Accounting

Author of the article: Elena Petrenko Last modified: January 2020 10598 According to Art. 140 TK

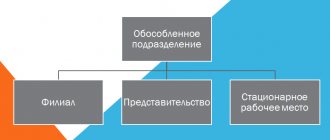

In 2020, separate departments of many enterprises can experience the beauty of communication

Zero reporting “Calculation of insurance premiums”: who must submit Persons paying employee benefits are required to

What it is? In 1999, the Federal State Statistics Service approved the package by Resolution No. 20

What are penalties? Penalties for taxes and contributions are penalties for late payments.

Future businessmen are interested in how to open an individual entrepreneur in another city without registration? notice, that

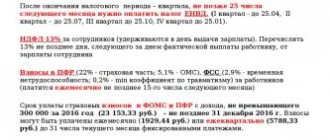

What taxes does an individual entrepreneur pay on the simplified tax system in 2020 from employees - a complete list

It happens in life that a person, while on vacation, needs an urgent dismissal. IN

Skip to content Kontur.Partner PRACTICAL ACCOUNTING, TAXES, HR 8-800-551-36-30 Free call within Russia 10/09/2019

Having a car in a company or for individual entrepreneurs - representatives of small businesses - is not so