What is the Federal Tax Service code?

The tax authority code is a combination of four Arabic digits. The first two are the code of the subject of the Russian Federation (for example, 72 is the Tyumen region, 77 is the city of Moscow), and the last two are the number of the tax office in the region. It must be remembered that the last two digits were assigned to inspectorates a long time ago and may not coincide with the current names of tax authorities. For example, Interdistrict Inspectorate of the Federal Tax Service of Russia No. 12 for the Tyumen region has code 7205.

There are several ways to find out the code you need:

- according to the taxpayer's TIN;

- his place of residence;

- upon a personal visit to the tax authority.

Next, we will tell you how to find out the tax authority code.

How to find out the tax office code at your place of residence

Go to nalog.ru - the official page of the Federal Tax Service of the Russian Federation. Open the tab “How can I find out the address and details of my inspection?” and in the search form:

- select the type of person applying (legal entity, individual, including individual entrepreneur);

- Enter the legal address of the organization or the registration address of the citizen.

We talk about the rules for registering an individual at the place of residence in the article “Rules for registering at the place of residence for citizens of the Russian Federation.”

When you enter your address, a special form will open in which you fill in:

- The subject of the Russian Federation;

- city, district, other populated area, street;

- house number, household number;

- case, letter (if available);

- apartment, office, room number.

Next, click the “OK” button.

This is important to know: Writing off personal tax debts

A new window will open, which will display the previously filled in address, as well as the name and code of the tax authority at the place of residence of the individual or the legal address of the organization.

By location (accounting): codes for calculating insurance premiums from 2020

The tax office serving it will be indicated next to it.

Attention! Make sure the area is no longer on the list. If it occurs, then in order to make sure exactly which tax office serves you, you need to use the search by address.

Find out the OKTMO inspection

This is also not the most reliable method, but it can also be used to find your tax office. Go to the section codes of the Federal Tax Service and OKTMO for Moscow and codes of the Federal Tax Service and OKTMO for the Moscow region. Find your municipality (previously they were called districts). The tax office that serves this municipality will be indicated next to it.

Attention! Make sure that the municipality no longer appears on the list next to another tax office. If it occurs, then in order to make sure exactly which tax office serves you, you need to use the search by address.

If you don’t know your way around the districts at all, then there is still the opportunity to look at the tax offices on the map. This will give you a general idea of the tax offices closest to you.

https://youtu.be/Rtj9lHYEyrM

How else can you find out the tax office code?

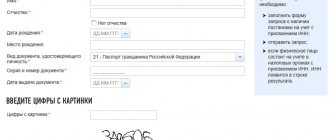

You can find out the tax office code by visiting it in person. Make an appointment in advance. For this:

- agree to the terms of service;

- select the type of taxpayer (legal entity, individual, entrepreneur);

- fill in the taxpayer's full name;

- Please enter your email address.

After this, all you have to do is come to the inspection office and get the required code from an employee.

Another way to get the current tax authority code is to use the Tax Authorities Designation Directory (SOUN). It, as well as the program for working with the reference book, can be downloaded on the website of JSC “Main Scientific Innovation Implementation Center”. In the directory, in addition to the code of the territorial tax division, you will find its current name, address, and contact numbers.

Was the article useful? Subscribe to our channel RUSYURIST in Yandex.Zen!

How to find out the Federal Tax Service code by TIN or address

All Russian citizens who receive income are taxpayers, and when they receive income, they regularly contribute certain amounts to the budget. To control this process, special services have been created in our state: the Federal Tax Service (Federal Tax Service) and the Federal Tax Service Inspectorate (Inspectorate of the Federal Tax Service).

The structure of these bodies is a network of interregional and territorial inspections and offices.

There are situations when a citizen needs to fill out information about the Federal Tax Service in documents, contact an inspector directly, or use the services of the tax authority at the place of registration. How to find out the code of the Federal Tax Service, its location and telephone number, and find out the list of services offered by the district service is of concern to many.

How to find out the OKTMO code at the place of residence of an individual for a declaration in 3 personal income tax

One of the important reporting indicators is the OKTMO code at the place of residence; You can find out how to enter it into 3-NDFL using samples of completed declarations and using a special electronic service.

When filling out a declaration with their own hands, citizens are faced with various columns in which they need to enter short values - adjustments, tax authority, period, document, etc. What it is, what sheets it is written on and what to do if it is indicated incorrectly is given in the material presented.

What is OKTMO code

OKTMO is the code in the 3-NDFL declaration. The form must indicate many different codes that hide one or another meaning. This system is designed to maximize the reduction and accuracy of the entered information.

The abbreviation is revealed as an all-Russian classifier of municipal territories. A specific OKTMO consists of 8 or 11 characters that imply some kind of municipality - city, district, town, village, etc. Down to the smallest settlements, like microdistricts, etc.

https://youtu.be/nNDt34QOsMA

Until 2014, only OKATO was used, which did not cover all administrative-territorial units and did not allow Rosstat to generate accurate statistical data. Therefore, it was replaced with a narrower indicator.

The issue itself consists of the following sections:

- the first 2 digits are subjects of Russia;

- the next 3 digits are a city district or municipal district;

- the remaining numbers are the specific locality.

So, if we are talking about a large city, then the last characters will contain zeros, since the city number will be reflected after the region.

In what cases is it required

The indicator is used in many tax reports and accounting documents, since it is uniform throughout Russia. But specifically, individuals most often encounter it in 3-NDFL, for example, when applying for a deduction or if it is necessary to pay tax, where it is necessary to indicate OKTMO.

On what sheets is it written:

- section 2 - as a payment information for the inspection for payment or return of personal income tax;

- Appendix 1 – as details of the employer.

It is assigned to each legal entity and individual entrepreneur at the time of registration and entry into the Unified State Register of Legal Entities or the Unified State Register of Individual Entrepreneurs. As a rule, the subject learns information about the assigned OKTMO from Rosstat, since it is this agency that actively works with this classifier.

We recommend additional reading: Code of the type of income in the 3rd personal income tax declaration

Where to find out the OKTMO code

Depending on the purpose for which OKTMO is needed, it can be found in existing documents or determined using a special service. So, for example, to fill out forms that require information about the employer, it is enough to use a 2-NDFL certificate or another accounting document of the company. As a rule, the company's registration information is indicated in the header.

And if you need to find out OKTMO to fill out the “Section 2” sheet of 3-NDFL, then the electronic service on the tax website – nalog.ru – will help.

Octmo at the place of residence of an individual

Section 2 in 3-NDFL reflects the entire result of the report - payment of tax, refund or lack of payment. in any case, you need to enter kbk and oktmo so that when automatically reading the information, the system correctly determines which or from which federal treasury account the operation will be performed.

It is necessary to determine the octmo code in 3-personal income tax at the place of residence. To do this, follow the instructions:

- open the tax website.

- In the search bar, enter the phrase “find out octmo.”

- Select the service with the matching name from the results.

- on the service page, fill in 2 columns – region and municipality. The data is displayed according to the FIAS address system.

- Octmo will be displayed.

alternative method - suitable if the details are needed not for filling out 3-NDFL, but for direct payment of tax when you do not have a ready-made receipt. To do this, follow the algorithm:

- open the tax website.

- In the search bar, enter the phrase “pay taxes.”

- select “individuals”.

- Next, indicate payment of taxes.

- for myself.

- Check the box and give permission to use your personal information.

- Click on “fill in all details”.

- An important parameter here is whether the inspection and the territory are in the same region or not. if you pay tax at your place of registration, then in one. if the tax is paid to the tax service of another entity, then the details are different.

- Select the inspectorate to which you want to pay the amount. You can immediately enter the code if you know it, or search in the list.

- Check the “identify by address” box. In a new line, enter your residence address. If you enter an index, the region and city will be downloaded automatically.

- An octmo corresponding to the specified data will appear.

- then fill out the remaining parts of the payment order and, using the completed receipt, complete the transaction in any convenient way.

Octmo code for Okato

Through the announced service, you can determine the required octmo not only with the help of the municipality, but also by okato, if you know it. but in 3-personal income tax, for example, for a property deduction, it is necessary to indicate octmo.

We recommend that you read additionally: what is 5-personal income tax and an example of filling it out

If you fill out the 3-personal income tax form using the samples at the stands in the Internal Revenue Service, then all the codes can be found in the examples. The “declaration” program for 3-personal income tax, which can be easily downloaded from the website, also allows you to quickly enter octmo. an alternative is an online service in the taxpayer’s personal account, where all codes are also entered automatically as the user enters data.

download octmo code book

It’s easy to find your octmo code at your place of residence for 3-personal income tax in directories for federal districts:

- central;

- northwestern;

- southern;

- North Caucasian;

- Volga;

- Ural;

- Siberian;

- Far Eastern.

Click on the desired link and find the required municipality in the list.

download octmo code book

how to correctly fill out oktmo in the 3rd personal income tax declaration

3-NDFL tax forms are automatically scanned to download information from them into the AIS-Tax database (automated information system), therefore there are strict graphical requirements for filling out the form.

So, in the 3-NDFL declaration, the OKTMO code, as well as other values, inspection number, amounts, titles and names, are written according to the following rules:

| Criterion | Requirement |

| Ink | Black, purple and blue only |

| Font | Printed, capital |

| Filling in the fields | For each symbol there is a separate cell |

| Corrections | Not allowed |

Please note - you need to enter OKTMO according to the inspection to which you are registered. This is not always the Federal Tax Service Inspectorate at the place of actual residence, because a person can register in one city, but actually live and be registered for tax purposes in another.

Filling example

Example 1

Egor Belyshev sold the car in December 2020, which he inherited in the same month. The cost of the transaction is 400,000 rubles. He lives and is registered with the Federal Tax Service in the city of Maykop.

https://youtu.be/PHxdPHJQthg

Based on the results of calculations in 3-NDFL, a tax payable arises, therefore, in section 2, the line “tax payable” is filled in and it is required to enter OKTMO at the place of residence of the individual. How to determine it:

- Open the Federal Tax Service website.

- Find the service page.

- Specify the subject of the Russian Federation – 01, Republic of Adygea. She's first on the list.

- Next, select the municipality - the city of Maykop.

- OKTMO: 79701000. Write it down in line 030 of the sheet.

In Appendix 1 of Form 3-NDFL you need to indicate the source of income. In case of sale of property to an individual, the source is the buyer. Therefore, on the sheet it is enough to indicate the last name, first name and patronymic of the second party to the transaction, without details. If the income is received from a legal entity and individual entrepreneur, then OKTMO can be easily found in the documents of the entity, for example, in the 2-NDFL certificate.

Example 2

Egor Belyshev lives in Moscow under temporary registration. Permanent registration is in Bataysk. He is employed by a company that submits reports about him as part of personalized employee records. In November, he made a profit due to savings on interest and is required to submit Form 3-NDFL in the coming year.

In Section 2 of 3-NDFL, he will indicate OKTMO at his place of permanent registration, although he received his income in Moscow. The basis is Article 11. Clause 1 of Article 83, Clause 3 of Article 228, Clause 2 of Article 229 of the Tax Code of the Russian Federation. The place of residence and income does not matter. Otherwise, citizens living abroad and making profits in Russia would easily avoid taxation.

In the service, you need to indicate the Rostov region as the region, and the municipality - the city of Bataysk. OKTMO: 60707000.

What to do if you specified the wrong code

An error in the code at the place of residence of the 3-NDFL declaration has 3 situations:

- you discovered it before you submitted 3-NDFL to the Federal Tax Service;

- you learned about the error after submitting Form 3-NDFL to the inspectorate;

- The tax office itself notified about the presence of inaccuracies and inconsistencies in 3-NDFL.

The correction form differs from the usual one only in the correction code on the title page: instead of “000”, “001” is placed. Facial errors are also corrected. The entire procedure for submitting and checking updated reporting is set out in Article 81 of the Tax Code of the Russian Federation.

As a rule, an error in OKTMO does not apply to cases requiring changes to the submitted 3-NDFL: in practice, tax authorities only require explanations in free form, but in order to avoid misunderstandings it is necessary to clarify the actions.

Federal Tax Service Inspectorate: functions, services

The Federal Tax Service Inspectorate monitors the correctness of accrual, withholding and timely transfer of funds to the budget, considers issues of granting deductions, and returns taxes paid.

The Federal Tax Service department registers new organizations and individual entrepreneurs, and issues certificates of TIN assignment to legal entities and individuals. The inspectorate can provide free information about current rates and the procedure for calculating fees, as well as the rights and responsibilities of tax agents.

Each organ has its own unique code. It consists of four digits. The first two indicate the subject of the federation in which the inspection is located (for example, for Moscow - 77, for the Moscow region - 50), the second pair indicates the serial number of the Federal Tax Service in this region.

Federal Tax Service code: how to find out by TIN

TIN (taxpayer identification number) is a unique digital code. It is issued to legal entities (organizations, individual entrepreneurs) upon registration and to individuals upon contacting their tax department. The TIN allows you to control information about income and deductions made by citizens of the Russian Federation and foreigners working in the territory of our state.

The four initial digits of the TIN are the code of the tax office where the certificate of its assignment was received. It is enough to find a document with your TIN to see the code in it. However, this can only be done in two cases:

- if the taxpayer (individual) has a TIN;

- if the taxpayer (individual) did not change the registration address after receiving the TIN (the Federal Tax Service is attached to the address of residence upon registration).

How to find out your tax office

The easiest way to determine your tax office is to look at its number in the TIN. When assigning a TIN, individuals, legal entities, as well as individual entrepreneurs, receive a Certificate of Registration with the tax authority. It will contain the TIN, which we will use. If you have not received a TIN or do not know where the Certificate is located, you can find out the TIN in the appropriate service.

So, having found or received a TIN, we must pay attention to its first 4 digits. In the identification number, the first two digits correspond to the number of the region where the registration was carried out, and the second two digits contain the number of the tax office that serves this tax subject.

Having received the tax office number, you can easily find it by number on our website. Another way to find out your inspection is to search for it by address, street or service area, which we'll cover below.

How to find out the Federal Tax Service code by address

If a citizen is not able to determine the Federal Tax Service code by TIN, then he can use the Internet and find out all the information about his inspection on the official website of the Federal Tax Service. In order to find out the Federal Tax Service code by address, you need to:

- go to the website nalog.ru;

- select the tab “Electronic services” - “All services”;

- select the tab “Address and payment details of your inspection”;

- Using the menu provided, fill in your address and click the “next” button.

This is important to know: Property tax in St. Petersburg in 2020

After entering the information, the system will provide the necessary information (an example of searching by address can be seen in the photos posted in the article).

How to find your tax office

If you want to find out which tax office services your address, there are several options:

- Find out the inspection by address or service street

- Find out the inspection for the area

- Find out the OKTMO inspection

Find out the inspection by address or service street

This is the simplest and most reliable way. To do this, go to the tax office section by address and use the street index. Homes Served field contains homes that are specific to your address. The tax office that serves this address will be indicated next to it.

Find out the inspection for the area

This method is not as reliable as determining the tax office by address, since one area may be under the jurisdiction of several tax inspectorates, but it is just as effective for identifying the inspection. To do this, you need to go to the section tax inspectorates by district and find your district in the list.

What to do when reorganizing the Federal Tax Service

The code of the local tax authority may change as a result of the dissolution or consolidation of the Federal Tax Service branch in the district. In order to find out the latest information about the recently reorganized service, you need to refer to the SOUN directory, which contains information about the services created to record taxpayers. To do this you should:

- go to the website gnivc.ru;

- select “Classifiers and reference books” from the menu on the main page;

- go to the tab “Directory of tax authority designations (SOUN)”;

- download the guide to your computer and find the information you need

Information about changing the Federal Tax Service code is also available on the official website of the Federal Tax Service. To receive them, you need to go to the website nalog.ru, enter the known Federal Tax Service code before the reorganization, and the system will issue a new one.

How to find out the tax authority code to fill out a declaration

The program for filling out the Declaration for 2020 requires indicating the code of the tax authority that will accept and verify this declaration. The issue is resolved very simply if the taxpayer submits the document to the same inspectorate where his employer is registered. And the second condition: to fill out the declaration, the data from the certificate of income and tax amounts of an individual in form 2-NDFL are used. This document contains the required code on the first page.

We simply transfer this code to the declaration.

But in real life there can be a variety of situations. For example, a citizen works in one region, but his permanent place of residence is in another. Or the declaration is filled out for the purpose of reporting on one’s income and paying taxes on it, and this does not require form 2-NDFL.

Find out the code of the tax authority at your place of residence that calculated the tax

Article current as of: February 2020

The tax authority code is a combination of four Arabic digits.

The first two are the code of the subject of the Russian Federation (for example, 72 is the Tyumen region, 77 is the city of Moscow), and the last two are the number of the tax office in the region.

It must be remembered that the last two digits were assigned to inspectorates a long time ago and may not coincide with the current names of tax authorities. For example, Interdistrict Inspectorate of the Federal Tax Service of Russia No. 12 for the Tyumen region has code 7205.

There are several ways to find out the code you need:

Next, we will tell you how to find out the tax authority code.

How to find out the Federal Tax Service code by TIN or address

All Russian citizens who receive income are taxpayers, and when they receive income, they regularly contribute certain amounts to the budget. To control this process, special services have been created in our state: the Federal Tax Service (Federal Tax Service) and the Federal Tax Service Inspectorate (Inspectorate of the Federal Tax Service).

The structure of these bodies is a network of interregional and territorial inspections and offices.

There are situations when a citizen needs to fill out information about the Federal Tax Service in documents, contact an inspector directly, or use the services of the tax authority at the place of registration. How to find out the code of the Federal Tax Service, its location and telephone number, and find out the list of services offered by the district service is of concern to many.

Federal Tax Service Inspectorate: functions, services

The Federal Tax Service Inspectorate monitors the correctness of accrual, withholding and timely transfer of funds to the budget, considers issues of granting deductions, and returns taxes paid.

The Federal Tax Service department registers new organizations and individual entrepreneurs, and issues certificates of TIN assignment to legal entities and individuals. The inspectorate can provide free information about current rates and the procedure for calculating fees, as well as the rights and responsibilities of tax agents.

Each organ has its own unique code. It consists of four digits. The first two indicate the subject of the federation in which the inspection is located (for example, for Moscow - 77, for the Moscow region - 50), the second pair indicates the serial number of the Federal Tax Service in this region.

Federal Tax Service code: how to find out by TIN

TIN (taxpayer identification number) is a unique digital code. It is issued to legal entities (organizations, individual entrepreneurs) upon registration and to individuals upon contacting their tax department. The TIN allows you to control information about income and deductions made by citizens of the Russian Federation and foreigners working in the territory of our state.

The four initial digits of the TIN are the code of the tax office where the certificate of its assignment was received. It is enough to find a document with your TIN to see the code in it. However, this can only be done in two cases:

- if the taxpayer (individual) has a TIN;

- if the taxpayer (individual) did not change the registration address after receiving the TIN (the Federal Tax Service is attached to the address of residence upon registration).

How to find out the Federal Tax Service code by address

If a citizen is not able to determine the Federal Tax Service code by TIN, then he can use the Internet and find out all the information about his inspection on the official website of the Federal Tax Service. In order to find out the Federal Tax Service code by address, you need to:

- go to the website nalog.ru;

- select the tab “Electronic services” - “All services”;

- select the tab “Address and payment details of your inspection”;

- Using the menu provided, fill in your address and click the “next” button.

This is important to know: Judicial practice on VAT in favor of the taxpayer

https://youtu.be/YnpfHAgSekI

After entering the information, the system will provide the necessary information (an example of searching by address can be seen in the photos posted in the article).

What to do when reorganizing the Federal Tax Service

The code of the local tax authority may change as a result of the dissolution or consolidation of the Federal Tax Service branch in the district. In order to find out the latest information about the recently reorganized service, you need to refer to the SOUN directory, which contains information about the services created to record taxpayers. To do this you should:

- go to the website gnivc.ru;

- select “Classifiers and reference books” from the menu on the main page;

- go to the tab “Directory of tax authority designations (SOUN)”;

- download the guide to your computer and find the information you need

Information about changing the Federal Tax Service code is also available on the official website of the Federal Tax Service. To receive them, you need to go to the website nalog.ru, enter the known Federal Tax Service code before the reorganization, and the system will issue a new one.

Conclusion

Every citizen must remember that ignorance of the tax inspectorate code does not relieve him of responsibility for late submission of income declarations, failure to pay contributions to the budget and other violations of the Tax Code.

If there is no Internet, you have not received a Taxpayer Identification Number (TIN), and there are no friends and acquaintances who can give you advice, then how can you find out the Federal Tax Service code? Go personally to the district tax office, they will definitely provide you with the treasured information. Good luck!

How to find out the tax authority code to fill out a declaration

The program for filling out the Declaration for 2020 requires indicating the code of the tax authority that will accept and verify this declaration.

The issue is resolved very simply if the taxpayer submits the document to the same inspectorate where his employer is registered.

And the second condition: to fill out the declaration, the data from the certificate of income and tax amounts of an individual in form 2-NDFL are used. This document contains the required code on the first page.

We simply transfer this code to the declaration.

But in real life there can be a variety of situations. For example, a citizen works in one region, but his permanent place of residence is in another. Or the declaration is filled out for the purpose of reporting on one’s income and paying taxes on it, and this does not require form 2-NDFL.

Name of the tax authority and its code

According to Article 65 of the Constitution of the Russian Federation, the entire territory of the country is divided into regions. Each subject of the Russian Federation has its own code. For example, 01 is the code of the Republic of Adygea. Since each region has more than one tax office, they all also have their own numbering - coding. Thus, the tax office code consists of 4 digits:

- the first two are the region code;

- the second two are the code of a specific tax office.

For example, code 0101 designates Interdistrict Inspectorate of the Federal Tax Service of Russia No. 2 for the Republic of Adygea.

How to find out the tax authority code

In addition to the method already indicated above (from form 2-NDFL), there are several more methods for determining the code of your tax office:

- by your own taxpayer identification number (TIN);

- according to a special reference book;

- on the official website of the tax service.

You can find out the tax number using the TIN if the taxpayer received his number and did not change his region of residence after that.

This is important because the first four digits indicate the region in which the TIN certificate was issued and the number of the tax office that issued this certificate.

The TIN is assigned once, is used throughout the Russian Federation and does not change, even if the taxpayer changes his place of residence, surname and other passport data.

This is important to know: Tax deduction for a guardian in 2020

EXAMPLE 1. Ivanov I.R. I was studying in Moscow when I received my tax identification number. After graduation, he went to work in the Krasnoyarsk region. His TIN remained unchanged, but it turned out to be impossible to find out the code of the tax authority at his place of residence.

https://youtu.be/GCkygyjwSgs

The second way to find out the code of the tax authority at your place of residence is to find it in a special directory. To do this, on the main page of the official website of the Russian Tax Service we find in the “Software” section the SOUN “Directory of tax authority designation codes for taxpayer accounting purposes.”

Download the program to your computer and unpack it. Working with the program requires some skill, so it is recommended for employees involved in taxpayer accounting to use it. There is no point in downloading and using such a program to an ordinary citizen who will need to find out his tax information once a year, or even less often.

On the same official website of the Federal Tax Service, you can determine the details of the tax office where you should submit your declaration or other reports.

The algorithm for working with the site is as follows:

1. Go to the main page of the site and immediately select your region from the drop-down menu: this will simplify further work on the site.

2. On the same page we find the “Electronic Services” section, and in the section open the “Address and payment details of your inspection” tab.

3. Next, you should fill out the form provided.

First, you need to decide on your own status and indicate the type of taxpayer (individual or legal entity): o.

The program requires you to indicate the code of the Federal Tax Service (tax office at the place of registration), but this point must be skipped, since it is the code that is the unknown value for which the form is being filled out. When you click on the “Address” line, a new sign appears.

When filling out the table, you must follow the sequence indicated in the form itself:

- The line “Russian Subject” automatically determines your region (23-Krasnodar Territory).

- The line “Address of the Russian Federation” is filled in in the following order: street, city, district (Vesennyaya, Sochi).

- After this, the house, building, or apartment are numbered.

- Once again, check all the entered details and click the “OK” button.

The program displays the following message.

Here's how to determine the tax office at your place of residence on the website: this is Interdistrict Inspectorate of the Federal Tax Service of Russia No. 7 for the Krasnodar Territory. And it is designated by code 2366. After this, it is not difficult to determine the tax details using the Federal Tax Service code.

There is another way to find the tax authority at your place of residence: find out the phone number of the inspectorate in the directory and make a request in person. Typically, employees of this organization provide such information over the phone.

»

Next

Name of the tax authority and its code

According to Article 65 of the Constitution of the Russian Federation, the entire territory of the country is divided into regions. Each subject of the Russian Federation has its own code. For example, 01 is the code of the Republic of Adygea. Since each region has more than one tax office, they all also have their own numbering - coding. Thus, the tax office code consists of 4 digits:

- the first two are the region code;

- the second two are the code of a specific tax office.

For example, code 0101 designates Interdistrict Inspectorate of the Federal Tax Service of Russia No. 2 for the Republic of Adygea.