Accounting

Tax calculation example Consider an example of how to calculate the tax rate in various cases. Example

Written disclaimer First, about the shortcomings of the article, so that readers who will waste

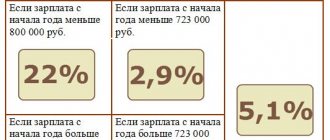

Personal income tax rate for 2020 The employer, as a tax agent, withholds personal income tax from the salary.

What are fixed assets? Fixed assets include any property of an enterprise used to carry out

Download work form knd0710096 for 2020. This choice falls on the management of the enterprise. Except

Transport tax for organizations from 2020 Transport tax for legal entities is a regional tax

A list of cost items is created in the accounting department of each enterprise. Grouping is carried out according to current principles

What are cash and cash equivalents? Cash and cash equivalents include all

Basic methods of cost accounting The efficiency of a company’s activities can be assessed using competent accounting of current

Part of your salary or in addition to it? Labor Code of the Russian Federation in Part 1 of Art. 135