Accounting

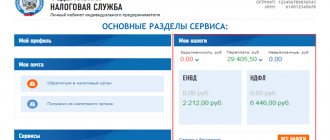

Questions discussed in the material: In what cases does overpayment of taxes occur for individual entrepreneurs? In what cases?

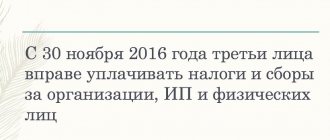

Is it allowed or not to pay taxes for other people? Is it possible to pay third parties for

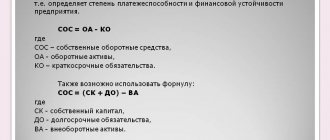

Current and non-current assets: what is the difference The structure of the balance sheet involves the reflection of information

Taxation base The obligation to pay property taxes to organizations using a simplified taxation system was imposed by the Federal

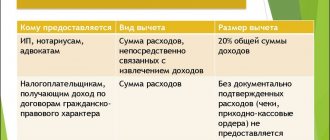

Home Reporting Conducting any activity for the purpose of making a profit is nothing more than

To quickly resolve production issues, enterprises need cellular communications more than ever. Like anyone

Where expenses are taken into account In order to correctly fill out a tax return for a single “simplified” tax, a special

Who submits UTII declarations All categories of taxpayers who use the

What are tax deduction codes for? The tax deduction code is a digital code. Deduction

When an employee resigns or his employment contract is terminated, to calculate the amount necessary for this