment for work/services agreed upon in the contract has been violated, for which a penalty is payable. If funds do not arrive in our bank account within 3 banking days from the receipt of this request, we will claim a penalty for the entire period of the violation.

We also reserve the right to claim a penalty for late payment of previous invoices.

Cooperation between our companies will resume only after confirmation of full payment of the debt.

From now on, any work with your company will be carried out on an advance payment basis.

Information letter about the debt incurred.

Dear [recipient's name],

Related article: Inventory of property in the office: sample form 2021

According to the agreement No. [number] dated [date] concluded between LLC [name of the organization] (hereinafter referred to as the Customer) and LLC [name of the organization] (hereinafter referred to as the Contractor), work was performed on [name of the work] for the amount of [amount] rubles.

According to clause [number of clause, which indicates the period for full payment] of the contract, payment for work performed is made by the Customer within [number] banking days from the date of signing the certificate of completion, which was signed on [date]. However, the Customer violated the terms of the concluded Agreement, work performed was not paid on time.

As of [date], the Customer's debt is [amount] rubles.

Based on the above, guided by the norms of current legislation, we suggest that you, within [number] calendar days from the date of receipt of the claim, transfer the amount of debt to our current account No. [account number] in Bank [name] c/s [number], BIC [number] .

If our demands are not satisfied, we will be forced to apply to the Arbitration Court to forcefully collect the amount of the debt, with the accrual of penalties (according to clause [clause number] of the Agreement), as well as charging the costs of paying the state duty to your account.

Best regards, [Your name]

Letter of demand for payment of debt.

Last year and this year, promises of payment were repeatedly made to me personally, ——— Oh.. Since May 2021, we have assigned an individual manager who reminds me about payment on a daily basis and again in response there are only promises, i.e. Empty words not backed up by action.

Payment reminder letters were sent repeatedly and invoices were duplicated with other documents.

Based on the above, guided by the norms of current legislation, we suggest that you transfer the amount of debt to our bank account within 3 working days from the date of receipt of the claim.

If the payment requirements are not satisfied, we will be forced to apply to the Arbitration Court to forcefully collect the amount of the debt.

Notice of debt repayment.

I would like to remind you once again that by [date] we expect you to fully repay the debt under all contracts. If you are unable to do this, then arrange a meeting for us with your general director. I hope that you will agree to meet us halfway and will assist in the prompt payment of all our bills.