Other

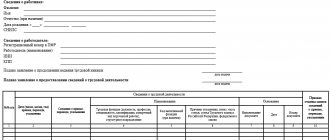

Insured persons are informed about the status of their individual personal account using the SZI-6 form. Let us remind you that

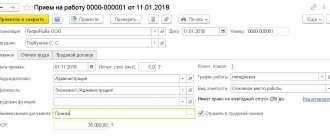

What to follow Art. 223 of the Tax Code of the Russian Federation - the day of receipt of income (in fact); Art. 226

Algorithm of actions if an employee refuses to sign a layoff notice in a difficult economic situation

Each company, in the course of its business activities, acquires various materials that are used in its work. Purchased

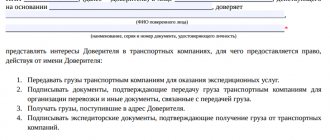

Who uses the paper? The key purpose of the paper is to confirm the expenses of an employee who, to perform his work

The report on sales of products (form SP-37) has been in use since 1997. Its compilation is

Tax laws are designed in such a way that if you are found guilty of a tax-related crime,

Certificate of work performed (services rendered) Form No. FPU-26 Report of identification of non-contractual consumption

3. If the amount of fixed insurance premiums paid by an individual entrepreneur exceeds or is equal to the amount of tax on

Total cost of equipment with VAT 65,150.00 Including VAT 18% 9,938.14