Accounting

Kontur.Accounting is a web service for small businesses! Quick establishment of primary accounts, automatic calculation of taxes, sending reports

Grounds for additional tax assessment Explanations on the grounds for additional tax assessment can be found in the letter

document Notes. 1. When leaving for several points, notes on arrival and departure are made

All enterprises, including those under special tax regimes, must provide forms

Features of calculating average daily earnings upon dismissal Since the amount of payments for performing job duties

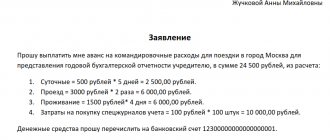

Introduction The economic activity of any enterprise is impossible without cash payments. Calculations are usually carried out

It is very important for young aspiring businessmen to know that even before registering their business

From your employees' salaries you withhold personal income tax or personal income tax - 13%,

Download sample documents: Sample appeal to the sponsor; Sample order for sponsorship; Sample

How to switch from USN 6 to USN 15 – Business Guide Quite a common occurrence