1+

Salary cards are a convenient tool for receiving payments from your employer. They significantly simplify the task of paying wages for the accounting department and make the process of receiving it more convenient for the employees themselves. But not everyone works in one place all their life. When changing jobs, a person inevitably faces the question of what to do with the salary card after dismissal. You can’t just put it on a shelf and forget it. This is a banking product serviced under certain conditions in accordance with the agreement and tariffs. A person will have to decide whether to continue using the previously received card or not and proceed further based on this. But a number of other nuances will need to be taken into account.

What to do with the card after dismissal

Often issued at the place of work without visiting a bank office. This is convenient for employees and the employer. But despite this, an agreement is concluded between the holder and the financial institution. It is the holder who decides what to do with the card after leaving the employer who issued it.

Cancellation

If it was used solely to receive a salary and is not needed for anything else, then the most correct thing to do is to cancel it completely. To do this, the owner needs to go to any office of the issuing bank with a passport and plastic card and write an application to close the card account. In the presence of the holder, bank specialists are required to cut the plastic. But the contract itself will usually be closed only after 30-45 days. Technically, cards allow deferred write-offs (for example, for car rental). The bank needs time to ensure that all transactions on the account are reflected correctly.

Advice. After closing the contract, it is recommended to obtain a certificate from the bank confirming the absence of unfulfilled obligations.

Blocking

You can block a salary card through online banking, by calling a call center or by contacting employees at a credit institution’s office. This is required in case of loss, theft of plastic or compromise of its data. Upon dismissal, blocking of the salary card is not required. If you still block the plastic, this will not affect the relationship with the bank in any way. In this case, the contract is not terminated; the opportunity to restore service by unblocking or re-issuing the card remains. If the tariff provides for a service fee, it will be debited in the general manner even if transactions are blocked.

How to apply for a Sberbank salary card and what to do with it after dismissal

The Sberbank salary card has become one of the most popular products. The convenience of plastic is obvious to both employers and employees. The main advantage was not only the absence of queues at the cash register on payday, but also the wide possibilities of the banking product.

The essence of the salary program is that the employing organization orders cards for all employees, after which wages are transferred to these accounts. Today, many small and medium-sized businesses and all government agencies operate using this technology.

Registration procedure

As a rule, the organization of issuing the card falls on the shoulders of the employer. The company becomes a participant in the salary project after signing an agreement on issuing personal plastic for the employee and crediting him with funds transferred from the employer’s account.

Salary cards are always debit cards; at the bank’s discretion, an “overdraft” loan can be issued on the account.

Plastic can be of the following types:

- Visa Electron;

- Visa Classic

- Maestro;

- Visa Gold;

- Visa Platinum;

- MasterCard.

The level of plastic is determined by the size of the enterprise, the position of the cardholder, and the size of his salary.

How long a card is made depends on the timing of data collection and submission by the employer. In practice, the production time rarely exceeds two weeks, after which each employee can receive their plastic at a bank branch. Sometimes delivery is carried out at the place of work.

Possibilities of plastic

For employees of enterprises who are holders of salary cards, Sberbank offers special conditions of service:

- Using a banking product, you can pay for goods and services both in Russia and abroad.

- The ability to use your personal account in the Sberbank Online system via a PC or mobile device. Through online services, you can check your account balance, track your salary receipts, and holders also have access to other features of the resource.

- Access to Mobile Banking.

- Bonus program "Thank you"

- Availability of special lending offers with minimum interest rates.

It is worth highlighting the bank’s loyal attitude towards salary card holders. Owners of plastic can count on quick consideration of loan applications, a greater likelihood of getting a loan approved, as well as a 0.5% discount when applying for a mortgage.

Service tariffs

The issuance and maintenance of a salary card for the holder is free of charge. A bank client can not only receive wages, but also deposit personal savings into the account.

There is no fee for cashing out unless the established limit is exceeded. The maximum amounts available for withdrawal depend on the card type.

You can find detailed information on the Sberbank website or in the documents received when applying for plastic.

The daily limit is formed based on the card level. For Maestro users this amount is 50,000 rubles, for premium plastic holders the tariff reaches 1,000,000 rubles. If there is a need to exceed the limit, you need to be prepared to charge a commission of 1.5-4%.

There is also a difference in which region the operation was performed. If the money was withdrawn from someone else's territorial bank of Sberbank, an additional fee is charged regardless of the amount and amounts to 0.75%. Therefore, if you decide to go on vacation, it is better to cash out some of the funds in advance.

When using ATMs of third-party institutions, for example, VTB24 or Alfa-Bank, the client will pay a commission of 1 - 4%. It is better to find out the exact cost of the service in advance by calling the hotline.

Actions of bailiffs

Late payments on loans and fines, late payment of alimony obligations or for housing and communal services can lead to account seizure. It is important to understand that this action is not carried out at the request of the bank, but by a court decision.

Bailiffs reserve the right not to report intentions to carry out the card blocking procedure. Most often, this becomes an unpleasant surprise for the plastic holder. To the question “do bailiffs have the right to withdraw money,” the answer is clear: they do. According to the law of the Russian Federation, no more than 50% of the amount contained in the account can be written off from a salary card.

Withdrawal of money to pay off the debt will be carried out automatically. The arrest is canceled within three days after the debt is completely closed. Without a court decision, such measures cannot be taken.

If the debtor's account contains an amount accumulated over several months, then the funds will be withdrawn in full of the debt or in the amount as close as possible.

If your salary card is blocked, the first thing you need to do is to understand the reasons. If you are arrested legally, you will have to pay the debt in any case. If you have doubts about the legality of the procedure, you need to submit an application to the executive service.

At the client’s request, a bank employee can print out a certificate indicating the name of the bailiff and the territorial authority.

What to do with the card after dismissal

When you change your workplace, you can terminate the contract with the bank by canceling the account into which the salary was received. But this is not at all necessary. By renewing the agreement with the bank, it is possible to transfer the plastic service from corporate to personal. In this case, the terms of use will also be changed.

How much annual maintenance will cost depends on the type of card and the established tariff plans. It is recommended to clearly define what plastic features you will need.

Thus, products from the “Classic” line of Visa/MasterCard systems are cheaper, they can be used to open a deposit, online payment, cashless payments in stores around the world, accrual of bonuses for the “Thank You” promotion and other services.

Premium plastic can be quite expensive, but it has higher limits for all transactions. If you plan to conduct transactions with large amounts, budget cards may not be profitable.

You can submit an application to transfer a card from salary status and order a new one via the Internet online.

The salary card has retained almost all the capabilities of traditional plastic. It cannot be converted to credit status, but users may be approved for an overdraft. Today, having a card helps to significantly save time on various operations to pay for services, which becomes another reason to transfer its status to personal.

Good to know:

Can an employer block

The employer cannot influence the functionality of the salary card of an employee (current or retired). The relationship between the bank and the plastic holder does not concern him in any way. In fact, the employer only provides assistance in obtaining the card when issuing it. Even if a conflict arises with a resigned employee, the employer cannot block the card that used to be a salary card or gain access to the money on it. Data on transactions carried out using plastic is also not available to him.

How to close a debit card

After receiving an answer to the question whether a debit card can be closed, the following appears: how to do this. If we talk about the procedure in general terms, then you just need to take an identity document and plastic, come to the branch and fill out the appropriate application. From the moment you contact the manager until the card is handed over to him for destruction, less than 15 minutes will pass.

It will take much longer to close the account. The procedure is carried out within 45 days after the client submits the application. This period is necessary to verify the absence of financial obligations. During these one and a half months, the client retains the right to withdraw the balance of money from the account through an ATM or cash desk (you must have a passport with you).

If the transfer is received into the account within 45 days, the client will still be able to receive it.

Tinkoff Black debit card

Apply online

You can check whether your card account has been closed at a branch of a credit institution. It is best to contact there in 1-2 months. At the same time, you can get a statement on the card.

Possible problems

Often, clients who did not close their salary cards after dismissal face various problems. They mainly concern the write-off of service fees. Even with a zero balance and blocked plastic, the bank will charge commissions in accordance with the agreement. But after dismissal, the former employer will no longer pay for them. These amounts will have to be paid by the client himself. If you do not repay the service fee debt for a long time, the debt can be very significant.

Another less common problem is the requirement to repay an overdraft. Banks usually provide it only during the period of the client’s participation in the salary project. After dismissal from a partner company, the credit institution has the right to close the limit and demand repayment of the debt in full, including all interest.

Sberbank salary card after dismissal

Modern employers are increasingly beginning to take part in such a service from Sberbank as a salary project. This direction has already shown and proven its effectiveness and benefit for both employers and employees themselves. Registration of salary cards from Sberbank takes little time and significantly saves enterprise resources.

And the employees themselves, becoming holders of salary plastic, receive a number of benefits from the bank, which become most relevant if they want to take out a loan. But is the Sberbank salary card returned after dismissal? What should I do with this plastic? Is it possible to keep it or should I definitely deactivate it?

The best solution would be to reissue the salary card into a regular debit card after the employee’s dismissal.

Salary card: its features and advantages

Often, all the hassle of ordering and issuing salary cards to employees falls on the shoulders of the employers themselves. Initially, the organization becomes a participant in the salary project, then draws up a separate agreement to receive and maintain a work card for its subordinates .

By default, all salary cards are issued as debit cards, but if the client wishes, such a card can be converted into a credit card with an overdraft.

Almost any Sberbank card can be used as a salary payment card. This plastic is available in the following types:

- Maestro;

- Visa-Gold;

- MasterCard;

- Visa-Classic;

- Visa-Electron;

- Visa-Platinum.

The management of the organization decides which work card to choose for its subordinates, based on the adopted policy and the size of its production. The employee’s position, length of service and salary are also taken into account. But, regardless of the type of card, each employee simultaneously receives the opportunity to use the special conditions offered by Sber. Namely:

- access to the Mobile Bank online service;

- opening deposits with higher interest rates;

- speed of payment for purchases of goods using non-cash payments;

- use of the multifunctional Sberbank-Online service;

- the opportunity to receive loans at preferential offers from Sberbank at reduced rates;

- SMS notification services that allow you to control the movement of money stored in the account;

- participation in the Thank You promotional program (receiving bonus points for non-cash purchases, accumulated cashbacks can subsequently be spent on part of the payment for the goods).

It is also worth noting Sberbank’s loyal, individual approach to clients and salary card holders. Such individuals can count on expedited consideration of loan applications and fairly high chances of loan approval . For current employees, receiving and servicing salary plastic is free.

Participation in the salary project brings many benefits to salary card holders

What to do with your work card after dismissal

As long as the person who owns such plastic is registered at the enterprise, no problems arise, but what to do with the Sberbank salary card after dismissal? For laid-off employees, there are two options:

- Cancel the card by completely closing the account to which it was linked.

- Keep the plastic for yourself, transferring it to the category of ordinary ones and continue to use it, but at the level of classic plastic.

After his dismissal, an employee’s salary card automatically becomes property and becomes personal. What to do with it in the future is decided by the holder himself.

Card cancellation

If a former employee is firmly convinced that the Sberbank card will no longer be useful to him, it should be deactivated.

This should be done, because upon dismissal, the free salary card becomes a regular card with an annual service fee. The bank tariff will depend on the type of plastic.

To carry out this procedure, follow these instructions:

- Visit a banking institution with a card and passport.

- Give the application and card to the Sberbank employee and make sure that the plastic is destroyed.

- Write an application to close the account to which the plastic was linked. This paper is compiled in any form.

- After the account is closed (this will happen within a month), you should visit the bank again and take a statement stating that the account has been cancelled.

- Reset your account in advance. You can do this yourself by withdrawing money from an ATM/terminal, or you can supplement the application with a request to transfer the cash balance to another savings account/card.

Blocking plastic

Some citizens, after settling with the organization, decide that the Sberbank salary card remains with them after the employee’s dismissal. Customers block the plastic and conveniently forget about it.

This should not be done, because a simple block only stops the validity of the card, but the account remains active, and the bank will subsequently charge the cost of servicing from it. If there is no money on the card, the holder will be fined.

And this can threaten the well-being of your credit history.

Blocking a card does not mean a complete refusal to service the account, for which the bank will continue to charge a commission

It is necessary to understand that cards are blocked in case of loss or theft, so that fraudsters cannot use the plastic card and reset the account.

If you are sure that a person will no longer use plastic, simple blocking is not enough. Complete closure of the savings account and cancellation and destruction of the card are required.

This procedure can only be carried out during a personal visit to the bank.

Is it possible to use a Sberbank salary card after dismissal?

This option is acceptable and is the most effective. Why waste plastic when it can also be effectively used as cashless payment . Of course, a number of benefits inherent in a salary card will go away. Namely:

- Free service.

- Benefits for lending and deposits.

But all the other numerous functions of the card will remain. To re-issue a banking agreement from corporate to personal, you need to visit the Sberbank office and write an application. This can also be done remotely, through your Sberbank Online personal account. But first, you should decide on the type of card in order to choose the optimal tariff for yourself.

In order to correctly decide on the type of card product, you should consider which features of the plastic will be useful. For example:

- Classic PS Mastercard and VISA cards. They are the cheapest in terms of tariff service costs. All the advantages and functionality are available to such plastic. In particular: online payments, cashless payments in markets (both in Russia and abroad). The user of such a card can use all the functions of online banking and receive cashbacks under the Thank You program.

- Premium class cards. It is worth knowing that servicing cards in this segment is quite expensive. But you also need to take into account that the plastic limits of this level will be increased. Premium cards are better suited for those clients who handle fairly large amounts of money.

It is also possible to submit an application for re-issuance of a salary card into a regular one through Sberbank Online. At the same time, the plastic will retain all the available capabilities of the classic one. It will not be possible to convert such a product into a credit card status, but if necessary, you can get an overdraft on it.

Having a plastic bank card makes people's lives much easier, helping them save effort on making payment transactions. And this is a significant reason to keep the work card and transfer it to the regular category.

When re-issuing a salary card into a regular one, the holder undertakes to independently pay for the annual maintenance

Nuances of plastic maintenance after dismissal

After settlement with the organization, the Sberbank client can continue to use his working plastic in the future.

But only after, based on the application, the bank transfers the salary card to regular, classic status. This means paying for plastic maintenance on your own every year.

All other existing privileges (except for preferential lending) remain with the holder of the working plastic at the same level.

An action such as blocking an employee’s card by an organization is illegal and impossible. The only thing an employer can and should do is to inform the banking organization about the dismissal of a certain employee who has a salary card. But the former subordinate can continue to use it, bearing the cost of maintenance himself.

Only the card holder or the banking organization can block a card (and not only a salary card). The reasons for blocking are usually situations such as:

- loss of plastic (at the client’s request);

- incorrectly specified PIN code (more than three times in a row);

- expiration of the validity period (occurs automatically);

- if there is suspicion of fraudulent activity on the card on the part of the holder himself;

- in the presence of credit debts, outstanding fines, alimony (by decision of bailiffs);

- when trying to cash out money at a self-service device equipped with a skimmer (device for reading confidential data);

- if any suspicious monetary transactions occur (for example, too large a one-time expense, atypical transfers, frequent cash withdrawals in small amounts, etc.).

If such a nuisance happens, you should prepare for long proceedings. After all, in this case it will not be possible to quickly return the plastic to working condition. And if it is blocked due to loss, expiration or compromise of the plastic, it will not be possible to unblock it. In this situation, the card must be reissued.

conclusions

What to do with a salary card after dismissal is up to the holder to decide. The optimal solution would be to re-register the plastic from the salary level to the classic one .

But the client also has the right to get rid of the card, although not by blocking it normally, but by going to the bank to cancel the account to which the salary card was linked.

Only in this case will the citizen save himself from future problems with suddenly arising debts.

Service details

The bank transfers the client to standard service rates 1-3 months after dismissal. It all depends on how quickly the employer informs him about the fact of termination of the employment relationship with a specific participant in the salary project. If the client wishes to continue using the plastic, he can pay for its maintenance on his own.

It is not always easy to understand on your own which tariff plan the service will be transferred to. It is better to clarify this point with the issuing bank. If desired, the client can receive a salary from the new employer on the old card by writing a corresponding application. But he will have to pay for the maintenance of the plastic himself, since the employing organization did not issue it as part of the salary project.

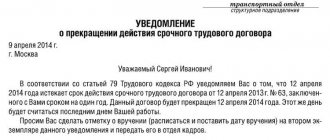

Bank notice of dismissal

After receiving the final payment, the bank is notified of the employee’s dismissal. The further fate of the salary project depends on the terms of the agreement between the business entity and the banking organization. The accountant is obliged to exclude the dismissed employee from the payroll and salary register, after which the bank may respond:

- Transferring the card to tariffs for individuals with automatic transfer of service costs. In particular, Sberbank does not require confirmation of the fact of dismissal, but transfers the card independently if funds are not transferred to the citizen by the employer within three months.

- Continued use of the salary tariff until the expiration date. A prerequisite is prepayment by the employer for cash management services.

- Termination of the card after the final payment of the wage fund. The accountant's notification is the basis for canceling the card account after withdrawal of funds due or transfer according to the citizen's documents.

A banking organization has the right to close an account if the client has not used it for two years (Article 859 of the Civil Code of the Russian Federation) or the amount of funds is below the limit established by the bank for a month. The bank can also reissue the card if the owner has not notified the credit institution of refusal to use it. The costs of re-registration are borne by the holder.

Advantages

Salary cards usually have the most favorable terms of service. They allow you to receive various privileges from the bank at no additional cost - increased cashback, free information about transactions, etc. By keeping the previously issued card, the client can usually keep most of the privileges provided.

The advantages of keeping a previously received salary card also include the ability to use online services and self-service devices with a familiar interface. Switching to service from another credit institution will inevitably lead to the need to get used to the new design of the application, online bank, etc.

How to close a debit card

After receiving an answer to the question whether a debit card can be closed, the following appears: how to do this. If we talk about the procedure in general terms, then you just need to take an identity document and plastic, come to the branch and fill out the appropriate application. From the moment you contact the manager until the card is handed over to him for destruction, less than 15 minutes will pass.

It will take much longer to close the account. The procedure is carried out within 45 days after the client submits the application. This period is necessary to verify the absence of financial obligations. During these one and a half months, the client retains the right to withdraw the balance of money from the account through an ATM or cash desk (you must have a passport with you).

Debit #Cashback card

Apply online

If the transfer is received into the account within 45 days, the client will still be able to receive it.

You can check whether your card account has been closed at a branch of a credit institution. It is best to contact there in 1-2 months. At the same time, you can get a statement on the card.

Flaws

The main disadvantage of continuing to use the old salary card is the need to pay for the service yourself. Employers often issue low-cost cards to save money. But you still need to clarify this information immediately after dismissal in order to avoid unnecessary expenses.

Another unpleasant moment is the uncertainty with overdraft. If it was available before, then in order to avoid unpleasant consequences it is better to close the debt immediately. Otherwise, the bank may close the limit at the most inopportune moment, and if it is simply not repaid, it will begin to forcefully demand repayment of the debt with all interest.

Does the card work after dismissal?

There are no separate provisions in the law requiring a salary card to be issued when applying for employment. The parties to the employment relationship independently choose the payment procedure, including the issuance of cash or crediting using the details provided by the employees. Another thing is that working with cash is more labor-intensive and costly, but a one-time deduction to the same bank that services the company is more profitable and simpler.

The only difficulty lies in the situation of dismissal, when the bank client stops receiving wages, and the bank revises the terms of cooperation. Now the responsibility to pay for annual or monthly maintenance falls on the individual for whom the account was opened upon employment.

There are no reasons to refuse a card due to leaving the company, and many continue to use plastic in daily payments. Since the owner of the plastic card and the linked account will be a citizen, and not an enterprise, he has the following powers:

- pay for purchases, including online payments;

- deposit and withdraw cash;

- use details for transfers and obtaining loans.

Closing the card is also included in the list of powers of the owner if the plastic is no longer needed.

Although the employer cannot close the card, he no longer makes regular payments for services. The card is excluded from the salary project and previously valid privileges are lost. The client has a choice - to continue working with the card, paying a service fee, or to submit an application to close the account and card.

If, after dismissal, a person forgets about the existence of the card, the bank will begin to write off funds from its balance as a service fee. As soon as the remaining balance does not allow you to make the next payment, it will be impossible to use it for payments.

Salary card

A salary card is usually called a special type of banking product issued under an agreement between the bank and a specific company. Such an agreement in the banking industry is called a salary project. This is a debit card with a set of standard functions, to which an overdraft service can be connected. It is to this that the organization transfers wages, bonuses, bonuses and other monetary rewards to its employees on a monthly basis.

In addition to the physical media, employees have the opportunity to use Internet banking services (if it is provided by the bank where the card is serviced). Using this service, it is easy to control all financial transactions and make remote payments.

A special feature of this type of bank accounts is that there are no fees for their use.

The commission is not charged only during the period while the card user works for a company that has signed a salary project with the bank. After dismissal, the free service period ceases to apply. A person has to either close it or pay for maintenance himself. Cards issued under the salary project serve as a kind of identifier for their owners. Bank employees are relieved of the obligation to issue a certificate confirming income, which is often required when applying for loans.

By concluding an agreement on the issue of salary cards with a particular company, the bank attracts potential clients who will be offered other services not included in the standard package of a debit salary card.

The hired employee, in turn, also receives certain benefits from its use. They consist in the convenience of receiving and using funds. There is no need to visit the accounting office to receive the money you are owed. They will be transferred within a strictly specified time frame, regardless of where the card owner is (at home, on vacation, on a business trip). You can also pay with money without any problems in any place where there is special equipment for working with debit cards.

A nice bonus of some salary cards is the possibility of overdraft. This service allows a person, if there is a lack of financial resources, to borrow them from the bank and then return them within a certain period. During this period, no interest is charged on the borrowed money.