When is a fine imposed for lack of compulsory motor liability insurance?

The penalty for driving a vehicle without an insurance policy is prescribed in the provisions of the Administrative Legislation of the Russian Federation. The Code of Administrative Offenses provides for several types of fines for driving without compulsory motor liability insurance:

- Art. No. 12.37, paragraph 2 – imposes penalties for driving an uninsured vehicle. Fine – 800 rubles .

- Art. No. 12.2, paragraph 2, regulates the imposition of penalties when the driver does not have a policy with him. That is, the car is insured, but the insurance is forgotten at home (at work, in a different jacket, etc.). Fine – 500 rubles .

- Art. No. 12.37 clause 2. Under this article, a person driving a vehicle with an expired policy is subject to a fine. Insurance that has expired is automatically canceled. Therefore, de jure, driving with a stitched OSAGO is equivalent to driving an uninsured car. Fine – 800 rubles .

- Art. No. 12.37, paragraph 1. The punishment in this situation is imposed if the car is insured, the driver has a valid policy in his hands, but his name is not included . Fine – 500 rubles .

- Art. No. 12.37, paragraph 1. Provides for punishment if the owner of the car operates it during a period of time not specified in the policy. For example, the concluded contract specifies an operating period from May to October, and the driver gets behind the wheel in November or March. Fine – 500 rubles .

There is a separate issue about electronic compulsory motor liability insurance . Until recently, this area was not sufficiently regulated, and traffic police inspectors could impose fines for the driver not having a paper printout of the digital policy. This conflicted with the very meaning of the introduction of electronic insurance, when the UISAGO policy was declared to be a complete analogue of a document drawn up in paper format.

Since 2020, according to the decision of the Supreme Court, a driver can present electronic insurance in digital form . That is, all he needs to do is show it on the screen of his smartphone or tablet, and an insurance fine cannot be imposed in such a situation.

Is it possible to drive without compulsory motor insurance? And what to do if it is expired?

The Law “On Compulsory Insurance” stipulates several cases when a driver can drive without a valid motor third party liability insurance contract.

These include:

- Owning a vehicle with a maximum speed of 20 km/h;

- Owning vehicles that are not intended for driving on roads. For example, tracked vehicles.

- Driving a vehicle of the Armed Forces of the Russian Federation;

- The car owner has foreign citizenship and international car insurance.

In addition, it is acceptable to have no insurance for a recently purchased vehicle . In this case, the BCC obliges the driver to take out an insurance policy within 10 days after purchase. During this period, you are allowed to travel only with a purchase and sale agreement, so that traffic police officers can check the date of purchase of the car.

In all other cases, the car owner is required to carry an MTPL policy in paper or electronic format.

Previously, the Union of Insurers provided one month to conclude a new insurance contract after the expiration of the previous one. Now the rules have become stricter. The driver must issue a new MTPL policy in advance, since State Traffic Inspectorate employees have the right to issue a fine the very next day after the expiration of the old contract.

Some novice drivers are mistaken about insurance rules:

- They follow the old rules and take their time when applying for a policy.

- They transfer the car to third parties. As we mentioned above, the policy belongs to the driver, not the car. This means that such vehicle control is possible only with open insurance.

- In order to save money, they buy policies from unverified insurers. Almost always OSAGO in such cases is false.

We remind you that if you do not have insurance, the traffic police officer must issue you a fine. Any other sanctions are unauthorized.

When is it permissible to drive without insurance?

Federal Law No. 40, which requires the driver to have a motor vehicle liability policy, allows for a number of exceptions. You can drive on public roads without compulsory motor insurance in the following situations:

- The car was purchased less than 10 days ago. The law gives the new owner a 10-day period to purchase insurance, undergo diagnostics and register the car with the traffic police. When stopped by a traffic police inspector, it is enough for the driver to present a purchase agreement with a specified period for its conclusion in order to avoid a fine for lack of insurance. It should be taken into account that this provision does not relieve the car owner from financial liability if he or she commits an accident. But in the absence of compulsory motor liability insurance, he will have to compensate for the damage caused from his own funds.

- A number of vehicles listed in the law do not need to take out insurance. These are low-speed vehicles that reach a speed of no more than 20 km per hour, tracked vehicles, and vehicles belonging to the Armed Forces and equivalent departments.

In all other situations, self-propelled motor vehicles and cargo trailers must be insured in the MTPL system.

How can I appeal a fine?

According to the standards established in Chapter 30 of the Code of Administrative Offences, every car owner can try to appeal a fine imposed for driving on public roads without compulsory motor liability insurance. The vehicle owner must complete this procedural procedure within 10 days from the date of execution of the relevant resolution.

The process for appealing a foreclosure is as follows:

- To begin with, the car owner must decide which body should file a protest against the imposed financial penalty. The list of possible recipients includes senior employees of the State Traffic Inspectorate, specialists from district courts, as well as inspectors who were involved in issuing the resolution.

- Next, the citizen should pay attention to the time frame within which the relevant complaint will be considered. If the claim was addressed to the courts, you will have to wait about 2 months. Citizens who submitted an application to State Traffic Inspectorate employees can expect a decision in no more than 10 days.

- The next stage of protesting a material penalty is the review of the corresponding administrative offense. As part of the process, the authorized bodies establish the appearance, explain the rights of the parties, hear the accusation, etc.

- Based on the results of the complaint consideration process, a positive or negative verdict is made and announced. In accordance with the Code of Administrative Offenses, the applicant must receive a copy of the decision within 3 days from the completion of the paperwork.

You can view a claim suitable for starting the process of appealing a financial penalty for driving without an insurance policy using the link below.

complaints

Repeated fine for driving a vehicle without compulsory motor liability insurance

The legislation, while providing for the collection of fines for driving without insurance, does not establish the interval for their imposition. Theoretically, if the driver of an uninsured car was fined at one traffic police post, then nothing prevents employees of another post from imposing a similar penalty on him. It does not matter how much time passed between these two checks of driving documents - a day or 10 minutes.

Expert opinion

Maria Mirnaya

Insurance expert

OSAGO calculator

Even greater problems for violators of Federal Law No. 40 are threatened by the introduction of fines for compulsory motor liability insurance from video cameras. Theoretically, the owner of a car without compulsory motor liability insurance will be able to “collect” penalties for the same offense amounting to several thousand rubles in one trip around the city.

What is the fine if it is not included in the car owner's insurance?

When a car is driven by a driver who was not included in the insurance policy, the owner of the vehicle will be held administratively liable and must pay a fine of 500 rubles .

If, due to your occupation or for some other reason, your car may be driven by other people from time to time, it is better to change your insurance to indicate an unlimited number of people who are allowed to drive (the insurance will indicate “without restrictions”). In this case, you will safely avoid a fine for driving without insurance in someone else's car.

In any case, the person who got behind the wheel of your car will need to issue a power of attorney (in simple written form), indicating the date, duration of the power of attorney and specific rights (management, registration, etc.).

Fine for driving without an MTPL insurance policy in 2016

From January 1, 2021, the traffic police began to provide violating drivers with a 50% discount on a certain list of fines, provided that you pay them within 20 days .

Moreover, the benefits do not apply to fines for gross violations of traffic rules:

- Driving a vehicle while under the influence of alcohol or drugs;

- Repeatedly crossing the lane of oncoming traffic;

- repeated driving of a vehicle through a red traffic light;

- Causing harm to the health of victims during traffic accidents;

- Other socially dangerous actions when driving a vehicle.

The absence of an MTPL policy is not included in the list of violations for which the 50% discount does not apply. But first of all, you must understand that a car is, first and foremost, a vehicle of particularly high danger. A compulsory motor liability insurance policy is necessary in order to compensate for material damage that was caused to the life and health of the victim, as well as to protect the property interests of the injured persons due to your negligence.

Other penalties for lack of insurance

In 2021, only a fine is applied for driving without a compulsory motor liability insurance policy. Previously, traffic police officers could restrict the operation of a vehicle only because the driver did not have MTPL insurance. Currently, inspectors do not have the right to remove license plates from a car or order the evacuation of a car.

Note that in the case of a forgotten policy or when a person is not included in the insurance, the amount of the penalty is not too high compared to other articles. At the same time, you need to understand that there may be several administrative penalties, so the total amount to be paid can be quite significant.

At the same time, changes in administrative legislation on the possibility of paying half of the fine within 20 days also apply to Article 12.37 of the Code of Administrative Offenses of the Russian Federation (violations of compulsory insurance rules).

It is quite possible that in the near future the fine for lack of compulsory motor liability insurance will be increased to 2,500 rubles, for which amendments have already been drawn up in the Code of Administrative Offenses of the Russian Federation.

Fine for expired insurance in 2021

After digital technologies appeared, they are constantly used by various government bodies. This even affected fines imposed on motorists for not having a car insurance policy. At the moment, there is an active implementation of technologies for determining the presence or absence of a policy using the vehicle number using special stationary cameras. Such cameras have already been installed and operating in Moscow and the Moscow region.

In the coming 2021, government authorities plan to install such technologies in other regions of the country. So in 2021, you can receive a fine for lack of insurance not only from the inspector, but also from the cameras. If the violation was recorded on camera, then the fine will be sent by mail.

Perhaps the only way to avoid being fined for not having an insurance policy is to take out one. This not only provides protection from fines, but also guarantees liability insurance in the event of an accident.

In order to get acquainted with possible insurance rates and choose the best one, you need to use a special online calculator. He will make calculations for more than 15 companies and offer the best option.

To prove a motorist’s guilt in committing an administrative offense, traffic police representatives provide the court with materials that can be considered a compelling argument for a certain situation. Most often, the case involves photographic and video materials and testimony of witnesses. All documents collected regarding the case are submitted to the court.

For violations in which the insurance policy appears, all possible documents are also collected.

Attention! If we are talking about failure to provide an existing document on insurance, the traffic police inspector must provide, among other things, evidence that the violator’s insurance policy exists.

To do this, you can indicate the contract number and insurance company details. The manager's contact information will also serve as evidence. In such cases, the traffic police officer draws up an administrative protocol stating that the car owner does not comply with the requirements established for the insurance document.

Despite the need for the driver to have car insurance at all times, the law provides for some relaxations.

A 10-day period of driving without a MTPL document is allowed. A week and a half is given to the car owner after purchasing a vehicle to re-register the car: registration, registration of vehicle registration certificate and insurance.

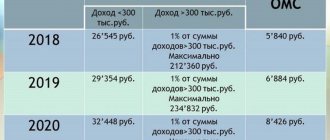

Insurance fine in 2021

Legislation has been in place for several years to encourage timely payment of most car fines. In 2021, the so-called “discount” for paying a fine during the first 20 days will continue to apply.

In this case, the fine for lack of insurance will be 400 rubles , and for an expired contract or errors in it - 250 rubles .

With the advent of digital technologies, they inevitably begin to be used by various government agencies. This also affected fines for lack of insurance. Last year, technologies for determining the availability of insurance policies using vehicle numbers using stationary cameras began working in Moscow and the Moscow region.

In 2021, the authorities promise to distribute the “new product” in other regions. Thus, now a fine for lack of MTPL insurance can be received not only directly from the inspector, but also by mail.

A pilot project to check, using automatic photo and video recording systems, whether a motorist has or does not have an issued auto insurance policy, was planned to be launched in Moscow and the Republic of Tatarstan from September 1, 2021.

However, the system did not work on the appointed date. The launch was postponed until November 1, 2021, but nothing happened on that day either.

There is no new information yet regarding when cameras will check MTPL policies in 2021, and decisions will be delivered by mail to violators.

Until November 15, 2014, such an administrative measure was used as a ban on the operation of a motor vehicle for the absence of compulsory motor insurance.

It consisted of removing the State License Plates (GRP) by a traffic police official (clause 144 of Order No. 185 of the Ministry of Internal Affairs of the Russian Federation dated March 2, 2009, which has now lost its legal force). The seized signs were stored in the territorial division of the traffic police.

Within 1 day, in a car without license plates, it was possible to get to the place where the reason for the prohibition of operation was eliminated (for example, to the insurer’s office in order to issue an MTPL policy). After 1 day, movement of the car without a road protection device was possible only with the help of another vehicle (for example, a tow truck).

In 2021, license plates will not be removed for lack of insurance, as well as for other traffic violations.

If you have a valid policy, but it was left at home or at work, you can count on a warning or a fine of 500 rubles. A monetary penalty is imposed if the inspector cannot confirm your words about the availability of insurance. These sanctions are regulated by Article 12.3 of the Code of Administrative Offenses (Part 2).

The law allows you to drive without an insurance policy only if you bought a new car less than 10 days ago.

This situation is fraught not only with a fine, but also with criminal liability. If you travel on knowingly forged documents, then you may face:

- Fine up to 80 thousand rubles.

- A fine in the amount of your salary for six months.

- 480 hours of correctional labor.

- Arrest for up to 6 months.

OSAGO is issued for 1 year, but the policyholder can reduce this period and save. This solution is actively used by summer residents who use their cars only from late spring to mid-autumn.

There is only one disadvantage of this program: if you go on a trip in winter, when the policy is not valid, then you will face a fine of 500 rubles.

Driving without insurance in Russia in 2021 will become more “transparent”: video cameras will monitor violators. The equipment will record the vehicles and then check if they are insured. Drivers who decide to save on compulsory motor liability insurance will receive letters indicating they will have to pay a fine.

The State Duma is also considering a bill that provides for a significant increase in sanctions for those who do not draw up an insurance contract at all. It is planned that the fine will be 5 thousand rubles (which is approximately equal to the cost of insurance). According to traffic police statistics, about 10% of motorists drive without an insurance certificate. If the bill is approved, then driving without insurance will no longer be profitable.

A fine for driving without insurance is nothing compared to the possibility of getting into an accident. If another car is damaged due to your fault, or harm is caused to a person’s health or life, you will have to pay for everything yourself. If the car is insured, then the insurance company will handle the payments: the maximum compensation for damage to property is 400 thousand rubles, and to health and life – 500 thousand rubles. Thus, the presence of compulsory motor liability insurance is a guarantee of your peace of mind and the safety of your budget.

Today you can get insurance even without visiting an office. Companies offer online purchasing. You need to provide personal data and information about the car, select a suitable insurance program and expect a document by email.

Drivers often refuse to purchase insurance for financial reasons. However, there are several ways to save:

- Choose the insurance company with the lowest base rate.

- Buy a certificate for a shorter period if you use the car temporarily.

- Drive carefully: if you have never had an accident during the year, then the Bonus-Malus coefficient will allow you to get a 5% discount.

- Take advantage of comprehensive insurance programs. Sometimes insurers offer a discount if the client takes out several policies at once and insures not only a car, but also an apartment, life, and health.

- Choose a car with average engine power. The more powerful the engine, the more expensive the policy. The recommendation is relevant for those who have not yet purchased a car.

- Indicate in the policy a specific list of persons who have the right to drive the car. If you select the “No restrictions” column, then the cost of the policy increases almost 2 times.

It is important to note that in the near future, receiving a fine for driving without compulsory motor liability insurance (in its complete absence) will become possible even if you were not stopped by an employee of the State Traffic Inspectorate. The fact is that in some regions of the country in 2021 (in particular, in Moscow), pilot projects have been launched to identify vehicles without insurance using traffic cameras.

In accordance with Law No. 196-FZ of December 10, 1995, the use of a vehicle without compulsory motor liability insurance is prohibited. And according to Article 4.1 of the Code of Administrative Offenses, there cannot be double liability for one administrative offense.

But you can receive a repeated fine for lack of compulsory motor liability insurance countless times during the day. This is allowed, since the new protocol will change the place and time of the administrative offense. That is, we will be talking about a new violation.

In conclusion, it should be noted that auto liability insurance is a mandatory type of insurance that allows you to compensate for possible material damage that you, as a motorist, can cause to the cars of other drivers.

Insurance companies recommend taking out open insurance for a reason: this way you can avoid many troubles. After all, the inspector will issue a fine if he does not see the name of the person who is driving on the insurance. The amount of the fine is the same as in the previous case ( 500 rubles

).

The fine will be issued even if the person included in the OSAGO policy is in the car as a passenger. However, his presence will help to avoid further troubles: after all, if no one who has the right to drive this vehicle is nearby, the car will be towed to the impound lot.

There is another way to avoid a fine for a driver who is not included in your insurance. If you anticipate a situation in which a stranger will have to get behind the wheel, draw up an agreement “On the free use of a vehicle” in advance. Such a document does not need to be registered, and its registration is free. At the right time, all you need to do is enter the details of the new driver into the printed contract: the paper will be valid for 10 days.

Some drivers ask what punishment they face for not having a compulsory motor liability insurance policy, in addition to a fine. There is no need to worry: the additional measure in the form of evacuation of the vehicle to an impound lot is not provided for by law. As we wrote above, the only situation in which a car can be seized is if the driver is not included in the insurance, and none of the persons authorized to drive this car are nearby (or are not arriving at the stop in the near future). This decision is logical, because traffic police officers cannot allow a person who is not included in the policy to continue driving: this means that it is necessary to transport the car to the parking lot until the circumstances are clarified and before the owner shows up.

Another sanction that is feared “for old times’ sake” is the removal of registration numbers (tantamount to a ban on the operation of the vehicle). In fact, this measure was canceled back in 2014, that is, neither in 2018 nor in 2021 you will face such a punishment.

Fined? You can drive further. But don't be surprised if you get stopped and fined again on the same day.

For a couple of years now, rumors have been circulating on the Internet that cameras on the roads record the driver’s lack of insurance, and you can get a fine even without communicating with a traffic police officer.

In 2021, not a single report of such a case appeared, and only in 2021 (from March 1) a fine for the lack of a policy began to be issued automatically. So now not only those who deliberately did not buy insurance are under attack, but also those who inadvertently purchased an invalid document from scammers.