Other

Why is the statistical form P-4 of Rosstat needed? The form in question is a source of statistical reporting, which in

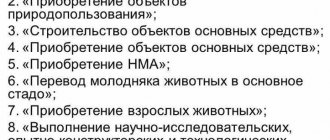

Specifics of reflecting costs To begin with, it should be noted that this category refers to funds allocated

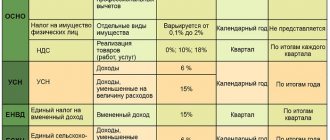

In what cases is it not necessary to pay VAT on advances? The VAT payer is not obliged to calculate

As follows from the provisions of Article 168 of the Tax Code, the seller of goods, works or services in

Home / News and changes Back Published: 04/19/2019 Reading time: 3 min 0

What is the Federal Tax Service code? The tax authority code is a combination of four Arabic digits.

Why is a collection order necessary? The role of a collection order is simple: to pay for any services or

KBK – budget classification code. It is used by entrepreneurs and organizations to transfer mandatory taxes

The author of the document Dogovor-Yurist.Ru is offline Status: Legal. company rating460 84 / 6 Personal

Accounting entries for investments in non-current assets (Account 08) Receipt of goods or intangible assets