In this lecture we will consider the following topics: Introduction Characteristics of account 04. Accounting for receipt of intangible assets (Accounting

What is accounting policy? The term “accounting policy” refers to the methods of maintaining accounting records.

Is it possible to quit while on sick leave? At the legislative level, there is a ban on dismissal during

Electronic labor books From January 1, all Russian employers can keep paper and electronic

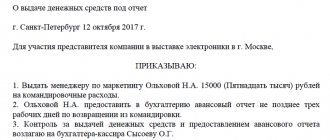

Settlements with accountable persons Accountable amounts include not only advances for travel expenses,

In the Republic of Belarus, starting from March 23, 2020, new requirements for business trips apply.

In this article I will not touch upon the issues of increasing VAT. In fact, with

Legislation The requirements of Russian legislation regarding the appointment and reassignment of financially responsible persons are contained in Art.

Home / Labor Law / Employment / Hiring Back Published: 05/09/2017 Time

Accounting In accordance with clause 5 of the Accounting Regulations “Expenses of the organization” PBU