The teacher was last certified in January 2004. In 2009, the qualification category was not

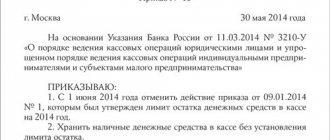

Introductory information Regulatory legal act that now regulates cash management - Directive of the Bank of Russia

How can a founder deposit money into an LLC current account for a simplified taxation system: Article 346.15,

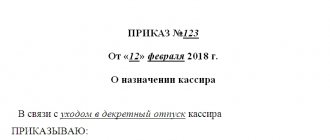

If the cashier is absent from the institution for valid reasons (vacation, illness) or such a position in general

Added to bookmarks: 0 When getting a job, many job seekers face some problems:

Tutorial 1C: Accounting 8 You and I already know how to move inventory items to warehouses,

Every person has heard about value added tax, because it is indicated on any receipts.

Is it necessary to include the founding director in the “zero” SZV-M report if he does not receive from his

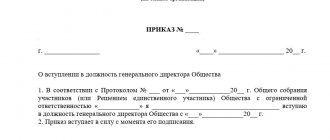

Sample documents Free samples in doc format, legal norms, examples. All about employment contracts

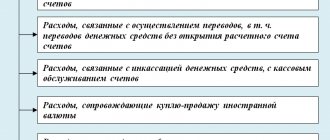

Accounting for bank commissions and interest under the simplified tax system Costs allowed to reduce the simplified tax base