Accounting

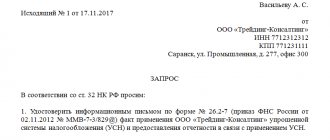

Do I need to confirm my right to the simplified tax system every year? Notification of the taxpayer’s desire to apply the simplified tax system

What are intangible assets? Intangible assets are classified as non-current assets, as opposed to fixed assets.

Currency transactions in accounting in 2019–2020 In accordance with the above PBU in

How can a founder deposit money into an LLC current account for a simplified taxation system: Article 346.15,

Every person has heard about value added tax, because it is indicated on any receipts.

Is it necessary to include the founding director in the “zero” SZV-M report if he does not receive from his

The balance sheet and income statement are the main reports on which external

Mandatory product labeling brings business not only procedural and technological difficulties. She influences

Cases of returning goods In accordance with the norms of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation),

Accounting in non-profit organizations must be carried out taking into account the concepts and provisions prescribed in its