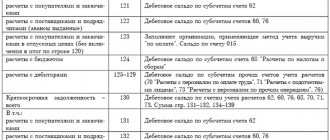

Accounting

Payroll taxes in 2020: an example of calculating the tax burden of Clean Sheet LLC for

Legal provisions establish that employers are required to pay all employees the money they earn at intervals

Receipt order M 4 Despite the entry into force of Law No. 402-FZ “On Accounting”,

Basic information Dear readers! The article talks about typical ways to resolve legal issues, but each

Rules for granting leave Article 122 of the Labor Code of the Russian Federation establishes general rules when a person should be

May 22, 2020 Legislation Elena Spi The calculation of vacation days is based on several factors,

Changes in 2020 In 2020, the previously existing algorithm for determining benefit amounts is in effect

Payers of income tax Entities whose responsibilities include the calculation and payment of tax on

Accrual of vacation days In the coming year, new rules and procedures for calculating vacation pay took effect

What it is? Accounts receivable are obligations of third parties for goods supplied by the company and