Accounting

Deadline for payment of VAT for the first quarter of 2020 VAT is calculated based on the results of the quarter and transferred

Cost of work in progress and construction The cost of work in progress includes all costs incurred directly

Who and where should take 4-FSS? The 4-FSS report must be submitted by all employers (organizations and

What kind of material incentives can there be for staff? Employee labor is a fairly expensive resource for

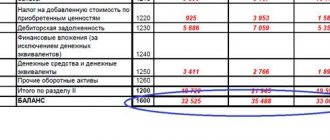

Receivables are nothing more than the unclosed financial obligations of counterparties (individuals and legal entities).

u. It includes authorized, additional, reserve capital, as well as retained earnings and

What’s wrong Let us remind you that according to part one of Article 178 of the Labor Code upon termination of an employment contract

Not every enterprise has in its documentation a Regulation on bonus payments to employees, which relates to

What is taken into account in account 68? According to the Standard Chart of Accounts, the 68th is called “Calculations according to

Book value of assets: where to look in the balance sheet (line) and how to calculate Book value of assets