Other

Order on imposing disciplinary sanctions and compensation for damage caused to the enterprise Name of organization ORDER ________________

Some time ago, the rules for submitting documents at the request of tax inspectors were adjusted, and in

Recovery of damages The amount of assessed damages during the performance of his work activities by the employee

Why do you need a termination agreement? How to compose it correctly? What are the consequences of imprisonment?

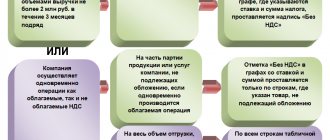

Writing off VAT that is not deductible in tax accounting There are some features of writing off VAT,

When carrying out certain transactions, companies have the right to declare the application of a 0 rate for tax on

What is this in accounting? According to PBU 9/99 “Income of the organization”, revenue is recognized as income from

To account for accrued insurance premiums in accounting. accounting, a special account is used - 69 “Calculations

This Personal Data Processing Policy (hereinafter referred to as the “Policy”) applies to information that the federal

Do I need an invoice if an individual entrepreneur works without VAT? In this case, the company will have to pay