Accounting

Simplified tax system and criteria for its use In order to be able to use it in your activities

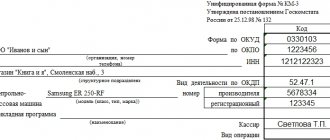

Form KM-3. Act on the return of money to buyers An act in the KM-3 form is used for

What is arrears? According to the Tax Code, arrears are taxes or obligatory payments that

KBC transport tax 2020 for organizations and individuals is different. Get information about him

» Managing an individual entrepreneur Any business activity that is carried out cannot be done without various financial transactions

Most entrepreneurs have encountered the concept of a tax audit. According to the Tax Code of the Russian Federation,

Property tax: accrual transactions Tax is paid by companies using OSNO, as well as firms

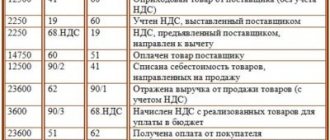

2. Calculation of tax deductions for VAT. We assume that all payments related to production costs for

Form 5 of financial statements Current as of: December 11, 2020 On the composition of financial statements

Pre-retirement age in the Russian Federation from 2020: pre-retirement years, citizens of pre-retirement age, etc.