Accounting

What is an advance? The part of the remuneration that employees receive during the pay month is usually called

Who must submit a declaration The following must declare their income, expenses, property and property liabilities: civil servants

# When do you have to pay tax on card-to-card transfers in 2020

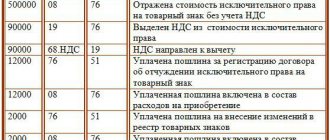

Possible reasons for writing off intangible assets As the most common reasons for writing off intangible assets, the main document

New status - new rules So, your company, meeting the criteria for “simplified”, has decided to switch

The Labor Code of the Russian Federation (Article 136) establishes the payment of wages at least twice

VAT on exports for organizations on the simplified tax system. Organizations on the simplified tax system are not payers.

Accounting statements - 2020: answers to questions Approval of statements Who, instead of the head of the organization, can

Deadlines and procedure for submitting the declaration for the 2nd quarter to the Federal Tax Service Deadline for submitting the reviewed report

Work experience plays an important role when applying for labor pension benefits. Moreover, it is necessary