The legal topic is very complex, but in this article we will try to answer the question “Account 40110 in budget accounting kek? 2020". Of course, if you still have questions, you can consult with lawyers online for free directly on the website.

In accordance with the latest changes made by Order of the Ministry of Finance dated No. 297n to paragraph 2 of Appendix 2 of Instruction 162n (Chart of Accounts and Instructions for its use by STATE institutions

) concerning the numbering

budget accounting

accounts .

Application of KPS on accounting accounts in 2020

to the KPS templates in the accounts of

budgetary and autonomous institutions

in 2020, the structure remained the same, but we must not forget about the changes made by Orders 245n from (on the use of budget classification) and 246n from (on the use of KOSGU).

For government institutions

In the general case, in categories 1 - 17 of the analytical accounting account number, 4 - 20 categories of the budget classification (KBK without chapter code) are used. Exceptions from the above requirements for the composition of the KPS are given in the form of a table:

Zamovte see online or call 0 For advice on changes in personal income tax this year, as well as examples of personal income tax calculation Let us reassure you right away: there are no radical changes yet, although there are minor changes.

Chart of accounts for accounting 2020 in budgetary organizations

Thus, the budget classification code is integrated into the chart of accounts code. This allows you to keep records of certain types of assets and create an information base for generating the necessary reporting in accordance with current legislation and IFRS requirements.

The list of accounts used for the economic accounting of an organization is called the Chart of Accounts. The chart of accounts of budgetary organizations is separate from the chart of accounts used in commercial organizations. In budgetary organizations, accounting is kept for budgetary and extra-budgetary sources of funding.

Acceptable kek 180 in correspondence with account 40110 kfo 7 2020

Accounting for other types of income is now more detailed. The institution is recognized as the injured party. Once a month we make a selection of articles, recommendations, news on current topics and send it out to our subscribers completely free of charge. Please leave your address if you would like to receive interesting professional information.

Acceptable Kak 180 In Correspondence With Account 40110 KFO 7 2020

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free! Let's consider these changes, but for now let's remember the basic tax rates, which remain in effect for the year. The net taxable income of individual entrepreneurs subject to the general taxation system is the difference between their income and expenses.

This is interesting: Payment of VAT penalties payment order 2020 sample

With this recording scheme, on the one hand, we obtain from the accounting data the amount of accrued income minus VAT for each analytical group of subtype of income (AGPD), on the other hand, we reflect the accrual and payment of VAT in accordance with Procedures No. 209n and No. 132n - according to AGPD 180 and KOSGU 189.

If electrical installation work is carried out under a public services agreement, spend the costs according to subarticle KOSGU 223 “Utilities”. If a separate contract has been drawn up for electricity connection services or electrical installation work, this is subarticle KOSGU 226 “Other work, services.”

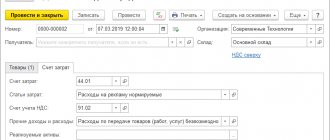

Useful functions of "1C: BGU" that you did not know about

Let's consider the main changes related to KOSGU and KVR in 2020. Financial department specialists have created methodological recommendations for the new procedure for applying KOSGU. They are contained in the letter of the Ministry of Finance dated June 29, 2020 No. 02-05-10/45153. Important changes include the new principle of using KOSGU codes when paying wages and providing social guarantees to employees.

Credit turnover on account 40110 KOSGU (KEK) “173” is analyzed in correspondence with accounts included in groups 208, 302, 303, 30402 and 30403 minus debit turnover on account 40110 KOSGU (KEK) 173 with the same correspondence. accounts.

What account are fines in a budgetary institution?

The fine does not cancel the obligation to pay the accrued tax and is imposed in a strictly defined amount, based on the type of violation. The decision to collect a fine is made by the tax authorities. But in addition to penalties, in case of failure to pay the tax on time, the payer becomes obligated to pay a penalty.

Based on the results of a desk audit of the declaration for the second quarter of 2015, organizations were assessed additional VAT, penalties and a fine in connection with the unlawful use of tax deductions (several invoices were issued with violations). The organization does not plan to challenge the inspection's decision.

Application of Kak for 105 Accounts in 2020

Thus, accounting for the costs of manufacturing products, regulated by the new instructions, allows for separate accounting of operations for the production of inventories for the institution’s own needs and for subsequent sales.

Impairment of non-financial assets

Expenses for the acquisition of non-exclusive rights to the results of intellectual activity, including the acquisition of user and licensing rights to software, the acquisition and updating of reference and information databases are excluded from subarticle 226 “Other works, services”.

If you need assistance of a legal nature (you have a complex case and you don’t know how to fill out documents, the MFC unreasonably requires additional papers and certificates or refuses them altogether), then we offer free legal advice:

Why do you need an off-balance sheet account of a budget organization?

Don't know what an off-balance sheet account is in accounting? In the working charts of accounts used in accounting in both budgetary and commercial and non-profit organizations, main (balance sheet) and off-balance sheet accounts are distinguished. On the main accounts, accountants must conduct transactions related to the movement of cash and other material assets, receipts and disposals, profits and mutual settlements with counterparties; information about various goods and works, as well as advertising and other services are taken into account. Off-balance sheet accounts are used to account for inventory items that are temporarily at the disposal of the organization and do not belong to it as property. Off-balance sheet accounts are also needed to reflect transactions on those obligations that are awaiting fulfillment, and the movement of values not intended for accounting on the main accounting accounts.

We recommend reading: When will the pension increase for Group 3 disabled people in 2019

Such accounts are auxiliary accounting accounts. The balances for them are not included in the balance sheet and are illustrated behind the results of the main balance sheet, that is, behind the balance sheet. They do not affect the financial result and are not reflected in the periodic and final reports of the organization.

Acceptable kek 180 in correspondence with account 40110 kfo 7 2020

Note. Access to the full contents of this document is restricted. Registration Login. Taxes, contributions and accounting from the year. Search content Navigator Related. Beginning Previous section Next section End. Registered users of the portal: Document date Kravchenko, expert in the field of accounting and reporting of public sector institutions At the beginning of February of this year, the Russian Ministry of Finance issued two system letters with recommendations for the preparation of annual reporting.

Accounting for the income of institutions in the light of recent changes in KOSGU

Kravchenko, expert in the field of accounting and reporting of public sector institutions. The Russian Ministry of Finance and the Federal Treasury jointly issued the following reporting letters:. Accounting in the year was marked by the beginning of the application of federal accounting standards for public sector organizations (hereinafter referred to as GHS), new KOSGU, approved for the year by order of the Ministry of Finance of Russia from By the way, the order was recognized as not requiring registration with the Ministry of Justice of Russia.

This is interesting: Cost of a cubic meter of water by meter 2020 Moscow region

Payment to employees of average monthly earnings for the period of employment upon their dismissal in connection with the liquidation or reorganization of the institution, other organizational and staffing measures leading to a reduction in the number or staff of the institution

New bank accounts are being introduced for the payment of taxes, fees, contributions: when and in which regions

However, for the convenience of payers, from the specified date to April 29, 2020 inclusive, the Central Bank is introducing a transition period. That is, during it, when filling out the payment, both options of bank accounts are relevant:

Correct and timely transfer of obligatory payments to the budget in 2020 - taxes, fees, insurance premiums - is impossible without indicating the correct and current bank account number in the payment order. The Federal Tax Service of Russia and the Federal Treasury report that for several regions its details will be updated very soon. We will tell you for which constituent entities of the Russian Federation this is relevant, when exactly the bank account will be changed, and how to fill out the payment correctly now.

We recommend reading: Dairy Kitchen During Pregnancy in the Moscow Region

Compliance with cash register and accounting accounts in 2020

Also, subarticle 129 should include income from fees for the rental of residential premises provided under social tenancy agreements or rental agreements for residential premises of the state or municipal housing stock, rental agreements for specialized residential premises.

Compliance with cash register and accounting accounts in 2020

Ministry of Finance of Russia dated December 30, 2017 No. 274n (hereinafter referred to as the GHS “Accounting Policy”). From 2020, when drawing up accounting policies, it is necessary to be guided by the provisions of this standard, as well as methodological recommendations for its application (communicated by letter of the Ministry of Finance of Russia dated 08/31/2020 No. 02-06-07/62480) 13 Conversion into rubles of accounting items whose value is expressed in foreign currency currency The procedure for recalculation is excluded.

According to paragraph 38

Instruction No. 157n for accounting for transactions with material objects related to fixed assets in accordance with the provisions of the federal accounting standard for public sector organizations “Fixed assets”, account 101 00 “Fixed assets” is intended.

“Future income from gratuitous receipts from budgets, received with conditions upon the transfer of assets, is recognized in accounting as part of income from gratuitous receipts from budgets of the current reporting period as such conditions are met insofar as they relate to the corresponding reporting period.” (clause 31

Standard "Revenue").

Why is data on accounts 111 00 “Rights to use assets” not generated in the property tax return?

Thus, from January 1, 2109, to reflect the costs of paying benefits for the first three days of temporary disability at the expense of the employer, subarticle 266 “Social benefits and compensation to personnel in cash” should be applied.

For example, compensation for travel and baggage costs to and from the place of vacation use for persons working in the Far North and equivalent areas, and members of their families, is classified as other non-social payments to staff in kind.

In 24-26 digits of account numbers, budgetary and government institutions reflect the KOSGU codes. This was indicated earlier, and currently such a norm is in Instruction No. 157n. And for autonomous institutions, Instruction No. 157n provided for the indication in these categories of an analytical code reflecting receipts or disposals.

Budget classification of KOSGU for 2020

Thus, reimbursement to staff of expenses related to business trips (travel expenses, rental of residential premises and other expenses made with the permission or knowledge of the employer) from 2020 is reflected in the type of expenses 112 “Other payments to personnel of institutions, with the exception of the payment fund labor" in connection with subarticle 226 "Other work, services" of KOSGU.

This is interesting: Child benefits for the third child in 2020 in the Moscow region

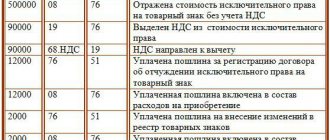

Since 2020, operations of taxpayers - state (municipal) autonomous and budgetary institutions for the payment of VAT on income from sales made, work performed, services rendered are included in article 180 “Other income” of the analytical group of the subtype of budget income in conjunction with subarticle 189 “Other income” KOSGU (clause 12.1.7 clause 12 of the Procedure approved by Order of the Ministry of Finance of Russia dated June 8, 2020 No. 132n, clause 9 of the Procedure approved by Order of the Ministry of Finance of Russia dated November 29, 2017 No. 209n (hereinafter referred to as Procedure No. 209n)).

Budget accounting

The amounts of receivables are reflected on personal accounts in the manner established by clauses 2.5.4 and 2.5.6 of the Procedure approved by Order of the Federal Treasury dated October 10, 2008 No. 8n. Cash expenses made by institutions on personal accounts opened with the treasury authorities are recorded in the following entries:

| No. | accounting entry | ||

| account debit | account credit | ||

| Transfer of funds to subordinate administrators (recipients) of budget funds | 1 30404 XXX | 1 30405 XXX | |

| Reflection of cash received at the institution's cash desk | 1 21003 560 1 20134 510 | 1 30405 XXX 1 21003 660 | |

| Transfer of funds from a personal account in payment for concluded contracts for the supply of products (performance of work, provision of services) | 1 302ХХ 830 | 1 30405 XXX | |

| Transfer of funds from a personal account in advance payment for products (work, services) | 1 206ХХ 560 | 1 30405 XXX | |

| Transfer of funds from a personal account in order to pay taxes and fees provided for by current legislation | 1 303ХХ 830 | 1 30405 XXX | |

| Transfer of funds from a personal account in order to pay income administered by the institution | 1 21002 XXX | 1 30405 XXX | |

| Transfer from a personal account of funds withheld from wages, scholarships, and other payments to the recipient of the withheld amounts | 1 30403 830 | 1 30405 XXX | |

| Transfer of funds from a personal account to the account of an accountable person in a credit institution | 1 208ХХ 560 | 1 30405 XXX | |

When restoring (clarifying) cash expenses in budget accounting, the following entries are made:

No.

VAT accounting by budgetary institutions from 2020

This conclusion is also confirmed by the following. According to the draft amendments to the Instruction, approved by Order of the Ministry of Finance of Russia dated March 25, 2011 No. 33n (hereinafter referred to as Instruction No. 33n), used by budgetary and autonomous institutions when preparing reports, the Report (f. 0503721) on line 040 reflects the amount of data on the corresponding analytical accounting accounts account 0 401 10 130, minus the VAT amounts accrued from this income (on the debit of account 0 401 10 130). It follows that the procedure for generating line 040 of the Report (f. 0503721) has not changed.

Budget classification for transactions with VAT from 2020

Since 2020, new procedures for the use of budget classification codes have come into force. The changes also affected VAT calculations. Let's consider VAT accounting operations by budgetary institutions starting from 2020 in a new article.

040100000 “Financial result of the institution”; 040101000 “Financial result of current activities”; 040102000 “Financial result for the reserve fund”; 040103000 “Financial result of previous reporting periods”; 040104100 “Deferred income”.

How to keep accounting records in a government institution in 2020

Before characterizing accounting in government institutions in 2020, let’s consider the concept of this type of government institution. This is a separate type of state and municipal organizations created to carry out state tasks and municipal tasks or carry out the functions of government bodies, financed from the corresponding budget on the basis of budget estimates.

Legal regulation

The rules for organizing and maintaining accounting records in government institutions in 2020 are regulated by:

- Law No. 402-FZ regarding key issues in the organization of accounting;

- instructions No. 157n and No. 162n regarding the unified chart of accounts and the rules for its application;

- Instruction No. 132n regarding the formation of budget classification codes to reflect transactions in corporate accounting;

- Instruction No. 191n regarding the composition and procedure for generating reports in the CU;

- order No. 209n regarding the formation of KOSGU;

- federal accounting standards regulating industry accounting methods;

- methodological recommendations, letters and explanations from the Ministry of Finance of the Russian Federation and individual departments regarding the settlement of issues related to accounting.

Also, the main system of regulatory regulation of accounting can include regional and municipal regulations that establish separate rules for accounting and reporting.

New in budget accounting in 2020 for government agencies

In 2020, almost all existing budget accounting instructions were adjusted. Officials have published a new procedure for the formation of budget classification codes to reflect income and expenditure transactions - Order No. 132n. The general structure of the KBK has been preserved, but there are changes, and there are quite a lot of them.

Innovations also affected the current procedure for the formation of KOSGU. Since January 2020, Order No. 209n has been applied. New provisions have added new accounting codes, the names of some old ones have been changed, and some have been completely eliminated.

Please note that the changes also affected the Unified Chart of Accounts - instruction No. 162n. For example, officials have established at the legislative level what accounting transactions should reflect the movement of fixed assets when transferring assets for lease, trust management or gratuitous use.

Read more about these innovations in the articles “Changes to the BCC from 2020: what is important for state employees and NPOs to know” and “We work correctly: all instructions on budget accounting.”

In addition to the adjusted instructions, officials approved five more new federal standards to the existing five, which detailed the accounting procedure in government agencies of the budgetary sector. It is planned to introduce 20 more standards, but the innovations will be gradual and will be completed before 2020.

Let us recall that the first five FSBs of 2020 determined that the accounting of fixed assets in government institutions in 2020 will be carried out in a new way. Accounting accounts have been changed, new methods for calculating depreciation have been added, and cost limits for calculating depreciation have also been increased. Read more about these changes in the article “Understanding the New Accounting Standards.”

FSBU 2020 adjusted completely new areas of accounting. So, officials:

- approved new requirements for accounting policies,

- approved the cash flow statement,

- approved the procedure for determining events after the reporting date,

- characterized the object of accounting - income,

- indicated the impact of changes in foreign exchange rates.

Taking into account these changes, CU had to adjust local documents regulating the methods and methods of accounting, that is, update the accounting policy.

These changes had to be approved in December 2018.

You can check the accounting policies for 2020 for government institutions, innovations - whether all changes are taken into account in the main document, in the article “Accounting policies: how to compile according to new requirements.”

Also pay attention to the article on how to properly account for bank guarantees.

Authorization of expenses in budget accounting

A distinctive feature of accounting in government institutions is the mandatory authorization of expenses incurred. Such transactions are reflected in special accounts PAS - 0 500 00 000. Thus, to reflect obligations of the current period and plan years, an account is used.

0 502 00 000 “Liabilities”. Please note that it is necessary to register transactions only on the basis of documents confirming the fact of accepting a specific obligation.

The list of such documentation that the organization will use in its activities should be fixed in the accounting policy.

Transactions for authorizing expenses of a government institution in 2019 should be reflected in the context of creditors, contracts and agreements and other analytical indicators that are established for the accounting entity in its accounting policies. Consolidation and generalization of information, bypassing the organization of reliable analytical accounting, is unacceptable. Balances of accepted obligations at the end of the reporting year are subject to mandatory re-registration in the next period.

State institution reporting in 2020

As noted above, the composition and procedure for preparing reports for such organizations is established by Order of the Ministry of Finance No. 191n. The specifics of drawing up budget reporting forms and current forms can be found in the article “How accountants of budget organizations report.”

Most of the questions of accountants are related to the preparation of an explanatory note to the annual report of a government institution.

The reporting form consists of five sections:

- Organizational structure of the subject of budget reporting (BO).

- Results of the activities of the BO subject.

- Analysis of the budget execution report by the BO subject.

- Analysis of financial reporting indicators of the BO entity.

- Other issues related to the activities of the BO subject.

Each section of the report contains special tabular forms and text information - explanations of the annual reporting indicators.

Current form: explanatory note to the balance sheet of a government institution for 2020

The superior manager has the right to establish additional reporting forms, detailed information and industry requirements for the formation of an explanatory note. Such requirements must be communicated to the CU by a separate administrative act.

Sample explanatory note to the balance sheet 0503160 of a government institution

Download

Source: https://gosuchetnik.ru/bukhgalteriya/kak-vesti-bukhgalterskiy-uchet-v-kazennom-uchrezhdenii-v-2018-godu

Account 30227 In Budget Accounting 2020 What Kak

220 Purchase for the provision of special fuel and fuels and lubricants, food and clothing supplies to bodies in the field of national security, law enforcement and defense

Budget accounting account

2. If an institution purchases bottled water if there is a centralized drinking water supply system and the water complies with sanitary standards, then the costs are charged to subarticle 342 “Increase in the cost of food” of KOSGU (codes 11.07.11.121 and 11.07.11.122 OK 034-2014 belong to class 11 "Beverages").

The updated Instruction N 162n clarifies that accounts for the division of non-financial assets, settlement accounts for income (205 00), for advances issued (206 00), with accountable persons (208 00), for damage and other income (209 00), for accepted obligations (302 00) should be formed as follows:

Transactions on “input” VAT (account 210 12 000)

As noted above, the amount of VAT payable to the budget is reduced by the amount of tax deductions, which are concentrated in account 210 10,000 “Calculations for tax deductions for VAT”.