- Irina Shishkina

- 4 109

Tax legislation of the Russian Federation allows citizens to receive compensation in the form of deductions for certain types of services and goods. The list of reimbursable services also includes medical services, such as paid operations. Refunds, in accordance with Article No. 219 of the Tax Code, can be issued by Russians of working age who have official labor relations, working pensioners and disabled people. In addition to compensation directly for the operation, taxpayers can count on a refund of money spent on diagnostic procedures and the purchase of medications. The law sets the amount of the deduction; it is 13% of the amount of costs. There are also restrictions on the calculated amount - the total cost of medical services should not exceed 120,000 rubles.

Regulatory documents

The issue of providing compensation for surgery and other types of medical services is regulated by relevant legislative acts, including:

Federal laws

- No. 442 - determines the general procedure for providing and a list of measures of social support for the civilian population, without taking into account special statuses;

- No. 143 – considers the list of civil status acts;

- No. 210 – regulates the rights of federal and local authorities in terms of providing services to the population;

- No. 326 – discloses basic information on issues of compulsory health insurance;

- – determines the procedure for receiving compensation for surgery by pensioners and veterans.

Codes

- Tax;

- Labor;

- Family.

Other documents

- letter of the Federal Tax Service No. ED-4-3/19630 - reveals a complete list of documentation required when applying for compensation for medical services;

- Government Decree No. 210 - establishes the rights and powers of medical organizations providing services to the population, including those performing surgical operations.

These laws can be used as a basis when applying for compensation for surgery and other services from private and public medical institutions.

Procedure for reimbursement of costs for certain categories of citizens

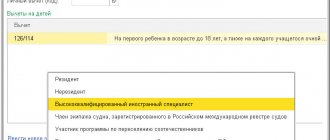

The norms of tax law, noted in Article 219 of the relevant code, determine the right to receive compensation in the form of funds for citizens - tax residents of the Russian Federation, permanently residing in the country for more than six months. Payments can also be issued by other persons receiving official income and paying tax in accordance with Russian legislation. Among other things, the law determines the right to compensation for surgery for the following categories of beneficiaries:

Pensioners

Since the law provides for payments from taxable income, only pensioners who decide to continue working and receive an official salary have the right to compensation. For non-working pensioners, if they need surgery, the law (Federal Law No. 326) guarantees benefits that determine the right to free medical services. Relatives of a pensioner who paid for the surgical procedure also have the opportunity to receive a 13 percent compensation by submitting the appropriate documents to the tax authority. Important! A woman receiving child care benefits has the right to receive a deduction only if the fact of payment took place during the period of working activity. Relatives who have the opportunity to apply for compensation include: parents, children and spouses of the person in need of surgery.

Disabled people

Citizens who have appropriate benefits due to serious health problems are also provided with compensation for the operation, but in this case, a different calculation scheme takes place. The following have the right to reimbursement of expenses:

- disabled people who are unable to work. The deduction can be issued in person or through a legal representative;

- citizens with 2 and 3 disability groups.

If there is an urgent need for surgical intervention, the state is ready to provide a subsidy to this category of beneficiaries.

When applying for compensation, it should be taken into account that federal legislation can only provide a deduction once. Upon repeated application, the applicant will be refused, regardless of the amount of costs. Important! Unlike a subsidy, compensation for disabled people is calculated after payment of the full cost of the operation and provision of relevant documents.

Veterans of Labor

The rights of this category of beneficiaries in the field of medical care are secured by Federal Law No. 5.

Labor veterans can receive compensation for the operation by submitting an application to the Pension Fund office at the place of registration. The personal application must be accompanied by a standard package of documents (information will be provided later in the material), a general passport and a veteran’s ID. The decision of the authorized body will be provided to the applicant within 30 days. Important! Compensation is not provided to veterans if it is possible to perform the operation at public expense. On general terms, reimbursement of costs is provided to working citizens (including those of retirement age) if they have the opportunity to confirm the fact of contributions to the compulsory medical insurance fund. Supporting documents are issued at the accounting department at the place of work.

How to get your money back for ophthalmological treatment

As a person ages, vision problems appear. It is not always possible to correct an illness with glasses or lenses, so a pensioner often needs surgery. Ophthalmological procedures are carried out in public and private medical institutions free of charge (when placed on a waiting list) or for money (at any time).

Read more: Is it possible to sell land that is given to large families?

By agreeing to paid medical services, an elderly person saves time, but is forced to find funds for surgery. It is legally determined that pensioners are entitled to compensation for paid surgical intervention. Partial or full reimbursement of costs occurs through:

- providing a tax deduction (exemption from income tax or its refund);

- contacting social security authorities with an application for one-time financial assistance.

Working pensioner

A tax deduction for medicines or surgery is only available to pensioners who continue to work or were working in the year when the eye surgery was performed. The maximum period for receiving compensation is 3 years from the date of surgery. For example, a pensioner was officially employed in 2021, and this year he had eye surgery. He will be able to receive the deduction during 2021, 2021 or 2021.

Officially employed pensioners pay personal income tax, the amount of which is 13% of earnings. There is no tax levied on pensions and other social benefits through the Pension Fund or social security. The deduction is due to all working individuals on the following grounds:

- for studying;

- after purchasing a home;

- on mortgage;

- for life insurance;

- for treatment.

For a non-working pensioner

A tax deduction for eye surgery is not provided to pensioners who have completely stopped official work. You can return personal income tax through your son, daughter or working spouse, but grandchildren cannot apply for compensation when paying for the operation of their grandparents.

According to regional legislation, full or partial monetary compensation for eye surgery can be paid to pensioners through social security authorities. To do this, you need to contact the territorial office and fill out a corresponding application. After reviewing the documents provided, a decision will be made. For example, in Moscow financial support is provided on the following grounds:

- Payment for expensive medical services for vital reasons, if they are not provided free of charge.

- Purchasing expensive drugs, medical supplies or materials. Disabled people can use this opportunity if they have not formalized a waiver of social services, and the medications are not included in the List for Medical Use.

How and for what types of services compensation is provided

The procedure for obtaining a 13 percent tax deduction for medical care of citizens is determined by the text of the Federal Law. Decree of the Government of the Russian Federation No. 201 regulates the procedure for monetary compensation for expensive operations and procedures in the following areas:

- ophthalmology;

- plastic surgery;

- gynecology;

- endocrinology (including diabetes mellitus), etc.

On a note! Expensive procedures include procedures with a total cost of over 120,000 rubles.

The norms of tax law reflected in Article 219 (clause 2) of the Tax Code of the Russian Federation allow you to receive monetary compensation in one of two ways:

By submitting an application to the tax authority

Before visiting the Federal Tax Service office, you must obtain a certificate in form 2-NDFL at your place of work.

Next, the 3-NDFL declaration is filled out, after which all certificates are attached to the application and, together with other documents, are submitted to the tax officer. Cash compensation for the operation will be provided within one calendar month. Recommendation! To increase the amount paid, it is recommended to submit an application for three tax periods.

Through the employer's accounting department

Officially employed citizens receiving taxable income can apply for a deduction directly to the accounting department at the place of employment.

In this case, 13 percent compensation will be provided in the form of a temporary exemption from personal income tax, for the period of accumulation of the amount corresponding to the deduction. Important! Surgeries or other procedures undergone by a citizen during the absence of an official place of work are not subject to compensation. An application for a refund of part of the money spent must be submitted to the accounting department after receiving medical services.

Procedure for receiving compensation

How can I receive full compensation from the state for the operation performed? You need to understand all the nuances of the procedure.

Refund of money for treatment (including surgery)

The standard tax deduction is equal to 13% of the money a person spends. If expensive treatment is necessary, you need to focus on Government Decree No. 201. It specifies the main types of services:

- restoration of visual functions;

- plastic surgery;

- treatment of diabetes mellitus in a complex form;

- gynecological procedures, including IVF.

Important! The category of expensive interventions includes procedures costing more than 120 thousand rubles.

Read more: How to design a consumer corner in a beauty salon

How to get money back for an operation

Based on clause 2 of Art. 219 of the Tax Code establishes 2 ways to receive compensation. The similarity of the options is that it is mandatory to provide documents confirming that the treatment was carried out.

Contacting the tax authorities

In 2021, citizens can apply for a tax deduction only at the end of the year according to the following scheme:

- Obtaining a certificate from the place of employment in form 2-NDFL.

- Filling out the 3-NDFL declaration for the current year.

- Transfer of declaration forms along with documentation from medical institutions and certificates to the territorial office of the Federal Tax Service.

- Visit to tax authorities after 3 months. and writing an application for deduction indicating the details.

- Receipt of funds to the account in 14-28 days.

Advice! The declaration is submitted for 3 periods. That is, in 2021 you need to submit a tax report for 2016-2018.

Through the employer

The taxpayer is also allowed a 13% refund scheme from income tax through the employer:

- Upon completion of treatment, provide a package of documents to the Federal Tax Service.

- Write a statement stating that you need to confirm your right to deduct.

- Wait for notification of the approved amount of money indicating the employer.

- Submit the document to the accounting department and write a statement.

- Receive personal income tax from the company in the form of a salary increase.

Important! If a person did not work during the period of surgery, the deduction is denied.

Tax deduction for the transaction

Is it possible to independently receive the required compensation for treatment or surgery from the tax service? Yes, but the citizen will need to submit:

- declaration filled out in form 3-NDFL;

- copies of company licenses to provide services;

- documents confirming that the operation was carried out - checks, contracts, receipts;

- copies of TIN and passport;

- 2-NDFL certificate from all places of work in the reporting year;

- an application addressed to the head of the territorial Federal Tax Service about the need to receive a social tax deduction;

- an application addressed to the head of the territorial Federal Tax Service at the place of residence for the transfer of income tax to a bank account.

When purchasing medications, costs are partially reimbursed. The conditions are the medical institution’s inability to provide medications, their necessity for the procedure, or expensive treatment.

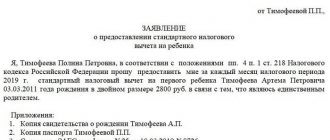

Application form

The completed application form can be downloaded from the official website of the Federal Tax Service nalog.ru. The addressee is indicated in the upper right corner of the document, and the taxpayer’s data is indented. The title is written in the center, followed by text explaining:

- the nature of the operation, its cost;

- need for intervention;

- grounds for benefits;

- return details;

- request for a tax deduction.

At the end of the document the date, initials and signature of the person are placed.

On a note! If the application is submitted by a company, the signature, surname, and initials of the general director and chief accountant are indicated at the end of the form.

How to apply for benefits for eye surgery for pensioners

Eye surgeries are classified as expensive interventions. Pensioners can follow the following algorithm:

- submit an application, documents and diagnostic certificates with a copy of the pension certificate;

- wait 1 calendar month while the application is being considered;

- if necessary, submit additional papers within 10 days;

- receive funds to your bank account.

Advice! If you want to receive a deduction in cash, you need to contact the cash desk of the relevant institution.

Rules for provision for disabled people

People with disabilities who are retired can have the operation free of charge. Employed citizens receive a deduction according to the general scheme, but additionally submit group examination documents.

Recipients of pensions from non-state funds can return funds from the budget of this organization.

Can I get a subsidy to pay for a hip replacement?

Installation of an endoprosthesis is included in the category of expensive services. In 2019, only compensation for the work of specialists is due; the prosthesis is fully paid for by the patient. A 100% tax deduction based on Government Decree No. 1273 can only be issued by:

- people suffering from articular dysplasia caused by arthrosis;

- patients in whom arthrosis deformans developed after surgery;

- persons who need to replace a joint due to a doctor’s error.

Important! The quota is valid on the basis of the IPR for disabled people or citizens who are in line for endoprostheses from January 1, 2015.

List of required documents

When applying for a deduction on your own through the Federal Tax Service, the recipient of the money will need to provide the following documents:

- an agreement between a citizen and a medical institution for the provision of paid services. The document is drawn up during a visit to the clinic;

- an extract from the outpatient card and/or epicrisis, certified by the personal signature of the attending physician and the seal of the medical institution. These papers are required if it is not possible to provide an agreement;

- a receipt for payment of services, with the amount based on which the amount of compensation will be calculated;

- checks, bank statements and other documents confirming material costs associated with the operation, purchase of medications and other medical services;

- certificate 2-NDFL and declaration 3-NDFL. The first document is drawn up at the place of work, the second is provided by the tax authority;

- personal application for a refund.

Important! When receiving services in a private clinic, in order to receive compensation for the operation, you will need to attach a copy of the license giving the institution the right to provide this type of service.

When registering a deduction by a relative of a citizen who received medical services, the following must be added to the above documents:

- certificate from the registry office confirming the marriage relationship;

- birth documents of children;

- copies of parents' passports.

Papers are provided on the basis of need, that is, the requirements depend on who exactly received the services for which compensation will be made.

For information! Citizens have the right to request the necessary documents for a three-year period.

Can a pensioner return a tax deduction for medical services?

Refund methods depend on whether the pensioner is working or not. Conditions for receiving a tax deduction:

- the medical institution has a state license to provide medical care. services;

- prescribed drugs are included in the established List;

- the person who claims to receive the benefit is a taxpayer.

In any case, a person will not be able to return more than the amount.

Working

The main condition for provision is that at the time of payment for medical services, the elderly person must be employed.

Not working

Payment is not required, but there are a number of cases in which an unemployed elderly person will be able to return money for treatment, provided that he has Russian citizenship and has other income that is subject to personal income tax.

If a pensioner has neither other income nor a permanent job, then you can get a tax deduction through your working spouse or children. The tax deduction refund period is no more than 3 years after payment for treatment.

- The cheapest loan for pensioners in Moscow banks

- How to attract luck and money to yourself - folk signs

- How to prepare brine for pickled cucumbers

How to write an application

To submit an application, you must fill out a standard form; it can be obtained from the Federal Tax Service office or downloaded from the department’s website - nalog.ru. The request form for compensation of the costs of the operation, in addition to the addressee and payer data, contains the following explanatory information:

- existing grounds for receiving funds;

- reasons for medical procedures;

- cost and nature of the procedure;

- bank details of an account opened for the purpose of receiving deduction funds.

The form contains a blank field in which the applicant personally enters the text of the application about the need to receive compensation for an operation or other types of medical services. After filling out all the fields and lines, the application is sealed with the citizen’s personal signature, next to which the date of writing is indicated. If the deduction is issued on behalf of a company, the application additionally contains the seal of the organization, as well as the signature of its director and chief accountant.

Registration of compensation for certain types of operations

A different procedure is provided for requests for deductions for expensive transactions, such as:

- ophthalmologic – the application is considered within one calendar month. Within ten days from the date of filing the application, the citizen can provide additional information or documents. When applying for compensation by a pensioner, it is necessary to present the appropriate identification. The issuance of funds can be carried out non-cash or in cash through the cash desk of the tax authority;

- joint prosthetics - in accordance with current rules, compensation can only be issued for the costs of the work of specialists; the cost of prostheses is compensated for certain categories of citizens. Cases in which full compensation for surgery and medical products is provided include: medical errors resulting in the need for joint replacement; the presence of articular dysplasia as a consequence of progressive arthrosis.

Important! Full compensation is provided if the patient has a disability or is registered on the waiting list for surgery before January 1, 2015.

The state provides a benefit to disabled people of retirement age in the form of the opportunity to undergo free surgery. The privilege is available to persons who do not have an employment relationship, provided they have an official place of work and verifiable income; compensation is provided on general terms, regardless of the applicant’s special status. If a pensioner receives payments from a non-state pension fund, compensation is provided from the funds of the relevant organization.

Under what conditions can compensation be claimed?

Legislation relevant in 2021 defines a number of conditions under which an application for a refund of funds spent on payment for an operation will be considered.

In accordance with the norms of 210 of the Decree and 219 of the Tax Code, surgical intervention must be performed in a clinic, hospital or specialized office of a sanatorium, if these institutions have a license to provide the relevant services. Compensation is also relevant for the payment of a bill issued by the emergency department whose employees performed the procedures. The deduction will be received only if the procedures were carried out in an institution that has Russian registration and a license issued by the relevant government agency. Paid procedures for which compensation can be issued include any operations, including: organ transplantation, prosthetics, plastic surgery, IVF, etc. Funds can be returned either to the direct recipient of the service or to the relative who made the payment.

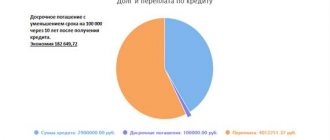

The maximum amount for which compensation can be issued (based on 12 months) should not exceed 120,000 rubles. Taking into account the permissible deduction percentage - 13%, the applicant is entitled to no more than 15,600 rubles for the reporting period. Expensive operations are compensated in full, but not more than the amount of all personal income tax transfers for 36 months. In this case, the transaction tax code will be requested when submitting the application.

Compensation for expensive operations is available to the above categories of persons. Depending on the status of the recipient, requirements are put forward for the list of documents provided. As with the general conditions for receiving a deduction, when considering social compensation, a basic set of documentation is provided, in this case we are talking about:

- an agreement concluded between a citizen and a medical institution;

- tax certificates 2 and 3-NDFL;

- pay slips, checks and receipts;

- act confirming the operation;

- evidence of relationship, when paying for services by another person in favor of the direct recipient.

If we are talking about compensation for medications, the original prescription for the medications and a receipt from the pharmacy where they were purchased must also be attached.

Reimbursement for surgery expenses

Employed people and working pensioners can return part of the money.

Basic requirements for receiving compensation

Based on Decree No. 201, in 2021, compensation applies to surgery performed in a city clinic, inpatient department, sanatorium or by emergency personnel. Paragraph 5 pp. 3 p. 1 art. 219 of the Tax Code notes the need for medical organizations to have a license issued by the Russian government.

That is, a deduction is possible only if you contact domestic institutions that provide standard and expensive services. The latter include plastic surgery of the body and face, prosthetics, IVF, organ transplantation, treatment of cancer and diabetes. A citizen can pay for the operation for his wife, parents, children and himself.

Reimbursement period for surgery costs

The money will arrive in your bank account in 2-4 weeks, but only if the tax authorities give a positive response. Documents are verified for about 3 months.

The amount of social tax deduction for the operation

The costs for which a refund is issued are limited to 120 thousand rubles. That is, a maximum of 15.6 thousand rubles can be credited to the taxpayer’s bank account. When receiving expensive services, you can return 13% of all money, but only within the limits of the transferred income tax.

Advice! The right to deduct for expensive medical care is granted based on the tax transaction code.

Documents required for social tax deduction

How can I get government compensation for an expensive paid operation? Collect and submit documents to the Federal Tax Service. Depending on whether a person is employed, disabled or retired, the list of papers differs. However, there are also mandatory documents:

- an agreement on the provision of medical services between a person and an institution;

- act of completion of work;

- certificate 2-NDFL;

- checks and receipts confirming the fact of payment;

- certificate of payment from the medical organization;

- declaration 3-NDFL indicating expenses;

- documents confirming relationship.

Advice! When purchasing medications, provide payment receipts and the original prescription.

Methods for submitting documents to receive a deduction

Options for submitting documentation, their convenience and disadvantages are discussed in the table.

| Feeding method | Benefits | Minuses |

| Federal Tax Service website | Quick login through your personal account | Temporary login and password are obtained only in person at the inspection |

| Through the employer | Can be submitted at any time during the current year | Tax deduction is calculated for the previous year |

| State Services Portal | Quick registration | Providing as much information as possible |

| Personally at the Federal Tax Service | View documents upon transfer, quick information about inaccuracies | Reception only on weekdays |

| Post office | Convenient if the branch is near your home | If there is an error, the papers will reach the recipient in 2-3 months |

Receipt of deduction by husband for wife

Based on Art. 34 of the Family Code, pensions, material benefits, including compensation and non-permanent payments belong to the common property of the spouses. For this reason, the husband has the right to receive a deduction.

Receiving a deduction for the operation together with other social deductions

If there are cumulative situations in one calendar year, the amount of costs cannot exceed 120 thousand rubles.

How many times can a taxpayer take advantage of the social tax deduction?

Russians have the right to receive an annual deduction. The state sets a certain limit, but this rule does not apply to deductions for expensive procedures.

Return deadlines

Verification of documents by the Federal Tax Service takes 3 months. You can receive compensation within a maximum of 4 weeks. Thus, the tax deduction will be credited to your account after 4 months. If there are errors in the documentation, the process is delayed for the same amount of time.

Read more: Driving license categories in Kazakhstan

Reasons for refusal to receive a tax deduction

Compensation is not provided in the following cases:

- not all documents have been submitted;

- errors in the 3-NDFL declaration;

- income tax was not transferred for the reporting period;

- the funds limit has been reached;

- the documentation was not transferred to the place of registration.

Advice! When submitting papers to the Federal Tax Service, you may be asked for originals; their absence may be one of the reasons for refusal.

In 2021, a tax deduction for treatment or surgery performed is provided only to officially employed persons. Pensioners, labor veterans or disabled people can receive a number of services free of charge. Women on maternity leave and the unemployed are not entitled to a deduction.

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

To quickly resolve your problem, we recommend contacting qualified lawyers on our website.

Additional terms

When paying for procedures by one of the spouses (in favor of the other), one should appeal to the norms of the Family Code - Article 34. In accordance with the rules specified in this collection, both spouses have equal rights to jointly acquired property and income, which includes funds received in the form of compensation for surgery, medications or other types of medical services.

If there are other expenses for which a tax deduction is due, the total amount of compensation is taken into account. That is, regardless of what article the compensation is issued for, the calculated amount should not exceed 120,000 rubles. The deduction can be issued by a citizen of the Russian Federation annually.

As for the processing time for documents, they do not exceed 3 calendar months. During this time, Federal Tax Service employees check the accuracy of the information provided and make an appropriate decision. If a positive decision is made, the funds are credited to the account provided by the recipient within four days.

Important! If errors are made that lead to a revision of the application, the review period is calculated from the date the papers are returned to the applicant.

It is possible that a refusal to provide compensation for an operation is possible for a number of reasons, including due to:

- failure to submit one or more documents from the list of mandatory ones;

- making gross errors, including when filling out the 3-NDFL declaration;

- discrepancies between the address of the branch where applications are submitted and the applicant’s registered address;

- absence of transfers to tax funds during the period for which compensation is issued;

- lack of rights to deduction due to its registration during the reporting period.

Important! If information is deliberately distorted or copies of documents are provided instead of originals (contrary to the requirements), a deduction for the operation will not be provided.

What is compensation for paid treatment?

Tax deduction is a type of social benefit that is provided to every resident of Russia, guaranteed by Art. 219 of the Tax Code of the Russian Federation. To receive it, you must have income that is taxed at 13%.

This percentage is refundable:

- From a tax base of 12 thousand rubles when using standard services.

- If the service falls into the expensive category. In this case, it is calculated from the full amount of treatment, and not from the tax base.

Expensive services:

- ECO;

- complex operations to correct congenital diseases;

- treatment of cancer tumors;

- surgical operations;

- nursing premature babies;

- dental prosthetics.

In addition, the state has established a list of medical services and medications that are included in the register of the Decree.

- How food helps overcome stress

- Cream for cake - step-by-step recipes for making it at home with photos

- What happens to your body when there is a hormonal imbalance?

By paying them, a person will be able to receive a tax deduction in the future:

- Call an ambulance.

- Outpatient-inpatient treatment.

- Recuperation in a sanatorium. Only the costs of treatment and the purchase of necessary medications are taken into account. The cost of the train, accommodation, food, and personal expenses are not taken into account.

- Public health education.

- Own health insurance.

- Purchase of medicines included in the state register. A prescription from a doctor and receipts confirming the purchase must be present.

Other ways to apply

There are several current methods for submitting an application for compensation, and each of them has its own disadvantages and advantages.

Covering the issue in general terms, we can note the following features of each method:

- through the production accounting department - the application is accepted at any time, the process is managed by a qualified specialist. Compensation can be received together with salary, which increases the amount of contributions to the Pension Fund, compulsory medical insurance and other funds;

- during a personal visit to the Federal Tax Service department - independent control of the process. Errors may result in the application being revised;

- via the Internet - on the Federal Tax Service website: a visit to the branch is required only to obtain a password and login; “State Services” portal: availability of a large amount of information, no queues;

- in Russian Post offices - convenient location (near the house), documents can reach the recipient in 2-3 months.

When giving preference to one of the existing methods of applying for compensation for surgery, you should carefully study all the advantages and disadvantages. It is recommended to consult a specialist for advice.