Accounting

Objects subject to tax based on cadastral value Since January 1, 2020, subjects of the Russian Federation have been provided

Diseases, poisonings and injuries happen to everyone. Such a nuisance can happen during business hours

What is indirect tax? Indirect taxes are mandatory payments that are levied on profits

Is compensation calculated for unused vacation upon dismissal in 2018? In practice

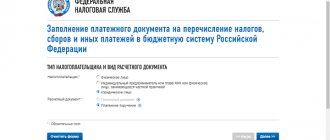

Filling out a payment order in the Federal Tax Service Main sources of law regulating the procedure for filling out payment orders in the Federal Tax Service

Many people involved in business activities know that, in some cases, when purchasing a product

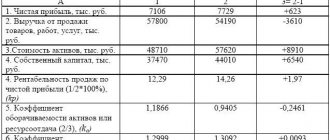

We make calculations To obtain this indicator, it is necessary to divide the net profit by the amount of all expenses.

Home / Taxes / What is VAT and when does it increase to 20 percent?

When drawing up an employment contract, citizens are guaranteed payment of monetary remuneration. IN

Of course, accountants usually do not have any difficulties with VAT calculations - they don’t even