Accounting

New edition of Art. 129 of the Labor Code of the Russian Federation Wages (employee remuneration) - remuneration for

Transport tax rates in the Moscow region For the year Name of the object of taxation Rate (rub.) for

Registered in the NRPA RB on December 14, 2011 N 5/34926 In order to ensure a uniform

Tax rate The standard rate is 20%. It is installed by default in the calculator. However

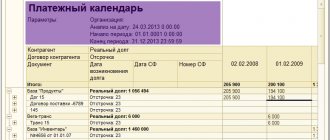

What is a cash flow budget and how to draw it up? The enterprise exists and receives

The cashier-operator must draw up a document that accompanies the closing of the cash register after the shift. This document is called

Salaried employees have the right to receive financial assistance for vacation pay. Dear readers! The article tells

Tax audits in 2020 - a list of organizations included by tax authorities in the visit schedule is contained

Material aid. What it is? There is no strict definition of the concept of “material assistance” by law. In general

To turn a hobby into a business, all you need is desire. For this business to succeed, you need to understand