Other

Fixed assets in accounting Fixed assets are material assets that are planned to be used

What data should be entered in line 100 of form 6-NDFL? Calculation of income tax amounts

Receipt of materials from the supplier Accounting at actual price (excluding VAT) + transportation and procurement costs (for example,

When imposing taxes, legislators give relief to socially significant enterprises, industries with priority development, public

Zero calculation of 6-NDFL is a situation when the company does not operate and does not

The activities of any enterprise are connected not only directly with the production of goods, provision of services and implementation

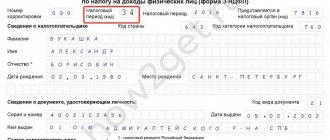

Tax period code In 3-NDFL, the tax period (code) is the period of time for which

Photo: pixabay.com Updated: 03.27.2020 Tax deduction for medical services and medicines is one

Let's get acquainted with the balance sheet items for 2020: their codes and explanations Assets of the new balance sheet (p.

About invoices One of the conditions for a tax deduction is the presence of a correctly executed invoice. If the document