- April 23, 2020

- Accounting

- Olga Strelkova

Beginning entrepreneurs often confuse concepts such as lost profit and damage. In fact, these are different things. Article 15 of the Civil Code of the Russian Federation defines lost profits as follows. These are the income that a person - individual or legal - could have received under normal conditions if there had not been a violation of his legal rights by third parties.

As for the actual damage regulated by the same article, it refers to funds that have either already been spent or are planned as expenses. For example, when a premises intended for rent was flooded. The first of these concepts, as well as the calculation of lost profits for the court, will be discussed in detail in the article.

Necessity of proof in court

So, in the situation with flooding of the rental premises, which is mentioned above, the lost profit will be the money that the owner of the property could have earned if he had rented it out. But due to damage caused by flooding, he was deprived of such an opportunity, since there were no people willing to use such a room. This is what is called lost profit in economics, a sample calculation of which will be given below.

When the entrepreneur who owns the flooded premises begins to estimate how much it will cost him to repair it, he will make a calculation of the damage received.

Many people have encountered the concepts of lost profits and damages. But the question of how to recover losses from the guilty party is quite complex. Especially in terms of damages in the form of lost profits. After all, it can only be obtained if the injured party manages to prove this fact in court with the help of convincing, documented arguments.

Direct damage and lost profits

Violation of the legal right of a legal entity or individual often entails not only direct material damage, but also loss of income, which is commonly called lost profit.

The legal definition of lost profits and direct damage is given in the Civil Code of the Russian Federation, in Article 15:

“Article 15. Compensation for losses.

1. A person whose right has been violated may demand full compensation for the losses caused to him, unless the law or contract provides for compensation for losses in a smaller amount. 2. Losses are understood as expenses that a person whose right has been violated has made or will have to make to restore the violated right, loss or damage to his property (real damage), as well as lost income that this person would have received under normal conditions of civil circulation, if his right had not been violated (lost profits).If the person who violated the right received income as a result, the person whose right was violated has the right to demand compensation, along with other damages, for lost profits in an amount not less than such income.”

To better understand how direct damage differs from lost profits, consider such a common case of damage as flooding with water. Let's assume that a grocery store on the ground floor of a building was flooded as a result of a water leak in an apartment on the top floor. Due to water damage, both the interior decoration of the store and its equipment (cash registers, refrigerated counters, goods, etc.) became unusable. As a result of this flood, the store was forced to close for the period necessary for restoration work. In this example, the store owner's losses will consist of the expenses that he will have to make to restore the normal operation of the store, namely the costs of renovating the premises and repairing or purchasing new equipment (direct damage), as well as from lost profits from trading during that time while the store is closed for renovations (lost profits).

Four specific examples of situations

Let us give examples of situations when people are faced with the need to calculate lost profits.

Example one. The company ordered equipment from the supplier, but he delayed delivery for one reason or another. This became an obstacle to the full functioning of the customer company. For the time for which there was a delay in delivery relative to the terms specified in the contract, it is possible to calculate lost profits.

Example two. A taxi driver was involved in an accident that was not his fault. During the period of downtime, when the car was being repaired, the driver could have earned money, but this did not happen. In such a situation, lost income is assumed.

Example three. The company hired a contractor to construct an office building. However, he violated the construction deadlines specified in the agreement of the parties. At the same time, the company is forced to rent premises for a lot of money, although it already planned to work in its own building. Thus, we can talk about lost profits.

Example four. Having handed over the car for repair, a person rents another one. The service station missed the deadline, and the repaired car was not handed over to the owner in a repaired condition. During this period, you have to continue to use rented vehicles to earn money. And again, lack of funds.

Recovery of lost profits

Do you think that in addition to actual losses you suffered losses in the form of lost profits? Such losses can also be recovered!

Lost profits refer to losses and presuppose lost income that a person would have received under normal conditions of civil transactions if his right had not been violated.

Despite the apparent simplicity of understanding what is lost profit, in practice the process of proving the existence of this type of loss causes great difficulties. In judicial practice, the percentage of satisfaction of this category of claims is very small.

This is due to several circumstances. The secret of the difficulty of proving lost profits is primarily explained by the fact that in the small amount of judicial practice that has developed, this category of disputes is left to the principle of adversarial behavior of the parties and does not fall under the principle of “objective truth”, which is valid in almost all other categories of judicial disputes. In other words, the court does not finalize the evidence base for the party, even if it sees that the claim is in some part justified. Secondly, the complexity is associated with the fact that in order to compensate for lost profits, the subject of proof includes circumstances, the proof of which is associated with certain difficulties, in contrast to claims for compensation for losses in the form of actual damage, where its presence is due to the events that actually occurred, and the amount is practically It is always possible to establish, even with the help of an expert opinion.

What needs to be done to appear convincing in court and recover damages in the form of lost profits? To begin with, it is necessary to determine a list of legal situations in which there will be no grounds for filing claims related to lost profits. A significant point in proof is whether the creditor associates the losses incurred in the form of lost profits with the expected income from a transaction with the debtor himself, or from a transaction with other counterparties. I would like to draw your attention to the fact that, by virtue of clause 1 of Article 14 of the Civil Code of the Republic of Belarus, the right to demand compensation for losses caused is given to the person whose right was violated, but only if the legislation or an agreement corresponding to the legislation does not provide otherwise. When filing claims for compensation for losses in the form of lost profits with expected income from a transaction with the debtor himself, the creditor must keep in mind that a number of legal relations - sale of goods according to samples (clause 3 of Article 467 of the Civil Code), household contracting (clause 2 of Art. .684 of the Civil Code), paid provision of services (clause 1 of Article 736 of the Civil Code), etc. provide for the possibility (unless otherwise provided by the terms of the contract itself) of unilateral refusal by the buyer, customer, etc. from the execution of the contract without the obligation to compensate for losses. In such cases, the responsibilities of the party that refused to fulfill the contract only include reimbursement to the counterparty for the expenses actually incurred on the day of refusal related to the execution of the contract, as well as the cost of work already performed (services rendered). Thus, in the cases listed above, as well as in cases with a similar legal structure, the statement of requirements to the customer, buyer, etc. about compensation as damages for lost profits within the contract price is doomed to failure in court. It is worth repeating once again that the above rule only works if other rules are not established by the agreement between the plaintiff and the defendant.

In cases where legislation or contract provisions establish the creditor’s right to recover damages, you need to know that in order to successfully complete a legal dispute over lost profits, the plaintiff must prove:

- the fact of non-fulfillment/improper fulfillment by the debtor of obligations that caused losses;

- the existence of a causal connection between the debtor’s violation of the obligation and the resulting losses;

- a real opportunity to receive a certain income in a certain amount under normal conditions of civil circulation

- the fact that the plaintiff took specific measures to obtain this profit and made the necessary preparations for this purpose and only the actions of the defendant were the only reason for the non-receipt of this profit (clause 4 of Article 364 of the Civil Code of the Republic of Belarus);

- the amount of lost profits.

And, if proving the very fact of non-fulfillment/improper fulfillment by the debtor of obligations that caused losses does not cause difficulties in most cases, then the remaining four points often become an insurmountable barrier on the creditor’s path to protecting his violated right. When making a claim for compensation for damages in the form of lost profits, the plaintiff in court often simply does not know what evidence can confirm the existence of this causal relationship, the real possibility of obtaining this income, the undertaking of exhaustive measures to obtain profit, as well as the amount of lost profits. I consider it possible to give an example from the judicial practice of the Economic Court of Minsk of the “classic” case of the plaintiff’s failure to prove a causal connection between the debtor’s violation of an obligation and the losses incurred, the possibility of receiving income in a certain amount under normal conditions of civil circulation, as well as the amount of lost income.

An example from judicial practice

The plaintiff's position. In the statement of claim, plaintiff ICHUTP “S” indicated that on January 20, 2013, as a result of an accident, their SCANIA truck tractor and platform semi-trailer were damaged. The traffic accident occurred due to the fault of driver B., who was driving a car owned by the defendant JV LLC “V”. Referring to the fact that as a result of the idle time of property damaged due to the fault of the defendant for 34 days, the plaintiff received a loss of income, the plaintiff asked to recover lost profits from JV LLC “V” in the amount of 56,427,586 Belarusian rubles (non-denominated).

Conclusions of the court. During the consideration of the case, the court found that, indeed, on January 20, 2013, as a result of an accident, a SCANIA truck tractor and a flatbed semi-trailer belonging to ICHUTP “S” were damaged. The traffic accident occurred due to the fault of driver B., who was driving a car owned by JV LLC “V”. The court stated that according to the general rule of Art. 14 of the Civil Code of the Republic of Belarus, compensation for damages is a measure of civil liability for the application of which the person demanding compensation for losses must prove a causal connection between the offense and losses (in this case, the connection between a traffic accident that occurred due to the fault of the defendant’s driver and the downtime of the plaintiff’s car due to vehicle repairs), as well as provide evidence confirming the amount of damages. When proving damages in the form of lost profits, the plaintiff must justify his chosen methodology for calculating damages in the form of lost profits and provide evidence based on the justification given. The basis for compensation for damages in the form of lost profits is the proof by the party in the case of the entire set of listed conditions. In accordance with paragraph 4 of Art. 364 of the Civil Code of the Republic of Belarus, when determining lost profits, measures taken by the creditor to obtain the corresponding benefit and preparations made for this purpose must be taken into account. According to the justification given by the plaintiff, the lost profit is calculated by him as the income received from the work of similar damaged property during the period of repair (34 days) of the SCANIA truck tractor and the flatbed semi-trailer, minus travel expenses, expenses for the purchase of fuel, wages , insurance premiums, for the purchase of a TIR carnet and the cost of pre-trip medical examinations. At the same time, with this calculation method, the amount of income in the amount of 56,388,286 Belarusian rubles (non-denominated), in the opinion of the court, is unjustifiably inflated, aimed at increasing the well-being of the plaintiff, since when calculating the amount of lost profits, the plaintiff proceeded from an unsubstantiated assumption, that in the event of no damage to the property of ICHUTP “C”, the SCANIA semi-trailer-platform truck tractor would transport goods along the routes: Slovakia – Germany; Germany – Belarus; Russia – Belarus; Poland - Belarus with daily employment. The court also stated the fact that the cost of freight even for vehicles identical in carrying capacity and technical characteristics will be different, since the cost of each specific cargo transportation depends on the cargo transported, the length and geography of the route, transportation conditions, etc. East also, according to the court, was not supported by any evidence to the effect that if the SCANIA truck tractor and the flatbed semi-trailer had not been damaged, they would have been provided with continuous operation during the period of forced downtime. By virtue of Part 2 of Art. 100 of the Code of Criminal Procedure of the Republic of Belarus, each person participating in the case must prove the circumstances to which he refers as the substantiation of his claims and objections, unless otherwise provided by law. The court asked the plaintiff to provide evidence of the presence in the period from January 20, 2013 to February 22, 2013 of applications for transportation that were available to ICHUTP “C” and for which the plaintiff was forced to refuse transportation due to the lack of free units of equipment. However, the plaintiff did not provide any evidence of this. The transport expedition agreements presented to the court were regarded by the court as inadequate evidence of the plaintiff’s lost profits since they have a different legal nature than the transportation agreement. The plaintiff also did not provide the court with any evidence that the provided contracts for the transport expedition were a consequence of the lack of ICHUTP “S” own transport and the inability to independently carry out transportation. The court also found that the plaintiff unreasonably overestimated the period of vehicle downtime (34 days). According to the work order dated February 22, 2013, the standard repair time for a damaged vehicle is 39.3 hours, which does not exceed 5 working days. The plaintiff’s arguments about the vehicle being idle for more than one month due to the lack of spare parts for it are untenable, since JV LLC “V” is not responsible for the presence or absence of spare parts at the repair organization. In addition, as follows from the repair request dated February 22, 2013, the SCANIA truck tractor received only minor damage (the rear view mirror was broken), which, according to the time standard, took 1 hour to repair. Consequently, the plaintiff’s inclusion of losses associated with the non-use of the truck tractor for 34 days in the amount of lost income was found by the court to be unfounded. The circumstances stated above indicate that the plaintiff has provided neither reliable justification for the amount of lost income, nor evidence of the possibility of obtaining the amount of income determined by him under normal conditions of civil circulation. Since the amount of lost profits is unreliable and not documented, the court decision rejected the claims of ICHUTP “S” against JV LLC “V” for the recovery of damages in the form of lost profits.

Conclusions. Analyzing the case considered, I would like to note that the plaintiff should either, before making demands, assess his chances in terms of the availability of evidence, or be more efficient in the process of presenting it to the court. According to the author, the fact of the possibility of obtaining income in a certain amount under normal conditions of civil circulation, taking measures to obtain this profit and making the necessary preparations for this purpose could be confirmed by the plaintiff in the above case with the following evidence: signed and not executed within the prescribed period or terminated due to the impossibility of fulfilling the contract of carriage with a third party due to the lack of transport; applications of third parties for the transportation of goods that are properly completed and not executed within the established time limit; correspondence between the plaintiff and a third party on the issue of approval of unrealized transportation; properly executed travel and travel documents for the driver and damaged transport; correspondence regarding the search/rental of a semi-trailer for a truck tractor (for temporary replacement of a damaged one). In this case, when providing the original documents, the basis for calculating lost profits should be the price of the contract not fulfilled in favor of a third party, and not the income claimed by the plaintiff, received from the work of similar damaged property, while the truck tractor was under repair (34 days). SCANIA" and a platform semi-trailer.

Of course, the amount of lost profits must be determined minus the expenses that the creditor should have incurred if the debtor had properly fulfilled the obligation. Thus, in the above example from judicial practice, the amount of damages in the form of lost profits would be the difference between the price of a concluded (agreed) contract, but not executed due to the lack of transport, and the costs included in the cost of transportation (travel expenses, costs of purchasing fuel , wages, insurance premiums, for the purchase of a TIR carnet, the cost of pre-trip medical examinations, road tolls, vehicle depreciation, etc.).

Speaking of the rationale for calculating lost profits , I would like to note with regret that at present there is no legally enshrined unified approach or approved algorithm for calculating damages in the form of lost profits, just as there is no uniform judicial practice in terms of what calculation is to be made in a specific situation of causing losses will be sufficiently justified for the court. An analysis of judicial practice suggests that in most cases, when the court recognized the plaintiff’s right to exercise such a method of protecting his violated right as recovery of lost profits, the claim was still refused due to the unreasonableness of the presented calculation of the amount of this type of damage and the plaintiff’s failure to provide evidence regarding the calculation of the amount of claims. I would like to note the positive experience in this area of the State Commission of the USSR Council of Ministers for Economic Reform, which on December 21, 1990 approved the Temporary Methodology for determining the amount of damage (losses) caused by violations of business contracts. Unfortunately, this experience remained practically unrealized by national legislation. Of course, this Temporary Methodology did not cover all possible aspects and options associated with the onset of consequences in the form of losses, however, it set a specific algorithm for calculating losses, including lost profits , and also set a specific direction for the development of legislative thought. Unfortunately, this idea was not further developed, and the developments made are not used in judicial practice. Availability of a methodology for assessing damage from fires on peatlands, approved by order of the Ministry of Natural Resources and Environmental Protection of the Republic of Belarus dated July 22, 1996 N 166, containing a formula for calculating lost profits, due to the specifics and narrow range of its application, when covering the general topic of the procedure for collecting lost profits benefits are not taken into account by me. It seems that the development of a universal methodology for determining the method of calculation and the amount of lost profits is not possible, since losses associated with lost income can arise from the great variety of currently existing legal relationships, each of which will have a basis for calculating this type of loss that is characteristic only of this legal relationship , features of price regulation, cost component, etc. The State Commission of the Council of Ministers of the USSR for Economic Reform, which I mentioned above, granted the right to ministries and departments to determine the sectoral features of the application of this methodology. The most logical would be the development of this legal institution through the compilation by the Ministries of the Republic of Belarus of relevant methodologies for sectoral components and their subsequent consolidation in judicial practice.

However, until this is done, in order to simplify the possible proof of the amount of losses associated with non-fulfillment / improper fulfillment of contractual obligations, the most reasonable solution seems to be to include in the provisions of contracts a procedure (algorithm) for determining this type of losses, or to use other possible institutions provided by law that ensure execution of obligations. In particular, a penalty.

In conclusion, I would like to draw the readers’ attention to a few more, in my opinion, significant points. When making claims for recovery of losses, it is necessary to remember the provisions of Article 365 of the Civil Code of the Republic of Belarus, which, as a general rule, establishes that losses are compensated in the part not covered by the penalty (if a penalty is established for non-fulfillment or improper fulfillment of an obligation), except in cases provided for by law or an agreement. It is not uncommon in judicial practice to encounter cases where a penalty under a contract is of an offset nature, but the plaintiff’s claims are made for the full amount of the penalty and the full amount of damages. As a result, the court found that the claims were partially unfounded. Another significant point is the fact that the creditor himself is at fault for the debtor’s failure to fulfill (improper performance) of his obligations, which, by virtue of the provisions of Article 375 of the Civil Code of the Republic of Belarus, is the basis for reducing the amount of the debtor’s liability.

Author: Baranovsky Andrey

Phrases: lost income, lost profits, how to recover lost profits, how to recover lost income, recovery of losses

Assessment and calculation of lost profits

Losses resulting from one of the situations described and similar ones must first be carefully assessed. And only after this can you go to court to claim compensation. In this case, it is necessary to take into account a number of factors. Here are the three main components of compensation that an injured party may be entitled to:

- Actually, profit that could have been earned, but was not received due to the fault of third parties.

- Damage, that is, financial costs intended to compensate for losses, for example, for rent or repairs.

- Payment for the services of an appraiser and lawyer.

To calculate the first of the indicators, you should use the formula for calculating lost profits, which can be presented in the following form.

Features of the concept of “lost profits”

Lost profits mean lost profits that should have been realized but were not realized due to the intervention of a third party.

It is necessary to distinguish between lost profits and real damage, when the victim receives real expenses due to property damage. Lost profits assume that no positive change has occurred and income, despite the guarantee of profit, must be received.

The concept of lost benefit is described in more detail in Art. 15 Civil Code of the Russian Federation. Common cases where lost profits can be calculated include flooding of a rental property. In addition to the actual damage after the apartment is flooded, the owner suffers a loss due to the inability to rent out the property while repair work is being carried out.

The second example is a failure to deliver goods on time by a supplier, due to which the company was unable to make a profit from the markup for unsold products.

The most difficult thing in the collection process is to be able to prove that the benefit would have been received if not for the actions (inaction) of another counterparty or third party. The second problem is to convince the judicial authority that the profit could amount to the specific amounts specified in the claim.

UV = D – R,

Where:

- LP – lost profit.

- D – potential income.

- P – associated costs (potential).

On the one hand, this formula looks quite simple and clear. But, on the other hand, it has a significant drawback: it is too general, and each of its components requires its own separate calculation. This is explained by the fact that all situations that arise are purely individual. Each specific calculation will depend on the reasons why the losses arose, as well as on the nature of the relationship between the parties. Let's look at this with examples.

Example one, related to renting premises

The Symbioz enterprise sells industrial products and owns large warehouse areas. Due to their incomplete occupancy of 200 sq. meters, it was decided to rent out at a price of 800 rubles per 1 sq. meter starting January 2021.

In connection with this, a lease agreement was signed for the 1st quarter of 2020. The agreement stipulated that the landlord transfers to the tenant the premises in good condition, suitable for use for storing goods, according to the acceptance certificate. At the same time, to bring the warehouse into proper condition, Symbiosis carried out cosmetic repairs, the cost of which amounted to 96,000 rubles.

The tenant, represented by Alliance LLC, agreed to transfer the rent no later than the last day of each month to the bank account of Symbiosis LLC. However, the deal did not take place due to unforeseen circumstances. At the end of December 2021, a warehouse intended for rental was flooded and severely damaged.

This happened due to the fault of Obedinenie LLC, whose office was located above the warehouse. As a result, Alliance LLC refused to lease, and the contract was terminated. As a result, Symbioz LLC lost the benefits of leasing warehouse premises, and also suffered damage due to their flooding.

How to prove lost profits

Kirill Afonin, founder of the legal telegram digest “Lawyer's Secret,” advises to be procedurally active and in any case offer your own version of the calculation.

Use all legal possibilities to prove lost profits (Article 65 of the Arbitration Procedure Code of the Russian Federation, Article 56 of the Code of Civil Procedure of the Russian Federation). For example, apply to the court to order a forensic examination to determine the most likely amount of losses (Article 82 of the Arbitration Procedure Code of the Russian Federation, Article 79 of the Code of Civil Procedure of the Russian Federation).

“In my opinion, it is more realistic to prove lost profits today than it was 5-6 years ago, thanks to the Resolution of the Plenum of the Supreme Court of the Russian Federation dated June 23, 2015 No. 25,” Kirill Afonin is sure.

In fact, in court you will have to prove three circumstances, warns lawyer Lyubov Larina:

- that no income was received;

- that the rights of the creditor were violated;

- that illegal behavior prevented you from earning income.

If at least one circumstance is not proven, the claim will not be satisfied.

What needs to be proven

Based on current judicial practice, when recovering lost profits, it is important to prove that the possibility of receiving income actually existed.

To do this, you need to document the completion of specific actions and preparations aimed at extracting income that was not received in connection with the debtor’s violation.

So you should:

- Document the possibility and inevitability of receiving income, that is, the reality of receiving a profit, taking into account the expected expenses from the property that was damaged (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 21, 2013 No. 16674/12, Determination of the Supreme Court of the Russian Federation dated January 29, 2015 No. 302-ES14-735 ).

- Confirm the legal ownership of this property by the person entitled to receive income.

- Establish the guilt of the causer of damage and the causal connection between the wrongfulness of the causer of harm and the resulting losses.

- Prove that the violation was the only obstacle that did not allow the legal owner of the property to receive income (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 21, 2013 No. 16674/12).

According to Kirill Afonin, the following will help prove lost profits:

- Agreements with third parties and related correspondence.

For example, if the tenant did not return the property to you after the lease agreement was terminated, you can present a preliminary lease agreement concluded with a third party that was terminated because of this. This will help confirm that you suffered losses in the form of lost profits.As an example, in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 21, 2013 No. 16674/12, the court took into account that after the return of the property, the lessor entered into a lease agreement with a person who was a party to the terminated preliminary agreement.

- Bank documents.

Together with the agreement on opening a current account, such documents can confirm that, for example, as a result of non-receipt of funds into the account, interest was accrued on the account balance in a smaller amount.You can also “arm yourself” with the testimony of witnesses.

Evidence must confirm precisely the actions aimed at obtaining income that was not received as a result of a violation of the obligation.

“The court may not recognize information about employees, rental premises and permission to perform work as evidence of preparations to receive income under a specific contract,” warns Kirill Afonin. “All this is necessary to carry out business activities and achieve the goals of creating an organization.”

Causal link between breach of obligation and losses

When establishing a connection, it is necessary to take into account what consequences such a violation could lead to under normal conditions of civil circulation.

“If the occurrence of losses, the compensation of which the creditor demands, is a common consequence of the debtor’s violation of the obligation, then the existence of a causal connection between the violation and the losses proven by the creditor is assumed,” notes Kirill Afonin.

If the debtor refutes the creditor's arguments regarding the causal connection between his behavior and the creditor's losses, he may provide evidence of the existence of another cause of these losses.

Causal link between breach of obligation and losses

When establishing a connection, it is necessary to take into account what consequences such a violation could lead to under normal conditions of civil circulation.

“If the occurrence of losses, the compensation of which the creditor demands, is a common consequence of the debtor’s violation of the obligation, then the existence of a causal connection between the violation and the losses proven by the creditor is assumed,” notes Kirill Afonin.

If the debtor refutes the creditor's arguments regarding the causal connection between his behavior and the creditor's losses, he may provide evidence of the existence of another cause of these losses.

Algorithm of actions

The general director of the lessor company decided to go to court to recover damages from Obedinenie LLC. To do this, he hired a lawyer who developed an algorithm for the company’s actions in this situation.

First of all, representatives of Vodokanal were invited, who eliminated the accident and, after conducting appropriate research, drew up a report stating that the flooding was the fault of Obedinenie LLC.

After this, a professional appraiser was invited to assess the damage caused by flooding of the premises. He compiled a detailed expert opinion on this for an appropriate fee.

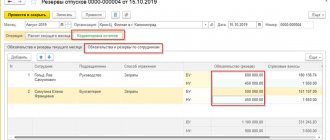

Accounting calculation

Accounting of Symbiosis LLC, using the formula

UV = D – R,

I compiled a calculation of lost profits, which looks like this.

First, the indicator D is calculated - potential income. Rental income in the 1st quarter of 2021 was expected to be:

800 rub. x 200 sq. meters x 3 months = 480,000 rubles.

Less value added tax (20%) this amount is:

480,000 rub. – 80,000 rub. = 400,000 rubles.

Next, the P indicator is taken into account - associated costs. In the case of Symbiosis LLC, these are the costs of materials for repairs carried out on their own in December 2021 before signing the lease agreement - 96,000 rubles. (without VAT).

Thus, the lost profit received by Symbiosis LLC due to the fault of Obedinenie LLC amounted to:

400,000 rub. – 96,000 rub. = 304,000 rub.

As for the other two indicators, in this case they also take place.

Damage caused by flooding, according to an examination carried out by an appraiser – RUB 223,000, including:

- materials necessary for repairs (excluding VAT) – RUB 158,000;

- salaries for builders along with accruals for payment to extra-budgetary funds - 65,000 rubles.

And also payment for services is 60,000 rubles, including:

- appraiser – 30,000 rubles;

- lawyer - 30,000 rubles.

At the same time, the total amount of compensation, consisting of lost profits, damage and specialist services, which Symbiosis LLC can claim in court, is:

RUB 304,000 + 223,000 rub. + 60,000 rub. = 587,000 rub.

How is lost profit calculated?

Often, on the topic of lost profits, the question arises: “How to calculate lost profits for the court?” Proving that the victim is right begins with modeling the situation.

At the time of writing there is no single formula for calculating lost profits –

it has not yet been enshrined at the legislative level. However, lawyers use the following formula:

The amount of lost profits = potential profit from the sale of goods/services not received – other potential expenses (from taxes to expenses, including a lawyer).

Remember that, according to the recommendations of the Supreme Court of the Russian Federation, the court does not have the right to refuse a claim on the grounds that the calculation of lost profits is only close to probable. You don’t have to calculate the loss down to the penny; just stick to approximate figures.

What needs to be taken into account when calculating

- The calculation of lost profits is purely hypothetical. Along with lost income, potential expenses and costs of making a profit are prescribed. Therefore, it is important to know all the nuances of the company’s activities;

- Also included in “other expenses” are the costs of a lawyer, mail, appraiser and court;

- Find out the amount of damage from each participant if several persons are to blame. If this cannot be calculated, then it is recommended to divide the amount recovered equally;

- Each situation is unique, and therefore a court adjuster will be involved in the case. He will also make calculations based on available documents and data.

- If we are talking about the sale of goods, then the profit includes the cost at which it is sold. In case of damage to the goods, which reduces its value, the accused party is obliged to pay the difference between the retail value and the real one;

- It is difficult to carry out calculations on your own, and therefore it makes sense to contact a specialist. And remember that expenses for it are also recorded as a loss, for which a penalty is due.

Example two, related to the supply of goods

produces parts for passenger cars made of fiberglass. For the 1st quarter of 2021, it concluded contracts for the supply of products for a total of 3,600,000 rubles.

LLC "Supplier" undertook under the contract to supply the "Manufacturer" with composite materials in the amount of 1,080,000 rubles, necessary for the production of parts for the specified amount, until January 10, 2021.

However, the delivery of the batch of materials was delayed by 10 days due to the fault of the “Supplier”; its cost was 300,000 rubles.

As a result, in the 1st quarter of 2021, the parts manufacturer was unable to produce and sell products worth 1,200,000 rubles. As a result, the legal department, based on the terms of the contract and data from the accounting and economic services of the enterprise, filed a claim against the supplier, where, among other things, it indicated the calculation of lost profits. It looks like this.

Loss calculation

Due to the fault of Supplier LLC, products worth RUB 1,200,000 were not sold. Less VAT (20%) is 1,000,000 rubles.

The costs required to produce this volume consist of:

- Materials worth 360,000 rubles. – VAT (20%) = 300,000 rub.

- Salaries to employees together with accruals to extra-budgetary funds amounting to 270,000 rubles.

- The cost of renting premises for 1 month, necessary for the production of undelivered products, is 50,000 rubles.

Total costs – 620,000 rubles.

Thus, the lost profit will be 1,000,000 rubles. – 620,000 rub. = 380,000 rubles.

Pre-trial settlement required

As can be seen from the examples given, in each specific case the calculation requires taking into account the specifics of the company’s activities. But besides this, there are a number of other nuances that must be taken into account in order to win a case in court. For example, before filing a claim, an attempt must be made to voluntarily resolve the dispute with the opposing party. Otherwise it will not be considered.

However, in order to send a claim to the person responsible for lost profits, it is also necessary to make a calculation. And only after the partner’s refusal to satisfy the demands, supported by significant evidence, can one go to the law enforcement agency for a fair decision.