Other

Errors when filling out invoices are not uncommon. Both experienced accountants and beginners can perform them.

Accounting and legal services Moreover, if it does not contain all the mandatory details provided for in paragraph

What legal norms are regulated? In the process of collecting material damages, the parties should focus on the provisions

Is the document required, its meaning For companies operating in the commercial sector, this

Who has signing authority? Who has the right to sign a particular document must

To compare information from the reports of taxpayers, suppliers and buyers, the Federal Tax Service uses various software systems,

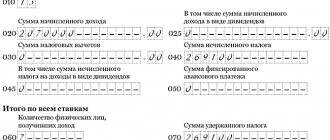

When there is no point in submitting an updated 6-NDFL Most of the errors made when generating the report on

The single tax on the simplified tax system is inextricably linked with the concept of “advance payment under the simplified tax system.” To pay

March 04, 2020 5109 5 Additional fine and blocking of current account - these are the possible

Why report on the number of personnel Tax authorities need information on the number of personnel working in the company