Buyers

62.01 K balance = 0 62.02 D balance = 0 don’t forget to make an account. in advance to buyers! 76.AB K balance = 0, also remember the debit balance (62.2*0.18/1.18=76.AB)

So: 1. receipt of goods from suppliers with invoices has been established. 2. Shipments to customers with invoices have been initiated. 3. Advance invoices are issued for the buyers' prepayments

We begin to study Operations - Closing the period - VAT Accounting Assistant . There is also a useful summary report in 1C, see. Reports - Analysis of VAT accounting If payment and shipment (receipt) are in the same period, then everything is taken into account very simply: all my documents “Receipts of goods” in the invoice received have a checkbox “Reflect the VAT deduction in the purchase book by the date of receipt.” Those. here we immediately make entries for VAT refund ( 68.02

Thus, the document formation of the purchase book and sales book is almost empty. And all sorts of advances and other evil spirits ended up there, which makes the life of an accountant bright and eventful. The problem is that if you give up and don’t deal with the advances, then it will all come out anyway. Therefore, we are looking for algorithms for checking advances.

What logic first tells us is that all options (where there are 2 periods, payment in one, shipment in the other) are divided into:

- 1.

- 1.1 client prepayment

- 1.1a счф. for advance payment (76АВ

- 1.2 shipment of goods to the client + regular invoice (there are no postings here, but see its shipment 90.03

- 1.2a we cancel the SCHF. for an advance payment (occurs when creating a purchase book - oddly enough).

- 2.

- 2.1 shipment of goods to the client

- 2.2 payment by the client

- 3.

- 3.1 prepayment to the supplier

- 3.1a supplier to you SCHF. for advance payment ( 68.02 Purchases - invoice for advance payment

- 3.2 receipt of goods from the supplier + regular invoice (68.02

- 3.2a we cancel the SCHF. for advance payment (76VA

- 4.

- 4.1 receipt of goods from the supplier (19.03

- 4.2 payment to the supplier

Please note that for paragraphs. 2 and 4 no SCHF is created. for advance They only appear if payment is made first.

76AB

God, how can we check all this crap with our counterparties, because since 2020. Each invoice must contend with the counterparty's accounting department.

Let's look at what the document “formation of a purchase book” contains. Attention ! : the document can only be found like this: Operations - Regulatory VAT reports , it is not in the log of all operations.

- “Creating a purchase book” - there is a division here:

- acquired values 68.02

- advances received 68.02

- Let’s look at what the document “formation of a sales book” contains:

- recovery on advances 76VA

First conclusions: 1. If the transaction went through 2 stages (shipment and payment) in full, then logically this can be seen in account 62 (there are no balances there) and, as a result, all advances are on the account. 76 of this counterparty must close, i.e. There should also be no leftovers. 2. If the client has an advance payment (there is a balance on account 62.2), then accordingly there will be a balance on account 76 in the ratio (62.2*0.18/1.18=76.AB). This is where a report on 62 with additional would be stupid. column according to the formula (62.2*0.18/1.18=76.AB). 3. If we made an advance payment to the supplier, then by law he must make an invoice. for an advance payment and send it to us, but usually this does not happen for obvious reasons: the supplier has made an SSF for himself. for an advance payment (paid VAT), but he doesn’t care about you - your problems, you need it - come for the SCHF yourself. for advance And it can also be understood - invoice documents and regular invoices are handed over with the delivery of goods, usually in boxes. If, after all, there is such a financial system. for an advance payment from the supplier, then it must be handled in Purchases - Invoices received - Invoice for advance payment . 4.

Account 76 av

The critical closing date for advances received is:

3.6.1. If the advance payment was received according to the “Buyer’s Order” - the date specified in the “Shipment” field;

3.6.2. If the advance payment was received without a “Buyer’s Order”, or the date is not specified in the “Shipment” field, then the date of receipt of the advance payment plus 30 days is taken.

3.7. To monitor the timeliness of closing accounts receivable from customers, the report “Register of accounts receivable and payable by customers” is used.

3.8. Accounts receivable managers are responsible for the timely use of the buyer's advance to close its receivables.

3.9. The report “Register of accounts receivable and payable by customers” with comments on overdue debts is provided by e-mail (Excel format) to the financial director weekly, on Thursdays until 14-00.

The developed register of receivables and payables of customers allows you to simultaneously group both receivables and payables of customers in the context of different divisions and legal entities of the company:

Moreover, if the advance payment is overdue, then the closing date of the advance payment is highlighted in red.

The report grouped in this way allowed us to see in one place the picture of mutual settlements for all buyer contracts. Working with this report made it easier to find information about unclosed sales documents and immediately eliminated questions about the timeliness of incoming payments for them. Since the report allows you to see information in the context of all legal entities of the company, it has become much easier to prepare documents for offset of counter obligations.

Regulations for the control of advances allowed the company's accountants to more accurately and unambiguously classify the incoming payment: now the accounting department accounts for excessively transferred funds in a separate subaccount to account 76 and does not charge VAT payable on them, which allows us not to divert funds to pay VAT or the single tax ( under the simplified tax system) according to them. And this is especially true in conditions of a shortage of free funds.

As a result of the implementation of this regulation, the measures taken to inventory accounts payable and return excessively transferred amounts previously taken into account in advances on account 62, made it possible to simultaneously reduce VAT payments to the budget by almost 70 thousand rubles.

Altai Financial Consulting Center

| IamAlexy | |

| bazvan | (0) There is an explanation about this on the closed forum |

| shuhard | (0) oxy, every time the balance sheet structure changes, you must reduce it to previous periods, otherwise it is not possible to compare rows |

| bazvan | https://partners.v8.1c.ru/forum/thread.jsp?id=1121701 like this. Thus, we comply with clause 10 of PBU 4/99: 10. For each numerical indicator of the financial statements, except for the report prepared for the first reporting period, data must be provided for at least two years - the reporting year and the one preceding the reporting one. If the data for the period preceding the reporting period are not comparable with the data for the reporting period, then the first of these data are subject to adjustment based on the rules established by regulatory acts on accounting. Each material adjustment must be disclosed in the notes to the balance sheet and income statement along with the reasons for the adjustment. |

| IamAlexy | chic and shine.. I wonder how many users who do not have access to the affiliate program corrected the balance manually by correcting, I quote, “behind this crude and buggy Adine” the balance, in particular the columns of 2011 and 2010? |

| IamAlexy | (3) thank you, good man, may your flocks be fat and your wives reward you with mighty sons... |

| Irbis | bazvan Where do the stars go? Are you drinking or what? |

| bazvan | (6):)))) |

| bazvan | (4) why have access to the affiliate program?? Finally, users should know the hardware. |

| IamAlexy | (8) waaah haaaa haaaaa made me laugh... you know.. 1C does EVERYTHING to ensure that cooks work in their programs with a work book in which “accountant” is written, what the hell is the equipment? |

| bazvan | (9) well, then in ZhPO, everything is clear and understandable |

Advances issued and received: procedure for registering accounting entries

If there were schf. for an advance from the supplier, then after the full cycle the balance is on the account. 60 of our supplier is empty and, accordingly, the balance of 76.VA for our supplier is empty. 5. If there is a balance left in the prepayment to the supplier at 60.2, then there should also be a balance at 76.VA, in the ratio (60.2*0.18/1.18=76VA).

That's all, miracles don't happen. Everything is very simple! And by the way, having calmly spent 1 day getting to grips with the meaning of VAT charges and another 1-2 days sorting out mutual settlements with suppliers and customers, as well as re-processing documents + re-closing months 30 times, I had noticeable confidence (turning into euphoria ) that we did VAT correctly.

We reclose sequentially January, February, March through “close month”. In the same place, see the formation of a book of purchases and sales; by the way, the creation of these documents must be controlled manually, since it has been noted that they may not be created automatically.

We prepare a VAT return for the 1st quarter. It appears in Reports - Regulated reports - list (VAT Declaration) . There is a sequence for filling out the Sections - see the icon on the right? .

Further errors: 1. If OKTMO is not automatically substituted in Section 1, then we stupidly re-select “tax authority” on the Title page.

account 76.AB is not closed

IAt the end of the year there were advances from buyers on account 62.2 and, accordingly, VAT on these advances on account 76.AB. Advances from customers were transferred using the document Entering initial balances of advances received from customers. Account 76.AB was transferred by operation. In January 2020, there were sales of these advances and they are included in the document immediately, but VAT is not included, i.e. account 76.AB is not closed. What was done wrong?

Get your work in order using the 1C configuration “IT Department Management 8”

ATTENTION!

If you have lost the message input window, press

Ctrl-F5

or

Ctrl-R

or the Refresh button in your browser.

How to reflect VAT on advances in the balance sheet

It is unlikely that any organization can manage its activities without an advance payment system. Remember the famous phrase: “money in the morning, chairs in the evening”? Accounting has long adapted to this situation, and accountants operate with separate subaccounts for advance VAT quite confidently.

But there is one issue that has not yet been resolved, and today they continue to break spears about it - how to reflect VAT on advances in the balance sheet? Before we talk about which line of the balance sheet should reflect the amount of VAT on advances, let's remember how this VAT appears and on what accounts it exists.

How does “advance” VAT arise?

Let's start with an example. LLC "Style" is engaged in tailoring women's clothing and is located on OSNO. The organization has just opened. Wherein:

— an advance payment was made to the supplier Tweed LLC for fabrics in the amount of 59,000 rubles, including VAT 18%;

— an advance payment was received from the clothing store Moda LLC in the amount of 141,600 rubles, including VAT 18%.

First, let's deal with the prepayment received from the store. According to the rules of the Tax Code, an organization on OSNO that is not exempt from VAT, when receiving an advance on account of upcoming deliveries of products, works, services upon receipt of them, must calculate VAT (clause 2, clause 1, Article 167 of the Tax Code). Let's do this:

VAT payable = 141,600 / 118 * 18 = 21,600 rubles.

At the moment when the clothes are sewn and shipped to Fashion LLC, VAT must be charged again - already on the cost of the shipped products:

VAT payable = 141,600 / 118 * 18 = 21,600 rubles.

And VAT accrued earlier on the advance payment is accepted for deduction (clause 1, clause 1 and clause 14 of Article 167, clause 8 of Article 171 and clause 6 of Article 172 of the Tax Code).

A deduction is made if, after receiving an advance payment, the terms of the contract are changed or terminated and the corresponding amounts of advance payments are returned (clause 5 of Art.

Balance and 76.AB

IActually there is an innovation: https://www.buh.ru/qaDescr-935

“Why did the algorithm for automatically filling out financial statements for 2012 change? The balance of account 76АВ “VAT on advances and prepayments” and 76ВА “VAT on advances and prepayments” began to be taken into account in lines 1230 (account balance 76АВ) and 1520 (account balance 76АВ), while in the explanations of section 5 to the financial statements the accounts receivable (+76АВ) and accounts payable (+76АВ) are entered taking into account these balances. In the reporting for the first quarter, half of the year, 9 months of 2012, these balances were entered on lines 1260 and 1550.

These changes were made on the basis of the Methodological Recommendations for Auditors on Reporting for 2012 dated January 9, 2013 (see https://www.minfin.ru/common/img/uploaded/library/2013/01/Rekomendatsii_auditorskim_organizatsiyam_za_2012_god.doc).”

ok, let's say.

Examples (by debit)

Some examples from the table will help you understand the material presented in the article.

| Correspondence | |

| The cost of unfinished main production decreased due to debtors and creditors. This may be an accrual of debt to the insurance company due to an event (emergency or force majeure). | |

| Losses from defects are charged to the account for settlements with creditors and debtors. | |

| Receipt of debts to suppliers, according to documents confirming consent to the transfer of funds. | |

| Payment of funds to creditors in cash (from the cash register). | |

| D76 K68-VAT | Identification of budget debt (for VAT) during the determination of revenue for taxation. |

| General business expenses are compensated through various debtors and creditors. | |

| Accounting for debts from various debtors for finished products. | |

| The cost of work in progress servicing production decreased due to the transfer of funds to the organization from debtors. |

Debit correspondence

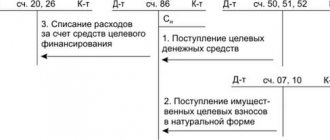

The account in question (76) by debit can correspond with the following: “Fixed assets” (01), “Equipment for installation” (07), “Income-generating investments in MC” (03), “Investments in non-current assets” (08), “ Intangible assets" (04). From the second section of the chart of accounts, it interacts with the items “Materials” (10), “Animals for growing and fattening” (11), “Procurement and acquisition of MC”.

Account 76 can correspond by debit with all items in the “Production Costs” section, as well as with 41, 45 and 43, in the “Finished Products and Goods” category. Postings are often made with cash accounts: 52, 50, 58, 51, 55, as well as with settlement accounts: 60, 67, 66, 62, 73, 70, 76, 71, 79. In addition, correspondence is carried out on debit with the following ( reflects profits and losses), 91 (records various income and expenses), 90 “Sales”, 97 “Deferred expenses”, 86 “Targeted financing”.

Loan correspondence

Account 76 can interact with the following categories of the chart of accounts: “Investments in non-current assets”, “Fixed assets”, “Intangible assets”, “Equipment for installation”, “Income investments in MC”. In the “Production Inventories” section, correspondence is carried out with the accounts “Materials”, “Procurement and acquisition of medical supplies”, “Animals for growing and fattening”, “VAT on purchased values”.

Account 76 can also interact on credit with all settlement accounts (except 68, 69, 75, 77) and the “Production Costs” category. From the section “Finished products and goods” - with accounts 52, 50, 51, 44.55, 41, 57, 45, and 58. In addition, correspondence is carried out with most current accounts and, of course, with those that reflect monetary transactions (91, 97, 94, 96, 99).

ToTo Design School

If it is necessary to calculate and withhold alimony amounts collected from employees, account 76 is also used. The final balance for these entries can be of a debit or credit nature, depending on the specified conditions. Debit records any debt owed to the company.

The loan collects information on the debts of the enterprise itself to third parties. Therefore, the account belongs to active-passive.76 the account in the balance sheet can be taken into account in both the active and passive parts.

To do this, its expanded balance is analyzed. Debit balances constitute the asset item “Debit Accounts”. The credit balance increases the balance sheet liability under the item “Accounts payable.” Analytical accounting is maintained separately for transactions.

Postings to account 76 form the final balance for each fact of mutual settlements with debtors and creditors. On account 76, subaccounts have many meanings, the most used among them are: 76.

Examples of business transactions (loans)

The table below with several examples will help you visually familiarize yourself with what account 76 transactions have.

| Correspondence |

| Write-off of purchased fixed assets (fixed assets) in the section on accounts payable. |

| Return of leased property to (occurs in cases where there has been no change of owner based on the agreement). |

| Write-off of materials regarding accounts payable. |

| Receiving funds from the client to the current account. |

| Receipt of debt from buyers based on an agreement. |

| Debt to various creditors and debtors for general production costs. |

| Fixing current accounts payable to the lessor (for leasing payments) to reduce long-term liabilities. |