Deferred income tax is the most important among the entire set of factors that have to be assessed and

KBK – budget classification code. It is used by entrepreneurs and organizations to transfer mandatory taxes

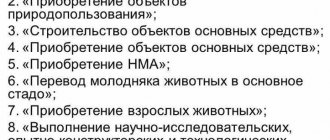

Accounting entries for investments in non-current assets (Account 08) Receipt of goods or intangible assets

The author of the document Dogovor-Yurist.Ru is offline Status: Legal. company rating460 84 / 6 Personal

Any financial and economic transaction in the activities of the company is reflected in the accounting accounts. All

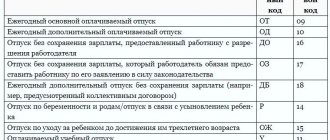

Types of additional leaves Leave from work at your own expense is one of the types of legal

An application for study leave with pay is a written request from a student employee

Legal regulations In the current legislation there are no direct indications that it is mandatory to have a staffing table in

Home / Other Back Published: 03/11/2020 Reading time: 10 min 0 5 1

Why is a special assessment needed? In addition to the formal reason, there is also a moral one: the commission determines the class of harmfulness,