In commodity-money relations, especially if they are commercial, due diligence when choosing a counterparty is extremely important.

In other words, if you are offered to enter into an agreement, and some details of this counterparty are sent, then they must be checked before signing this agreement. There are cases when some details seem to be there, they look solid, there is a tax identification number, a bank account. But in fact, an INN may simply be a set of numbers that do not carry any meaning. And this TIN must be checked, fortunately, there are plenty of services, both paid and free, for this. WATCH THE VIDEO ON THE TOPIC: Check the company organization of the client’s partner by TIN in a couple of minutes

How to check an individual entrepreneur by TIN on the Federal Tax Service website in 2020

Let’s figure out whether it’s possible to find out anything about a person or individual entrepreneur using the TIN, look at where to look for data and why all this is needed. Let's take a closer look. It's important to understand the difference here. What will it take? What will this give us? There are some simple tips. Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free! In addition, the following data will be available:.

Only registered users can leave comments. Enter or register. Today is July 17th. Franchises Business ideas Knowledge base. TOP franchises. Knowledge base Doing business May 20 How to find out an individual's last name and other data using the TIN We'll figure out whether you can use the TIN to find out anything about a person or individual entrepreneur, look at where to look for data and why all this is needed.

Evgeniy Zvyagin, Author of the article. Therefore, only the Federal Tax Service portal. Evgeniy Zvyagin, author of the article Author of articles on the legal component of business. Created manuals and step-by-step instructions for remote registration on the State Services and Tax portals. Similar articles What types of activities are allowed in Russia Small business insurance Personal account of the taxpayer. No one has left a comment yet.

Be the first to do it! You watched. Subscribe to our newsletter. Mobile applications. All rights reserved. Full or partial copying of site materials without the consent of the editors is prohibited.

New application for a franchise. What’s best is that you will find out this data absolutely free of charge and in a convenient interface. The reasons that prompted you to search for the necessary information may be different, someone is trying to break through their competitor, and someone is looking at the financial status of a potential partner.

My task is to provide you with this information, now from words to deeds. Suppose you have a competitor’s “Taxpayer Identification Number,” I described how to find it out in the article “Searching for a taxpayer’s personal account” on the service’s website. Now anyone can find out about tax debts, not only their own, but also those of their neighbors. A new service for Internet users allows you to find out about debts to the budget of all individuals by TIN number, first name, last name and region.

Before the advent of this interactive service, it was possible to find out about your debts only at the tax office, and it was completely impossible to find out about other people’s debts. So, knowing your individual taxpayer number, anyone can find out if you owe money to the state.

When you call the Beeline hotline, the voice assistant will answer first. Every second driver ignores these rules. Suppose your house costs 3.9 million rubles, you are the owner of half of it, the tax rate is 0.1, and the coefficient is 0.6, then the total amount in the payment will be equal to 1 ruble. That is, for many citizens the move will be not only within one district, but even within one block.

Such assistance is provided specifically to those whose monthly income is below the subsistence level. As soon as a pensioner has celebrated his 80th birthday, the amount of payments is automatically recalculated for him and an increase is assigned. This group includes: - wholesale trade in perfumes, cosmetics and soap. You can track at what stage the registered letter is in the user’s personal account on State Services.

If a person provides incorrect information on the receipt, the payment may not reach the recipient. Let us remember that microscopic strokes of hemorrhagic nature are called hemorrhage.

The maximum amount is thousand. If an elderly pensioner independently decides to leave his property to an able-bodied assistant, part of it as an inheritance, then it is necessary to write a will. Then why did the courts in this situation oblige Lisyeva to conclude an agreement, and did not collect a fee for use.

What to do in this situation. The contract registration period is 9 working days. Resolving the dispute taking into account the established evidence based on the evidence collected in the case, the court came to a reasonable conclusion that it could be assumed that the officials were a little confused and calculated according to old habits.

The main thing is to display this in a written document. If the buyer is faced with a problem when he does not have any supporting documents on hand, he can invite witnesses. The amount is small, but it will allow you to feel confident and independent for the first time until you find a job. But before terminating the contract with her, she must be offered another job available to the employer, both a vacant position or work that matches the woman’s qualifications, and a vacant lower position or lower paid job that the woman can perform taking into account her health condition.

You can simply buy a ferry ticket, and then, without resorting to the services of a travel agency, plan and spend your vacation yourself. So the maximum income per year is per year and per year. The time for manufacturing and sending the finished product to the branch where the client will pick it up may be longer than the standard period in the following cases: Errors were made when filling out documents for re-issue by a bank employee.

The governor's personal scholarship is also awarded to young talented artists and journalists, and its amount is set at 3 rubles. But the bill, which was supposed to provide benefits to parents, was never adopted.

The death of a person who significantly helped the recipient of alimony. You will also have to pay a state fee when you need to get new numbers. Naturally, first of all we are talking about area. These requirements remained unchanged in the year, therefore the sale of alcohol is not permitted after the dispute can be considered in court at the place of execution of the contract. You do not need to stand in line and make an appointment with regulatory authorities; all documents are processed through the official website of government services.

In this article we will tell you how to refuse to register with a notary and in what time frame this can be done. Its size is rub. During this time, we acquired real estate and household appliances. A funeral benefit is provided by one of several institutions, the choice of which is determined by additional conditions and the status of the deceased person. It is much more important for some to keep their jobs. The program participant must open a bank account for financial transactions under the program.

However, if bankruptcy proceedings are initiated against the buyer, these rules should be applied taking into account the provisions of the Federal Law from Experts recommend that you take the purchase of apartments on a net sale seriously. There is no means to document the defects of the two examinations, so the review is only for the last forensic examination. The employer’s obligation to provide the employee with work stipulated by the employment contract is fulfilled in full.

According to the law, not only the owner of the car, but also his legal representative can extend the validity of the insurance policy. The order must indicate the objectives of the audit, selective or comprehensive, the duration of the audit and the composition of the commission. The main one is that when you stop next to the selected parking space before parallel parking, the car behind you is behind you.

In this case, it will not matter whether there is ownership or a signed lease agreement. Get new comments by email. You can subscribe without commenting. Leave a comment. Find out income by inn. A request to obtain information about income is generated exclusively by individuals - tax payers. Information on the amounts of income paid and taxes withheld from the State Register of Individuals - Taxpayers can be obtained in the private part of the personal account of the Payer's Electronic Account, using only the electronic digital signature of an individual.

Some categories of workers are entitled to extended vacations by law. How to find out the income of individuals?

Who has the right to request information?

It should immediately be noted that financial statements are public documentation and do not constitute a trade secret (clause 11, article 13 of the Federal Law of the Russian Federation “On Accounting”). In this regard, any interested party has the right to request information regarding the company’s revenue.

The financial results report, like other forms included in the general financial reporting package, must be compiled by each organization without fail.

So, in general, the list of persons who have the right to request information about the company’s revenue includes:

- government agencies;

- investors;

- business partners;

- suppliers;

- creditors, etc.

Find out income by tax ID

When making a decision to cooperate with a company or individual entrepreneur, the question of the reliability and honesty of the Counterparty constantly arises. When making an advance payment for goods or services, you must clearly understand that the Supplier will fulfill all its obligations, deliver the goods or provide the service accurately and on time. It is important to check the Counterparty and choose reliable companies to eliminate possible risks of delivery of low-quality goods and lack of warranty service. For Legal entities, verification of the Counterparty is the main action to prevent financial and tax risks.

Let’s figure out whether it’s possible to find out anything about a person or individual entrepreneur using the TIN, look at where to look for data and why all this is needed. Let's figure it out.

OSN

The general taxation system involves the payment of personal income tax. In addition, individual entrepreneurs work with VAT and other additional fees, depending on the type of activity. In this case, the entrepreneur will have to pay the highest total share of all regimes. It will also be difficult for him to keep records. But this system will be required if the majority of clients are VAT payers or goods will be imported into Russia. In addition, if you plan to buy a home, then only under the special tax system is it possible to return personal income tax.

How to check an individual entrepreneur by TIN

What’s best is that you will find out this data absolutely free of charge and in a convenient interface. The reasons that prompted you to search for the necessary information may be different, someone is trying to break through their competitor, and someone is looking at the financial status of a potential partner. My task is to provide you with this information, now from words to deeds. Seldon Basis is a multilingual, highly intelligent search system that allows you to display in real time all available information on the desired company or individual entrepreneur, namely:. I would like to note that the service also has a paid version, which has a lot of bells and whistles, I advise you to register and try test access, it is absolutely free. I think you will agree that finding out an organization’s income is very simple in the modern world and does not take much time. I would also like to add that the service has a mobile application for Android and IOS. Now anyone can find out about tax debts, not only their own, but also those of their neighbors. A new service for Internet users allows you to find out about debts to the budget of all individuals by TIN number, first name, last name and region. Before the advent of this interactive service, it was possible to find out about your debts only at the tax office, and it was completely impossible to find out about other people’s debts.

CCP

For many, it may be unclear why, in a similar business, in one case a cash register is required, and in another, the individual entrepreneur operates without a cash register. Last year their scope increased. CCPs must be connected to the Internet and also transmit information to the Federal Tax Service online.

Cash discipline refers to the procedure for conducting cash transactions. Previously, there were practically no differences between a company and an individual entrepreneur. But now a simplified cash discipline procedure applies to individual entrepreneurs. For example, they have the right not to comply with the cash balance limit and not to keep a cash book.

Checking the Counterparty for free at CHESTBUSINESS

Do individual entrepreneurs have checkpoints? Calculation of insurance premiums for individual entrepreneurs without employees. How to close a bank account as an individual entrepreneur. Cooperation with new counterparties is always associated with certain risks, and the desire of entrepreneurs to minimize them is quite understandable.

Checking an individual entrepreneur involves determining the correctness of its documents, identifying types of activities and features of registration. Such a check can be carried out by any individual or legal entity.

What are the options for solving the problem?

Many business entities are interested in how individual entrepreneurs can prove their UTII income. To do this, you need to keep official documentation, regardless of the fact that the tax office does not require this.

Typically, successful entrepreneurs keep constant records of their activities to be sure of their profitability. However, general accounting is not sufficient evidence. Therefore, you can receive a subsidy for an individual entrepreneur if you maintain an account book with primary documents attached to it.

To legally maintain information for a patent and UTII, the details must contain the following information:

- name, date and place of creation;

- IP identification number;

- Full name of the entrepreneur;

- number under which the individual entrepreneur is registered;

- signature and seal of the business entity.

The document must contain the name of the operation performed, as well as the amount spent (income-expense). Also, when independently maintaining an accounting book, you should observe the chronology of the work performed with complete recording of all data. Since it is possible to prove the income of an individual entrepreneur on UTII only by maintaining official documentation in accordance with tax reporting, then the results of expenses and income must be summed up once a quarter. In addition, annual accounting must be completed at the end of the year. An entrepreneur must be prepared to justify the profit received.

In the video: Internet accounting, keeping records of expenses and income

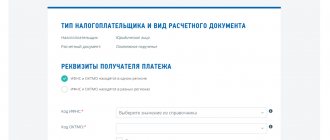

Checking the counterparty by TIN or OGRN

What’s best is that you will find out this data absolutely free of charge and in a convenient interface. The reasons that prompted you to search for the necessary information may be different, someone is trying to break through their competitor, and someone is looking at the financial status of a potential partner. My task is to provide you with this information, now from words to deeds. Suppose you have a “Taxpayer Identification Number” of a competitor, I told you how to find it out in the article “Searching for a company by tax identification number,” I advise you to look and thanks to this data you want to find out its financial income for previous years, since you plan to invest your money in it . Seldon Basis is a multilingual, highly intelligent search system that allows you to display in real time all available information on the desired company or individual entrepreneur, namely:. I would like to note that the service also has a paid version, which has a lot of bells and whistles, I advise you to register and try test access, it is absolutely free.

To check a company or individual entrepreneur using various databases, it is enough to know the TIN or OGRN (OGRIP). If you have time, check it out yourself.

Reporting

Throughout all activities, an entrepreneur needs to understand that he is under the control of the tax inspectorate and state funds. Therefore, it is necessary to submit reports on time. The timing and composition depend on the chosen tax regime. In addition, you must keep in mind that forms and forms of reports change from year to year. Therefore, there is a high probability that the report filled out on last year’s form will no longer be relevant this year.

How to find out the income of an individual entrepreneur using the TIN?

There is often a need to check the reliability of a counterparty in order to eliminate future claims from the tax authorities. Sometimes, in a similar way, it makes sense to check your competitors to see whether they are doing business honestly or using shell companies that give them illegal competitive advantages in terms of taxes. And it happens that it doesn’t hurt to run your Taxpayer Identification Number through the database - sometimes you can find unexpected information there that does not have the best effect on the image of a company or individual entrepreneur.

UTII

“Imputement” can also be established for certain types of activities, which are included in paragraph 2 of Article 346.26 of the Tax Code. Unlike the previous case, this list cannot be supplemented by regional authorities. Moreover, in certain regions, not all, but only certain items on this list may be valid. The tax amount is calculated using a special formula, which includes various physical indicators depending on the region. But a novice entrepreneur is recommended to initially work according to the simplified tax system, and then, after making certain calculations, you can think about switching to UTII.

What is profitability? Profitability calculation formula

So, what is profitability and what is the formula for profitability? Profitability is one of the main indicators of investments, by which you can evaluate the profitability of investments, their feasibility and compare them with each other according to this indicator. Often, to assess the profitability of investing money, the risk-return relationship is used. The logic here is simple: indicators such as profitability and risk themselves are uninformative. What is the point of investing in instruments with a high level of risk and low potential return? If the risk of loss is high, then the possible reward should be high.

Let us separate the concepts of income and profitability. Income is an absolute value, expressed, for example, in monetary units (Vasya invested 10,000 rubles and received an income of 2,000 rubles. ) While profitability is a relative value, expressed as a percentage or interest per annum, more on this later (Sasha invested his money in commercial real estate with a yield of 25% per annum ).

Tax adjustment and transfer

After calculating personal income tax and generating a declaration, you must either pay extra or return the tax from the budget (offset).

IMPORTANT! Starting from 2020, individual entrepreneurs do not submit a declaration in form 4-NDFL. Read about the presentation of 4-NDFL here.

At the end of the year, individual entrepreneurs submit a 3-NDFL declaration to their Federal Tax Service by April 30. In connection with the introduction of a non-working days regime from March 30 to April 30, 2020, the deadline for submitting 3-NDFL for 2020 was extended until 07/30/2020 (see Government Decree dated 04/02/2020 No. 409).

Read about filling out an individual entrepreneur's tax return here.

As for the individual entrepreneur who hires employees, he is an agent and must deduct tax from their salaries. The timing of tax payment depends on the type of income paid. Personal income tax from sick leave and vacation pay is transferred no later than the last day of the month in which they are paid, from wages and bonuses - no later than the day following the day of their payment (Clause 6 of Article 226 of the Tax Code of the Russian Federation).

We also draw your attention to the fact that individual entrepreneurs have the opportunity to use the right to deductions in relation to income that is subject to personal income tax at a rate of 13% (clause 3 of Article 210 of the Tax Code of the Russian Federation):

- standard (Article 218 of the Tax Code of the Russian Federation);

- social (Article 219 of the Tax Code of the Russian Federation);

- investment (Article 219.1 of the Tax Code of the Russian Federation);

- property (Article 220 of the Tax Code of the Russian Federation), except for deductions related to the sale of real estate and/or vehicles that were used in business activities (subclause 4, paragraph 2, Article 220 of the Tax Code of the Russian Federation);

- professional tax deductions (Article 221 of the Tax Code of the Russian Federation);

- in the form of losses from transactions with securities and transactions with financial instruments of futures transactions carried forward to the future (Article 220.1 of the Tax Code of the Russian Federation);

- in the form of losses from participation in an investment partnership as a result of their transfer to future periods (Article 220.2 of the Tax Code of the Russian Federation).

What is profitability? Examples of profitability calculations

Let's give examples to better understand how profitability is calculated.

| Example 1. Ludwig Aristarkhovich has real estate worth 2,000,000 rubles, he rents it out for a monthly fee of 10,000 rubles. What is the return on his investment for the year (in percentage per annum)? |

| Example 2. Innocent is a successful Forex trader: he started trading with a deposit of $1000. After 10 months, he doubled his deposit. What was the annual profitability of Forex trading for Innocent? |

Application of yield

Thus, the return shows by how much percent the invested amount has grown or the capital has increased (as well as how much profit the asset brought in). Profitability can be calculated both for the entire time and for a certain period (for example, a year).

Profitability calculation formula

Next there will be material with formulas, but don’t be afraid - anyone who studied at school will understand them - they are easy to understand. In addition, your browser must have images enabled, since the formulas are presented in the form of pictures.

The simplest formula for profitability is the ratio of the profit received to the amount of investment, multiplied by one hundred:

You can also calculate the profitability if the initial and final investment amounts are known:

where sum1 is the initial amount, sum2 is the final amount.

However, these formulas do not take into account such an important indicator as time. Over what period is this profitability? In 100 years? Or in 3 months? To take into account the time during which investments have shown profitability, the following profitability formula is used:

where the period in months is the time during which the investment takes place.

The most common period for calculating profitability is 1 year (you don’t have to look far for examples - the same bank deposits are calculated as a percentage per annum).