To whom is it issued?

The FSIN pension is issued exclusively to citizens who have legal grounds for its registration and subsequent receipt.

A similar pension is issued to the following categories of recipients:

- Persons with at least twenty years of work experience in the penitentiary authorities.

- Subjects who received injuries and a degree of disability established by law during their active service.

- Subjects who completed military service in units of the Federal Penitentiary Service.

- Employees of the organization were dismissed from their jobs through staff reduction.

- Persons who received occupational diseases while serving in the Federal Penitentiary Service.

- Those who have reached the statutory retirement age.

- Subjects who, during their service in this organization, underwent specialized training in specialized universities.

- Other categories of persons legally entitled to receive such a pension.

Payments to employees of the Federal Penitentiary Service upon retirement, the person is insured

72. Employees, at their request, are paid monetary compensation for the next annual leave not used in the year of dismissal in full upon dismissal from service in institutions and bodies of the penal system on the following grounds: a) according to length of service giving the right to a pension; b) upon reaching the age limit; d) in connection with organizational and staffing measures (reduction of staff); e) in connection with a violation (non-fulfillment) of the terms of the contract by an authorized manager; For additional vacations not used in the year of dismissal, monetary compensation is paid in proportion to the period of service in the year of dismissal at the rate of 1/12 of the additional vacation for each full month of service. 73.

Tver, st. Vagzhanova, 19, room 201. Reception hours for pensioners of the penal system: Monday, Thursday: from 14:00 to 17:00, Wednesday: from 9:00 to 12:00; Tuesday, Friday – work with documents In January, payments and credits of military pensions to the personal accounts of pensioners are not made. Hotline number 8-800-301-17-77 (toll-free), when contacting in person, indicate the department - FSIN.

09 Jun 2021 uristlaw 306

Share this post

- Related Posts

- Collection by Bailiffs of Pledged Movable Property Sold by the Debtor

- Federal Law 491 of 2021

- Complaint about reclassification of the Article on an Administrative Offense

- How to Get Building Materials from the State for Free

Procedure

Thanks to the law, you can quit your job without completing your contract. The right to care at one's own request is enshrined in Article 80 of the Labor Code of the Russian Federation. Article 58 establishes one’s own desire as one of the grounds for terminating a contract. The whole process is regulated and standard:

- a report is filled out addressed to the head of the penal system facility;

- after processing, calculations are made;

- documents are issued and official property, including identification, is taken away.

Officers must notify management 30 days before actually leaving. The junior squad has a standard 2 weeks.

Dismissal has a standard type of process with writing a letter of resignation. In some cases, it is possible for officers to withhold compensation to pay for training. After graduating from a special educational institution, this category must serve a specified period. It all depends on the type of contract. It is worth considering that you can quit in any case.

The dismissal itself can be carried out either in the usual way or through an agreement.

Payments for uniform upon dismissal from the Federal Penitentiary Service in 2021

In what cases and how is compensation made for unused vacations during the year of dismissal: In addition to one’s own desire, there may be other grounds for dismissal from the ranks of the internal affairs department: The procedure for dismissal from the internal affairs department itself depends on the reason.

Dismissal from the Federal Penitentiary Service at your own request

When an employee under the age of 18 is laid off, dismissal can only take place with the consent of the relevant state labor inspectorate. If a company removes an employee who is on sick leave or vacation, its actions will be considered illegal. An exception is dismissal due to the liquidation of an organization or termination of the activities of an individual entrepreneur.

- After the court verdict comes into force.

- If the employee already has the necessary length of service to retire.

- After the end of service life.

- If for any reason a person becomes unfit for further service.

- Due to loss of confidence or deprivation of rank.

Before retiring, they write a report to pass the IVC. Dismissal will occur in accordance with the results of the commission. Employees are also sent to VVK to renew their contracts. You can refuse to undergo a commission during the period of dismissal. The report should indicate the reason for the refusal. As a rule, they limit themselves to the following wording: I refuse to undergo VVC, since I consider myself completely healthy. Passing the IVC when leaving the FSIN for retirement cannot be ignored .

Other grounds

The report is written at your own request addressed to the head of the unit in free form. The text is followed by a signature and date. The document must contain a reference to the current legislation, and it is also advisable to indicate the reason for writing the application. A document containing as much information as possible indicates the high qualifications and competence of its author.

- Kotp. – vacation compensation;

- DG – employee’s income for the year, including salary, bonuses and allowances;

- 12 – number of months in a year;

- 29.3 – average monthly number of days accepted for calculations according to the Labor Code of the Russian Federation;

- Nod – unused vacation days.

This is interesting: How to get a labor veteran in St. Petersburg today without awards in 2021

IMPORTANT INFORMATION! If an employee’s absence from work on the last day is caused by a health condition, which is documented, then, firstly, the deadline for dismissal will be extended until the employee leaves sick leave, and secondly, compensation for temporary disability will be added to the mandatory payments.

Calculation for unused vacation days

- if an employee goes on leave (paid or administrative) before dismissal, after which he will no longer return to work, then the calculation must be made before the vacation, that is, on the last day when the employee will be present at the workplace;

- if the employee does not show up for work on the day specified in the order, then in order to receive payments he will need to contact the accounting department with a request, and the next day he will receive all the funds due to him;

- if in a company salary and other payments are credited to the card through a bank, then the calculation must be made on the day of dismissal indicated in the order, regardless of whether the person being dismissed is at work or not.

However, if the company in which a person worked is liquidated, then, in fact, there is no one to pay him money. At the end of last year, the Constitutional Court of the Russian Federation recognized the deprivation of an employee of the opportunity to receive payments due to him as illegal, and ordered the Ministry of Labor to correct this legislative injustice. The new bill appeared precisely for this purpose: it does not allow the employer to liquidate until it has paid off all its employees.

Conditions

The conditions for assigning pension benefits to employees of the Federal Penitentiary Service are established as follows:

- an employee of the organization must be of the legal age for such a pension to be accrued to him;

- length of service is required, which is recognized as sufficient for the calculation and accrual of such a pension;

- an application is submitted according to the form for calculation of the FSIN pension and its subsequent payment to recipients;

- it is necessary to provide all the documents necessary to calculate the pension and accrue it to the employee;

- pension payments are carried out according to a specially approved schedule in compliance with the payment procedure;

- It is necessary to have continuous work experience in the FSIN system in order to assign a long-service pension to a former employee;

- pension calculation is carried out immediately after the recipient provides all the data that is requested from him to perform this operation;

- the procedure for calculating pensions and its frequency are stipulated by the basic conditions for paying pensions to employees;

- documents submitted for consideration by employees of the organization for the accrual of their pensions are considered within ten working days;

- additional benefits are established for employees when they receive a similar pension.

Looking for an answer to the question -

how to calculate the individual pension coefficient

? Then you should read the information provided at the link.

If you are interested in the question of whether pensions will be paid to working military pensioners, then we advise you to read the article.

Peculiarities

There are a number of nuances that differ from regular dismissal. This is due to the nature of the service. Peculiarities:

- During the contract, the employee is provided with clothing and material support, that is, upon leaving, they will withhold money for the uniform if it was received in accordance with the schedule;

- official property of any type is handed over for inventory, including identification and service weapons, if available;

- Only officers write a report before the application; other categories with a fixed-term contract fill out a standard resignation letter;

- dismissal at will occurs in accordance with the Civil Code, therefore the employer does not have the right to refuse or retain an employee;

- if there is any material support, it is terminated.

Payment for training upon dismissal is possible only if the clause is specified in the contract.

Payments upon reduction of staff of the Federal Penitentiary Service

When leaving due to redundancy, is a pension from the Federal Pension Service entitled to housing? When I was dismissed due to staff reduction, I was not paid the benefits due on the day of my dismissal. Lawyer's answer to the question: Let me start with the fact that if you know of vacancies that could have been offered to you, but were not, you have the right to try to appeal in court dismissal order.

What are the payments for redundancy?

Far North? Lawyer's answer to the question: If you are dismissed due to staff reduction, having worked for 2 months after receiving a notice of dismissal letter of happiness, what is the period of payment according to the certificate of average earnings? All issues related to the termination of an employment contract on the basis of paragraph 2, part 1 of Article 81 of the Labor Code of the Russian Federation, hereinafter referred to as the Labor Code, are regulated by Articles 81. 2, part 1, article 81 of the Labor Code, this does not mean that you will be dismissed due to reduction exactly 2 months after such notification, since the employer has the right in this case to terminate the employment contract with the employee both 2 months after the written notice, and after 3 month, and after 5 months.

Calculation

The calculation of the FSIN pension is carried out in accordance with the established procedure for such calculations.

The procedure for calculating the FSIN pension includes the following immediate steps:

- Submission of an application by an employee retiring from service with a request to calculate his FSIN pension.

- Providing all documents that, in accordance with the current legislation in the country, give the right to calculate such pension accruals.

- Clearly establishing a citizen’s length of service in the authorities, which is required to calculate his pension.

- The purpose of the calculation coefficient, which is used to calculate the pension in each individual case.

- The pension calculation is carried out individually in each specific case when all calculation parameters are established.

- The calculation results are provided to the pension recipient in a report specially prepared for him.

Documentation

Upon resignation, you will need to write a statement using the standard form. For certain categories of employees, a report addressed to the boss is also required. A sample report can be found on the official website of the FSIN or UIS. It is updated every year.

The report is necessary to notify management and find a replacement for the person leaving.

All documents are processed on the last working day. Property can be transferred for inventory earlier. After submitting all certificates and documents to the HR department, the calculation and issuance of a labor report indicating the reason for dismissal is carried out.

The list of documents required to receive a FSIN pension should look like this:

- Application for calculation of such a pension and its issuance to the employee.

- Passport of the pension recipient.

- Work record book of a FSIN employee indicating whether he has the required work experience.

- Individual code for registering an employee with the tax control authorities.

- Evidence that the recipient has a disability group, if this circumstance is taken into account when assigning a pension.

- Federal Penitentiary Service employee ID.

Reporting to the Pension Fund

A reporting form has been developed necessary to reflect accruals and pension savings - SZV-STAZH. Since 2021, all forms of enterprises have been required to submit this type of reporting for their employees. When a pensioner is dismissed, the SZV-length of service includes complete data about the working employee.

To fill them out, you need to take into account insurance premiums and personal data of the pensioner:

- type;

- information about the pensioner (SNILS, INN, passport details);

- in the reporting period, indicate the year in which retirement occurs;

- indicate how much time was worked before retirement;

- o or “no” in the column: whether deductions were made for the working employee.

Important! The accountant is obliged, together with SZV-STAZH, to provide a reporting form to the Pension Fund of the Russian Federation using the EDV-1 form. It reflects complete information about the employer.

If desired, each employee upon dismissal upon reaching retirement age can be issued a reporting form to the Pension Fund of Russia SZV-STAZH. This is an innovation that is just being introduced. Mandatory issuance of a reporting form will be an additional stage in the dismissal of a pensioner. In addition, the employer informs the territorial authority of the list of people retiring in 2021, doing this in advance.

In case of a financially responsible position, before dismissal it is necessary to go through the procedure of transfer of valuables. This stage, if necessary, will help the citizen to report a shortage if it is discovered. The dismissal of a financially responsible person is otherwise no different from terminating a contract with an ordinary employee.

After writing the application, the pensioner according to the rule must work for 2 weeks. At this time, the transfer of material assets takes place. A special commission is created that maintains an inventory of items, logging the necessary data. The transfer of valuables is subject to signature. If the employer does not have time to withdraw the property within the specified time frame, the pensioner is dismissed without his consent.

Important! Article of the Labor Code No. 232 of the Russian Federation states that if a shortage is identified after the dismissal of an employee, he may be required to pay the debt or reimburse property.

Employees of the Federal Penitentiary Service have preferential rights. They retire based on length of service or disability.

To resign, you must follow the legal procedure:

- drawing up a report on dismissal;

- passing the military examination upon dismissal from the Federal Penitentiary Service;

- issuance of an order;

- familiarization with the order;

- settlement with the employee.

Important! If medical personnel discover serious health problems upon dismissal, a preferential disability exit may be issued.

Many employees do not know where to apply. This is dealt with directly by the head or office of a part of the organization.

The retirement age required for successful calculations of pensions for employees of the FSIN system is established by law and practically does not differ from the age determined for all categories of recipients.

The retirement age for FSIN employees is set at 60 years for men and 55 years for female pension recipients.

At the same time, it is possible to change the time frame of pension recipients when they go to provide for an earlier appointed period due to an injury or disability group.

What cash payments am I entitled to upon dismissal due to staff reduction at the Federal Penitentiary Service?

For example, the company employs 12 drivers. As a result of optimization and outsourcing of a certain amount of transportation, 4 drivers become unnecessary and are fired due to reduction in numbers. After some time, management comes to the conclusion that it would be advisable to outsource all transportation. An order is issued to reduce the driver's position, resulting in the dismissal of the remaining 8 employees.

As stated above, the abbreviation may vary. It concerns changes in numbers or staff, the differences between which are fundamental. In the first case, the number of personnel is abolished, while the job unit itself remains on the staffing table . If there is a reduction in a position, then all employees who were hired for it are fired.

Art. 178 of the Labor Code of the Russian Federation Upon termination of an employment contract due to the liquidation of an organization (clause 1 of part one of Article 81 of this Code) or a reduction in the number or staff of the organization’s employees (clause 2 of part one of Article 81 of this Code), the dismissed employee is paid severance pay in the amount of average monthly earnings, and he also retains the average monthly salary for the period of employment, but not more than two months from the date of dismissal (including severance pay).

In our article today, we will look at who may be affected by staff reductions, who cannot be laid off, and also find out what the compensation is for dismissal due to staff reductions in 2021. In 2018, there will be a reduction in funding for budgetary organizations, which means that public sector employees may be at risk. These include: A difficult situation has developed in the domestic automobile industry and the banking sector.

29. In cases of transfer to a lower position due to organizational and staffing events or for health reasons, employees with 15 or more years of service (in calendar terms) retain the amount of the official salary for the previously filled position.

For regular annual leave unused in the year of dismissal, monetary compensation is paid: to employees dismissed from service on the grounds provided for in paragraphs “b”, “c”, “f”, “g”, “h” of Article 58 of the Regulations - for the entire vacation due in the year of dismissal; (Order of the Ministry of Justice of the Russian Federation dated 06.06.2005 No. 76)

We recommend reading: Benefits for a third child in 2021 Volgograd

At the same time, there is no need to issue a separate order for its payment - the decision on this can be included in the main order for reduction or not indicated anywhere at all. To make all payments and settlements with the employee, the employer is given a certain time frame - he must do this on the day of his dismissal.

Severance pay is one of the guaranteed compensations that all laid-off workers are entitled to receive. The amount is calculated on the basis of the employee’s average daily earnings, however, internal regulations may set its value at a larger amount.

Dismissal from the Federal Penitentiary Service

As practice shows, quitting during a valid contract is extremely problematic and costly. This carries both monetary and moral costs. In order to resign from this structure, there must be compelling reasons. The legislation identifies the following reasons that may be grounds for dismissal:

- Inconsistency with the position held, in which an employee with a higher education does not have the opportunity to fully apply his knowledge.

- Low wages and, as a result, the inability to provide financially for yourself and your family.

- Reasons for dismissal may include family circumstances. For example, caring for a sick relative or child. Both men and women can take advantage of this opportunity.

- If an employee needs to care for elderly parents.

- Women take maternity leave.

All of the above reasons are quite compelling and can become a reason for termination of service. Separately, it should be noted that the dismissal was due to health reasons. Sometimes an employee is unable to perform the duties of his position. In such cases, he may be offered another job.

Diseases that are an obstacle to further service include: mental disorders, open tuberculosis, malignant tumors, diseases of the hematopoietic and musculoskeletal systems. As well as AIDS and cardiovascular diseases.

At will

If a contract employee quits of his own free will and has not had time to complete his service contract, then he is obliged to compensate the state money spent on his training. In the event of martial law or emergency situations, the contract will be automatically terminated.

The employee must notify his superiors 2 weeks before the expected date. If the reason for stopping work is study or retirement age, then the employment contract is terminated on the day the report is submitted.

Before retiring, they write a report to pass the IVC. Dismissal will occur in accordance with the results of the commission. Employees are also sent to VVK to renew their contracts. You can refuse to undergo a commission during the period of dismissal. The report should indicate the reason for the refusal. As a rule, they limit themselves to the following wording: I refuse to undergo VVC, since I consider myself completely healthy. Passing the IVC when leaving the FSIN for retirement cannot be ignored.

Other grounds

In addition to their own wishes, employees are fired for other reasons. All of them are stipulated in the contract and enshrined in the legislation on military service (Article 51 of the Constitution of the Russian Federation). FSIN employees may be fired in the following cases:

- After the court verdict comes into force.

- If the employee already has the necessary length of service to retire.

- After the end of service life.

- If for any reason a person becomes unfit for further service.

- Due to loss of confidence or deprivation of rank.

If an employee violates the contract, the command terminates relations with him. The basis for termination of an existing contract is often a systematic (more than two) reprimand. If the terms of the contract are violated by senior management, the employee sets out claims and options for resolving the dispute. Only after their consideration can he submit a report.

The standard period is two weeks. In some cases, a preliminary report must be issued a month before the actual date of dismissal. For fixed-term contracts, including filling a position, the dismissal process takes 3 days.

It is also possible to resign without working, but this will require one of the following valid reasons:

- moving for medical reasons to another area, including with family members;

- caring for a sick relative;

- conclusion of the Military Military Commission on the impossibility of continuing service;

- caring for a minor child in the absence of a father or mother.

It is worth considering that if tuition fees are required, the above points also apply.

For any moves to another location, the possibility of transfer will be taken into account.

In the absence of any reason, the procedure has a standard two weeks. When agreeing, the period is specified in the contract. It may be standard or absent altogether.

The minimum length of service in the Federal Penitentiary Service required to receive a pension is stipulated by law.

According to the current pension legislation, in order to receive such a pension, you must have at least 20 years of experience in order to receive a pension.

One-time benefit upon dismissal from the Federal Penitentiary Service

Part 7 of Article 3 of Federal Law No. 283-FZ determines that employees whose total duration of service in institutions and bodies is 20 years or more, upon dismissal from service in the drug control authorities, are paid a one-time benefit in the amount of seven salaries, and employees, the total the duration of service in institutions and bodies of which is less than 20 years, upon dismissal from service in the drug control authorities, a one-time benefit is paid in the amount of two salaries based on the official salary and salary for a special rank established for the employee on the day of dismissal from service.

6. Employees (including those enrolled at the disposal of an institution or body of the penal system) dismissed from service in the penal system on the grounds provided for in paragraphs “b”, “c”, “e” (in case of dismissal on the initiative of a penal system employee in connection with a violation ( failure to fulfill) the terms of the contract by the authorized manager), “f”, “g”, “h”, “n” of part one of Article 58 of the Regulations on Service in the Internal Affairs Bodies of the Russian Federation, approved by Resolution of the Supreme Council of the Russian Federation dated December 23, 1992 N 4202- I (Gazette of the Congress of People's Deputies of the Russian Federation and the Supreme Council of the Russian Federation, 1993, No. 2, Article 70; Collection of Acts of the President and Government of the Russian Federation, 1993, No. 52, Article 5086; Collection of Legislation of the Russian Federation, 1998, No. 30, Article 3613; 2001, No. 1 (Part 1), Article 2, No. 53 (Part 1), Article 5030; 2002, No. 27, Article 2620, No. 30, Article 3033; 2004, No. 35 , Art. 3607; 2005, N 14, Art. 1212; 2007, N 10, Art. 1151, N 49, Art. 6072; 2008, N 52 (part 1), Art. 6235; 2009, N 30, Art. 3739, N 51, art. 6150; 2010, N 30, art. 3987, 3988, 3990; 2011, N 7, art. 901, N 48, art. 6730, N 49 (part 1), art. 7020; 2012, N 53 (part 1), art. 7608; 2013, N 48, art. 6165; 2015, N 48 (part 1), art. 6720) (hereinafter referred to as the Regulations on Service in the Internal Affairs Bodies), financial assistance is provided in the amount of one salary, if it has not been provided previously.

Regulations on the procedure for completing military service, Article 34 4. A serviceman performing military service under a contract may be early dismissed from military service: a) in connection with organizational and staffing measures (subparagraph “a” of paragraph 2 of Article 51 of the Federal Law) and in the absence of other grounds for dismissal: in case of reduction of the military position (position) held by him, including in the event of liquidation (disbandment, reorganization) of military units, bodies or organizations, and the absence of his consent to appointment to another military position (position); when at the disposal of the commander (chief) beyond the time limits established by paragraph 4 of Article 42 of the Federal Law and these Regulations, and without his consent to appointment to another military position (position); when the military rank corresponding to the military position (position) held by him is reduced, or when the military specialty corresponding to the military position (position) held by him is changed, the military position (position) is renamed and he does not want to continue military service in the military position (position) he occupies. or in another military position (position); if a military medical commission recognizes him as unfit for military service in the existing military specialty (not meeting special requirements), but fit for military service or fit for military service with minor restrictions in the absence of his consent to appointment to another military position (position) ; when reducing military positions (positions) within the limits of their total number, subject to replacement by one composition of military personnel, including if the military position (position) held by him is not subject to reduction, with his consent (for military personnel with length of service giving the right to a pension) ; b) in connection with the transition to service in the internal affairs bodies of the Russian Federation (federal tax police authorities, customs authorities of the Russian Federation, institutions and bodies of the penal system) (subparagraph “b” of paragraph 2 of Article 51 of the Federal Law) - upon transition to service in internal affairs bodies of the Russian Federation, federal tax police authorities, customs authorities of the Russian Federation, institutions and bodies of the penal system; c) in connection with the serviceman’s failure to fulfill the terms of the contract (subparagraph “c” of paragraph 2 of Article 51 of the Federal Law) - if he fails to fulfill the terms of the contract for military service; d) in connection with the refusal of access to state secrets (deprivation of access to state secrets) (subparagraph “d” of paragraph 2 of Article 51 of the Federal Law) - in case of refusal of access to state secrets or in the event of deprivation of the said access to a military personnel holding a military position (position) related to access to state secrets, if appointment to another military position (position) is impossible and there are no other grounds for dismissal; e) in connection with the imposition of a sentence of suspended imprisonment (subparagraph “d” of paragraph 2 of Article 51 of the Federal Law) - when a court verdict imposing a suspended sentence on a serviceman comes into force; f) at his own request (clause 6 of Article 51 of the Federal Law) - according to the conclusion of the certification commission of the military unit (organization) if the serviceman has valid reasons. 5. A serviceman performing military service under a contract has the right to early dismissal from military service: a) in connection with a violation of the terms of the contract in relation to the serviceman (subparagraph “a” of paragraph 3 of Article 51 of the Federal Law) - in case of a significant and (or) systematic violation in relation to his terms of contract for military service; b) for health reasons (subparagraph “b” of paragraph 3 of Article 51 of the Federal Law) - in connection with the recognition of a serviceman by a military medical commission as limitedly fit for military service; c) for family reasons (subparagraph “c” of paragraph 3 of Article 51 of the Federal Law - Federal Law No. 53 of March 28, 1998.

We recommend reading: Child benefits in 2021 in Kostroma for low-income and large families

Housing is not severance pay, which everyone is supposed to pay upon leaving military service. To receive it, you must be recognized in the prescribed manner as needing housing and put on a waiting list. Then it will be possible to talk about getting housing.

Pension increase

The procedure for increasing pensions for FSIN employees is determined depending on each individual case.

It is possible to increase your pension in the following cases:

- When the calculated pension coefficient increases in the event of a pension reform.

- When recalculating pensions for employees of the organization.

- In case of increasing the length of service of an employee of the organization whose pension is being calculated.

- If the pension recipient has additional benefits and they are disclosed when calculating his pension.

- If it is confirmed that the recipient of the FSIN pension has a disability received during the period of his service in this organization.

- In other cases provided for by the provisions of the law currently in force in the country.

Process order

The whole procedure has a step-by-step plan. It is standard for almost all categories of employees in the Federal Penitentiary Service. Actions:

- preparation of reports and applications;

- filling out a bypass form, including at checkpoints;

- transfer of cases to a replacement person;

- delivery of property;

- receipt of documents and payment.

In fact, dismissal according to the procedure does not differ from the usual severance of employment relations. But all the nuances will need to be taken into account. This will allow the dismissal to be carried out quickly and correctly.

If there are disciplinary reasons, voluntary dismissal is possible. This allows you not to display the items and reason for dismissal in your personal file.

Payments and benefits to a person upon retirement

In a number of cases, the law provides for the option of retiring from the Federal Penitentiary Service due to illness.

The procedure in this case is as follows:

- Documents are provided confirming that the citizen has an occupational disease.

- The FSIN pension is calculated, which is due to the employee for retirement due to his state of health.

- It is mandatory for an employee of this organization to provide information regarding his or her current length of service in order to calculate pension accruals.

- A clear procedure for paying sickness pension to an employee of the organization is established.

- Providing a medical document confirming the impossibility of serving due to illness of the pension recipient is mandatory.

- All additional benefits available to the employee at the time of accrual of his pension are taken into account.

Upon termination of an employment contract, the employer is obliged to pay the employees on the same day.

For care, a dismissed employee must receive the following payments:

- payment for the employee’s hours worked;

- compensation for missed vacation;

- unpaid wages and outstanding debts (bonuses, travel allowances, vacation pay).

If a pensioner is entitled to compensation under a collective agreement, it should be paid on the settlement day along with the principal amount.

Please note: if on the day of payment an employee of retirement age is on sick leave or on paid leave, then payment of the due funds must be made to a bank card on the day of dismissal specified in the order.

What payments are due to an employee of the Federal Penitentiary Service upon layoff?

In exceptional cases, the average monthly salary is retained by the dismissed employee for the third month from the date of dismissal by decision of the employment service body, provided that within two weeks after the dismissal the employee applied to this body and was not employed by it.

Upon termination of an employment contract due to the liquidation of an organization (clause 1 of part one of Article 81 of this Code) or a reduction in the number or staff of the organization’s employees (clause 2 of part one of Article 81 of this Code), the dismissed employee is paid severance pay in the amount of the average monthly salary, as well as for he retains the average monthly salary for the period of employment, but not more than two months from the date of dismissal (including severance pay).

In this regard, of fundamental importance in terms of protecting the rights of employees is the Resolution of the Constitutional Court of the Russian Federation of June 6, 1995 No. 7-P “In the case of verifying the constitutionality of paragraph 2 of part 7 of Article 19 of the RSFSR Law of April 18, 1991 “On the Police” in connection with with a complaint from citizen V.M.

N 269 “On approval of the Procedure for providing monetary compensation to employees of the penal system, the Procedure for paying bonuses for conscientious performance of official duties to employees of the penal system and the Procedure for providing financial assistance to employees of the penal system” With amendments and additions dated: April 9, 2015 , December 20, 2021, May 15, 2017 In accordance with the Federal Law of December 30, 2012 N 283-FZ “On social guarantees for employees of certain federal executive bodies and amendments to certain legislative acts of the Russian Federation” (Collection of Legislation of the Russian Federation , 2012, N 53 (part 1), art.

Dismissal due to staff reduction is a situation from which no one is immune. If the relationship between the employee and the employer is officially registered, the procedure is carried out in accordance with the norms of labor legislation, and the dismissed person is entitled to special payments upon layoff.

Upon dismissal, payment of all amounts of compensation due to the employee is made on the day of dismissal of the employee. If an employee was absent from service on the day of dismissal, then the corresponding amounts of monetary allowance are paid no later than the next day after the dismissed employee submits a request for payment. When an employee is granted leave with subsequent dismissal, the final payment to him is made no later than the last working day before the start of the leave. In the event of a dispute about the amount of monetary compensation due to an employee upon dismissal, the institution or body of the penal system is obliged to pay the amount not disputed by it within the period specified in this paragraph.” In case of forced dismissal, the law protects the rights of the citizen. First, employees must be notified of the upcoming event 2 months in advance so that they have time to look for a new job. Secondly, the employer is obliged to provide financial assistance in the form of certain payments.

You need to write a report about dismissal for non-compliance with the terms of the contract c) in connection with the serviceman’s failure to fulfill the terms of the contract (subparagraph “c” of paragraph 2 of Article 51 of the Federal Law) - if he fails to fulfill the terms of the contract for military service, or serve until the end of the contract and then resign, you will not be fired for any other reason

Igor, I’m leaving the army now, so I’ve studied all the federal laws. In short, you do this - you write a report on dismissal according to the General Staff, because you do not agree with the transfer to a lower position, with the provision of an apartment in your chosen place of residence not at the location of the military unit (if you have official housing and do not own housing), and so on How do you have more than 20 preferential calculations - you apply for a pension. You are being taken into custody, but since your homeland doesn’t have a house right now, you can be in the military for another year. like this.

We recommend reading: Relocation of emergency housing in Penza in 2021

Re-employment

After dismissal from the penal system, it is possible to re-employ in the Federal Penitentiary Service or a similar structure. The dismissal person’s personal file will be kept in the HR department for three years. When re-employed in the authorities, this file can be requested.

An important point is that in case of self-dismissal, the manager does not have the right to give another reason for dismissal or add something to his personal file. If any item was incorrectly recorded, then it is possible to appeal this recording in court.

Among the most important points of dismissal from authorities, it is necessary to remember that independent dismissal is impossible during martial law or an emergency. In this case, the manager has the right to refuse.

You can resign from the FSIN on your own. To do this, it is necessary to carry out the entire procedure, taking into account the nuances of the service. Without reasons, the manager does not have the right to retain the employee, as well as documents and all funds.

By length of service

A long-service pension is assigned to an employee of an organization in accordance with the established procedure.

In this case, the following procedure applies:

- The exact length of stay of a FSIN employee in service in this organization is established.

- A long-service pension is established only when the employee reaches the age legally defined for receiving a pension of this type.

- The calculation of the FSIN pension for length of service is carried out taking into account a certain calculation coefficient.

- To receive a pension of this type, the employee’s work experience must be at least twenty years of continuous service.

- It is obligatory for the employee to receive a salary during the period of service in an amount sufficient to accrue a long-service pension to him.

Pension FSIN

Issues regarding the implementation of state pension provision for this type of pension are under the jurisdiction of the Federal Penitentiary Service. This means that registration and payment are carried out within the personnel departments at the last place of work. It is the employees of the personnel department who check the data on service and confirm that they count the length of service. But the calculation itself is consistent with the pension authority. In addition, an application for a pension must be submitted to the pension authority. As well as a number of documents received from the personnel department. The decision to grant a pension is approved by the head of the territorial body of the Federal Penitentiary Service. Or his deputy.

This is interesting: Is there a program for Koreans who were forcibly sent from the USSR to the Republic

The FSIN pension is divided into pensions for length of service, disability and loss of a breadwinner. The right to assign such a pension belongs only to the personnel. Workers and employees, as well as persons working under civil contracts, are not employees of the FSIN system.

Requirements

The requirements for pension recipients are as follows:

- Submitting an application for calculation of a pension and its subsequent issuance.

- Preparation and provision of all documents required by law for proper registration of a pension.

- Availability of sufficient length of service in the authorities to assign pension benefits.

- Staying at the age stipulated by law for granting a pension.

- Confirmation of the fact that an employee of the Federal Penitentiary Service has Russian citizenship.

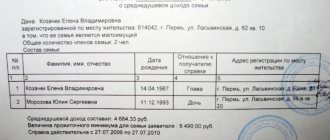

- Russian registration at the employee’s place of residence.

Fsin benefits for layoffs

1. Recognize clause 1 of part 1 of article 19 of the Federal Law “On social guarantees for employees of certain federal executive bodies and amendments to certain legislative acts of the Russian Federation” as not corresponding to the Constitution of the Russian Federation, its articles 7 (part 1), 19 (part 2) , 37 (part 1), 38 (part 1) and 55 (part 3), in the part stipulating that in relation to employees with special ranks and serving in institutions and bodies of the penal system - single mothers raising children under the age of 14, part seven of Article 54 of the Regulations on Service in the Internal Affairs Bodies of the Russian Federation does not apply.

Social policy in Russia is associated with fundamental transformations of economic and social relations. The patronage model of the Soviet period provided a guaranteed life support mechanism that looked modest compared to European standards. At the same time, social policy based on the unity of social classes and strata was stabilizing, since the state used the command and administrative apparatus to streamline social relations. The ongoing reforms objectively contributed to the destruction of “guardianship” over the subjects of social relations; “natural” income inequality characterizes the dynamic “compression” of the social sphere. It is quite clear that military personnel have suffered damage as a reference social group: the deterioration in the quality of life is determined by the “shift” of social policy towards a preference for the economy of financial and material resources.

25 Mar 2021 klasterlaw 214

Share this post

- Related Posts

- If There Are Payments For Material Damage, Can The Car Be Seized?

- What awaits Chernobyl victims in 2021 in Russia

- How much will a mother have 3 children and pasobiya if the third child is already 5 years old?

- Guarantees to Ensure Compliance with the Principles of Family Law

Employee benefits

Payments to employees in the order of accrual of their pensions are made according to the following options:

- accrual of cash within the period established for the payment of pensions;

- transfers of pension funds to the recipient’s card within an agreed time frame;

- payments to bank accounts of pension recipients;

- payments by postal orders at the place of residence of the pension recipient.

Looking for an answer to the question -

how pensions are paid to working pensioners after dismissal

? Detailed information is provided at the link.

You can read what documents are required to apply for a pension supplement for military pensioners by clicking on the link.

And you can find out how to get SNILS for an individual not at the place of registration, using the link provided.