Specialized regulations that are aimed at controlling all processes related to work in various fields and ensuring the safety of the health of citizens of the Russian Federation are labor protection rules.

Not only employees, but all employers must pay close attention to new changes in labor legislation.

News in labor protection in 2020, 2020 Labor protection rules for certain industries in 2020, 2020

News in labor protection in 2020, 2020, which came into force or are expected to change

The implementation of new bills not only at the federal, but also at the regional level is necessary to improve industrial safety and tighten measures for employers who violate labor safety rules in various industries.

The development, revision and approval of occupational safety rules occurs annually. It is known that they take into account all global safety standards, occupational safety instructions and require confirmation by the Ministry of Labor of the Russian Federation.

This condition applies to all rules, regardless of the field of activity. The rules are selected and prescribed in the “Methodological recommendations for the development of state regulatory requirements for labor protection” and safety documents, which are the basis of contracts between the employer and employee and other documents of organizations.

We'll tell you what awaits employers who violate labor safety rules.

Responsibility of employers in case of violation of labor protection rules

First, employers are subject to penalties for every violation.

What awaits them:

- Disciplinary action. The manager may be reprimanded, reprimanded or fired.

- Administrative punishment. In case of serious or repeated violations, the employer may be fined.

- Financial compensation for harm caused to the employee. The employee has the right to demand reimbursement of funds spent on treatment, improvement of health or emotional state.

- Criminal penalty. A negligent employer may be punished more severely, for example, subject to enforcement or criminal liability, deprived of the right to engage in certain activities or hold leadership positions.

All of the above penalties are provided for persons who violated or failed to comply with labor safety requirements, failed to take into account or fulfill their obligations under agreements concluded with employees, and also interfered with government specialists monitoring the company’s activities.

Fines and punishments for labor protection in 2020, 2020

| Offense | Punishment | Article / law |

| Violation of occupational safety requirements prescribed and approved in the federal laws of the Russian Federation and other documents. | For officials: warning, fine in the amount of 2000-5000 rubles. (regardless of whether you have an entrepreneurial education). For legal entities: a fine in the amount of 50,000 to 80,000 rubles. | Clause 1 of Article 5.27.1 of the Administrative Code. |

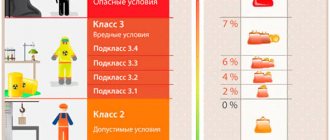

| Failure to conduct a special assessment of workers’ working conditions or violation of the procedure prescribed in Chapter 2 of Federal Law No. 426. | For officials: warning, payment of a fine, the amount of which is 5,000-10,000 rubles. For a legal entity: a fine in the amount of 60,000 to 80,000 rubles. | Clause 2 of Article 5.27.1 of the Administrative Code. |

| Allowing an employee to perform his job duties without testing his knowledge, experience, and skills. The employer did not train the employee in health and safety, did not conduct medical examinations, psychiatric examinations, and did not check for contraindications. | Officials: fine – 15,000-25,000 rubles. Legal entity: fine from 110,000 to 130,000 rubles. | Clause 3 of Article 5.27.1 of the Administrative Code. |

| Lack of equipment with personal protective equipment listed in Art. 221 Labor Code of the Russian Federation. | The official will be fined from 20,000 to 30,000 rubles. A legal entity will be fined in the amount of 130,000 to 150,000 rubles. | Clause 4 of Article 5.27.1 of the Administrative Code. |

| If the employer commits the above offenses repeatedly. | The official will be punished with a fine of 30,000-40,000 rubles. or disqualification for 1-3 years. Private entrepreneurs who do not have a legal background will be required to pay a fine in the amount of 30,000 to 40,000 rubles. or will not be able to engage in activities for 3 months. A legal entity will be fined in the amount of 100,000-200,000 rubles or deprived of the right to engage in certain activities for 3 months. | Clause 5 of Article 5.27.1 of the Administrative Code. |

These penalties will apply to employers who violated labor safety rules in relation to each employee, and not to the entire workforce.

Let us note the Resolution of the Supreme Court of the Russian Federation No. 60-AD14-16, issued on August 15, 2014.

An example of how this document works: a manager who is a legal entity, who for the second time did not conduct occupational safety training for 30 employees on time. For the first time, he could be fined 50,000 rubles; in case of repeated violation, the fine will be charged to each employee of the organization and increased to 60,000 - 80,000 rubles.

In total, the manager will have to pay a fine in the amount of 1,800,000 - 2,400,000 rubles.

Of course, such changes will bring additional losses to companies, but at the same time the period for paying fines will be increased, which will not be 2 months, as before, but 1 year.

https://youtu.be/btGu74GMsa8

A little about regular salary indexation in our country

We have all repeatedly heard about the annual indexation of pension payments, unemployment benefits, salaries of officials and citizens working in budgetary organizations, but very rarely information appears about such compensation measures carried out by the heads of commercial structures in relation to their employees.

One gets the impression that the norms of Russian legislation regulating this issue are addressed strictly to the federal government, which manages budget money, and do not concern other areas of labor relations at all.

A completely legitimate question arises: maybe our laws really do not provide for any points of contact between their requirements for regular increases in wages, and the reaction to these demands on the part of enterprises operating in the commercial and industrial spheres?

We cannot agree with this, since for several years now, Article 134 has been in force in the Labor Code of the Russian Federation (LC RF), which obliges all employers, without exception, to regularly increase employee salaries.

It is difficult to say why the relevant authorities paid attention to this point of labor legislation right now, but the state is beginning to take practical steps in this direction. Since the beginning of this year, tax control services began to apply penalties to enterprises that do not comply with the rules prescribed by this article.

In the city of Tambov, for example, several enterprises were fined 50,000 rubles for violating these requirements of the Labor Code of the Russian Federation, which became a kind of reminder to employers at all levels that it is worth paying attention to the existing requirements of the labor code at least sometimes.

Information about this “incident” spread throughout the country, and the issue of compliance with labor legislation, in particular Art. 134 of the Labor Code of the Russian Federation, became interested even in those circles where their existence had not been remembered for many years.

Let's take a closer look at the content of this legislative act. Let's start with the fact that compliance with the requirements of this document is mandatory for all business entities that use the labor of hired employees.

The essence of these requirements is as follows: the increase in the level of income of citizens belonging to this category must correspond to the level of increase in prices for essential goods, and, in addition, compensate for the financial losses associated with an increase in utility tariffs.

And since the listed parameters correspond to the inflation rate recorded in the country at the end of the previous year, then, accordingly, the salary level of enterprise employees should regularly increase by this value.

Do these instructions remind you of anything? In my opinion, this sounds like a strong recommendation to employers to index employee salaries in accordance with the economic situation in the country, regardless of the level of their commercial profits.

All the problems with the practical implementation of these norms lie in the absence of a mechanism for fulfilling the requirements specified in the article. It does not say a word about income indexation and the frequency of its implementation.

That is, the grounds for claims against such legal entities can only be of the most general nature. For some reason, this legislative act does not provide for the possibility of obliging the head of a private enterprise to monitor the level of income of his employees.

If any commercial structure nevertheless comes to the attention of the labor relations inspectorate or judicial authorities, due to non-compliance with the requirements of Art. 134th Labor Code of the Russian Federation, then, first of all, the real growth in income of its employees will be considered. At the same time, the date of the last salary increase, the frequency of such changes, and at the expense of what payments this increase occurs will not be of the slightest interest to such authorities.

If, for example, an employee goes to court or the labor dispute commission with a complaint against his employer regarding the lack of growth in his salary over many years, then the amount of his salary, as such, will not interest anyone. Only his annual income will be considered.

And if it turns out that the positive growth dynamics of this indicator did occur, say, due to bonus payments or one-time financial assistance, the claim will be rejected and the complaint will be declared unfounded.

Returning to the issue of indexation, we can say the following - if the real growth of an employee’s income corresponds to the level of inflationary losses, there will be no claims against the employer, even if the employee’s salary has not increased since the registration of the enterprise.

New labor protection rules for certain industries in 2020, 2018

According to the latest changes, the Ministry of Labor of the Russian Federation considered it necessary to change and approve the list of regulatory documents that ensure safety and comfortable conditions for workers in such industries as:

- Woodworking industry.

- Motor transport, trucks and cars.

- Processing of raw materials from minerals.

- Food industry.

- Department of Housing and Utilities.

- Construction.

- Logging or forestry.

- Economic activities in agriculture, field farming, livestock farming and forestry.

These areas are considered economically unstable and traumatic.

The developed rules on health and safety must be complied with by individual entrepreneurs, officials and legal entities.

Verification of compliance with these requirements will be carried out by representatives of the executive branch of the Russian Federation and specially organized commissions.

Compliance with the rules will help reduce the occurrence of tragedies and accidents in production, while reducing the occurrence of possible occupational diseases that arise among specialists.

Latest changes in labor legislation for 2020

From January 1, 2020, the minimum wage is RUB 9,489. Federal Law No. 421-FZ dated December 28, 2017 implies a gradual increase in the minimum wage to the subsistence level. From January 1, 2020, it has been increased to 85%.

Previously, it was planned to equalize the minimum wage with the subsistence level from January 1, 2020. However, Federal Law No. 41-FZ dated 03/07/2018 accelerated the process. The minimum wage will be equal to the subsistence level on May 1, 2018 and will be 11,163 rubles.

In addition, officials intend to oblige employers to index employees' salaries at least once a year. Bill No. 1119655-6 is under consideration. It is assumed that the indexation value should not be lower than the inflation rate in a particular region.