Accounting

Who should pay quarterly Once a quarter, transfer advance payments for tax on

Measures to improve working conditions Employers must carry out some measures to improve working conditions every year

Share of salary in revenue By Vadim Falin / 12th June, 2020 / Alimony /

What taxes do they pay under the simplified tax system? Operating business entities, whether legal entities or entrepreneurs, have the right

Procedure for payment to founders The frequency of payment of dividends is chosen by the owners of the enterprise. Payments can be made quarterly, one

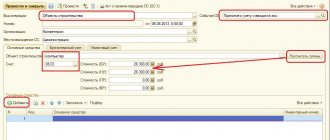

We assemble a fixed asset from components in 1c accounting. You cannot issue a copy of SZV-M to a resigning employee.

From July 1, 2020, all medical institutions can issue certificates of incapacity for work as in

Perhaps the first serious problem faced by a novice entrepreneur who decides to open his own business is

Declaration of income: who is obliged to report For officially employed citizens who do not have other income

Legal basis Federal Law dated October 2, 2007 No. 229-FZ “On Enforcement Proceedings” states that with