What is a payment order?

A payment order is a document in a prescribed form that regulates the account holder’s instructions to make non-cash transfers in favor of the recipient of funds.

The instruction has been sent to the bank that maintains the payer’s account. Funds are transferred from a deposit account. If for some reason the account does not have the required amount of money, but the agreement between the bank and the payer provides for an overdraft, the transfer will be carried out. This document must be drawn up and submitted to the bank for execution in electronic or paper form.

Individuals can also process payment orders without opening a bank account.

When submitting an order to the bank from an individual, the order can be drawn up in the form of an application, which must include the following information:

- payer details;

- details of the recipient of funds;

- bank details of the payer and recipient;

- amount of money;

- purpose or purpose of payment;

- other information established by the bank.

Based on the order, the bank employee generates a payment order.

When drawing up an order to the bank electronically, it is very important to correctly indicate the payer, recipient of the transfer, amount, and purpose of payment.

Blue stamp for state duty (Ermolinskaya T.)

Article posted date: 01/04/2016

When filing a statement of claim or complaint in court, you must provide proof of payment of the state fee. For an organization, this is usually a payment order with a bank mark. Payments are mainly made electronically. However, is it enough to attach a printout of an electronic payment document to confirm that the state duty has been paid? As practice shows, a court of general jurisdiction and an arbitration court have different approaches.

Electronic payments

In accordance with the requirements of the Civil Procedure Code of the Russian Federation and the Arbitration Procedure Code of the Russian Federation, a document confirming payment of the state duty is attached to the statement of claim, appeal and cassation complaint. If the specified document is missing, the statement of claim or complaint may be returned to the applicant. Payment of the state duty can be made by transferring funds by bank. For a legal entity this is the most convenient option. Transfers of funds by banks are carried out by order of the client electronically or on paper. According to Art. 333.18 of the Tax Code of the Russian Federation, the fact of payment of the state duty by the payer in non-cash form is confirmed by a payment order with a note from the bank or the relevant territorial body of the Federal Treasury (another body that opens and maintains accounts), including one that makes payments in electronic form, about its execution. The rules for transferring funds are regulated by Bank of Russia Regulation No. 383-P dated June 19, 2012. In accordance with clause 4.6 of Regulation N 383-P, the execution of an order in electronic form for the purpose of transferring funds to a bank account is confirmed by the payer’s bank by sending the payer a notice in electronic form about the debiting of funds from the payer’s bank account indicating the details of the executed order or by sending the executed order in electronic form indicating the execution date. In this case, the specified notice from the payer’s bank can simultaneously confirm the acceptance of the order for execution in electronic form and its execution.

Arbitration court

Based on these rules of law, arbitration courts accept statements of claim and complaints if the fact of payment of the state duty is confirmed by printing an electronic payment document containing all the details (the date of debiting the funds, the type of payment - “electronic”, a note about the payment). For example, in the Resolutions of the FAS SZO dated 02.13.2014 in case No. A26-5598/2013, FAS VSO dated 08.20.2012 in case No. A19-9761/2012, judicial acts on the return of statements of claim were canceled, since they were based on the explanations of the information letter Presidium of the Supreme Arbitration Court of the Russian Federation dated May 25, 2005 N 91 (currently inactive), according to which, in confirmation of payment of the state duty, a payment order must be submitted with a bank stamp and with the signature of the responsible executor. The cassation court explained that such requirements apply to the execution of a payment order on paper. When transferring funds electronically, the payment order must indicate: type of payment - “electronic”, date of debiting the funds, bank mark confirming the payment. The electronic version of the payment order executed in this way was recognized by the court as complying with paragraph. 2 p. 3 art. 333.18 Tax Code of the Russian Federation.

Court of General Jurisdiction

A court of general jurisdiction, when resolving the issue of submitting a document confirming payment of the state duty, proceeds from the fact that the applicant must submit a duly certified payment order. In other words, a payment order with the bank’s blue seal, certified by a bank employee, is required. For example, cassation rulings of the Moscow City Court dated 02.09.2015 N 4g/2-9494/15, dated 26.06.2015 N 4g/2-6865/15 returned cassation appeals. The court motivated the return by the fact that the attached printout of the payment order form from the electronic system is not properly executed and is not certified in the prescribed manner: it does not contain the signature of a bank employee on the bank’s mark on acceptance of the payment order, the bank’s seal and the mark on the transfer of state duty to the budget, duly certified. Similar requirements for a payment order when transferring state fees electronically were presented, for example, in case No. 33-2119 (Appeal ruling of the Kirov Regional Court dated June 17, 2014).

At extra charge

As a rule, the bank issues a payment order with a blue seal for an additional fee. It is clear that this is regulated by an agreement between the bank and the client. However, if this service is paid, then you cannot argue with the bank, and you will have to pay for issuing a payment card certified by the bank. In accordance with Art. 46 of the Constitution of the Russian Federation, everyone is guaranteed judicial protection of their rights and freedoms. In fact, having paid the state fee, but not being able to pay for the service for receiving a printout of the payment order with a blue seal from the bank, the legal entity will be deprived of the right to judicial protection. After all, a statement of claim or complaint will not be accepted for processing until a payment order with the bank’s blue seal is submitted. Consequently, the requirement to submit a payment order with a bank stamp indicating payment of state duty with a blue seal may create an obstacle to judicial protection and increase legal costs. Especially for an organization that, due to the nature of its activities, is often forced to go to court to collect any periodic payments (for example, utility bills from the population). It seems logical to accept procedural documents when submitting a printout of an electronic payment order for payment of state duty. And only if there are doubts about their authenticity, require additional evidence.

What is the state duty paid for?

According to Article 333.16, State duty is a fee collected from persons when applying to state bodies, local government bodies, other bodies and (or) officials who are authorized in accordance with the legislative acts of the Russian Federation, legislative acts of the constituent entities of the Russian Federation and regulatory legal acts of local government bodies, for the performance of legally significant actions in relation to these persons, with the exception of actions performed by consular offices of the Russian Federation.

In other words, payment of the state duty is made in:

- government agencies;

- local government bodies;

- other organs

behind:

- performing legally significant actions in relation to state duty payers.

Article 333.18 of the Tax Code of the Russian Federation provides an explanation of the reasons that are mandatory for paying the state duty:

- when contacting judicial authorities to submit a request, petition, application, statement of claim, administrative claim, complaint;

- when applying for notarial acts;

- when applying for the issuance of documents (their duplicates);

- when applying for an apostille.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Payment order: state duty

State duty is a fee established by the state for applying to various government authorities to perform any legally significant actions.

As a rule, you need to pay the state fee before applying. Typically, a copy of the payment slip with the bank’s mark is attached to documents sent to one or another institution. For example, when filing a claim in court. In order for the sent payment to be transferred specifically as payment for a particular action, you must correctly indicate the BCC (budget classification code) of the payment. Usually it is provided by the authorities where the payer is going to apply, along with other details. The BCC is established at the state level, with its own for each type of state duty.

Also, when filling out a payment order to pay the state fee, you need to pay attention to filling out the following fields:

- The name of the organization to which the payment is sent, that is, the recipient.

- Recipient's bank details.

- Purpose of payment. In the case of state duty, you need to indicate what the payment is for. The designation must contain not only an indication that this is a state duty, but what exactly it is for. For example, when paying a fee when going to court, you need to indicate for what specific claim it is being paid (“for consideration of a claim against Lyutik LLC,” or “consideration of a claim for debt collection from D.D. Kozlov,” etc.) , as well as the amount of the claim.

All other fields are filled in as usual.

Filling out a payment order for state fees

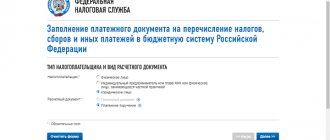

Most government agencies provide the opportunity to issue a payment order for state duty directly on their own websites.

A payment order for state duty can be generated using the service of the Federal Tax Service https://service.nalog.ru/gp2.do.

In general, when creating a payment order, you should be guided by the Bank of Russia Regulation No. 383-P dated June 19, 2012 “On the rules for transferring funds” (with amendments and additions) and the Order of the Russian Ministry of Finance dated November 12, 2013 No. 107n “On approval of the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation.”

| Filling stage | Explanation |

| Payment order number | The serial number of the document is indicated |

| Date of payment order | The date is indicated in the format DD.MM.YYYY |

| Payment type | “Urgent” – in this case, the transfer of funds will be carried out by means of urgent transfer. If the payment type remains blank, then such an order is classified as non-urgent using the appropriate means of transfer. |

| Status | 01 |

| Sum | Indicate the amount in words with a capital letter, while writing the words “rubles” and “kopecks” in full, but write the number of kopecks in numbers. Digital designation of the amount:

For example: seventeen thousand one hundred fifty rubles 17 kopecks (17150-17) |

| Payer |

|

| Recipient | See Payer, but the Recipient's details are entered |

| Type of operation | The payment is always coded 01 |

| Payment order | 5 |

| Code | 0 |

| KBK | KBK state duties |

| Basis of payment |

|

| Taxable period | 0 |

| Number (field 108) | 0 |

| Date (field 109) | 0 |

State duty to court

State duty is a federal tax established by the Tax Code of the Russian Federation (Chapter 25.3 of the Tax Code of the Russian Federation). It is paid in case of contacting various bodies (state, municipal, etc.) for the commission of certain legally significant actions.

The type of BCC you indicate in the payment depends on what action is required. For convenience, we will present the main types of actions for which a duty is paid in a table and immediately present the BCC for payment.

| Legally significant action | State duty amount (for 2018–2019) | BCC for state duty |

| 4,000 rub. 800 rub. 800 rub. 800 rub. 160 rub. | 182 1 0800 110 |

| 22,000 rub. - for organizations. 2,000 rub. — for “physicists” | 321 1 0800 110 |

| From 350 to 1,600 rubles. | 188 1 0800 110 |

Court fees, including:

| The amount of the fee depends on the type of appeal, the price of the claim and who the plaintiff (applicant) is - an organization or an individual | 182 1 0800 110 182 1 0800 110 182 1 0800 110 182 1 0800 110 |

To learn how the state duty will be reflected in accounting, read the article “Basic entries in accounting for state duty.”

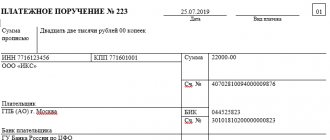

Let's look at the procedure for filling out a state duty payment using a conditional example.

Let’s say LLC “ICS” filed an application with the Federal Tax Service for the return of an overpayment of property tax in the amount of 90,000 rubles.

The material “Sample application for refund of overpaid tax” will help you fill out such an application.

However, the inspection did not return the money within the prescribed period, and the company decided to appeal to the Moscow Arbitration Court with a statement declaring the inaction of the tax authorities illegal, as well as with a demand for the return of the overpayment in the specified amount and payment of interest in the amount of 990 rubles.

To learn how such interest is calculated, read the article “How to calculate interest for late tax refunds.”

Since in this case the appeal combines requirements of a property and non-property nature, ICS LLC will pay 2 state fees (subclause 1, clause 1, article 333.22 of the Tax Code of the Russian Federation):

- 3,000 rub. — for recognizing inaction as illegal (subclause 3, clause 1, article 333.21 of the Tax Code of the Russian Federation);

- RUB 3,640 (4% of 90,990 rubles) - on a property claim for the return of overpayments and interest (subclause 1, clause 1, article 333.21 of the Tax Code of the Russian Federation).

That is, the total amount payable will be 6,640 rubles.

When drawing up a payment order, ICS LLC:

- will indicate the payer status - 01;

- recipient - the Federal Tax Service for Moscow, indicating the Federal Tax Service Inspectorate at the location of the court (in this case, Federal Tax Service Inspectorate No. 26);

- KBK - 182 1 0800 110;

- OKTMO - at the location of the court;

- basis of payment (field 106) - TP;

- in fields 107 “Tax period”, 108 “Document number” and 109 “Document date” will enter 0;

Read more about payment fields here.

- in the purpose of payment it will explain what the claim is, to whom it is being brought and what its price is.

As a rule, you can find all the details for paying the state duty on the website of the court to which you want to apply. There you can also calculate the amount of state duty.

TYPICAL SITUATION™ current as of December 20, 2020.

How to fill out a payment order to pay state duty to the arbitration court? How much is the state fee for considering a case in an arbitration court? What payment details should I provide in 2020? Let's give a sample and explain the main points.

According to clause 2, part 1, art. 126 of the Arbitration Procedure Code of the Russian Federation, the statement of claim is accompanied by a document confirming the payment of the state duty in the established manner and in the amount, or the right to receive a benefit in the payment of the state duty, or a petition for a deferment, installment plan, or a reduction in the amount of the state duty.

When filling out a payment order to pay the state fee for consideration of a claim in the Arbitration Court, I indicate the following details: Payer status: 01KBK: 18210801000011000110 Payment basis: TP Tax period: 0 Document number: 0 Document date: 0 Payment type: 0

When saving a 1C payment order (8.3.4.408, edition 3.0.31.14), an error is indicated: “The tax period is indicated incorrectly. When establishing a TP, you must indicate the period for which the tax (fee) is paid.” Also indicates an error in Internet Banking.

Is it correct to indicate TP (current year payments) as the basis for payment or is it better to indicate 0 (it is impossible to specify a specific value)? Or should I just ignore the program error and leave it as in my example?

The corresponding explanations are given in the letter of the Federal Tax Service of Russia dated April 26, 2020 No. KCh-3-8/ “On consideration of the appeal.” They relate to the specifics of filling out individual fields of a payment document.

Tax officials emphasize that in order to ensure timely and reliable posting of payments to the information resources of tax authorities, all fields of payment documents must be filled out in the manner approved by Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n (hereinafter referred to as Order of the Ministry of Finance of Russia No. 107n).

Recommendations are also given for filling out details “106” and “107” of the payment document. These fields indicate the value of the payment basis (detail “106”) and the value of the tax period indicator - the frequency of payment of the tax payment or the specific date for its payment established by the legislation on taxes and fees (detail “107”).

Thus, in case of payment of state duty on cases considered in arbitration courts, in field “106” the value of “TP” should be indicated - payments of the current year, and in field “107” - the date of payment (since when filling out a payment document for payment of state duty on cases considered in arbitration courts, the frequency is not established).

What other information should be included in the payment order for payment of state duty? Find out from the material “Registration of payment orders for the payment of tax payments, insurance premiums and state duties” in the “Encyclopedia of Solutions. Taxes and contributions" Internet version of the GARANT system. Get full access for 3 days for free!

Let us add that “TP” is indicated if the administrator of the state duty is the tax authority. If the administrator of the state duty is any other government agency, then “0” is entered in field “106” (clause 7 of Appendix No. 2, clause 5 of Appendix No. 4 to Order No. 107n of the Ministry of Finance of Russia). The state duty administrator can be identified by the first three digits of the BCC.

Article posted date: 01/04/2016

When filing a statement of claim or complaint in court, you must provide proof of payment of the state fee. For an organization, this is usually a payment order with a bank mark. Payments are mainly made electronically. However, is it enough to attach a printout of an electronic payment document to confirm that the state duty has been paid? As practice shows, a court of general jurisdiction and an arbitration court have different approaches.

Electronic payments

In accordance with the requirements of the Civil Procedure Code of the Russian Federation and the Arbitration Procedure Code of the Russian Federation, a document confirming payment of the state duty is attached to the statement of claim, appeal and cassation complaint. In the absence of the specified document, the statement of claim or complaint may be returned to the applicant. Payment of the state fee can be made by transferring funds by the bank.

For a legal entity this is the most convenient option. Transfers of funds by banks are carried out by order of the client in electronic form or on paper. According to Art. 333.18 of the Tax Code of the Russian Federation, the fact of payment of the state duty by the payer in non-cash form is confirmed by a payment order with a note from the bank or the relevant territorial body of the Federal Treasury (another body that opens and maintains accounts), including one that makes payments in electronic form, about its execution.

The rules for transferring funds are regulated by Bank of Russia Regulation No. 383-P dated June 19, 2012. In accordance with clause 4.6 of Regulation N 383-P, the execution of an order in electronic form for the purpose of transferring funds to a bank account is confirmed by the payer’s bank by sending the payer a notice in electronic form about the debiting of funds from the payer’s bank account indicating the details of the executed order or by sending the executed order in electronic form indicating the execution date.

Arbitration court

Based on these rules of law, arbitration courts accept statements of claim and complaints if the fact of payment of the state duty is confirmed by printing an electronic payment document containing all the details (the date of debiting the funds, the type of payment - “electronic”, a note about the payment).

For example, in the Resolutions of the FAS SZO dated 02.13.2014 in case No. A26-5598/2013, FAS VSO dated 08.20.2012 in case No. A19-9761/2012, judicial acts on the return of statements of claim were canceled, since they were based on the explanations of the information letter Presidium of the Supreme Arbitration Court of the Russian Federation dated May 25, 2005 N 91 (currently inactive), according to which, in confirmation of payment of the state duty, a payment order must be submitted with a bank stamp and with the signature of the responsible executor.

The cassation court explained that such requirements apply to the execution of a payment order on paper. When transferring funds electronically, the payment order must indicate: type of payment - “electronic”, date of debiting the funds, bank mark confirming the payment. The electronic version of the payment order executed in this way was recognized by the court as complying with paragraph. 2 p. 3 art. 333.18 Tax Code of the Russian Federation.

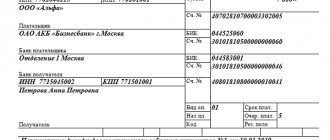

- Payer status, field 101 – “01”;

- TIN and KPP of the payer, fields 60 and 102 – TIN and KPP of the organization;

- Payer, field 8 – name of the organization;

- Payment order, field 21 – “5”;

- Code, field 22 – “0”;

- KBK, field 104 – KBK state duties;

- Reason for payment, field 106: – “0”;

- Tax period, field 107 – “0”;

- Document number, field 108 – “0”;

- Document date, field 109 – “0”

- Purpose of payment, field 24 – text explanation.

Sample of filling out a payment order for state duty

| Notice Bank marks | Index doc. 18209965171147669381 | (101) 13 | Form No. PD (tax) | |

| FULL NAME MUKHINA MARIA MIKHAILOVNA | Address 119019, st. ARBAT, 1, KV. 1, MOSCOW | |||

| TIN | Sum 4000.00 | |||

| Recipient bank of the State Bank of Russia for the Central Federal District | BIC 044525000 | |||

| Account No. 000000000000000000000 | ||||

| Recipient of the Federal Tax Code for Moscow (MIFTS of Russia No. 46 for Moscow) | Account No. 40101810045250010041 | |||

| TIN 7733506810 | ||||

| Gearbox 773301001 | ||||

| KBK 18210807010011000110 | OKTMO 45373000 | |||

| (107) 05.11.2017 | ||||

| (106) TP | (110) | |||

| date | Signature | |||

| Receipt Bank marks | Index doc. 18209965171147669381 | (101) 13 | Form No. PD (tax) | |

| FULL NAME MUKHINA MARIA MIKHAILOVNA | Address 119019, st. ARBAT, 1, KV. 1, MOSCOW | |||

| TIN | Sum 4000.00 | |||

| Recipient bank of the State Bank of Russia for the Central Federal District | BIC 044525000 | |||

| Account No. 000000000000000000000 | ||||

| Recipient of the Federal Tax Code for Moscow (MIFTS of Russia No. 46 for Moscow) | Account No. 40101810045250010041 | |||

| TIN 7733506810 | ||||

| Gearbox 773301001 | ||||

| KBK 18210807010011000110 | OKTMO 45373000 | |||

| (107) 05.11.2017 | ||||

| (106) TP | (110) | |||

| date | Signature | |||

Validity period of payment order for state duty

According to the payment order, the bank is obliged to transfer funds to the recipient within the deadlines established by law, but provided that other deadlines are not specified in the agreement concluded between the bank and the account holder.

In accordance with the Regulations on the Rules for Transferring Funds, approved by the Bank of Russia on June 19, 2012 No. 383-P, a payment order is valid for 10 days from the day following the day the order was drawn up . It is during this period that the payment order must be submitted to the bank for its execution.

It is necessary to understand that we are talking about calendar days, including weekends and holidays.

If the validity period expires, you can go in two ways:

- change the date of the order;

- create a new payment.

It is clear that if a new payment order is generated, an unprocessed payment order will appear in the chronology, but this situation does not entail any punitive measures and is easily explained by the expiration of the document.

Payer's TIN

For the value of the claim: · up to 100,000 rubles - 4% of the claim price, but not less than 2,000 rubles; · from 100,001 rubles to 200,000 rubles - 4,000 rubles 3% of the amount exceeding 100,000 rubles; · from 200,001 rubles to 1,000,000 rubles - 7,000 rubles 2% of the amount exceeding 200,000 rubles; · from 1,000,001 rubles to 2,000,000 rubles - 23,000 rubles 1% of the amount exceeding 1,000,000 rubles;

· over 2,000,000 rubles - 33,000 rubles 0.5% of the amount exceeding 2,000,000 rubles, but not more than 200,000 rubles. Submission of applications to recognize a non-normative legal act as invalid and to recognize decisions and actions (inaction) of state bodies, local governments, other bodies, and officials as illegal. · for individuals - 300 rubles; · for organizations - 3,000 rubles.

Errors in payment order for state duty

When generating a payment order, errors are often encountered that can have some consequences. In this article we will look at the most common mistakes:

| Error | What to do? |

| Error in amount | If the amount of transfers exceeds the required amount, then in this case several options are possible:

If the payment amount turns out to be less than necessary, in this case the payment is not taken into account. It is necessary to transfer the missing amount. |

| Invalid KBK code specified | The payment in this case will fall into the category of “unexplained payments”. The entrepreneur will need to write an application with the obligatory attachment of a paper copy of the payment order. |

Payment of state duty basis of payment

A familiar situation, if all documents contain e - contact the registry office for correction. our situation was worse - all the documents issued after the birth certificate had the letter e and not e - we had to change our passport, pension, diploma, and the letter about the equality of the letters was of no use, they refused to privatize our housing

“__”_____ 200_ Judge ______________ of the Arbitration Court _____________ made a decision in case No. ________ about ______________. To date, the plaintiff (defendant, third party) has not received a copy of this court decision. Based on the above and in accordance with Art. 177 Arbitration Procedure Code of the Russian Federation,

03 Feb 2020 etolaw 442

Share this post

- Related Posts

- Is it possible to cancel capital in a mortgage?

- What Documents Need to be Provided for the Construction of a House for Return

- Bailiffs seized a car that was pledged to another bank

What Documents Are Needed to Renew a Russian Passport If Lost?

Questions and answers

- We plan to file a claim in court. When is it necessary to pay the state duty?

Answer: According to paragraph 1, paragraph 1, Article 333.18 of the Tax Code of the Russian Federation, payment of the state duty is made before filing a statement of claim.

- How can I confirm payment of the state fee if I transferred funds to a notary?

Answer: In accordance with paragraph 3 of Art. 333.18 Tax Code The fact of payment of the state duty by the payer in cash is confirmed either by a receipt of the established form issued to the payer by the bank, or by a receipt issued to the payer by an official or the cash desk of the body to which the payment was made.

Payment order for payment of state duty: sample

State duty is a mandatory fee paid when filing a claim. In 2020, the fee is transferred to the Arbitration Court of First Instance, to the Arbitration Court of Appeal and is paid strictly in accordance with the payment details. Here are the main amounts of the state duty, which in 2020 are applied when applying to the arbitration courts of the Russian Federation and the Supreme Court of the Russian Federation (in cases considered in accordance with the Arbitration Procedural Code of the Russian Federation):

Also read: How to become a federal labor veteran in 2020