How to write an application to the court to establish the fact of acceptance of an inheritance?

An application to establish the fact of acceptance of an inheritance begins with determining the type of legal proceedings in which it is subject to consideration. Among them are two:

Special order . In this case, an application for recognition of the fact of inheritance is submitted in the absence of a dispute about the right. Namely, when there are no other direct heirs who have properly taken measures to accept the inheritance.

To draw up an application in special proceedings you need:

- In the header we indicate the court, district (city), magistrates do not consider applications of this type

- Submitted at the place of residence of the Applicant, from the parties we write Interested parties, most often a government agency that has the right to inherit escheated property if no one applies for inheritance

- State duty 300 rubles

- Requirement to establish the fact of acceptance of inheritance

Claim proceedings . A statement of claim is being prepared here, since it is assumed that there is a dispute between you and other heirs. When other heirs are against you.

- In the header we also indicate the district (city) court

- Submitted at the place of residence of the Defendants in the case, indicate all the heirs who apply for registration of the inheritance, select the address for one of the parties to the case. Do not forget that in the case of inheritance of real estate, the rule is to file a lawsuit at the location of the home, land, office or other object.

- The state duty is paid based on the price of the claim, i.e. from the value of the inheritance object

- The requirement to establish the fact of acceptance of the inheritance simultaneously with the recognition of the right to inheritance and other requests to the court

USEFUL : watch the video with recommendations for filing an application to the court

What constitutes actual non-acceptance of inheritance?

If a person has not declared ownership of the property within a six-month period by filing an application and has not applied for a waiver, then there is an actual non-acceptance of the inheritance.

In this case, the heir completely ignores accepting the inheritance and does not take any actions to enter into it.

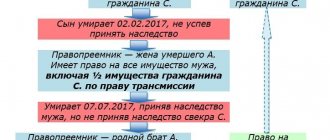

If within a six-month period a person does not accept the inheritance and dies, then the right is transferred by transmission. If the successor is alive and has not accepted his share after the expiration of the specified period, then he is considered a fallen heir and part of his inheritance mass will go to the remaining applicants who will claim their rights to the inheritance.

At the same time, we should not forget that in order to accept a share it is not necessary to submit an application - the legislator has provided for a number of actions that can be regarded as an intention to enter into an inheritance.

How can I register an inheritance? The answer is presented in the article “In what ways can you accept an inheritance?” You can find out about inheritance litigation here.

Sample application to establish the fact of acceptance of inheritance

To the Ordzhonikidze District Court of Yekaterinburg

Applicant:

Interested people:

Statement

on establishing the fact of acceptance of inheritance when the deadline is missed

On November 21, 1998, O. died, my aunt, what remained after the deceased and was part of the inheritance, passed into the possession of Z., my mother, and Z., my daughter. They actually accepted the inheritance.

The inheritance property includes:

- apartment number ..., located in the city of Yekaterinburg, on Kirovgradskaya Street, consisting of one room with a living area of 21.40 sq.m.; usable area of the apartment is 34.70.

On May 19, 1999, according to Z.’s application, it was opened by the notary of the city of Yekaterinburg Vasetskaya V.V. inheritance matter. A certificate of inheritance was not issued, only an agreement between Z. and Z. was certified to change the form of ownership and establish the size of shares for the apartment numbered ..., located at the address: Yekaterinburg, st. Kirovgradskaya, owned by Z. and O. by right of joint ownership

The fact that my mother Z. accepted the inheritance is confirmed by receipts for payment of taxes and utilities. I also organized O’s funeral at my mother’s expense. After my mother’s death, I continued to pay utilities and taxes.

On November 18, 2008, I contacted A.K. Khusnidinova at the notary office in Yekaterinburg. with an application for the issuance of a certificate of right to inheritance by law after the death of my mother - Z., who died on December 1, 2003, who accepted the inheritance, but did not formalize her inheritance rights after the death of her sister - O., for 1/2 share in the property right for an apartment under ..., located in the city of Yekaterinburg, on Kirovgradskaya Street, ... for which he received a Resolution refusing to perform a notarial act.

In accordance with Art. 1153 of the Civil Code of the Russian Federation: “it is recognized, until otherwise proven, that the heir accepted the inheritance if he performed actions indicating the actual acceptance of the inheritance, in particular if the heir:

- took possession or management of inherited property;

- made at his own expense expenses for the maintenance of the inherited property.”

According to Art. 264 of the Code of Civil Procedure of the Russian Federation: “the court establishes the facts on which the emergence, change, or termination of personal or property rights of citizens and organizations depends. The court considers cases to establish: the fact of acceptance of the inheritance and the place of opening of the inheritance.”

I need to establish the fact of my acceptance of the inheritance in order to obtain a certificate of the right to inheritance and registration of an apartment in the Office of the Federal Registration Service.

In accordance with Art. 264 Code of Civil Procedure of the Russian Federation

ASK:

- establish the fact that I accepted the inheritance - 1/2 shares of the apartment at the address: Ekaterinburg, st. Kirovgradskaya, house...

Date, signature

USEFUL : watch the video and find out why it is better to draw up any sample claim or complaint with our lawyer, write a question in the comments of the video, subscribe to the YouTube channel

What can be considered as receiving property?

The following actions of the heir may be considered as actions indicating the actual acceptance of the testator's property:

- management of inherited property or expressed actions in relation to it, as its owner would do under the right of ownership;

- expenses of own funds for the maintenance of the inheritance;

- settlement of debt obligations of the testator or acceptance from other persons of funds due to the deceased as a debt;

- actions aimed at protecting against illegal attacks by other persons on movable or immovable property included in the inheritance share.

That is, by performing the above actions, a person confirms acceptance of the inheritance, even in the absence of his application with a written statement.

In this case, there can no longer be actual non-acceptance of the inheritance, and the waiver of the share will have to be achieved during legal proceedings.

How to win a court case to establish the fact of acceptance of an inheritance?

In general and in general, in both cases the subject of proof will be the same. Namely, within the framework of judicial proceedings, you must prove the circumstances associated with the actual acceptance of the inheritance after the death of the testator.

These will be:

- Living together with the testator on the date of his death in premises belonging to the testator . Proof of this will be certificates of registration at the place of residence

- Taking possession of inherited property . For example, if after the death of the testator you rented out an apartment that belonged to him before his death, then such actions can be regarded as taking measures to dispose of property. To do this, you must submit an agreement with the tenant of the property

- Taking measures to preserve property . So if, within six months from the date of opening of the inheritance, you have made any improvements to the inherited property. Such actions can also be regarded as acceptance of an inheritance. Proof of this may be an agreement with a contractor to carry out repair work.

Failure to accept inheritance by law

» Advice from an inheritance lawyer May 26, 2021

How to refuse an inheritance in advance

Inheritance is a type of property that passes to relatives by law or according to a will after the death of a citizen. One way or another, every person will face this question one day in their life. And this meeting is not always pleasant.

Sometimes an inheritance turns out to be completely unnecessary or even burdensome. It may consist not only of property, but also of debts and obligations that the heirs clearly do not need. Therefore, the law provides for the right to refuse inheritance if desired.

What is renunciation of inheritance

Refusal of an inheritance, as well as its acceptance, are measures permitted by law that allow a citizen to voluntarily make a choice in this matter. The key word in this concept is the voluntariness of the decision made.

The legislation distinguishes two concepts that are similar in sound, but have completely different definitions: refusal of inheritance and non-acceptance of inheritance.

Failure to accept an inheritance is the inaction of a citizen in the matter of inheriting the property of the deceased within six months, which are allocated by law for making a decision. In this regard, he automatically loses the right of inheritance, which can then only be restored through the court.

Refusal of inheritance is a deliberate active action of the successor in relation to the bequeathed property, namely, non-acceptance of it through the submission of a written application. Such a decision cannot be canceled in the future; it is made once, without the right of return.

You can refuse an inheritance either in favor of a specific person or without specifying a successor. In the first case, the share goes to the person indicated in the application for refusal, and in the second, the share is distributed among all other participants in the process.

Types of refusal of inheritance

In accordance with the legislation of the Russian Federation, a citizen has two ways to refuse an inheritance: absolute and directed refusal.

An absolute refusal is just a refusal without specifying a specific recipient of the applicant’s inheritance share. It is in this case that it is distributed evenly among all other heirs who are indicated in the will or act as successors by law.

A directed refusal is the transfer of a share of the inheritance by the applicant to a specific person or persons. The applicant has the right to independently choose the person in whose favor the refusal will be made, but the law provides for a number of restrictions on the choice.

Thus, the inheritance share can be transferred only to those persons who are indicated in the will or who can act as heirs by law; it cannot go to a citizen who was deprived of the right to inherit by the testator himself or is considered an unreliable successor.

In the application, the heir who decided to renounce the share must indicate all the persons to whom he wishes to transfer his part. There may be a situation when the testator himself indicates in the will a specific person to whom a certain share should go in case of refusal, then the applicant can transfer it only to him.

Deadlines for renunciation of inheritance

In order to renounce an inheritance or take over the right of ownership by the state, a single period of six months is established from the date of death of the testator.

If it was not possible to submit an application for refusal within six months, the law allows you to file a claim in court.

But through the court it will be necessary to indicate and justify with evidence the reasons for failure to appear with a refusal application within the established time frame. if the court considers the reasons to be solid and valid, then the application for refusal will be granted.

Failure to accept an inheritance does not automatically mean rejection of it. If the heir did not come and express his decision in the law office for six months, but at the same time actively used the inherited property, then he automatically becomes its owner in accordance with the will or by law.

How to formalize a refusal of inheritance

In order to refuse an inheritance, you must correctly draw up an application.

It must necessarily contain the following points:

- full name of the notary office that deals with inheritance issues, actual and legal addresses

- Full name and actual place of residence of the applicant

- name of the document: “Application for renunciation of inheritance”

- main body of the letter: indicating the form of refusal of inheritance - with transfer to certain persons or without the participation of the latter

- date of application

- applicant's signature with transcript.

- Take the application personally to a notary office that deals with the issue of inheritance distribution

- Send the certified application to the notary by registered mail or courier

- Submit the application to a trusted person or official representative who has the right to conduct business on behalf of the applicant legally.

- management of inherited property or express actions in relation to it, as its owner would do under the right of ownership

- expenses of own funds for the maintenance of the inheritance

- settlement of debt obligations of the testator or acceptance from other persons of funds due to the deceased as a debt

- actions aimed at protecting against illegal attacks by other persons on movable or immovable property included in the inheritance share.

- about renunciation of inheritance

- to refute the actual acceptance of property

- about non-acceptance of inheritance.

- the person did not know or could not know about the opening of the inheritance due to his age and the obstructive actions of trustees or guardians

- the deadline was missed due to compelling reasons - serious illness or other insurmountable circumstances.

- Is it possible to inherit pension savings?

- Missed the deadline for entering into inheritance

A sample application can be found on specialized legal portals, and can also be obtained directly from a notary’s office. Filling out such an application does not cause any difficulties, but if suddenly some points turn out to be unclear, it is better to contact a notary for clarification.

A sample application for unconditional renunciation of inheritance can be downloaded here.

A sample application for renunciation of inheritance in someone else's favor can be downloaded here.

Is it possible to refuse an inheritance in favor of the mother?

Read here what are the consequences of refusing an inheritance.

The list of documents that must be attached to the application is small, and mainly this is the applicant’s passport, a will or other documents confirming the right of inheritance, a death certificate of the testator, a document confirming the last place of residence of the deceased. But sometimes a notary may request other documents, since each situation is unique and is considered individually.

After drawing up the application and collecting all the documents, it is necessary to have it certified by a notary so that it receives full legal force and transferred to the notary office that deals with this issue.

You can do this in three ways:

Is inheritance waived in advance?

Regarding this issue, the legislation provides only one option: you can refuse an inheritance only after the death of the testator.

After official confirmation of the death of the testator, each of the successors is given a period of six months, during which they must decide the fate of their share in the direction of acceptance or refusal. It must be remembered that each of the decisions is final and is not subject to further cancellation or change.

If the testator draws up a will in which he indicates certain persons to receive the inheritance, and deprives the remaining applicants of this right, then the last word remains with the testator and the inheritance is distributed only among those participants indicated in the document.

Was the Recording helpful? Yes No 1 out of 1 readers found this post helpful.

Comments on the article “How to refuse an inheritance in advance”

§ 7. Non-acceptance of inheritance (clauses 1821-1825)

1821. The opposite action to accepting an inheritance is non-acceptance of an inheritance. The legislation does not specifically regulate the procedure for performing such an action, only mentioning its possibility, and even then in a small number of cases (see paragraph 2 of Article 1121, paragraph 3 of Article 1154, paragraph 1 of Article 1161 of the Civil Code). It seems that non-acceptance of the inheritance should be considered the inaction of the heir during the period for accepting the inheritance, i.e., a situation in which the heir does not perform any of the actions that could be regarded as acceptance of the inheritance. Interested parties (including other heirs) have the right to regard such passive behavior as non-acceptance of the inheritance. The legal consequences of such an act vary somewhat, depending on the situation in which it is committed.

1822. In case of non-acceptance of the inheritance by the heir by law*, the share of the inheritance due to him goes to other heirs by law and is distributed among them in equal shares (paragraph 1, clause 1, article 1161 of the Civil Code). Example: when inheriting by law by two children and the surviving spouse of the testator, the share of the inheritance due to one of the children of the testator who did not accept the inheritance must be distributed between the second child and the surviving spouse in equal shares.

Another situation: the number of heirs includes: (1) by law - two children of the testator and the surviving spouse, and (2) by will - an old friend of the testator, to whom several specific things have been bequeathed. And in this case, if one of the children (the heir at law) does not accept the inheritance, his share will be divided into two parts between the heirs at law. The heir under the will will not participate in the division of this share.

* As we remember from paragraph 1802 of the Textbook, persons included in the circle of heirs by law are called upon to inherit in two situations - when inheriting only by law and in mixed inheritance, including by the right of compulsory share.

1823. The same consequences occur if the heir under a will does not accept the inheritance in situations of (1) mixed inheritance, as well as - (2) inheritance under a will, in which among the appointed heirs there is at least one person who is an heir at law (ibid.), regardless of which particular queue it is the heir to. An example of situation (1) can be given as follows: part of the property is bequeathed to several work colleagues of the testator.

If one of them does not accept the inheritance, its share will be distributed among the persons called to inherit by law (other “colleagues” - heirs under the will, will not participate in its distribution). Example for situation (2): if the testator bequeathed property (no matter - all or part of it) to his uncle and aunt (heirs according to the law of the third priority), while in the absence of a will his two children and surviving spouse would be called upon to inherit (heirs according to the law of the first priority), then if, say, an uncle does not accept the inheritance, the share due to him will be distributed between the children and the surviving spouse of the testator, without the participation of the aunt (heir under the will).

1824. But if all the property was bequeathed to persons who are not heirs by law, then the share of the inheritance due to the heir who did not accept the inheritance goes to the remaining heirs under the will and is distributed among them in equal shares (paragraph 2, paragraph 1, article 1161 GK). So, if all the property was bequeathed to work colleagues who were not heirs by law, then the share of one of them who did not accept the inheritance would be distributed among other colleagues - heirs by will. In this case, the legal heirs would not be entitled to anything. The legislation does not regulate the issue of the relationship of this rule with the rules on the right of compulsory share in inheritance, from which we can conclude that inheritance by the right of compulsory share does not eliminate the effect of paragraph. 2 p. 1 art. 1161 Civil Code. The heirs under a will, to whom all property is bequeathed to persons who are not included in the circle of heirs by law, distribute the share due to the heir who did not accept the inheritance, exclusively among themselves, even if other persons are called to inherit by the right of compulsory share.

1825. As stated above (footnote to paragraph 1809 of the Textbook), the right of increment does not arise in the event of non-acceptance of the inheritance by the heir who has a substitute. According to paragraph 2 of Art. 1121 of the Civil Code in this case, the right to accept the inheritance in the part due to the heir who did not accept the inheritance passes to the substitute - the substituted heir. For the timing of its implementation, see paragraph 1817 of the Textbook.

Non-acceptance of inheritance by heir

After the death of the testator, the successor has the right not to accept the inherited property. The possibility of renouncing your share is not affected by the method of receiving the inheritance - by will or by law. In both cases, the heir has the right to refuse the inheritance or actually not accept it. What is the essence of non-acceptance of inherited property, and what are its legal consequences?

How is it different from refusal?

Non-acceptance of an inheritance is possible by refusing it. In this case, the person makes an informed decision about renouncing the due share of the inheritance and expresses it in the form specified by law.

In case of refusal, we are talking about a unilateral transaction, which indicates the unconditional and unconditional non-acceptance of the inheritance by a person through a written statement of such expression of will to the notary in charge of the inheritance case.

A share can also be renounced in favor of other persons who have the right to inherit the property of the deceased.

In case of actual non-acceptance of the inheritance, the person does not submit an application for refusal and at the same time does not take any steps or actions to receive his part of the property.

Causes

The reasons for a written refusal of an inheritance may be related to the reluctance to deal with paperwork, the unfavorable position of the successor after receiving the inheritance share, or other personal circumstances. In each specific case, the heir himself decides whether to exercise the right to renounce the share or not.

The basis for the actual non-acceptance of the property of the deceased may be the same as in the case of refusal - the heir simply does not submit an application in the established form within the period specified by law.

However, the reason for such non-acceptance may also be the person’s ignorance of the death of the testator or the impossibility, due to obstacles, to contact a notary within the prescribed period and enter into an inheritance. In this case, the heir has the right to challenge the missed deadline in court.

The actual non-acceptance of the inheritance will also occur in the event of the death of the heir during the period between the opening of the inheritance case and the expiration of the period for entering into the inheritance. At the same time, the Civil Code of the Russian Federation provides that his immediate heirs can receive the property due.

How to register a land plot as an inheritance? The answer is presented in the article “How the entry and registration of inheritance on a land plot occurs.”

Whether the law allows you to enter into an inheritance before 6 months can be found here.

Consequences

If the heir decides to abandon his share left to him by the deceased, then he loses the right to receive this property by inheritance. In case of actual non-acceptance through inaction, the person also loses this right, but at the same time retains the opportunity to appeal the missed deadline.

When refusing part of the inheritance, a person may indicate in the application that the share will be transferred to other claimants to the property of the deceased.

It is not possible to withdraw an application or correct it, including by changing applicants. If the successor fails to act regarding the acceptance of the share, the rights to it are transferred to other applicants by will or by law in the order of priority.

Who can exercise the right

The law does not provide for a specific list or list of persons who have the right to refute the fact of acceptance of an inheritance. But such a position of the legislator does not mean at all that anyone can prove such a right.

Persons who have a legal interest - the heir and third parties (other heirs) - have the right to refuse to accept an inheritance.

If the heir died without having time to exercise the right to accept a share of the property, then it is transferred to his heirs. Such transfer of rights in legislation occurs from transmitter to transmitter, and the procedure itself is called hereditary transmission.

When transferring rights, the transmitter cannot receive a share of the inheritance greater than that which was due to the transmitter. The right that is transferred by way of transmission is not included in the estate left by the transmitter after death, that is, the transmitter receives two rights to different shares of the inheritance.

In turn, after the transmission, the transmitter himself can exercise the right to not accept the inheritance.

What constitutes actual non-acceptance of inheritance?

If a person has not declared ownership of the property within a six-month period by filing an application and has not applied for a waiver, then there is an actual non-acceptance of the inheritance.

In this case, the heir completely ignores accepting the inheritance and does not take any actions to enter into it.

If within a six-month period a person does not accept the inheritance and dies, then the right is transferred by transmission. If the successor is alive and has not accepted his share after the expiration of the specified period, then he is considered a fallen heir and part of his inheritance mass will go to the remaining applicants who will claim their rights to the inheritance.

At the same time, we should not forget that in order to accept a share it is not necessary to submit an application - the legislator has provided for a number of actions that can be regarded as an intention to enter into an inheritance.

How can I register an inheritance? The answer is presented in the article “In what ways can you accept an inheritance?”

You can find out about inheritance litigation here.

What can be considered as receiving property?

The following actions of the heir may be considered as actions indicating the actual acceptance of the testator's property:

That is, by performing the above actions, a person confirms acceptance of the inheritance, even in the absence of his application with a written statement.

In this case, there can no longer be actual non-acceptance of the inheritance, and the waiver of the share will have to be achieved during legal proceedings.

How can you implement

You can renounce an inheritance by refusal - a unilateral transaction by the heir. Also, the right to not accept an inheritance can be exercised by submitting an appropriate application to a notary. The will of the successor to not accept property requires lifetime confirmation, as in the case of refusal of inheritance.

Despite the fact that failure to accept an inheritance is a person’s inaction, the heir must inform the notary that he did not accept his share.

After the six-month period, the notary might not take statements from the successors, but he should make sure that the person knew about the share of the inheritance due. In addition, he needs to know about the presence or absence of reasons for missing the deadline, in connection with which the heir can then go to court to receive the inheritance.

Statement

To confirm non-acceptance of an inheritance, the following applications may be submitted:

In the first case, we are talking about an irrevocable renunciation of the property of the testator.

The second type of application must contain information confirming the lack of intention to take a share in the actions of the heir.

Also, it must be indicated that in the future the person will not file a claim in court to restore the missed deadline for accepting the share.

In the third case, the application is submitted after the deadline has been missed and must contain information from the heir that he knows about the inheritance due and the deadline for accepting it has been missed; he did not accept the inheritance and does not intend to accept it, and will not apply to the judicial authorities to restore the deadline.

Refusal procedure (transaction)

Refusal of inheritance occurs in the form of a unilateral transaction; the rules of law that regulate the general provisions of civil transactions are applied to it. Refusal of a share is also possible after acceptance of an inheritance.

The right of refusal does not depend on the circumstances; for it it is not necessary to apply for permission from a notary’s office or from other heirs.

After the death of the testator, the heir has six months to enter into the inheritance - it is during this period that a refusal can be filed.

You can apply to renounce an inheritance only once; subsequently, the person will not be able to change or cancel it. The heir does not have the opportunity to accept one part of his share and renounce the other - the share is accepted in its entirety. This should not be forgotten if, along with the right of ownership, the inheritance includes obligations to pay off the debt.

However, the successor has the right to refuse the inheritance on one of the grounds (by law or will), and on the second he has the right to accept the share.

The procedure for filing an application for refusal is the same as for accepting an inheritance. When submitting it to a notary, it is necessary to note in the text that the person refuses the inheritance - this wording most legally correctly reflects the essence of the refusal.

What laws are responsible

The legal institution of non-acceptance of inheritance is fully regulated by the Civil Code of the Russian Federation. Articles 1156-1159 of the Code address issues of hereditary transmission, non-acceptance and renunciation of inheritance. The institution of non-acceptance of an inheritance, especially in terms of timing, is closely related to the rules governing the provisions for accepting an inheritance.

Renewal of the term

If a person has not accepted the inheritance within the period established by law, then he has the right to its restoration in certain cases:

The heir must apply to restore the term before the expiration of 6 months from the date of termination of the circumstances preventing him from receiving his share.

Legal practice

In practice, it is possible to refute actions that are considered acceptance of an inheritance under certain conditions. In the case of registration of an heir in the deceased’s home, in order to refute the acceptance of the inheritance, the successor must prove that at the time of the death of a loved one he did not live with him and did not take actions aimed at owning real estate.

A refutation of the actual acceptance of a share cannot be considered separately from the intentions of the heir when performing actual actions with the property.

For example, the successor sold things that belonged to a deceased relative, but was not aware of the debt obligations included in the inheritance estate, and subsequently decided to abandon his share.

In favor of another contender

In an application for refusal of inheritance, a person has the right to indicate another applicant in whose favor the applicant’s share will go. The specified person may receive a share in the same amount as the first heir. If the refusal is made in favor of several people, then the share will be divided equally between the applicants.

The applicant can independently distribute his part of the inheritance in favor of several persons.

However, a directed refusal cannot be made if the heir has a personal right to the share, the heir has his own sub-heir under the will, or if in the course of implementing the provisions of the application the heir violates the will of the testator.

Refusal to accept inheritance in the Russian Federation. Ways to renounce the testator's property

Before receiving the property of the deceased, the heir must complete a number of actions. However, situations arise when a person considered an heir refuses the inheritance for certain reasons. Failure to accept an inheritance may consist of inaction and the preparation of a waiver of the testator's property. This issue is regulated by Chapter 64 of the Civil Code of the Russian Federation. Acceptance or non-acceptance of an inheritance is the right of every heir, so the law offers several ways to do this.

Non-acceptance of inheritance due to inaction of the heir

The Civil Code establishes a six-month period for persons claiming the property of the testator to have time to contact a notary and provide the necessary package of documents. However, federal law also provides for the case when the heir does not submit an application to the notary on his own initiative. An heir who has not submitted an application to a notary within six months is considered to have not accepted the inheritance. In this case, the property of the deceased is distributed among the remaining heirs, who are included in one of the following queues.

The reasons for not accepting an inheritance through inaction may be different. The heir may not have known about the death of the testator, or he knew, but could not contact the notary within the prescribed period. In this case, the timing of acceptance of the inheritance may be challenged in court. We discussed how this is done in an article on the topic: “Entering inheritance after death by citizens of the Russian Federation.”

An heir who died after the opening of the inheritance, but before the deadline for its acceptance expires, transfers the opportunity to receive the property of the deceased to his heirs. This right is regulated by Article 1156.

Registration of refusal of inheritance

Each heir has the right to refuse to receive property. This right is established by articles 1157-1159 of federal law. In accordance with these norms, a person who has received the right to accept an inheritance can formalize with a notary a written renunciation of the property in favor of one or another heir. The heir can abandon the property completely. However, options are not excluded when a person deprives himself of the right to only part of the property. If the heir has rights to an obligatory share in the property, it cannot be renounced.

Registration of refusal of inheritance is an irrevocable way of not accepting an inheritance. Article 1157 states that a person who has executed a written renunciation of the property of the deceased does not have the right to change or revoke it. Therefore, a more prudent way of not accepting an inheritance is inaction, because if something happens, the heir will be able to challenge it with a statement of claim.

Before deciding to accept an inheritance, it is advisable to consult with our lawyers, because there are pitfalls that can lead to major financial problems. Our professionals are ready to advise you as soon as possible.

Sources: uropora.ru, uchebniki-besplatno.com, sudguru.ru, arenaprava.ru

Next:

No comments yet!

Share your opinion

You might be interested in

Application to court for inheritance after death

Documents for receiving inheritance after death

Registration of inheritance up to 6 months

Limitation period for inheriting real estate

Popular

Within what period is a notary required to issue a certificate of right to inheritance (Read 119)

How to inherit a car if there are several heirs (Read 109)

Benefits for disabled people when accepting an inheritance (Read 74)

Kirpichnikov inherited a residential building that required major renovation (Read 55)